Janet Yellan and Rasing Interest Rates

YouTube Transcription

hi guys Lynette Zang with ITM Trading

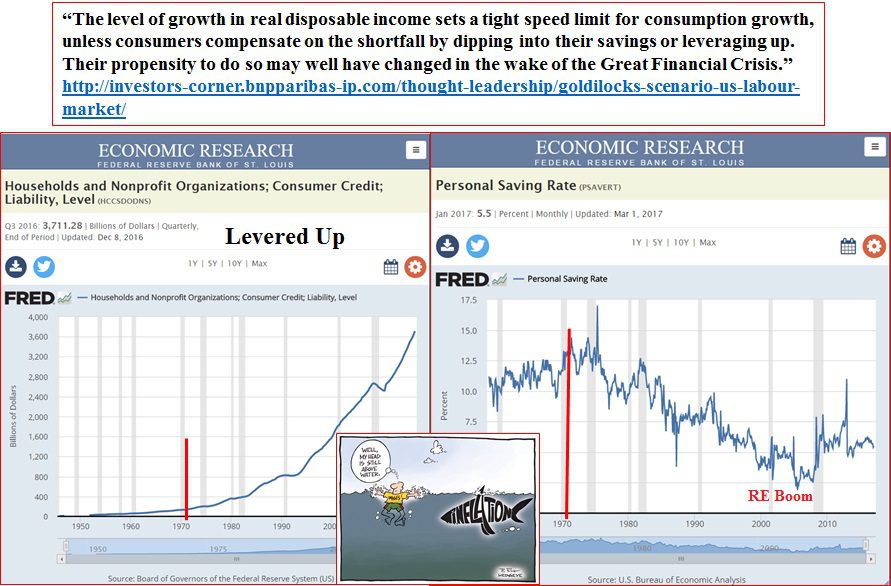

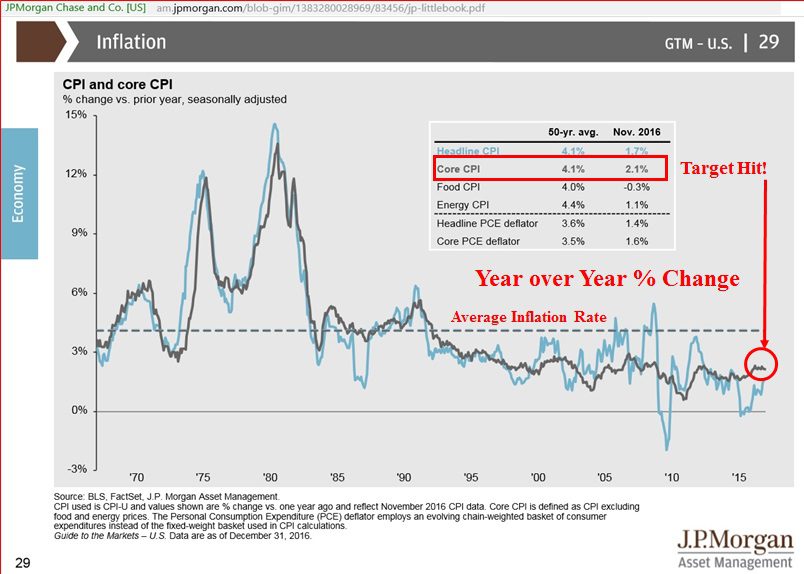

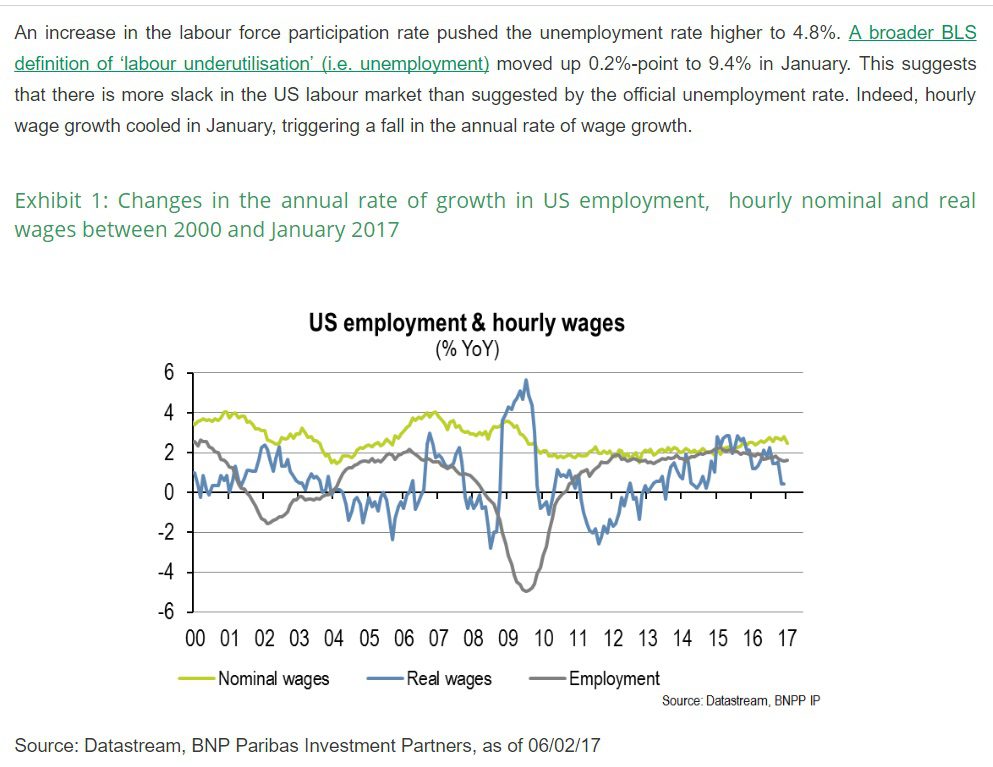

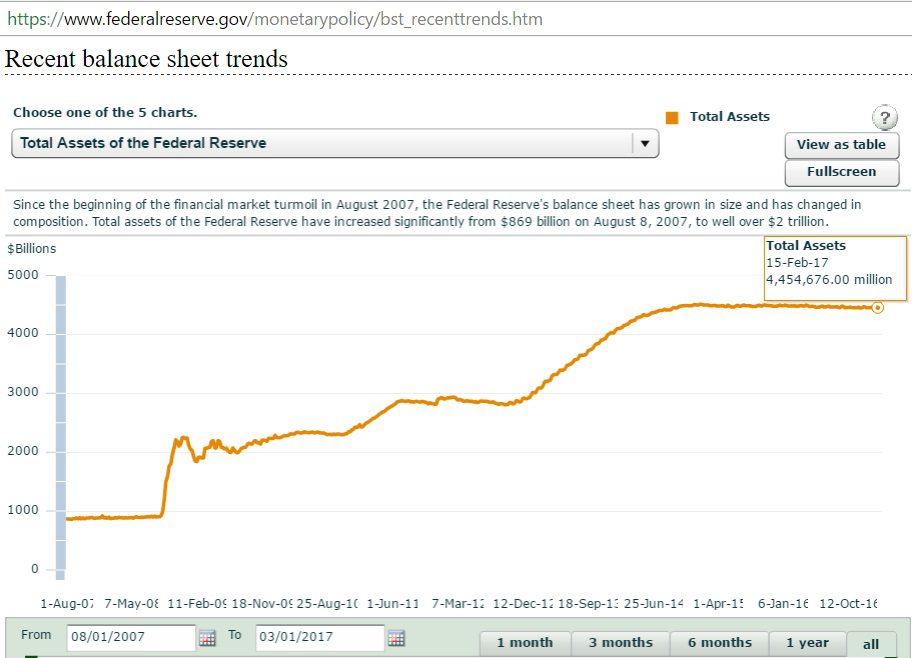

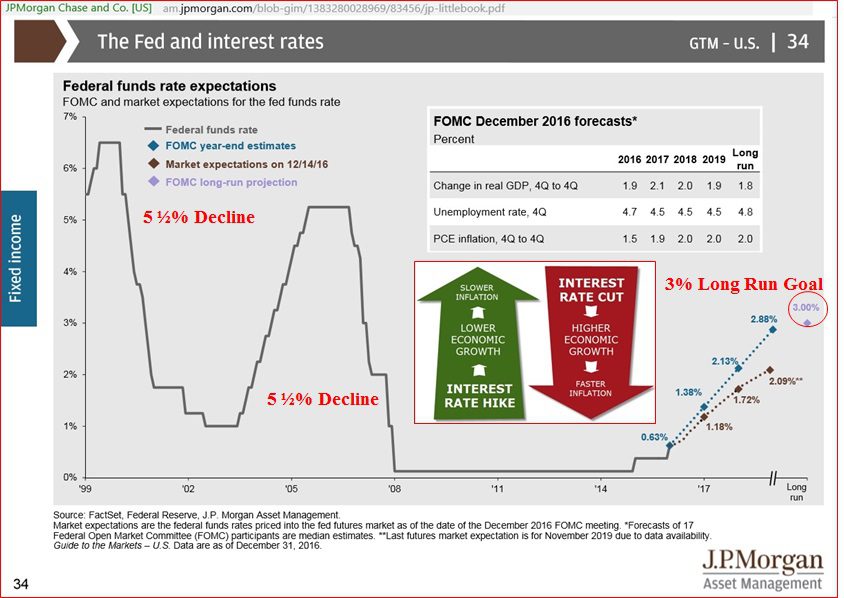

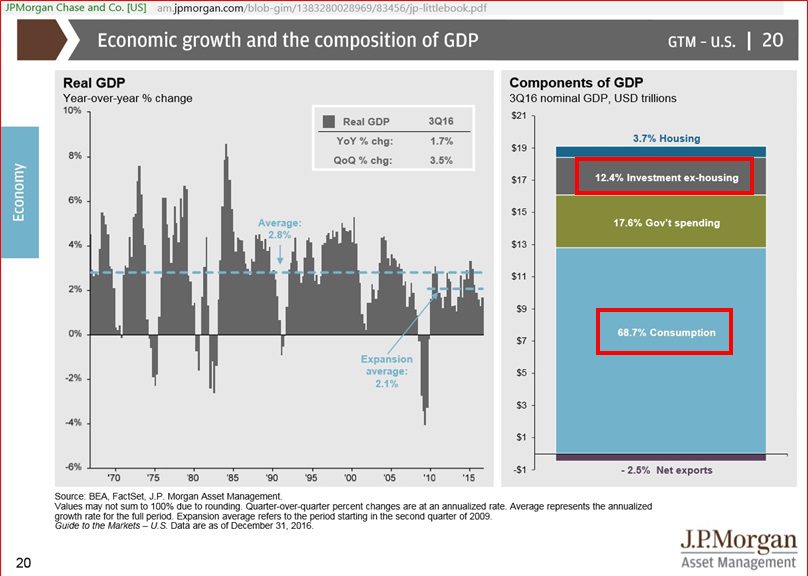

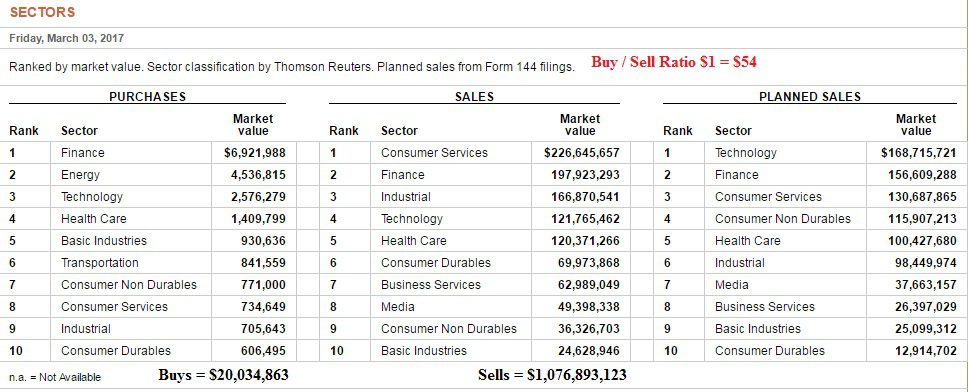

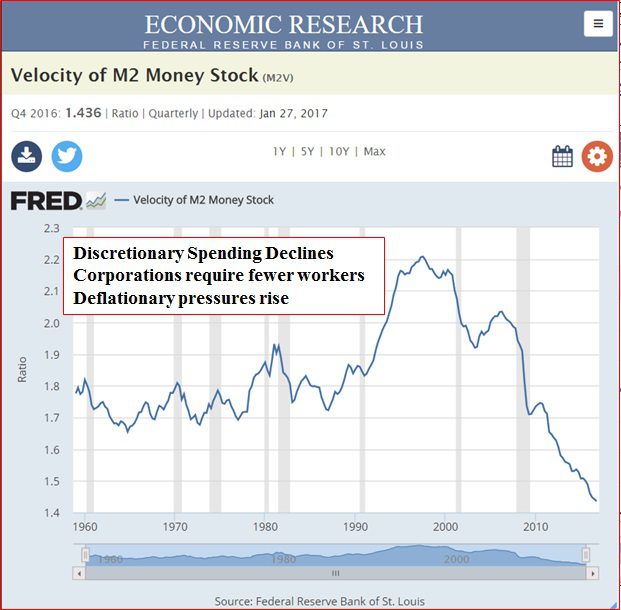

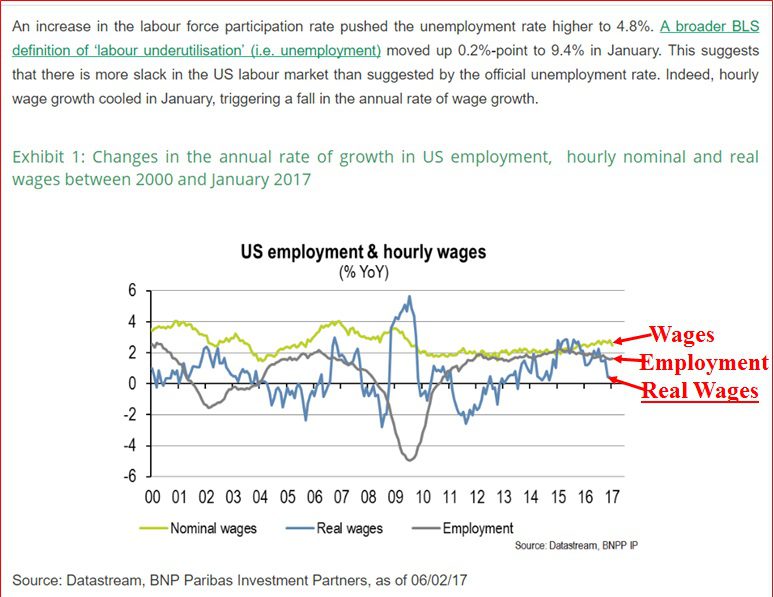

We are a  full-service physical precious metals brokerage house so today we’re going to talk about whether or not the Fed and Janet Yellen will raise the interest rates now they’re saying that they can because of course they have hit their target in both employment and inflation so we’re going to take a look at that today that she also said that they will not be touching the best balance sheet which you can see is quite elevated another story for another day however this is the Fed interest rates that they charge the bank overnight ok and you can see how in every crisis the first crisis from the nineties another one in but interest rates are a key tool special bankers because if they want to stimulate the economy and buying and selling they lower interest rates down that that gets people to borrow words spend more and then if it’s overheated and inflation is riding too quickly they raise interest rates up that fewer people borrow and spent so that’s the theory and we’re going to come back to that in a minute but there were two things I haven’t first was employment ok so really the employment numbers are a Goldilocks number because many of the jobs that were lost during the crisis were middle-management upper management and those jobs simply went away so people have to do something to make money so many people have taken a lot left just to get by so here’s more of the truth ok now this top line in wage growth as you can see it’s pretty much flat line the bottom where I have an underlying with real wages that was happening to the wages with inflation so you can see that the real wages are really well below where they were now this is really ok as long as people have the capacity to take on and service more debt and reduce three savings which is exactly what you’re seeing in the into Federal Reserve grass however I like you let me just have this back for this there is the pattern shift over here where prior to it after every crisis it would be flat stages rate would be slapped for a little while and then continue to go down particularly here in to that real estate boom but now you’re seeing that people are really not spending money they may be putting their food on a credit card or or essential bills on a credit part but they are not shopping like it’s and where we really see it because they’re saying the economy is doing really well in this a monetary velocity chart so you can see that since they started keeping it at the fed by a wide margin it slower and we also know that it’s lower than it was during the Depression of great so they can tell you that everything’s rosie was their own data show you something different and so if you have to buy a banana or a loaf of bread you’re going to buy banana or loaf of bread but if that means that you can for a new car a new shirt guess what village first in car or the new shirt so that’s the truth of what’s going on and here but they met their mandate they hit their inflation their employment art now they’re going to try to hit their inflation target because there’s only one way to fight that inflation and that’s what inflation so what you’re looking at is a year-over-year percentage change chart and bam they hit their inflation target which was to prevent ok but here’s how that impacts you okay as there’s the compounding inflation rate and there’s your loss of value of the dollar meaning that everything cost you all a lot more so is it really getting better no do they really need to raise interest rates because of the economy of overheating no but here’s the real reason okay it is because number one of their credibility this was a piece that was done by Bill Gates or bill growth like he’s definitely an insider so central bank credibility is being very tested because over all these years they keep promising rate increase well why don’t you really need the rate increase i know i showed you this at the beginning I said we’re going to come back to it by the way just before it went out they announced that gdp today is running at one point three percent ok but during the previous crises they lowered the five-and-a-half percent their target over time we’ll arrange to get it up to three percent so they also need the interest rates to be up so that they can lock them during the next crisis because these low interest rate has really impacted the global economy particularly the pension plan crisis which we’re going to be talking about in a webinar pretty quickly here but the insurance industry all sorts of levels of insurance life insurance health insurance reinsurance etcetera savers and bank interest rates that force everybody out on on the risk spectrum and we’re about to see what that looks like but that means that those assets that they targeted for relations the stock but there are real estate are severely over values and guys they have nowhere to go but negative talk cashless talk blockchain that’s what’s coming but they are probably going to raise the rates but it’ll be for different reasons that are giving in my opinion and based on what i showed you so that’s it for today i will see you on Thursday and make sure that you like us on Facebook subscribe to us on YouTube follow us on twitter and give us a call eating