Interested In Gold, But Unsure.

Invest in Gold?

A while ago the president and founder of ITM Trading, Craig Griffin, had a chance to interview Jim Rickards, author of Currency Wars and The Death of Money. Jim has a high powered mind that is often tapped by governments and corporations for his thoughts and ability to suss out complex financial and currency situations. If you do not know who Jim Rickards is, you owe it to yourself and your nest egg to do a bit of research and learning, but I digress. Before Craig interviewed Jim, we invited ITM Trading clients and the general public to submit their questions for Mr. Rickards. Recently I received the following question in response to our invitation. The Jim Rickards interview has already happened, so I cannot have Jim Rickards respond to Janelle, but I can offer my two cents. Janelle is interested in gold but unsure what avenue to take.

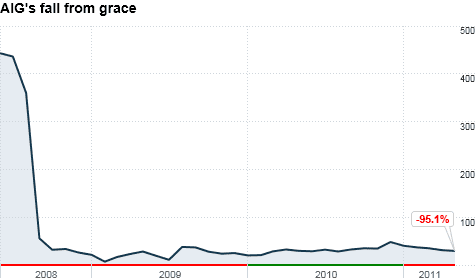

Janelle has a lot to say in a few words. If you are not familiar with AIG, AIG is a huge world-wide insurance company that ended up with massive amounts of financial exposure during the somewhat simultaneous crashes of the stock markets and real estate back in 2007-8. Judging from Janelle’s post, I’m not exactly sure when AIG lost half of the retirement funds that Janelle had trusted them with, but it sounds like AIG definitely lost them. If Janelle was interested in gold back in 2000, she would have had the opportunity to diversify into gold when gold was under $300 an ounce. Today gold is over $1200 an ounce. This is one example of how owning gold can help offset stock market losses and other financial calamities.

First, I should say that 50% is too high of a percentage of your wealth to invest in a single direction, for exactly this reason; one company going down can cost you half of your wealth – or more. Diversification is key, and in retrospect perhaps Janelle will agree that she was not properly diversified. Any financial adviser that suggests a 100% paper investment vehicle financial portfolio and excludes physical gold coins and gold bars does not truly understand or practice financial diversification.

When a potential client calls ITM Trading and is interested in gold, ITM Trading seldom suggests holding more than 10% to 20% of one’s wealth in physical gold and silver, unless the client wants to be particularly aggressive or needs to protect large amounts of wealth against currency devaluation.

I’m Interested In Investing In Gold But Have Invested In Certain Foreign Currencies.

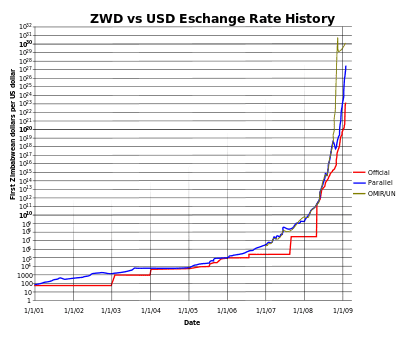

Currency devaluation is something that happens regularly. Currency devaluation happens for several reasons; inflation, increasing government debt, war and economic policy are reasons that come readily to mind. Unfortunately, for currency holders as well as long-term investors, fiat currencies (paper currencies backed only by government decree) always lose value over time and eventually become worthless. All of the above factors I listed are reasons why fiat currencies have obsolescence designed into them.

Over the past few years, I have heard of Americans buying paper currencies from Zimbabwe, Iran, Iraq and Afghanistan. The sales pitch is always the same…. the currency for sale is only down right now because of war or sanctions or oil production or some factor, but as soon as things get straightened out, the currency will be revalued (either by the government or by world markets) and you will triple or quadruple your investment or more.

There are some fundamental reasons why this does not and will not happen. In general, currency trading and currency speculation are not for beginners, and currency trading is also not a good long-term strategy, but more on that in a bit.

Zimbabwe Dollar vs US Dollar Exchange Rate. Notice The Exponential Factors On The Left Side Of The Chart.

Governments do not want their currency to gain value. When currencies get stronger instead of weaker, this essentially makes government debt harder to pay off. Here is an example set on a personal level:

Imagine you have a job that pays $1000.00 a month, and you have a mortgage that is $500 a month. If this is the case, you have to watch your pennies. Imagine one day your employer comes to you and tells you that since the currency has been revalued and that it is now stronger. Therefore, he only has to pay you $750 a month for your work, because the dollar has gained in value against your work.

On the plus side, theoretically groceries and most things should be cheaper to purchase with your strong dollar. On the negative side, since your mortgage debt is an agreed upon contract, your monthly mortgage payment will not decrease, and in effect the amount of work you must do and be paid for in order to pay off your mortgage just greatly increased.

Invest In Gold? Governments Don’t Want Strong Currencies.

Since governments today carry billions and trillions of dollars in national debt as a routine matter, no government wants to intentionally strengthen their currency very much, much less by factors of 100%. If they did, they would, in fact, be increasing the national debt and decreasing their ability to continue to borrow. A strong currency can also cause problems for international trade.

Countries that do a lot of international trade have a hard time keeping exports up if the exports become more expensive to customers in other countries as the currency of the producing nation gains strength. A Mercedes is not only expensive because it is a Mercedes, a Mercedes is expensive because it is built in Germany and Germany has a strong currency. Americans have to trade relatively weak dollars for a German automobile.

Invest In Gold? Gold Is The Safest Long Term Currency Speculation In History.

There are several reasons that currency speculation is dangerous, especially speculating in currencies from war-torn areas of the world. The other caveat to foreign currency investing is that Janelle more than likely started by investing US dollars. While the US dollar is a fiat currency, it is a strong fiat currency. In fact, the US dollar is still the world reserve currency. In order for Janelle’s currency trade to work out, the weak foreign currency must gain value while the dollar in essence loses value. The inherent problem is that if Janelle’s foreign currency is making big profits for her, the rest of her dollar denominated investments would have to be losing value and purchasing power. This is perhaps not the best strategy.

The Iraqi Dinar Is Another Fiat Currency That Draws Speculation. Some Supporters Of Dinar Speculation Have Been Waiting For A Currency Revaluation For More Than A Decade.

As far as selling or investing these currencies, I would suggest that Janelle contacts an ITM Trading senior analyst and speaks in detail about the currencies and values in question. One thing is for certain in this scenario, however, gold as a currency existed before the US dollar, the Zimbabwe dollar, the Iranian rial, the Iraqi dinar and the Afghanistan afghani. Gold will continue to be a currency after the fiat currencies of these countries fail. Being interested in gold is wise, investing in gold is wiser.