LIQUIDITY FREEZE AHEAD: Why & How Fiat Wealth Freezes By Lynette Zang

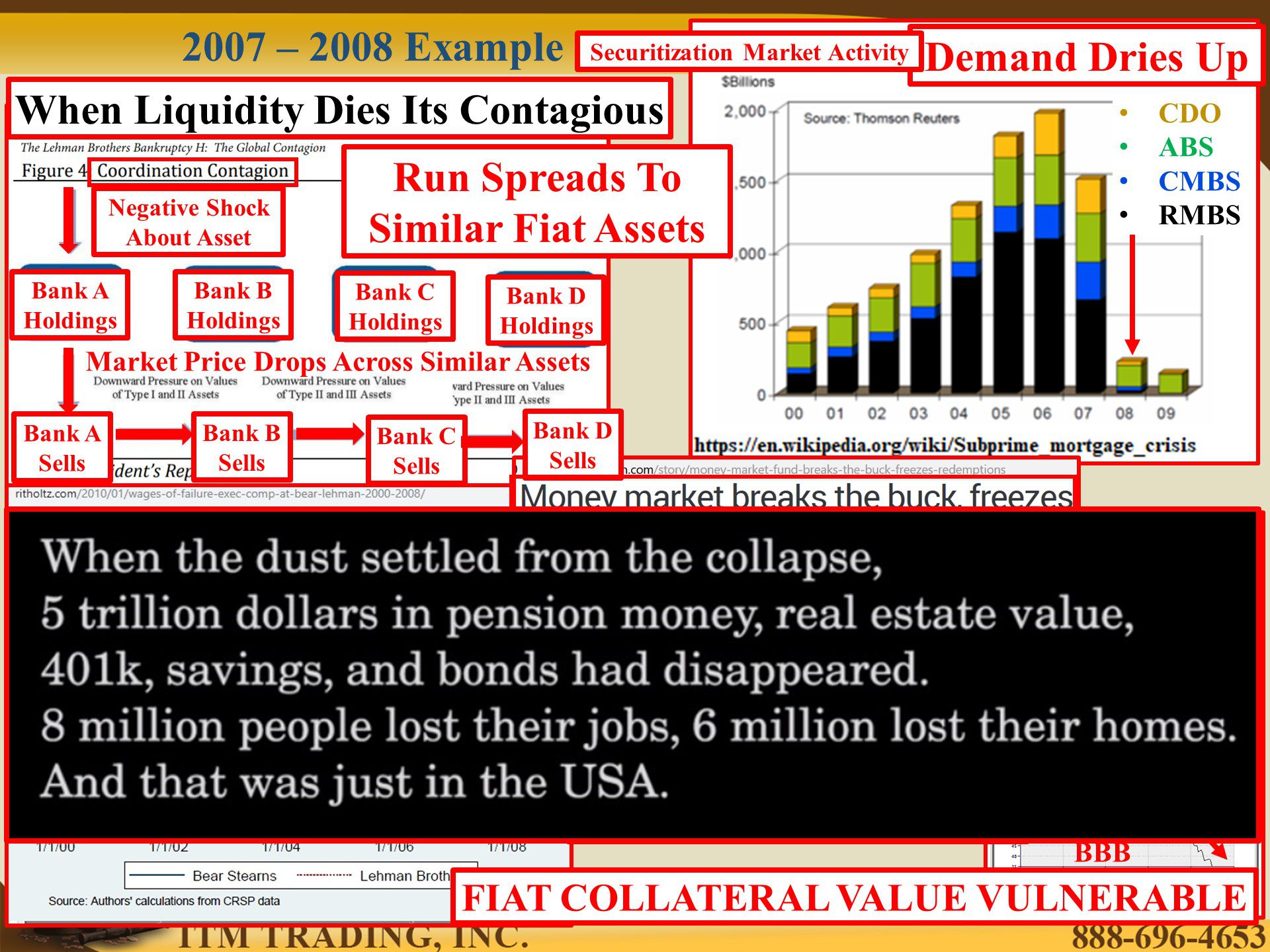

In part 1 of this series, we discussed the importance of collateral quality in this debt-based system, which, since 2008, has transitioned into one based on short-term, wholesale debt provided by corporations and vulnerable to runs that could see their market value evaporate, possibly going to zero.

It’s hard to believe that “they†would allow such a thing, though evidence shows that not only do governments and central bankers, allow financial experimentation (called “innovationâ€) but they socialize the losses and this time will be no different.

Ignorance of financial plumbing does not make you immune, it just leaves your fiat wealth vulnerable to confiscation. If you can see the risk and what the smartest guys on money are doing for themselves, you can emulate them and most likely be in the best position when the next financial crisis becomes apparent.

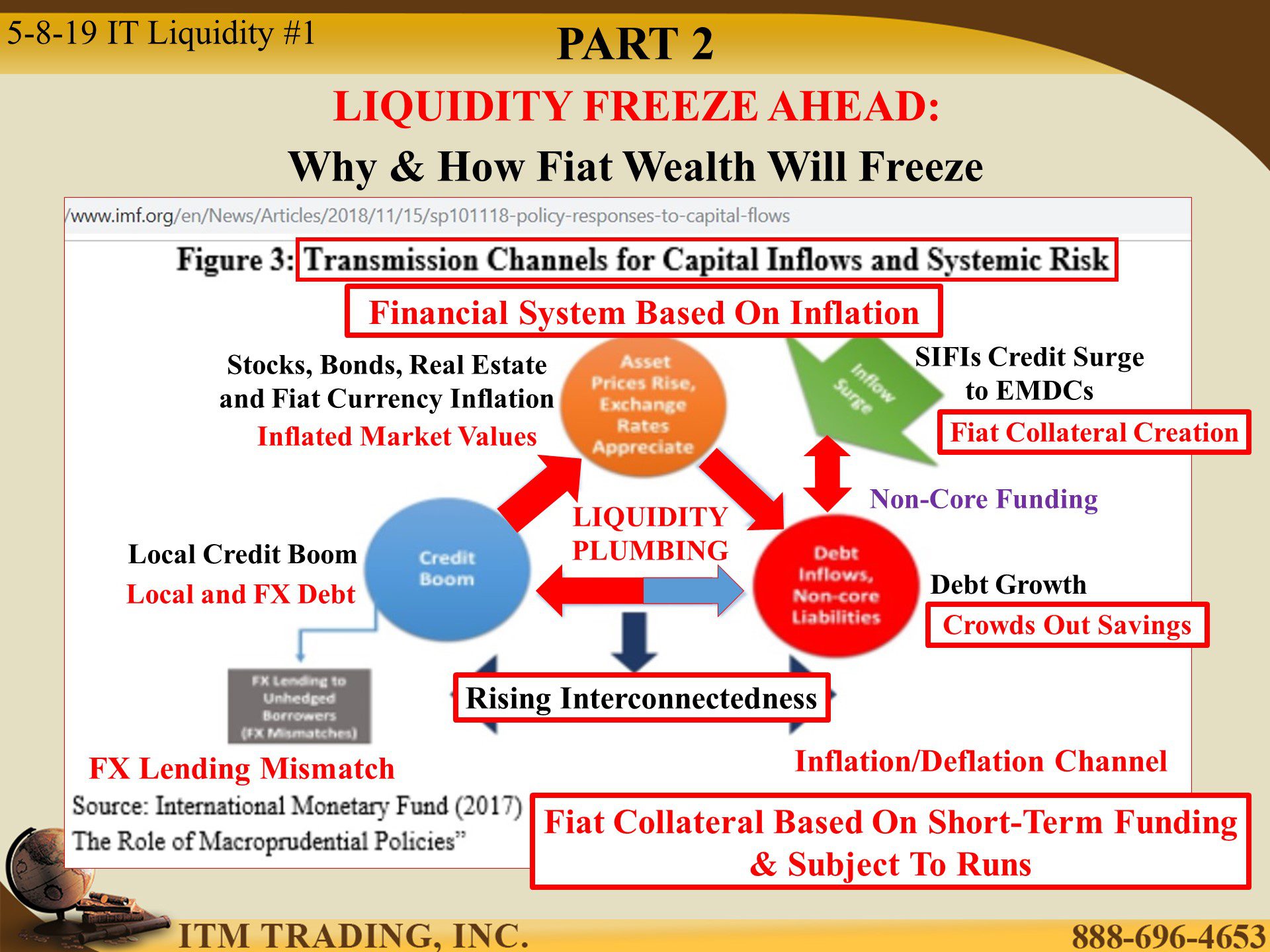

Globalization and integration have created doom loops, that if broken, could create the black swan event that nobody saw coming (duh) when allowing this risky behavior. Today we’re turning attention to the plumbing that funded the explosion of emerging market debt and the mismatches that could ignite the next global financial explosion.

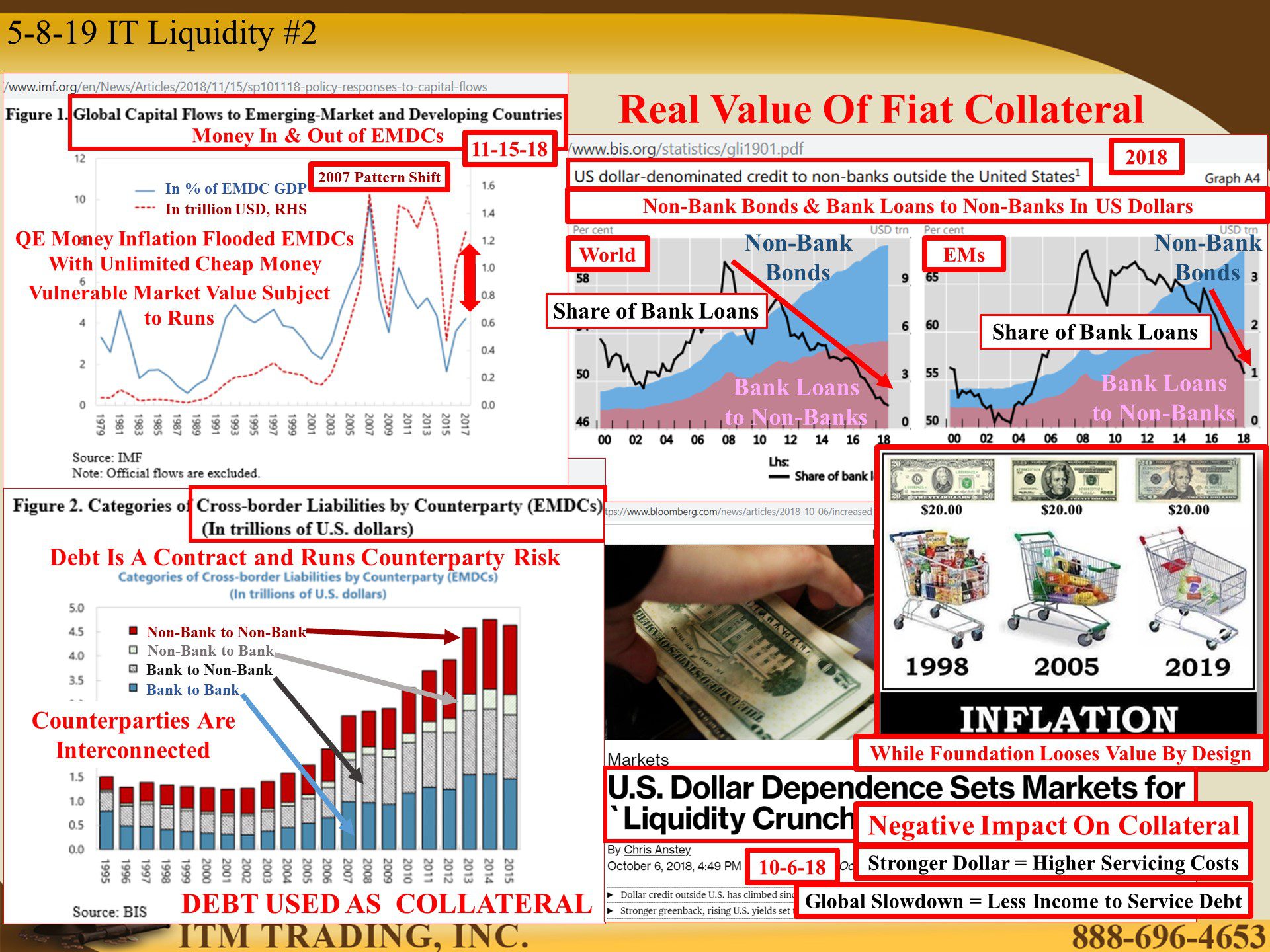

Corporations were the biggest beneficiary of the QE money tsunami. Armed with cheap fiat money, advanced economy (US, EU etc.) banks and non-bank corporations loaned emerging market and developing countries short-term loans which leads to a local credit boom, which inflates financial assets, which then provide inflated collateral values and enable more debt, on the same overvalued asset. When a shock occurs, foreign money can become scared and not rollover or provide new debt (the run).

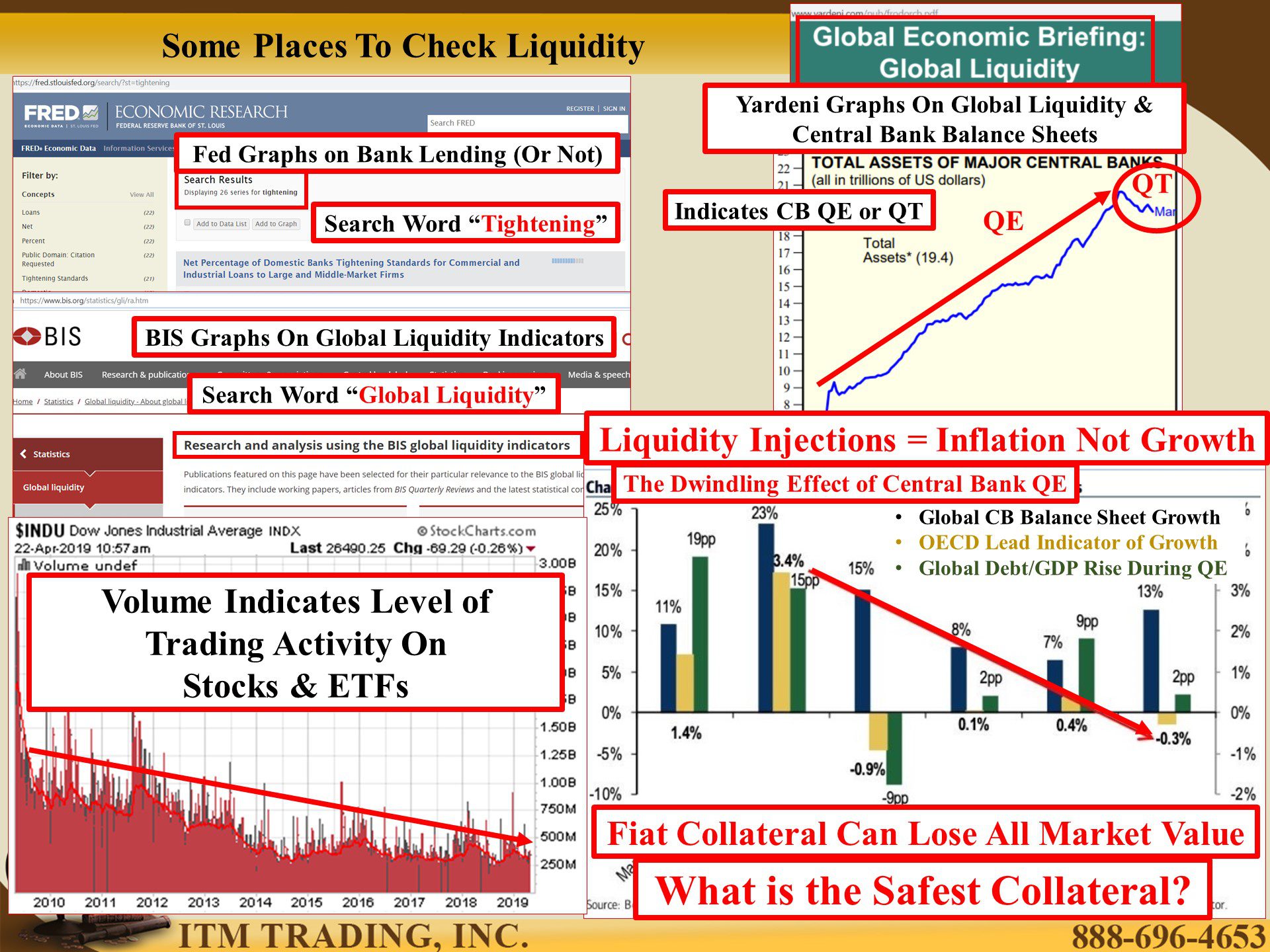

Without credit, inflated assets DEFLATE and the value of abundant, intangible financial assets evaporates and lenders are now at risk of default. When this happened in 2008, central banks had reflation room on their balance sheets. They used that up.

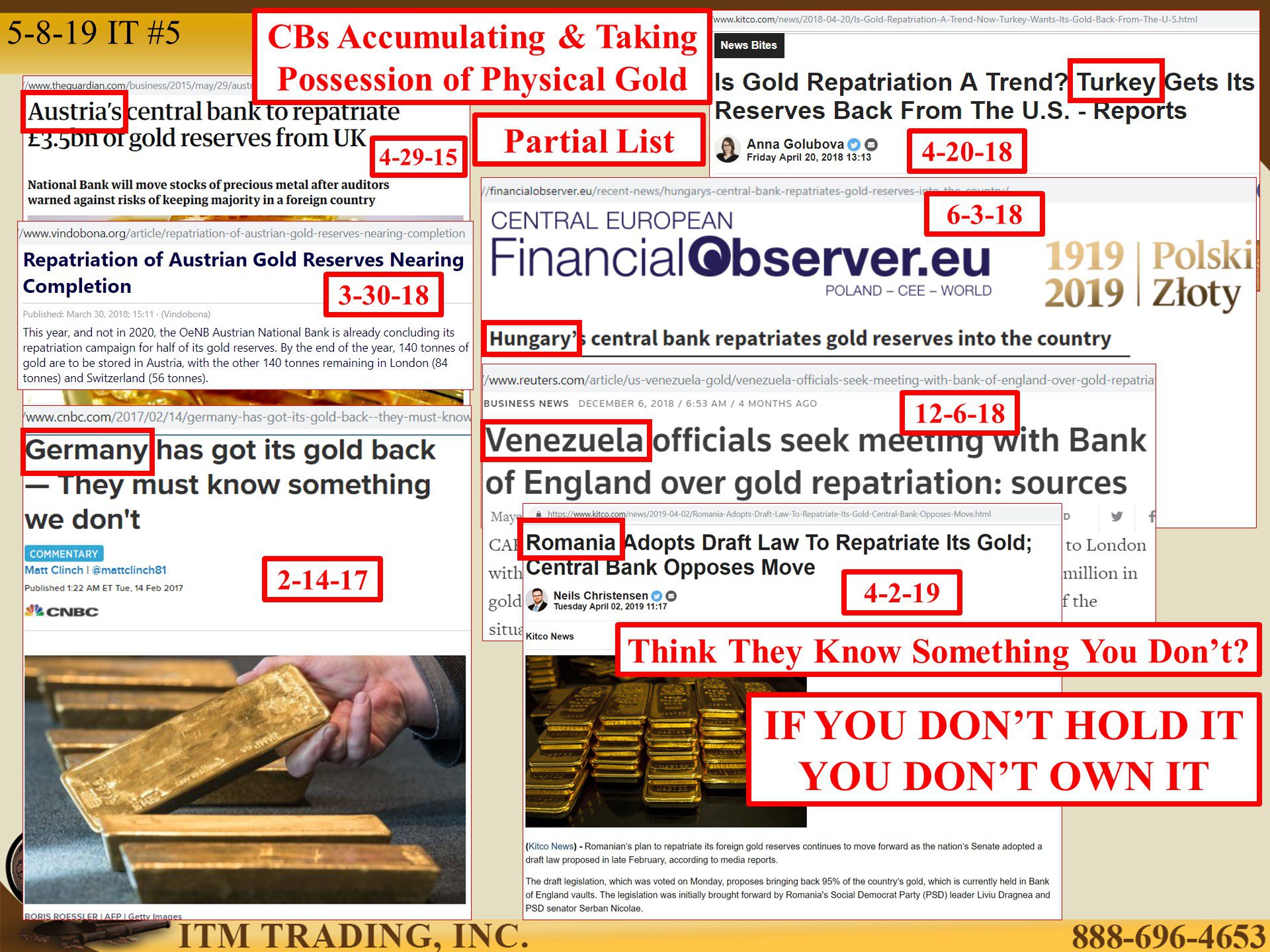

Evidence shows that as central bankers expanded their balance sheets, the effect of that QE diminished. Now, all we have is lots of debt, the most expensive markets in history, and wealth inequality at levels last seen in 1928. Central bankers know the system is failing. What are they doing to protect themselves? Calling back their gold, held off shore.

In 2011 Venezuela kicked off a wave of global gold repatriation. Austria, Germany, Turkey, Hungary and Romania (partial list) have either begun or completed bringing their gold home at the same time they are accumulating gold near the highest levels in history.

Why? I think it’s because of two key reasons:

- They know the financial plumbing is critically fragile

- IF YOU DON’T HOLD IT, YOU DON’T OWN IT

I own it, do you?

Slides and Links:

https://www.imf.org/en/News/Articles/2018/11/15/sp101118-policy-responses-to-capital-flows

https://www.imf.org/en/News/Articles/2018/11/15/sp101118-policy-responses-to-capital-flows

https://www.bis.org/publ/bppdf/bispap57y.pdf

www.ritholtz.com/2010/01/wages-of-failure-exec-comp-at-bear-lehman-2000-2008/

https://fred.stlouisfed.org/search/?st=tightening

https://www.bis.org/statistics/gli.htm

https://www.bis.org/statistics/gli/ra.htm

https://www.bis.org/statistics/gli1901.htm

https://www.yardeni.com/pub/frodorcb.pdf

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://www.stockcharts.com/h-sc/ui

https://www.cnbc.com/2017/02/14/germany-has-got-its-gold-back–they-must-know-something-we-dont.html

https://www.vindobona.org/article/repatriation-of-austrian-gold-reserves-nearing-completion

https://www.ft.com/content/813c5460-87f9-11e7-bf50-e1c239b45787

YouTube Short Description:

Ignorance of financial plumbing does not make you immune, it just leaves your fiat wealth vulnerable to confiscation. If you can see the risk and what the smartest guys on money are doing for themselves, you can emulate them and most likely be in the best position when the next financial crisis becomes apparent.

In 2011 Venezuela kicked off a wave of global gold repatriation. Austria, Germany, Turkey, Hungary and Romania (partial list) have either begun or completed bringing their gold home at the same time they are accumulating gold near the highest levels in history.

Why? I think it’s because of two key reasons:

- They know the financial plumbing is critically fragile

- IF YOU DON’T HOLD IT, YOU DON’T OWN IT

I own it, do you?