ITM Trading Facebook Flash Five Presentation Q&A

Lynette Zang is the chief market analyst at ITM Trading. Eric Griffin is the chief operations officer at ITM Trading. Lynette has been a student of the markets, a stockbroker, a coin trader, and an outspoken opponent of fiat currencies for quite some time. Eric has a degree and a background in finance. The two have been working together for several years. One of their common goals is to inform not only the clients and potential clients of ITM Trading but to reach out through social media to spread information regarding owning gold.

To this end, ITM Trading has established and maintains a YouTube account, a Facebook account, a Twitter account, a Google plus account, and a Pinterest account. While these formats all vary quite a bit, the one common thread between all of the ITM Trading social media accounts is the desire to educate Americans so that they may make informed choices. Lynette is a very strong proponent of informed choices. You should be, too.

Take a few moments and read this article. The point of this article is to chronicle questions posed during an ITM Trading Facebook flash five presentation that Eric and Lynette have put together. These are short videos that contain a lot of information. Sometimes Lynette will break down current market happenings. In other ITM Trading Facebook flash five presentations Eric and Lynette team up to answer questions that are submitted to ITM Trading.

ITM Trading Facebook Flash Five Presentations : Gold or Silver?

In this ITM Trading Facebook flash five presentation, Eric and Lynette answer questions submitted to ITM Trading through the ITM Trading YouTube channel. The idea is for Eric to ask questions to Lynette live on Facebook so that you can get organic “off the cuff” answers. This is a unique way to demonstrate that Lynette, and ITM Trading, really know what they are talking about and that they have the answers you need and want.

Buying Gold Online Via ITM Tradings Online StoreÂ

The first question addressed comes from a Youtube user with the screen name “Who Am I”. Who Am I states,”You never say if gold or silver is a better investment.” This is a question Lynette gets all the time. Lynette’s answer has not changed since I’ve known her. Lynette responds that she does not think of gold and silver in terms of fiat money. Lynette instead, thinks of gold and silver in terms of function.

She then states that since the dollar is declining against both gold and silver she prefers to own silver and some small gold coins for her barterable position while holding larger gold coins to grow wealth. Here Lynette points out that unless you are paying dollar-denominated bills or taxes, you will not want to convert precious metals to dollars once the dollar starts to quickly fail. Here, Eric joins the conversation and quickly gives his astute view. “It sounds like you are talking about gold and silver as a tool, so gold and silver are the right tools for the job.” “Exactly”, says Lynette.

ITM Trading Facebook Flash Five Presentations : Down Markets On Increasing Volume?

For the next question in the ITM Trading Facebook flash five presentation, David asks, “If a market moves down on increasing volume, does that indicate anything?”. Lynette pauses for a brief second and answers, “Absolutely”. When markets move down on increasing volume, Lynette explains, this indicates that people are getting out of the market. “When markets move substantially downwards while you have a strong increase in volume, this means there is a ‘run’ on the market,†she says.

ITM Trading Facebook Flash Five Presentations : Money Market Concerns?

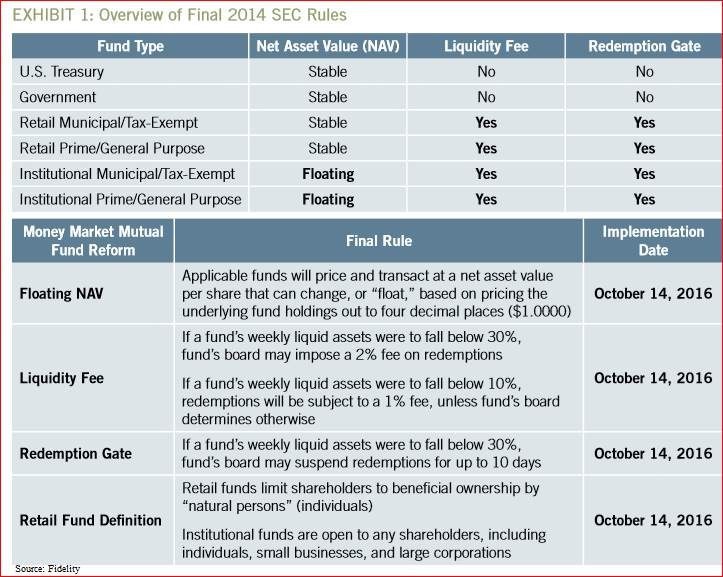

The next question in this ITM Trading Facebook flash five presentation comes from Jesse James. Jesse asks, “Should we be concerned about any cash we have in money market funds, and in what circumstances?”. Lynette has answers on this topic. First, Lynette states that money market funds have changed quite a bit recently. For instance, fees and gates have been added to corporate money market accounts. This means that if there is a run again on these corporate money market accounts, your money will be locked up and inaccessible. You will not be able to withdraw or spend it.

Here, Eric asks Lynette to clarify what she means by a “run”. Lynette’s answer is a bit terrifying. She states that because all of the economic systems are so interconnected that once a run, or a mass selloff, starts in one market it will continue over into the other markets. So, if there is a run in the stock markets, and everyone is selling, your money market account will be affected. Here Lynette states that people think money markets are quite liquid. However, as she then points out, back in 2008 the money market accounts froze. People were unable to access their money.

Laws have been changed and fees and gates were established in regards to money market accounts. These changes pushed a lot of funds out of corporate money market accounts into government run money market accounts. Of great importance, Lynette points out that the government run money markets do not have the same fees and gates that corporate money market accounts do.

Essential Information.

This information is essential. If you are invested in a corporate money market account, when the market run starts either the fund will be closed and you won’t be able to access your money, or “onerous fees” will be charged to you if you want to access your money. Lynette takes great pains here to point out that the fees charged are specifically designed to be so high that people leave their money in the corporate money market account even as the account loses value and becomes unstable. If you are not aware, these money market funds are how some corporations fund their day-to-day expenses. For this reason, you can see why they don’t want massive withdrawals of “their” capital.

Once again Eric Griffin interjects to help surmise what Lynette has just said. Eric brings up the fact that since 2008, due to these changes, there is an added layer of risk inherent to corporate money market accounts. If you are invested in corporate money market accounts, these are added risks that you need to be aware of. Again, the point of the ITM Trading Facebook flash five presentation is to allow the consumer to access the information from which they can make educated choices.

ITM Trading Facebook Flash Five Presentation : Why Wouldn’t The Fed Raise Rates?

Before we delve too far into this question, let us make sure we understand the question thoroughly. The “Fed†refers to the Federal Reserve. The Federal Reserve is a private banking entity that is responsible for setting the base interest rate in the United States. Currently, the chairman of the Federal Reserve is Janet Yellen. Just as Alan Greenspan and Ben Bernanke before her, Janet Yellen makes decisions that affect the economies of the entire world.

The Chairman of the Federal Reserve is without a doubt the most powerful banker on the planet. Many would argue that the chairman of the Federal Reserve wields more economic power than either the secretary of the Treasury or the president of the United States. Over the last several years the different Federal Reserve chairmen have together lowered the Federal Reserve interest rate to zero or near zero. In essence, the Fed has created through these policies “free money” for corporations and banks.

Wades Question.

The final question that Eric Griffin posits to Lynette Zang is from Wade. Wade asks, “Why wouldn’t the Fed raise rates?”. If you have been following the news, Janet Yellen on several occasions, has said that she plans on raising the Federal Reserve interest rate. There have even been comments made that would suggest that there are at least three interest rate hikes coming in the near future. Lynette informs us that the purpose of raising interest rates is generally to slow down and overheated economy. However, Lynette states that the American economy is not currently overheating.

Conversely, she believes that the Federal Reserve must raise rates so that the next time the Federal Reserve needs to lower rates, they can. Some countries have investigated and implemented negative interest rates. A negative interest rate means that you actually get paid to borrow money. To normal American citizens the idea of being paid to borrow money is about as foreign as the idea of a true 0% loan.

Out Of Tools.

Ultimately, what Lynette Zang is saying is that the Federal Reserve has lowered rates so low that they now have no tools available to them to combat fluctuations in the markets and currency. The only way that the Federal Reserve can restore these tools is to raise interest rates, so that they can lower them again in the future as needed. In essence, the Federal Reserve is out of tools. For this reason, Lynette does not see any reason for the Fed to not raise interest rates. Essentially, they must.

In addition to restoring the tool of being able to lower interest rates for future use, the Fed must also save face. In the past several years, the Fed has only raised interest rates three times. Usually, these raises are about one fourth of 1%. While these interest rate increases are very small, the dollar amounts affected by these increases are enormously immense. A small increase in the Federal Reserve rate results in a huge increase in the payment on the federal debt. This fact must be kept in mind at all times. If the interest rates are raised too high, the United States will no longer be able to service it’s debt, and will default. This will cause chaos in the stock markets and with the dollar. Collapse will be most probable.

Lynette And Wade Agree.

After a few minutes of explanation, Lynette agrees with Wade. The Federal Reserve must increase interest rates. The Federal Reserve must save face. And, the Federal Reserve must preserve the few tools it has in order to combat future financial challenges, problems, and meltdowns. Lynette takes this opportunity to point out that the rest of the world is lowering its interest rates. In some cases, rates are being lowered to below zero, otherwise known as negative interest rates. The fact the United States central bank (the Fed) is not following what other central banks are doing may be somewhat troubling.

Data And Fact.

Eric brings up the fact that according to ECRI, the Economic Cycle Research Institute, the current growth trend in the United States began late in 2016. Prior to this the United States was in a period of stagnant growth or perhaps recession. Since economic growth in the United States has truly only been on the upswing for a few months, we know that the United States economy is not overheated.

Lynette agrees with this sentiment. In addition to the ECRI report, Lynette mentions a PowerPoint presentation recently produced a J.P. Morgan Chase. According to J.P. Morgan Chase it is inflation that is pushing the value the stock markets upward. If this is the case, this finding should be alarming to you. What this ultimately means is that stocks are not gaining value. The opposite is happening. The value of the dollar is decreasing and therefore it takes more dollars to purchase the same share of stock. This is not good for the investor.

ITM Trading Facebook Flash Five Presentation : Submit Your Questions.

Lynette and Eric close this ITM Trading flash five presentation by inviting you to submit any question you may have to be answered in another ITM Trading flash five presentation. You may submit your question via YouTube in the comments section, or on Facebook in a message, or tweet ITM Trading (@ITMTrading). Also, if you would like to speak to Lynette Zang directly to have your questions answered personally, please contact her at 1.888.OWN.GOLD. Lynette Zang, Eric Griffin, and the entire ITM Trading staff of professionals are here to be of service.