What Is Happening To American Expats And Their IRA’s ?

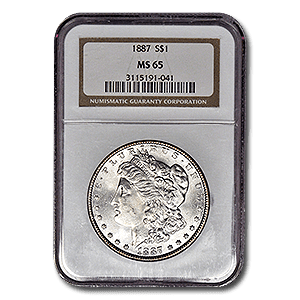

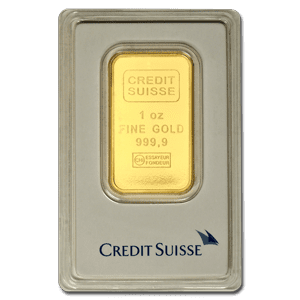

Investing in Gold or Silver in IRA and Roth IRA

Imagine working hard at the same job for over forty years. Imagine while you are doing this, that you trustfully deposit money into your IRA every year, waiting for the day that you can wake up, and call yourself retired. Perhaps at some points over the years, you watched in horror as hard earned money in your IRA evaporated due to poor investment choices, a lack of financial supervision, market crashes, or worse yet your account was ravaged by all three. Meanwhile, gold, and therefore gold bullion, gold coins, and rare gold coins have increased in value sometimes ten-fold. You may wonder if you made the right decision to pass up the opportunity to buy gold coins online, and continue to deposit earnings into your IRA. You put these thoughts out of your mind and focus on the little beach cottage that you want to retire to, with the thoughts and dreams of spending mornings fishing from the beach, and afternoons with a cool cocktail.

Five Years Later You Get A Letter

After a morning fishing from the beach in the small Chilean town where your beach cottage is nestled, and halfway through a mai-tai, you begin going through your mail which has traveled a ways from the United States to find you enjoying your dream, finally retired and living out what you hope will be the best years of your life. Nothing in the mail seems too interesting, just some of the usual bank statements and a couple of bills that always seem to follow you around the globe, no matter where you travel. In fact, your travels have exposed you to many different cultures and economies. As you put down the envelopes and pick up the mai-tai, which is tasting maybe a little too good, you reflect on your travels. You recall how in China it seemed that even the poorest people stood in line to buy gold from little coin shops. They would save to buy a small gold coin, happily handing over a thick stack of colorful paper money in exchange for their golden treasure. In India, you noticed everyone wore gold, which was their common version of gold bullion. You recall visiting a nice little jewelry store in Honduras, that had a display case of old American rare gold coins on display, and you found it odd that American gold coins had made their way that far to sit in a display case in such a rural part of the world. As you turn your attention from the beach and the waves gently cresting onto the shore, and then back to your tall glass shimmering with condensation that you know tastes slightly of salt from the sea water, you ponder a few moments on the way that others around the world save money, probably for their retirement. You chuckle to yourself that probably none of the people you have come across have American IRA’s. That reminds you of the letter from your IRA servicing company, and you look over at it.

OK, you are living your dream. After forty years of hard work and faithful IRA contributions, you were able to retire to a little beach town in Chile, where you have a small but very comfortable home with all of the modern amenities and conveniences of a home that would cost at least five times as much if it were on an American coastline. One of your favorite things about living here, is sitting on your deck, watching the ocean, and knowing that somewhere in those waters is the next fish that will take your line and play it’s part in fulfilling your retirement fantasies. Sometimes the fish end up on the grill, and sometimes they get away, but you like the challenge. Some afternoons, your thoughts wander to the stories of the ships that have sunk along the coastline, carrying golden treasures from one part of the long-gone world to another. You know that somewhere out there, somewhere in your field of vision, there is sunken gold bullion, old gold coins, rare gold, and other treasures. As you pick up your mai-tai, you regret a little bit that you’ll probably never get the chance to go exploring for these gold coins, for scuba diving in these waters at the necessary depths is a challenge for people half your age, but you still dream. In fact, one of your favorite things to do, is walk the beach after big storms have subsided. You have heard tales of all kinds of things being washed ashore after a nasty storm, and perhaps the fates will be very kind to you and deliver you a few old, rare gold coins by way of the angry waves. As you ponder this little fantasy, you muse that the likelihood of a second mai-tai is much greater than that of finding some Spanish galleon’s nearly ancient treasure of gold coins and gold bullion laying on the beach, but you can dream. You do know, however, that gold does not corrode or rust, and that is why from time to time you still hear stories of some lucky soul striking it rich by finding an old shipwreck.

Your Thoughts Turn Back To The Mail

Beside you are a few envelopes from the States. You recognize one immediately because you have a love / hate relationship with it. It’s your IRA company. For decades you sent them your money, and for decades they charged you fees. Some years you didn’t even open the envelopes, because you knew the economy was down, you just hoped the good years would make up for the bad ones, and then some. After all, that is what your account representative told you, “some years will be better than others, sir, this is a long-term investment, heck, keep sending in your checks and you’ll probably be a millionaire by the time you retire!†You reach for the envelope with a bit of irony still ringing in your ears, because you know you are not a millionaire.

In the beginning of this article you were lazing on your deck, enjoying the sunshine, the light ocean breeze, and a mai-tai. You were recollecting your travels, the cultures you had encountered, and your slight longing to dive to the bottom of the waters in front of you and discover an old shipwreck full of gold coins and gold bullion, and perhaps some very rare gold coins that would fund some more world travels. After all, you’re doing well financially, but you have to be careful, and another world cruise like the on you took the year you finally retired is currently out of the question. But, on the other hand, you are quite content in your cozy beach house, you have made several good friends here in Chile, some American ex-pats like yourself.

Your Eye Catches That Envelope Again

There is that envelope from your IRA servicer again. It’s been nagging at you ever since you picked up your mail at the little post office in town. Something doesn’t seem right about it. Is it time for your statement already? You remember the last statement they mailed you; you were disgusted that the fees ate up most of your gains, which were small to begin with. You lament that the fees you have paid over the decades you have had the IRA would have bought a really nice fishing boat. As it is you fish from the shore, unless you treat yourself to chartering a local fishing boat for the afternoon. Fishing makes you think of your mai-tai, and you drain the glass, listening to the crisp clatter of the half melted ice cubes as you sit the glass back on the little table beside your lounge chair. Part of you wishes a strong ocean breeze would just pick up your little stack of mail blow it away forever, but the wind is too calm for that today.

You Open The Envelope

Curiosity gets the best of you, and you finally reach for the envelope. It seems thinner than usual. Maybe its another letter saying that your old account representative has moved on, and some new account wizard that will make you tons of dividends has taken his place. You have received that letter a few times. Or maybe the envelope contains an itemized description of the new fee structure, which always seems to go up rather than down. You have received that letter a few times too. In fact, you surmise they have a whole room full of those letters, that they can’t wait to send them out every chance they get. You open the letter, but this afternoon is too nice, and these letters never seem to bring good news…so you put it down and opt for another mai-tai, heavy on the pineapple juice, which you really like. Maybe the letter will be better with another mai-tai, you chuckle to yourself. As you head off to the kitchen, you glance once again at the ocean, and your mind skips to the idea of finding gold coins and gold treasure, wishing that perhaps you might find some gold bullion washed up on the shore. After all, with a few gold coins in your safe, the letter would be less of a headache, wouldn’t it?

Ok So you went for the kitchen to make a second mai-tai, your normal limit for the afternoon. You probably would have been content with one, but going through the mail always makes you a little nervous. You really love being retired, and it seems to you that anything that could ever jeopardize your current pleasant state of affairs will probably show up in an envelope, one way or the other. Perhaps you shouldn’t have been so one directional with your retirement savings. Your neighbor back in Arizona was always suggesting you buy some silver and some gold coins, he even sent you a link to buy gold coins online and offered to bring them down with him the next time he came to visit you in Chile. You had thought seriously about it, but had just never pulled the trigger on beginning to invest in gold coins. Gold bullion and gold coins always interested you, but the banker said that an IRA was the way to go for tax purposes. Taxes. Maybe this mai-tai needs more rum than pineapple juice you think to yourself. The taxes seem to be higher now than ever, and wasn’t the whole reason to have an IRA to save on taxes? You know that gold gets taxed too, but you also remember your buddy Paul back in Arizona showing you one ounce gold coins that he was buying for $200. How Much is gold today you wonder to yourself? $1200 an ounce, $1300? You know gold hasn’t been as high as $1900. Buy low and sell high you tell yourself, you have heard it a thousand times before. Then the irony strikes you, your IRA always seems to do it the other way around, buy high and sell low, and the losses mount. You cringe at thinking about how much you actually sent them over the years, and you cringe again at how much you have paid them to buy high and sell low. You need some fresh air, and your mai-tai is mixed. This one a little stronger than the last. You head back out to the deck, and the letter is still there, waiting.

What The Letter Says

As you lay down to read the letter, you take a long sip, perhaps for courage. You were right. It’s not a statement. In fact, after reading the letter three times in disbelief, while you finish the drink that you usually nurse for half an hour, it occurs to you that you probably won’t be getting any more statements from this IRA company. They fired you. It seems that unless you have $500,000.00 in your account, they no longer wish to service the retirement accounts of Americans who live abroad! Your head spins, but it’s not from the rum. You think to yourself that you should have $500,000.00 in your account, but after three stock market crashes and forty years of fees, your fortunate to have what you have left.

This Is Really Happening To Americans

Well, now that you finally opened and read the letter from your IRA servicing company, and they fired you as their client. After forty years of you sending them money, and you paying their fees, and you have lost track of the number of account representatives that you are supposed to be trusting your future to, they fired you! Why? Because you live outside of the United States and don’t have a half-million dollars in your account? How many people have half a million dollar IRA’s you wonder to yourself…It occurs to you that the few wealthy people you do know never talk about even having IRA’s, they always seem to make their money elsewhere. You have watched some of them make a bunch of money in real estate, only to lose it during the crash. There were some that did well in the stock market, until the first crash, or the second, or the third. Your mind goes back to your friend Paul, and his little horde of gold coins and gold bullion. Sometimes, when you two were sharing a couple of beers in his backyard, Paul would disappear for a minute and then return with a few rare gold coins he had just purchased, and would tell you a little bit about each one. The rare gold coins always fascinated you, and quite often you thought about buying one or two gold coins, even if they weren’t the rare gold coins Paul liked the best. Then you think to yourself what Paul’s Chilean villa would look like, or what type of fishing boat he could afford to have waiting at the dock. You miss your friend Paul, his heart attack came too early in life, but all those cigarettes can do that to a man. Sometimes you still talk to his wife. She is doing well, as it turns out Paul’s rare gold coin collection remained intact for her when he passed. They did have to go through nearly all of their cash savings and other accounts when he was in the hospitals, but rare gold coins are considered collectible by the IRS, so their wise accountant suggested leaving them right where they were, in the safe.

Your Mind Rushes Back To The Letter

Damn them! After decades of passing up other opportunities to invest, just so you could always send in the maximum contribution, this is what happens. Even when you called them about converting to a precious metals IRA after Paul suggested you do so, they said that their was more “market opportunity†available in their funds, yada, yada, yada….And you fell for it. At least if you had switched over to a gold backed IRA, you would have been in better profits, and you could just just write on the back of their letter that you wished to close your account, pay your taxes, and have your gold coins and gold bullion sent to you. But you can’t do that. You are still caught up in their system where they make the rules. And they just ruled against you.

Today, more and more Americans are choosing to retire outside of the United States, simply because living well in the U.S. has become very expensive, and their dollar goes much further elsewhere. In fact there are beautiful places around the world where you can live well for a week for what a one-day deep sea fishing license costs in California, but I digress.

When I Read This Article

I should say that I have never worked with such a collection of very bright, diverse professionals as when I worked on the trading floor at ITM. ITM Trading strategically hires vetted, trustworthy professionals from varying backgrounds in the financial and investment sectors. These people spend a large part of their days looking for information that their clients can use to make informed and intelligent decisions regarding buying gold coins, gold bullion, and rare gold coins. Sometimes their clients open gold backed IRA’s, and sometimes they take physical delivery of their gold and silver purchases. One way or the other, the client is always well informed. A few days ago, one of these well researched ITM employees sent me an article about how IRA servicing companies were choosing to end their relationships with long term clients who had chosen to retire out of the country, and the article shocked me. Diversification is key when investing and saving for retirement. Not all of us will retire millionaires, no matter what some investment company representative tells you or “guarantees†you. In my way of thinking, if you were to have at least $500,000.00 in an IRA, then you should have twice that amount spread over three or four other investment arenas, perhaps gold coins and gold bullion. Therefore, if you were to have $500,000.00 in an IRA, and were properly diversified, then you would be a millionaire. According to the article I read, the companies that are no longer choosing to continue servicing IRA’s for American’s living outside of the U.S. are Fidelity, Scottrade, and Vanguard, and I expect more to follow. The reasoning is that they just don’t make enough in costs and fees from clients with accounts of less than $500,000.00. I have to reason to myself; if they don’t make enough profit from a $400,000 IRA to make it worth their while to continue servicing the account, what type of effort do they put into a $50,000.00 account or even a $100,000.00 account?

ITM Trading And You

If this article-blog intrigued you, and you would like to begin the discussion about diversifying out of an existing IRA or other financial vehicle, and into gold coins, rare gold coins, gold bullion, or a precious metals IRA, please call us at ITM Trading. We are here to be of service.