ITALY IS TIPPING OVER: Who Will Get Crushed? by Lynette Zang

Why Does Italy Matter to Me?

The Euro experiment was born as an accounting currency on January 1, 1999. In 2002 twelve-member countries began using it as their official currency, effectively pegging their economies together. Pegging requires economic policies to be identical, even though the economies are not the same.

Today, nineteen-member countries use the single euro currency. Those countries include: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain.

The peg enabled all countries to borrow with rates reflecting the strongest economy, Germany. And borrow they did. At this writing, Italy has grown the largest debt to GDP level in the European union with Germany the primary creditor.

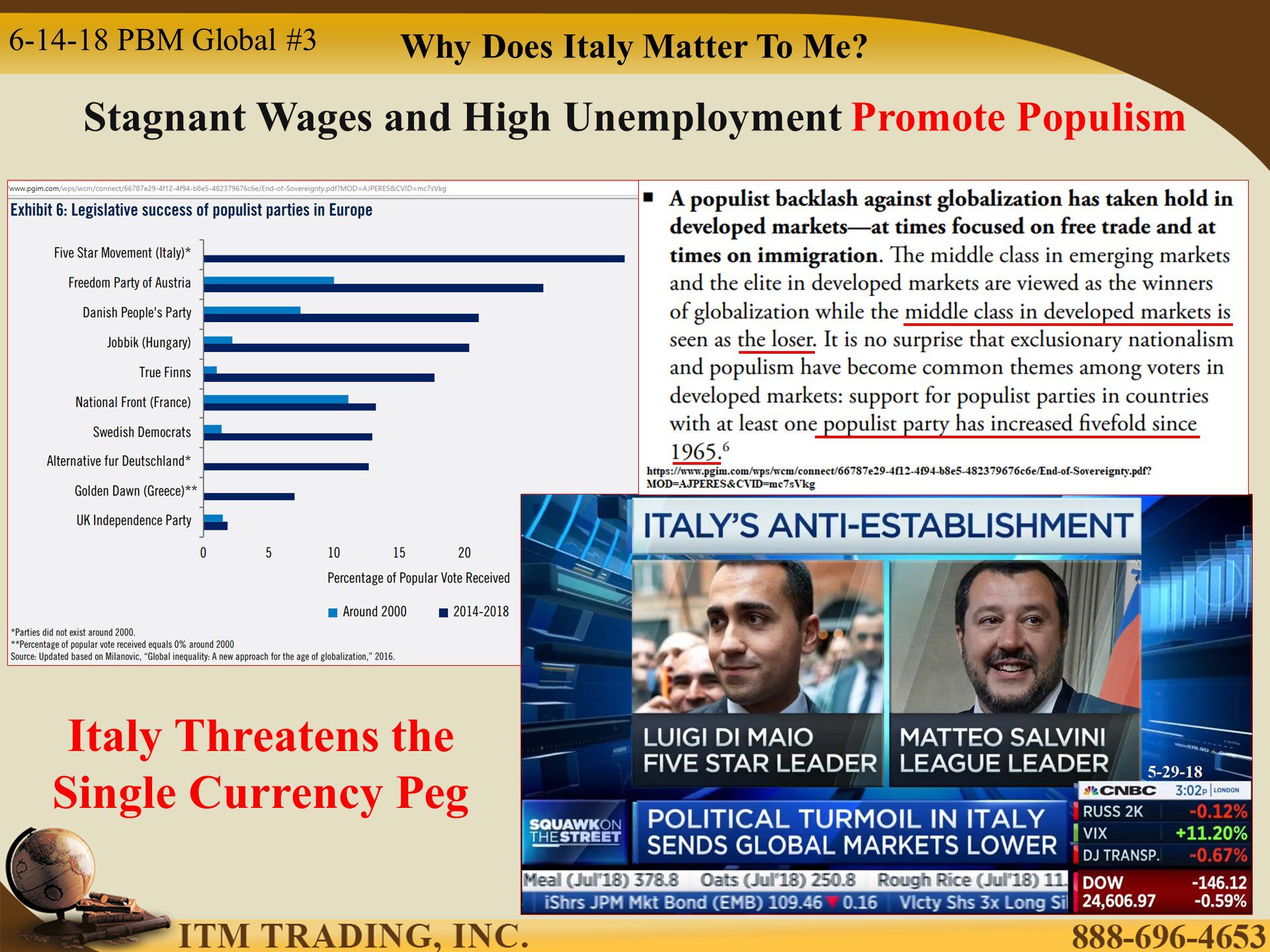

Over time, this relationship has produced income inequality and high unemployment in many of the eurozone countries. As a result, populist parties have emerged as a real threat to the union.

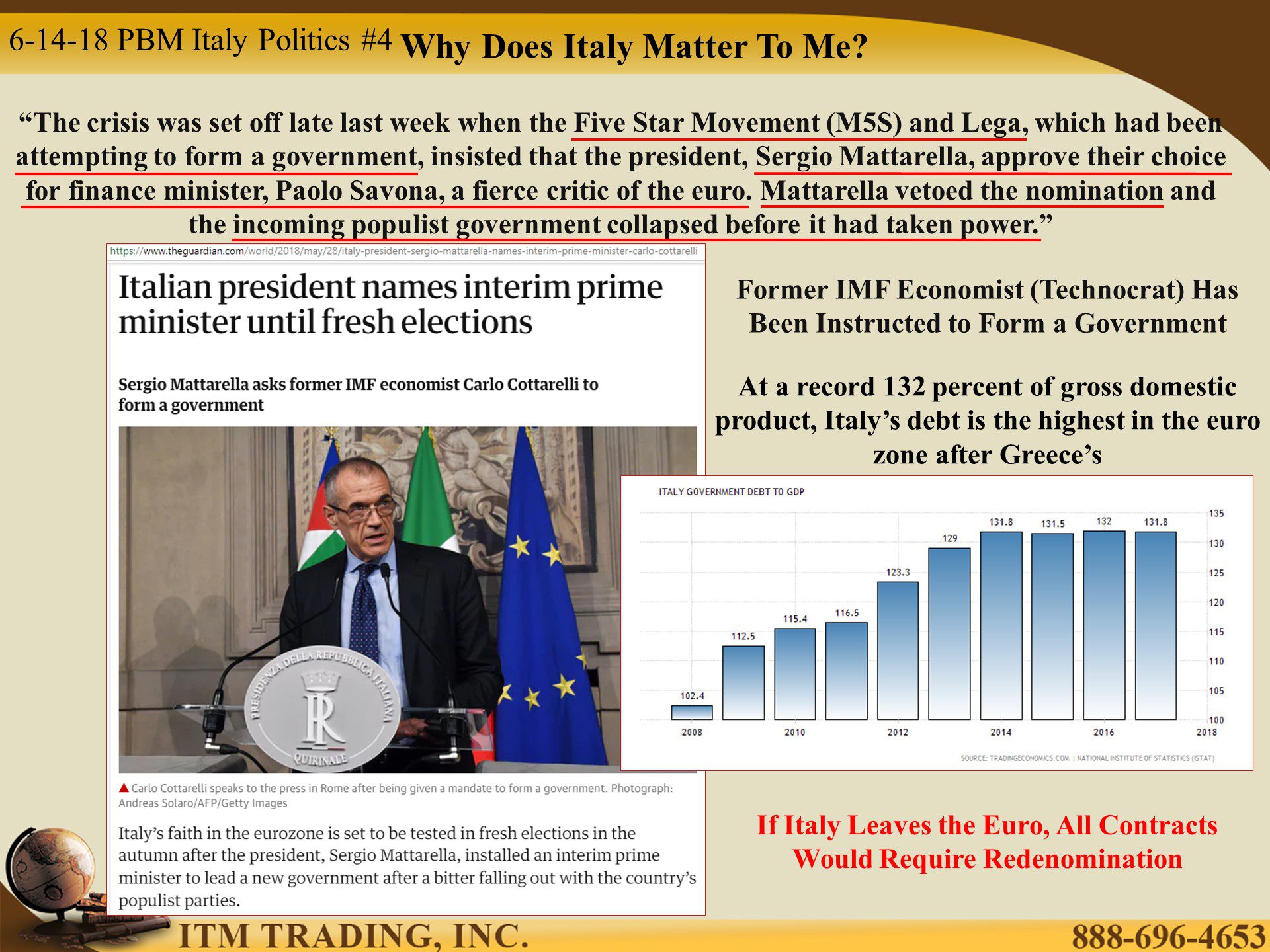

In fact, recently in Italy, the incoming populist government collapsed before it had taken power when Italian president, Sergio Mattarella, vetoed their nomination for finance minister because, as a fierce critic of the euro, he might push Italy into leaving the euro. If Italy leaves the Euro, the experiment is over.

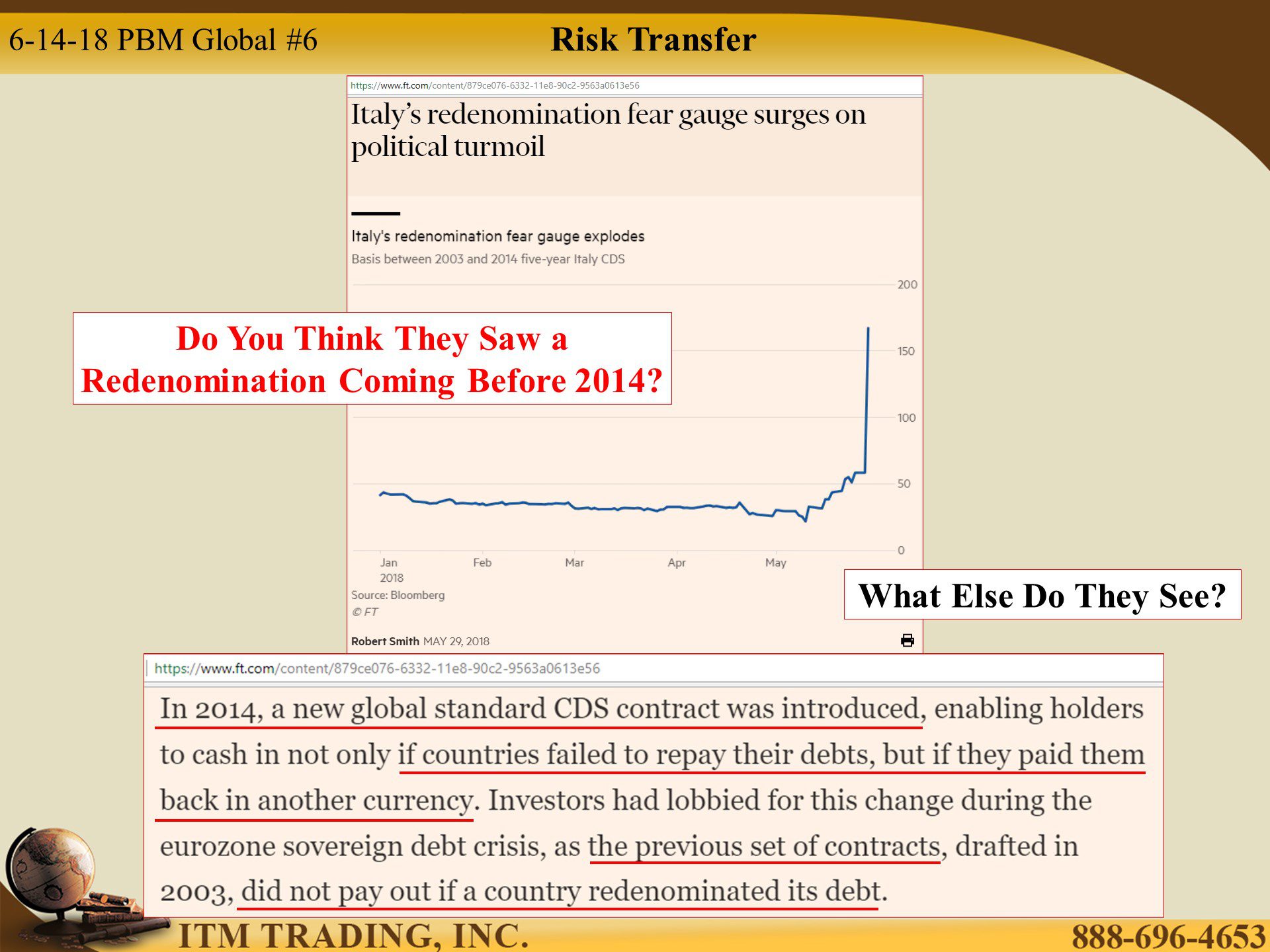

In addition, since that debt was created in terms of euro’s, if Italy reclaimed the lira, all contracts would have to be redenominated. Do you think all of this has been a surprise?

Not for those paying attention. Since 2008 capital flight from Italy to Germany has been occurring, with a pick up in flight since May 2015, a pattern similar to what we saw in Cyprus before the first bank bail-in test.

Who Owns Italian Debt?

I maintain my position, that the global debt-based financial system died in 2008 and that the last 10 years have been used to transfer risk.

Insurance companies and pension funds surpassed private banks in Italian debt ownership in 2013 and recently, the Italian Central Bank surpassed private bank ownership this year. Taxpayers are responsible for central bank balance sheets. Therefore, the public sector is the largest holder of Italian bonds.

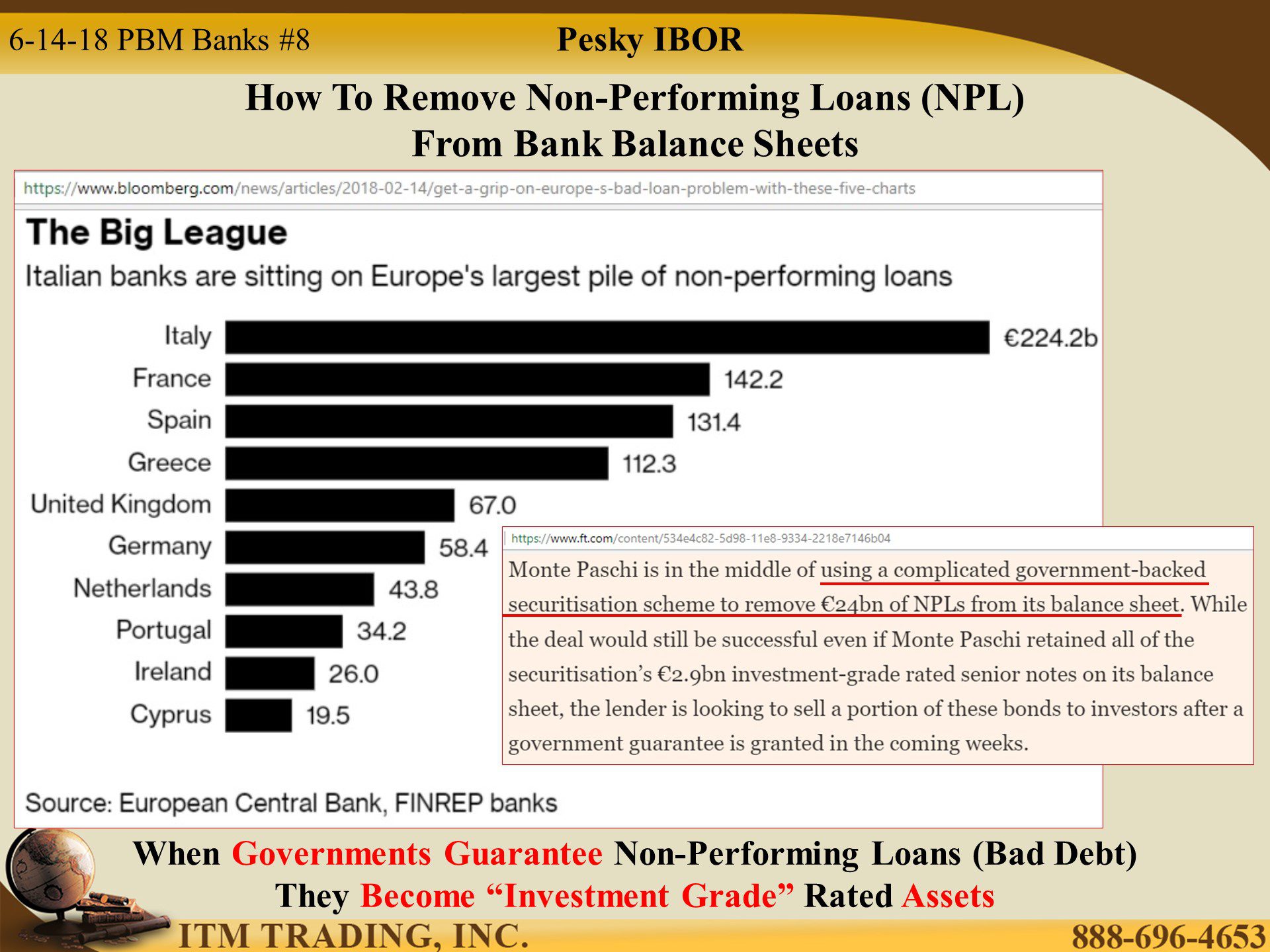

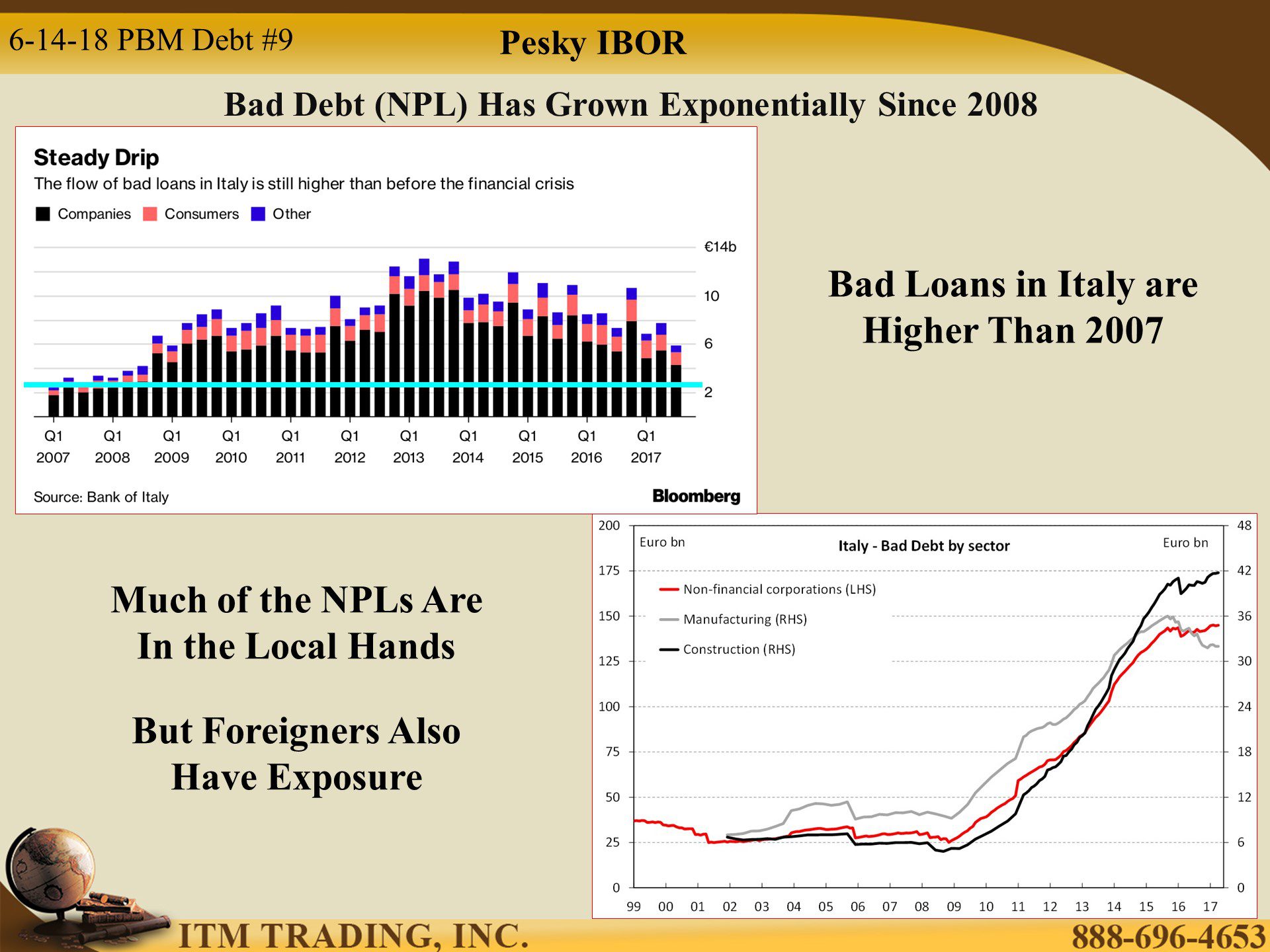

It does not mean that Italian banks are out of the woods. They are sitting on Europe’s largest pile of non-performing loans, totaling at least 224.2 billion euros, exponentially growing since 2009.

Of course, there is a complicated plan that removes bad loans from bank books. Simply put, the government guarantees the bad debt held by the banks, who then turn them into a securitized derivative product. Because of the government backing, this bad debt becomes investment quality!

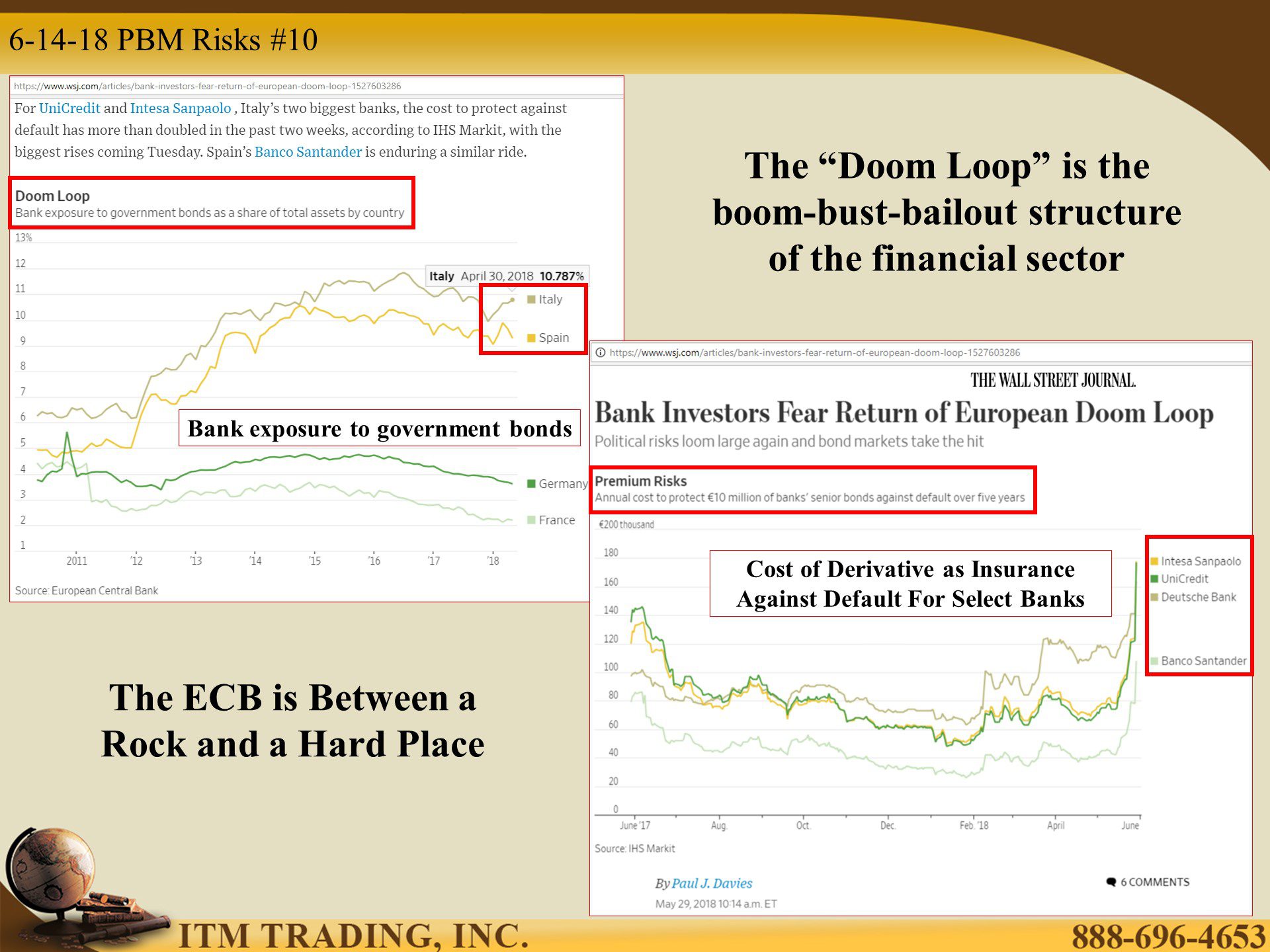

The Doom Loop

The “Doom Loop†is the boom-bust-bailout structure of the financial sector. As defined by The New York Times, “A virtue less circle in which banks take ever-greater risks to boost returns (secure in the knowledge the state will underwrite them), and governments are forced to break their promises “never again†to bankroll losses (further encouraging banks to take dangerous risks).â€

Further, as governments issue new debt to bailout the banks, the banks buy that debt with funds supplied by central banks.

Recently the Italian Central Bank overcame the Italian banks as the largest holder of Italian bonds. Keep in mind that central bank balance sheets are backstopped by the taxpayers.

House of Cards

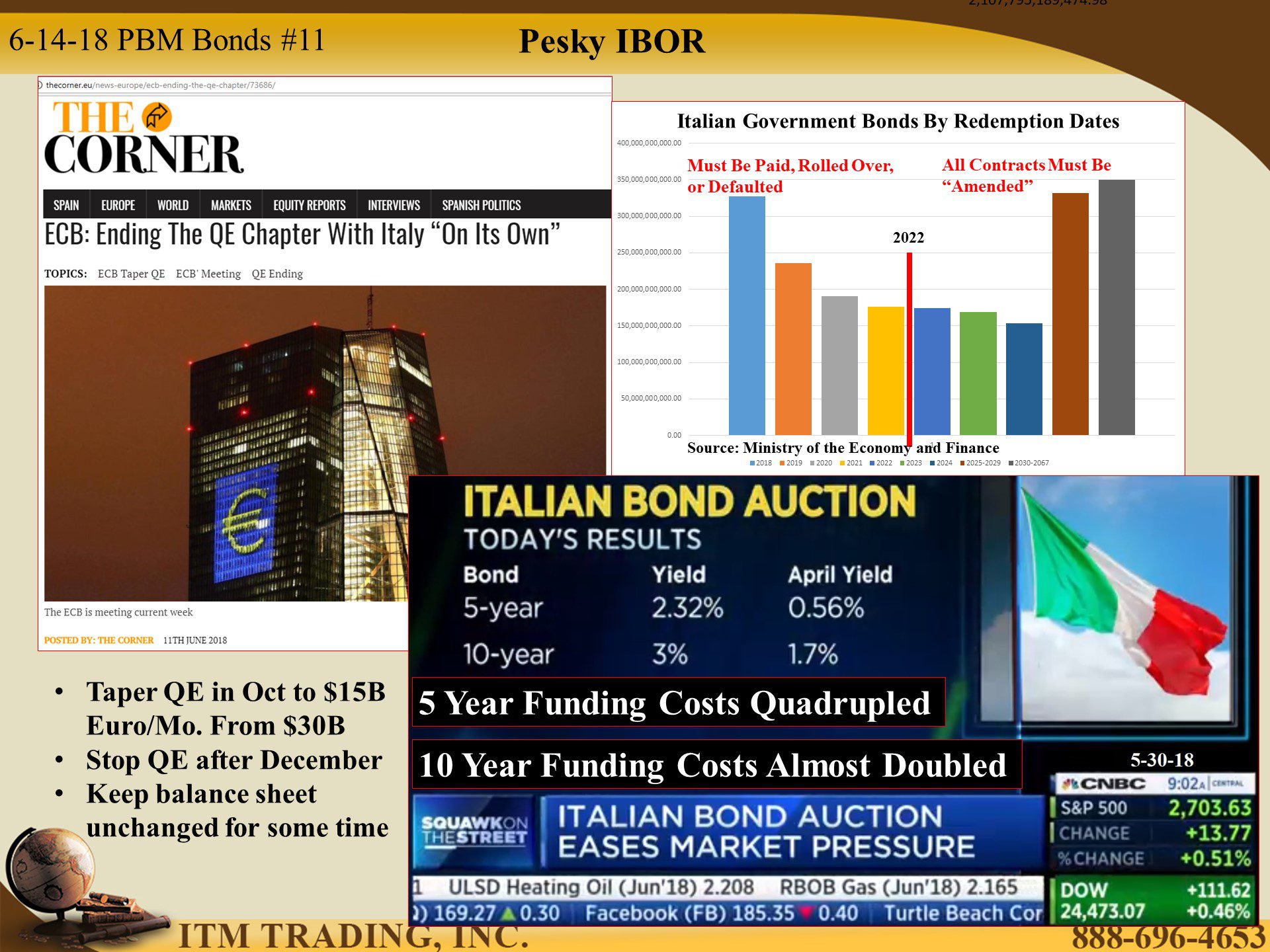

Today, Mario Draghi the head of the ECB, announced that by year end they would stop new money QE indicating that Italy would be “On its own†when dealing with their debt problem. Personally, I don’t believe it because Italy is Too Big to Fail.

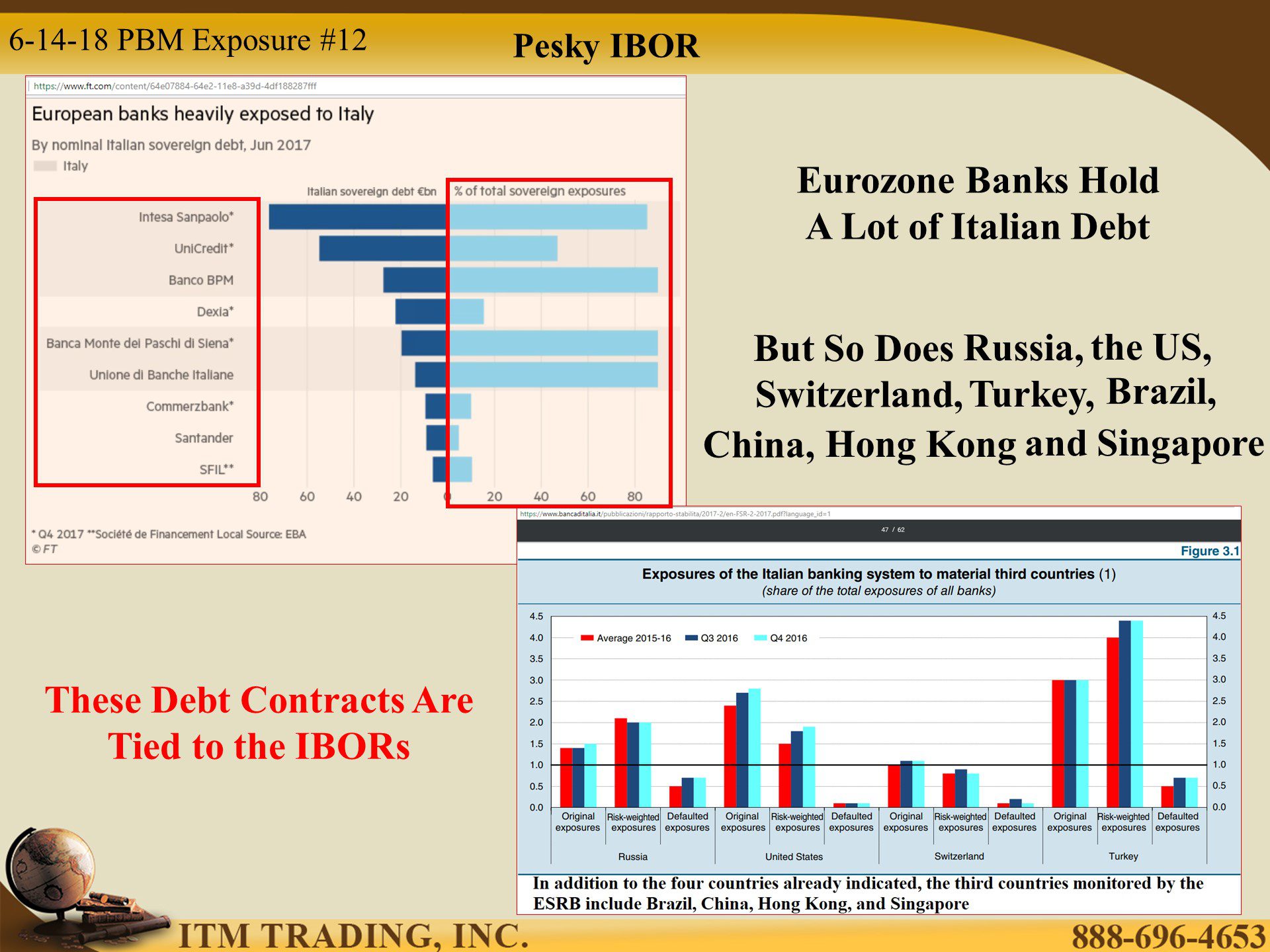

It’s not just the Italian taxpayer that is on the hook since eurozone banks also hold quite a lot of Italian debt. But so does Russia, the US, Switzerland, Turkey, Brazil, China, Hong Kong and Singapore.

That Pesky IBOR Issue

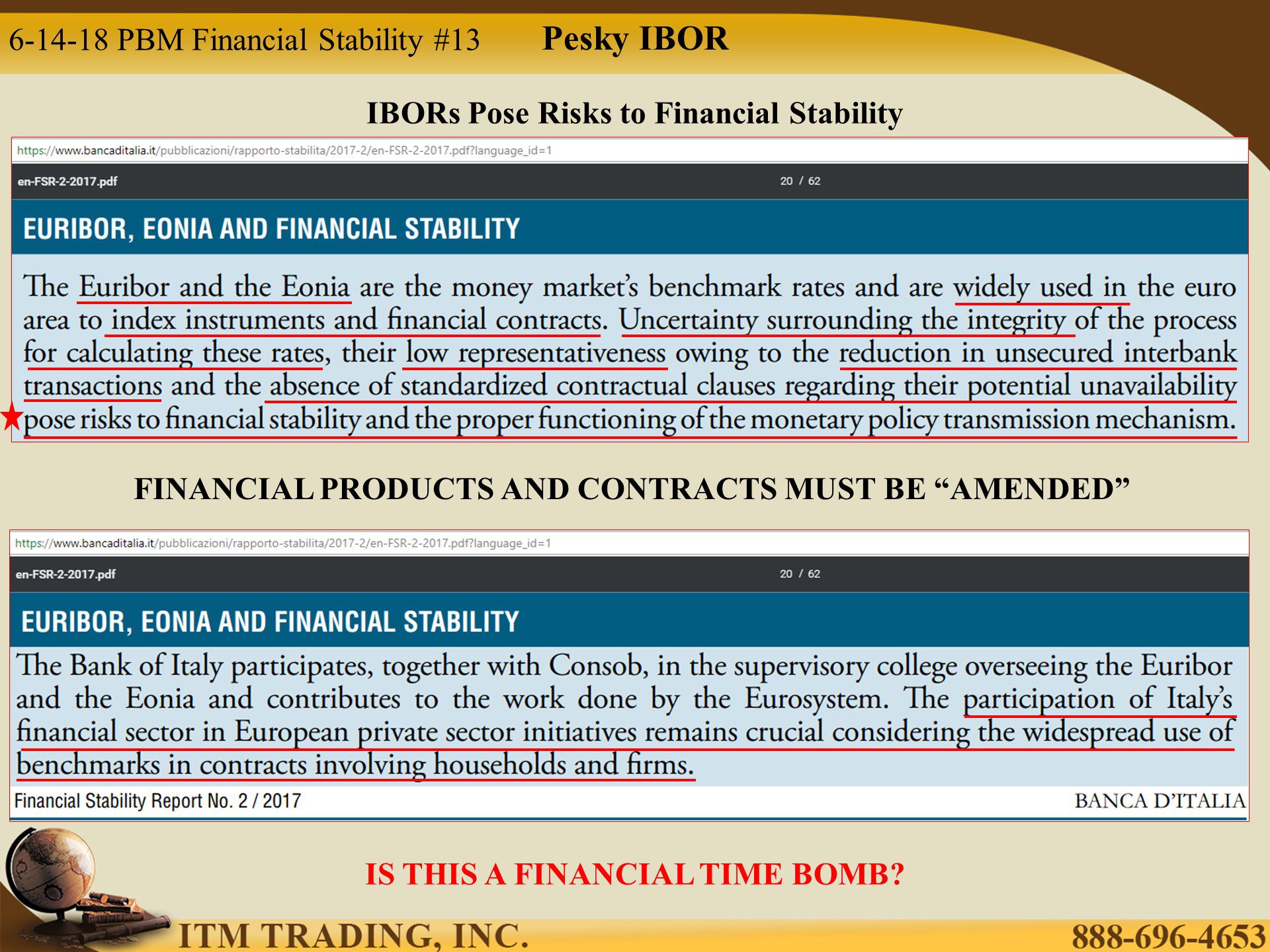

And if that is not enough, more than half of those debts mature after 2021 when the IBORs (Inter Bank Offer Rate) go away, requiring “amendments†to all of those debt contracts. YIKES!

To recap this very complicated issue. Italy has the largest debt to GDP (second to Greece) of the Eurozone. Interest rates on this debt is tied to an IBOR. They may choose to leave the euro and go back to the lira. If they do, all contracts tied to the euro will have to be redenominated. Even if they don’t, any debt that matures after 2021 will have to be “amended†to tie them to a new benchmark.

Italian debt is held globally, so any changes will have global ramifications.

Into this complicated stew, Mario Draghi announces the end of new money QE by the end of this year, indicating that Italy is on its own.

Fiat money is local government money. If governments can legalize it, they can also demonetize it. But gold is universal, decentralized, private money. Any questions?

Slides and Links:

https://tradingeconomics.com/italy/government-debt

https://www.aei.org/publication/italys

https://www.ft.com/content/879ce076-6332-11e8-90c2-9563a0613e56

https://www.ft.com/content/716390f6-22b0-11e8-add1-0e8958b189ea

https://www.ft.com/content/534e4c82-5d98-11e8-9334-2218e7146b04

http://blogs.lse.ac.uk/europpblog/2017/06/28/italy-spain-two-measures-same-banking-problem/

https://www.wsj.com/articles/bank-investors-fear-return-of-european-doom-loop-1527603286

http://stockcharts.com/h-sc/uihttps://schott.blogs.nytimes.com/2009/11/12/doom-loop/

http://thecorner.eu/news-europe/ecb-ending-the-qe-chapter/73686/

http://www.dt.tesoro.it/en/debito_pubblico/fondo_ammortamento/

http://rooseveltinstitute.org/doom-cycle/

https://www.ft.com/content/64e07884-64e2-11e8-a39d-4df188287fff

https://www.bancaditalia.it/pubblicazioni/rapporto-stabilita/2017-2/en-FSR-2-2017.pdf?language_id=1

https://www.bancaditalia.it/pubblicazioni/rapporto-stabilita/2017-2/en-FSR-2-2017.pdf?language_id=1

http://www.euribor-rates.eu/eonia.asp

https://www.goldbroker.com/charts/gold-price/eur