It’s All About The Leverage – The Net Capital Rule And Dodd-Frank

9-5-17 It’s All About the Leverage, by Lynette Zang

Leverage, The Net Capital Rule,The Lehman Moment, And Dodd-Frank.

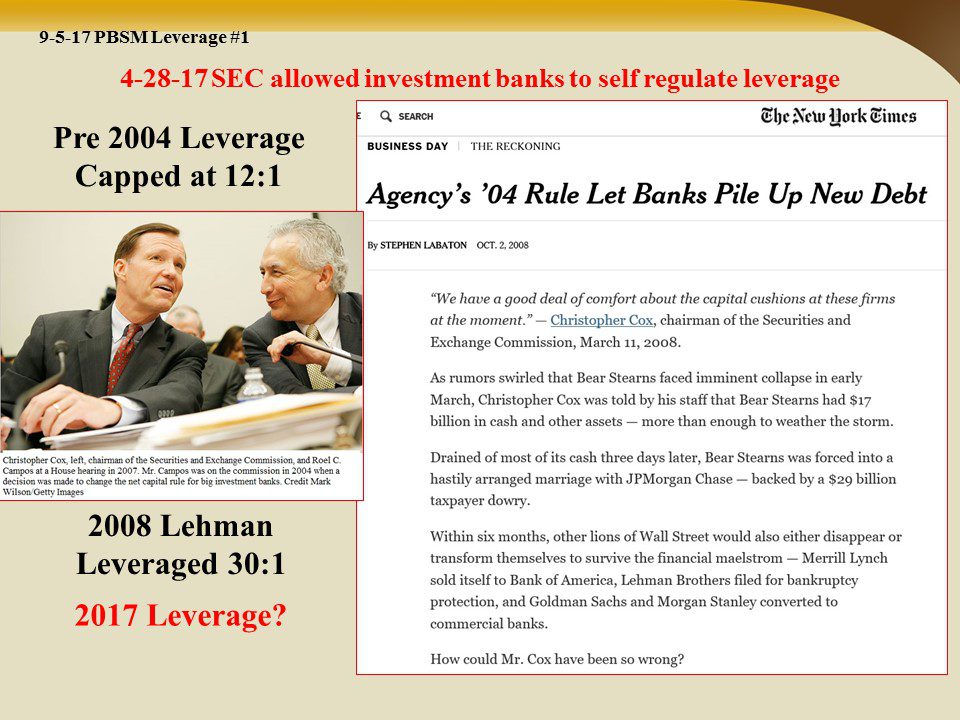

On April 28, 2004, under pressure from the largest broker dealers (Bear Stearns, Goldman Sachs, Lehman Brothers, Merrill Lynch, and Morgan Stanley) the SEC approved the “Net Capital Rule†which allowed these entities exemptions that enabled them to dramatically increase leverage. Many believe this, in part, formed the foundation of the 2007 crisis.

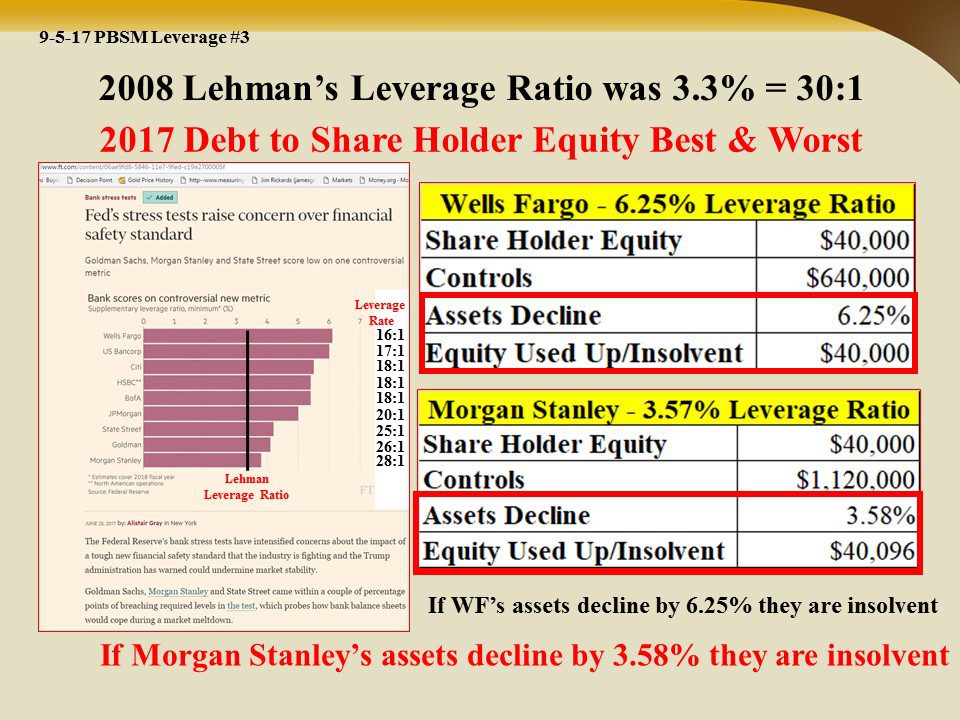

At that time Lehman was levered at 30:1 which only required a 3.3% downside of assets to push the firm into insolvency. On September 15, 2008 Lehman Brothers filed for bankruptcy. That is called the “Lehman Momentâ€.

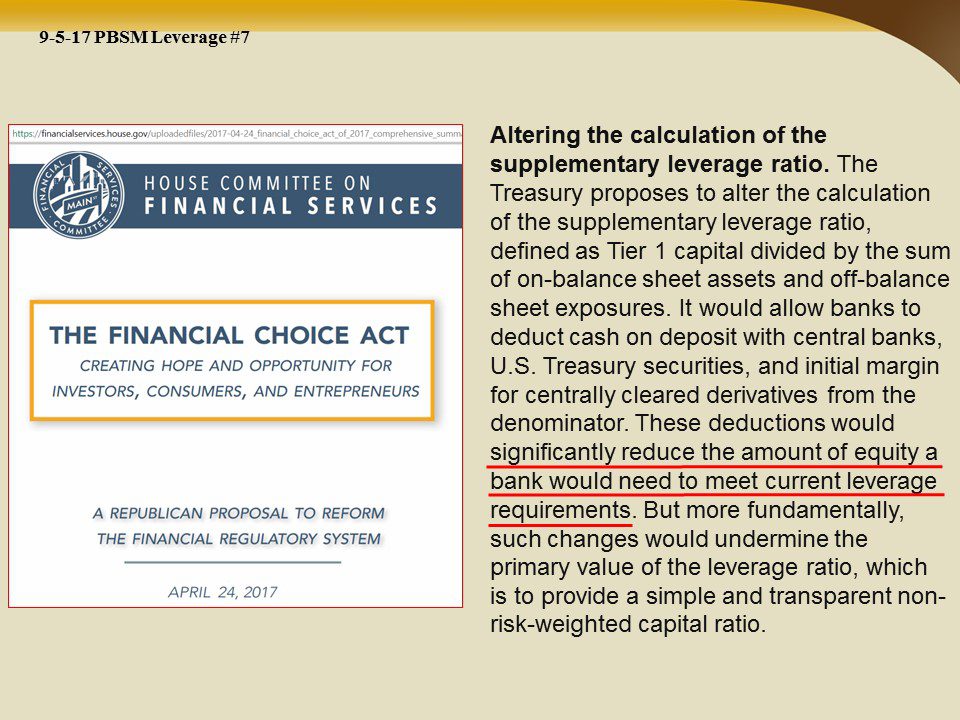

Do we have another Lehman Moment a head of us? Dodd-Frank legislation enacted during that time, though over 22,000 pages, is still being written and yet the recent Financial Choice Act of 2017 aims to dismantle those cumbersome regulations that keep a lid on leverage.

In June 2017 the Federal Reserve stress tests revealed current leverage in the US banks. Are we better off? This webinar looks at current leverage ratios and just how far markets can drop before insolvency sparks the next financial crisis.

Slides And Links Regarding Financial Leverage :

Slide 1

https://www.sec.gov/rules/final/34-49830.htm

http://www.nytimes.com/2008/10/03/business/03sec.html?mcubz=1

http://www.nytimes.com/interactive/2008/09/28/business/20080928-SEC-multimedia/index.html

Slide 2

Slide 3

https://portal.hud.gov/hudportal/HUD?src=/press/press_releases_media_advisories/2017/HUDNo_17-068

https://www.clarusft.com/supplementary-leverage-ratio-comparing-us-banks

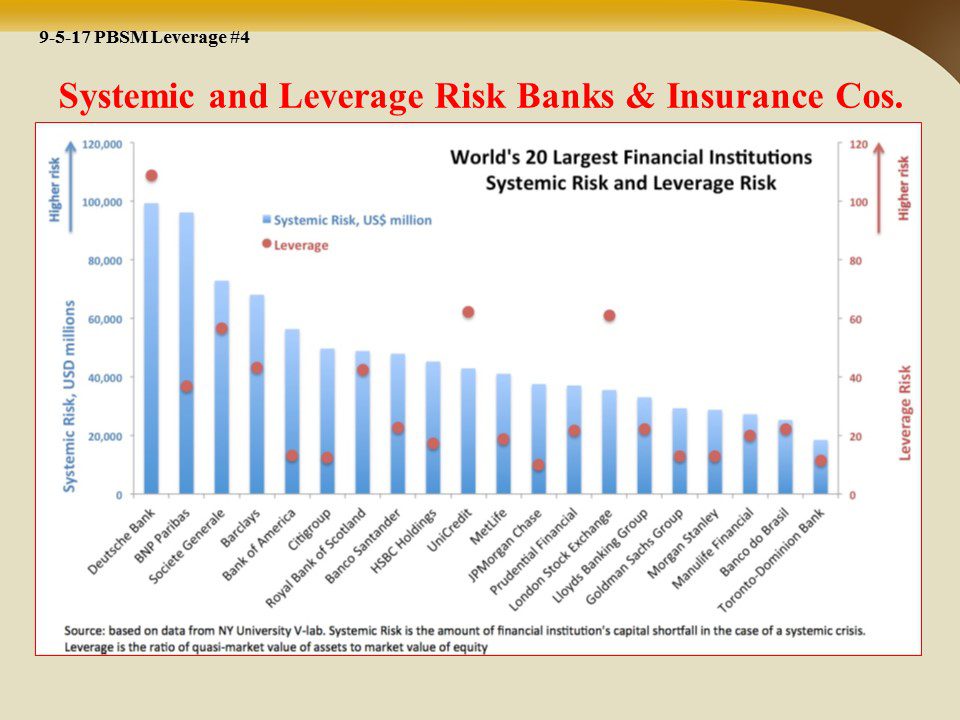

Slide 4

There Is No Link Associated With This Slide.

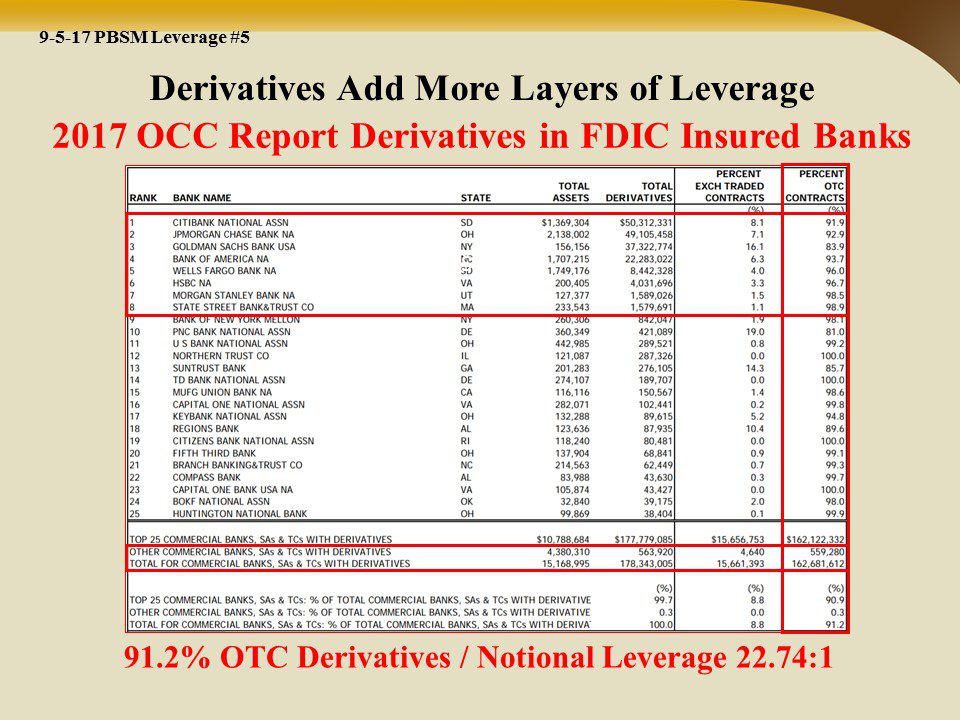

Slide 5

https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/dq117.pdf

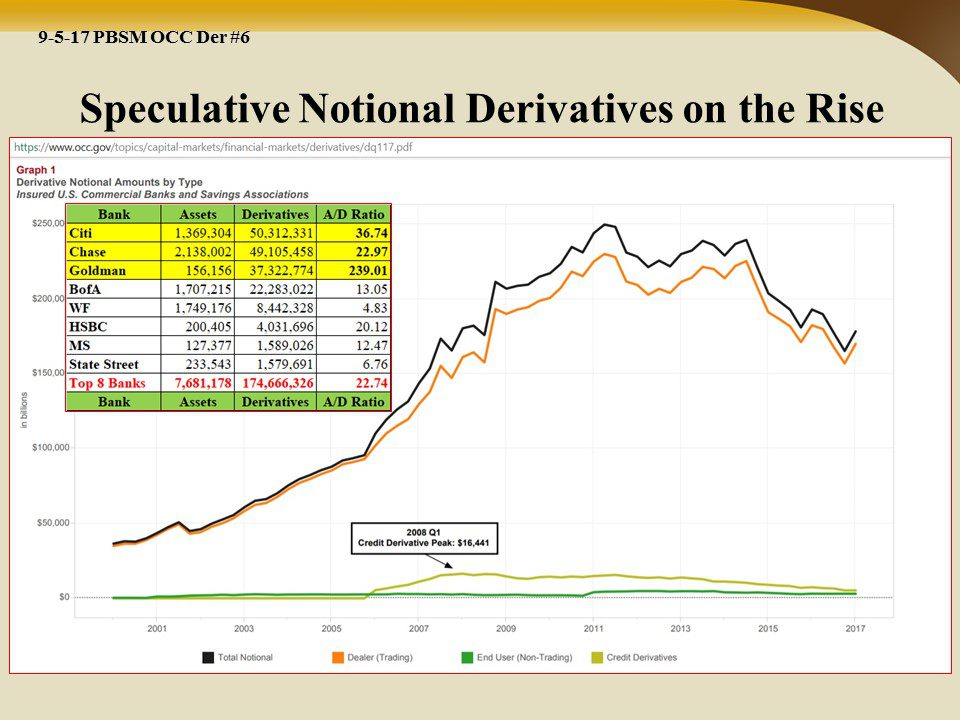

Slide 6

https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/dq117.pdf

Slide 7

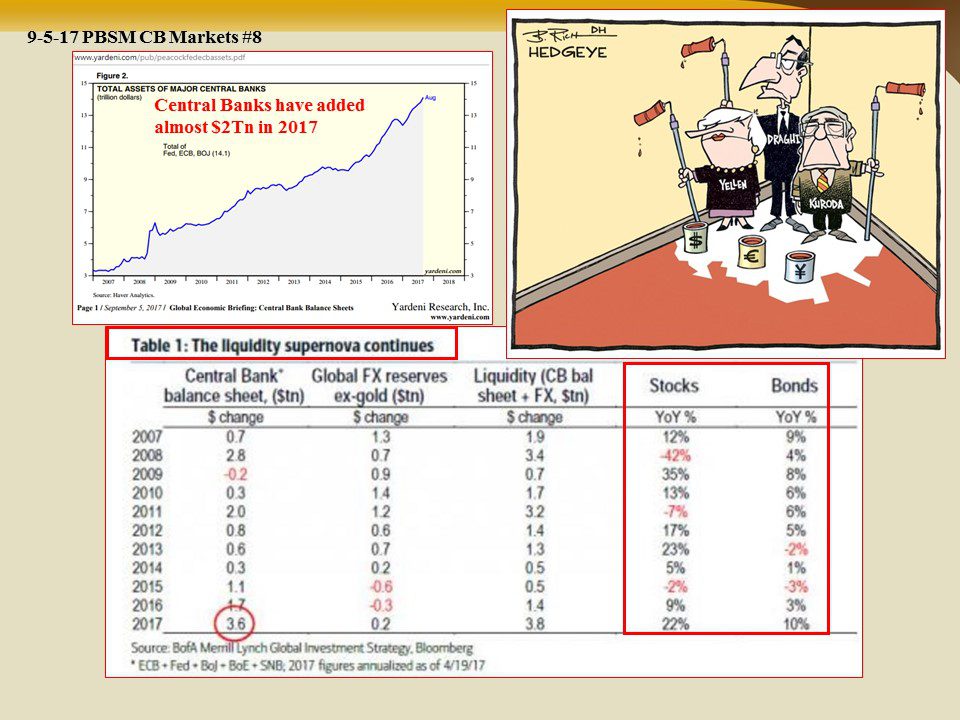

Slide 8

https://www.yardeni.com/pub/peacockfedecbassets.pdf

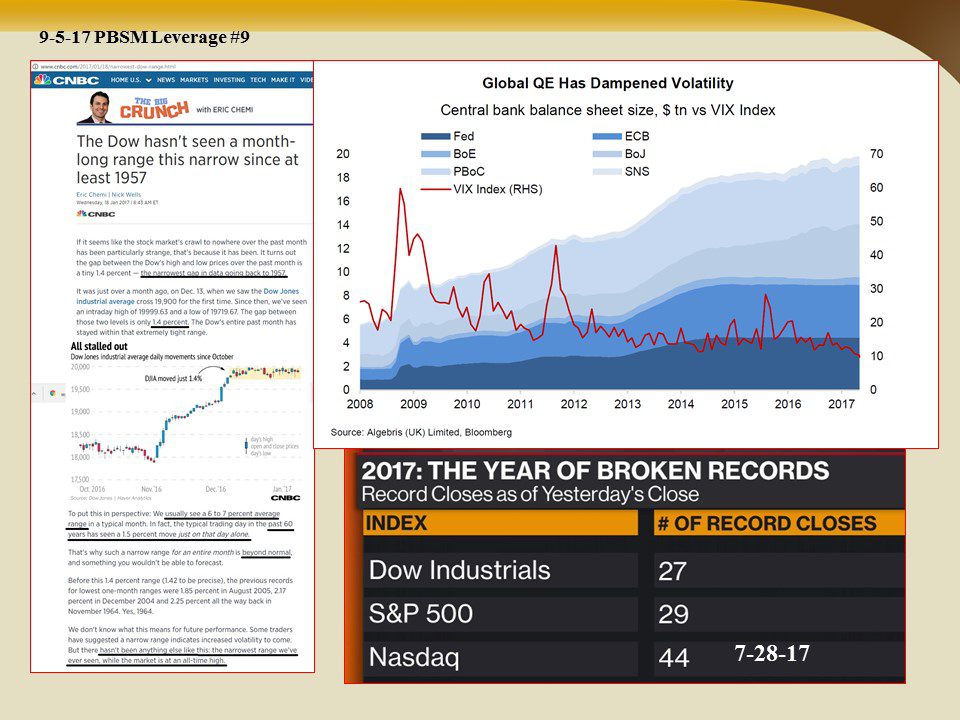

Slide 9

https://www.cnbc.com/2017/01/18/narrowest-dow-range.html

https://www.algebris.com/silver-bullet-low-volatility-trap/

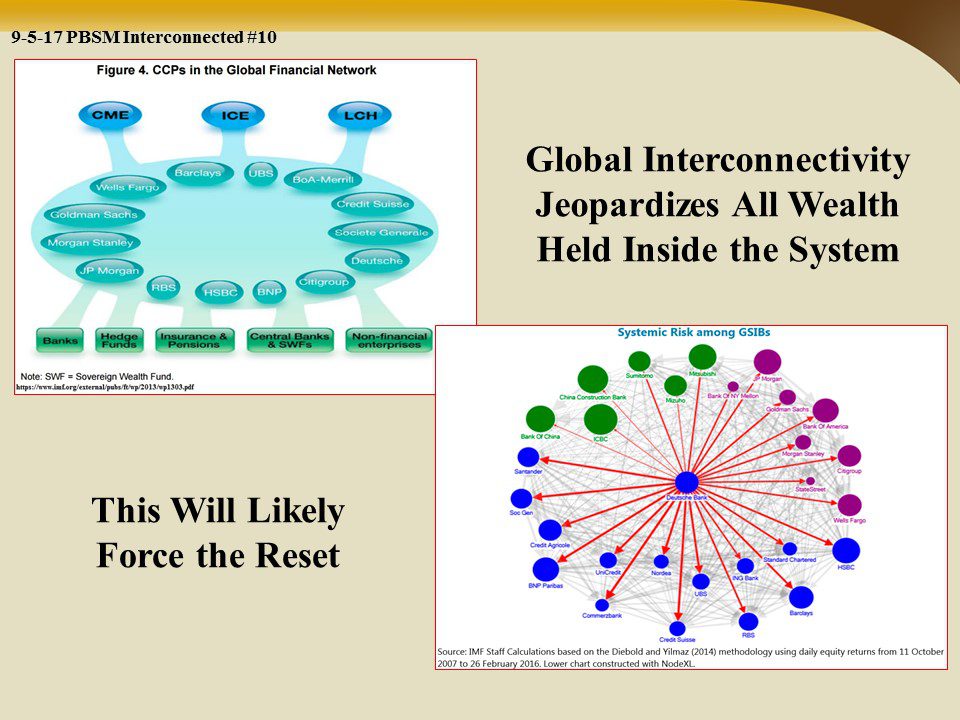

Slide 10

https://www.imf.org/external/pubs/ft/scr/2016/cr16189.pdf

http://www.imf.org/external/pubs/ft/wp/2013/wp1301.pdf