Insiders Selling Stocks

Insiders selling Stocks as Stock Market Reaches All Time Highs

YouTube Translation

Insiders Selling Stocks

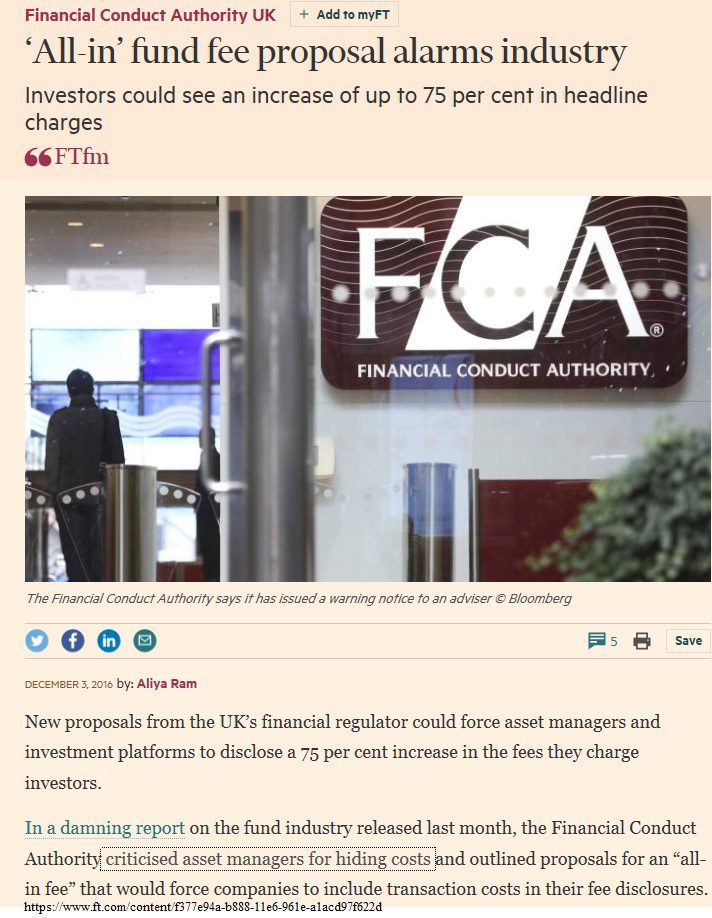

hi guys Lynette the chief market analyst at ITM Trading a full-service physical precious metals brokerage house so I’m going to do just a couple of quick little update and remember all of these jpgs will be available at that link below if you remember we both really briefly about last week about how they were fighting the fiduciary in other words brokers didn’t have to do what was in your best interests first well now they’re fighting letting you know how much they’re really charging you for it which i think is really interesting not going to spend a lot of time on that if they get more interesting.

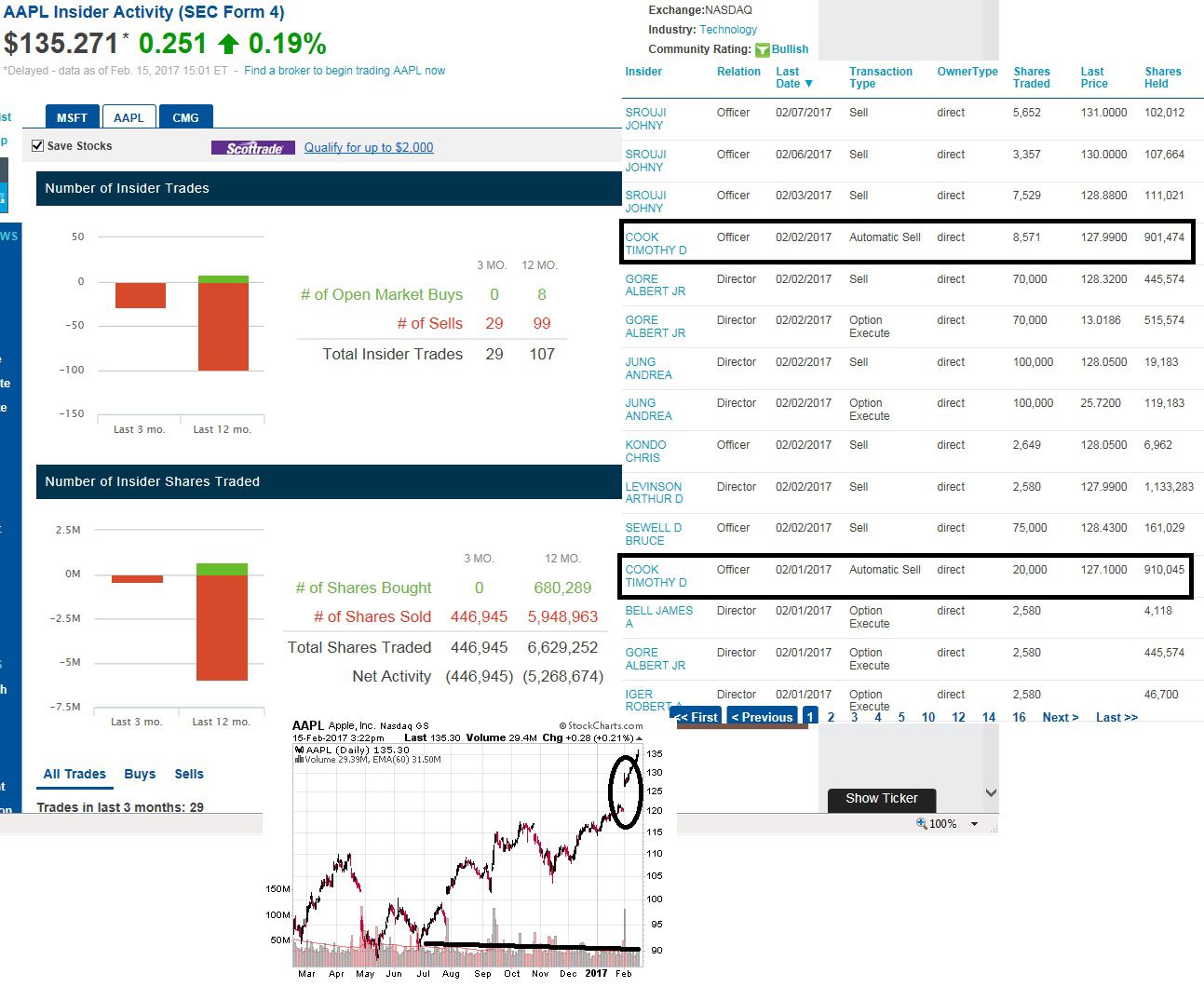

Also just a little update from Bitcoin the Chinese market was the ability to withdraw break point we all they’ve been halted so you’re not going to get away with that alright I just wanted to kind of update you want those two things but if you’ve been watching the market at all you know that all of the markets have been on this very long winning streak and my goodness the NASDAQ longest winning streak since what’s happening in all of this is that the fighters are using this opportunity a why shouldn’t they to take advantage of the stock at all hi so this is the current insider-trading report  with insiders selling stocks from the wall street journal.

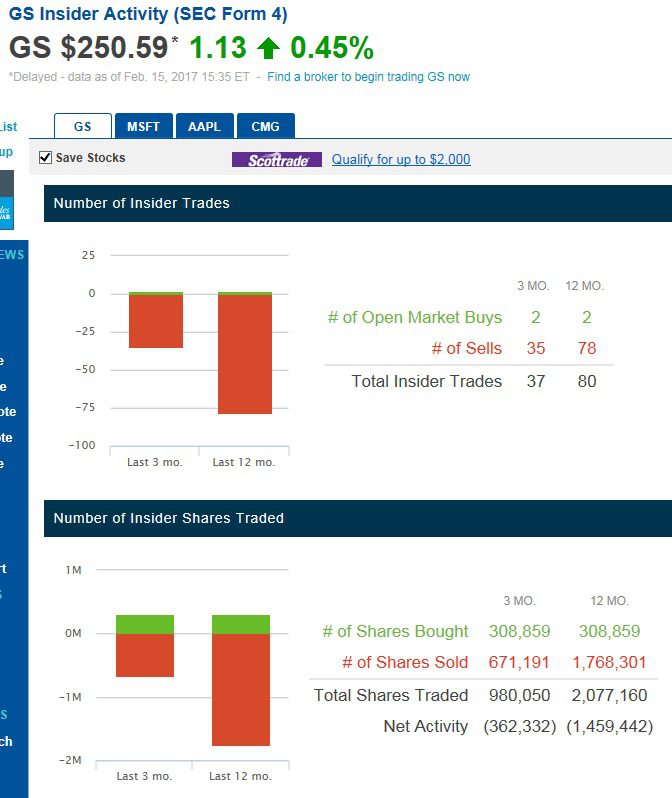

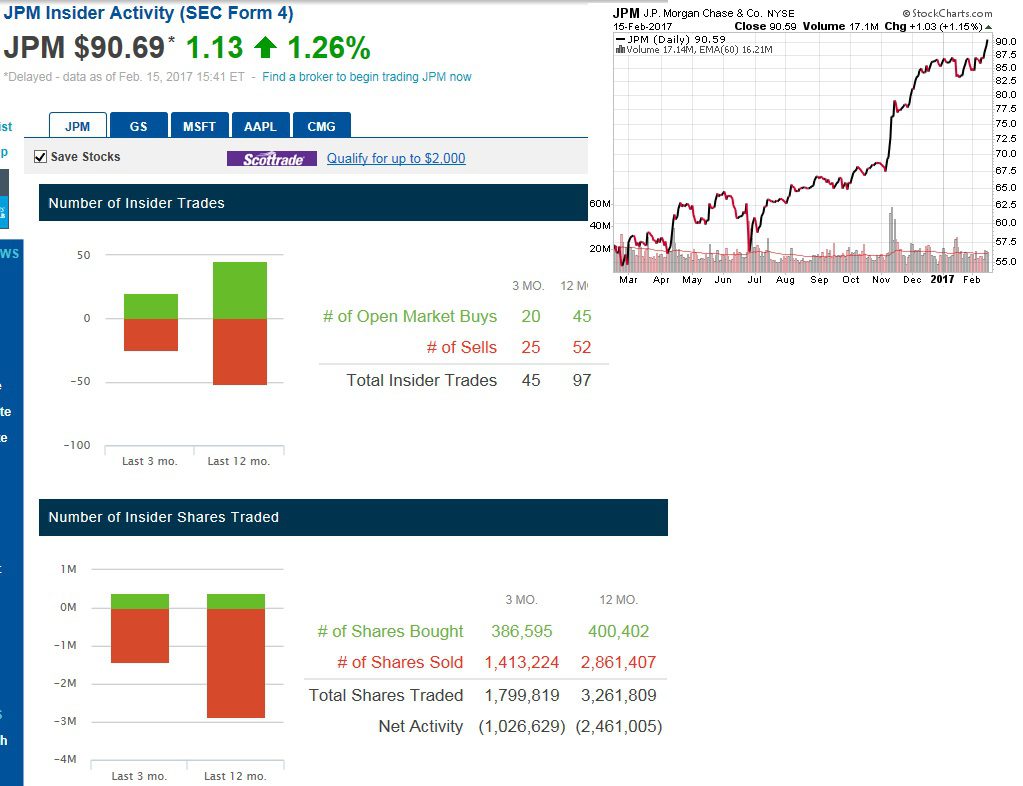

and you can see that this spelling which is in the center is technology and then finance a cetera so a lot of huge selling but what’s also interesting about this particular report in this isn’t the same wall street journal article is look at how much the insiders that’s I think Microsoft have been selling and it says on the other clean that up there that there was only points for milk million in sales but that tells a very different story but not really sure how those numbers of coordinate because that all of Jillian just just in the top micro thought fail anyway let’s look at what that looks like ok so this is from the nasdaq if you own an individual stock you can go in there look at the insider that bottom graph in particular this one right here shows the number of shares and that rusty color bar well you can see they’re tickling an awful lot more than they are buying and then if we go to the chart itself can you see that chart Eric the one on the bottom ok so you’ve got a decline of volume and the document is making new high of course they’re selling why wouldn’t say there’s apple just staying on the technology again because everybody owes apple or if you have a mutual fund and ETF you probably do and my goodness it looks like a very similar pattern on the stock chart so you should be clear on the selling and what’s happening in that market and then let’s look at finance let’s look at banking four minutes and they’re having a boot time to of course we’re talking about read deregulation so why not we saw how well that worked in the nineties here is the insider selling from goldman sachs okay and there’s the stock ok now something should be pretty clear to you that doesn’t make any sense least I hope it’s clear to you that a stop rising on even flatter declining volume and the insider selling out well who’s buying all of this stock don’t know maybe pension funds insurance companies mutual funds that kind of thing so you need to be very very weary i always think you should do it the smartest guys in the room from themselves who knows more about what their corporations are really doing than the insiders we’re taking advantages it’s rally if you’re spilling it you might want to follow their lead up to you but if I had anything in there i certainly would I don’t ok so with insiders selling stocks now.

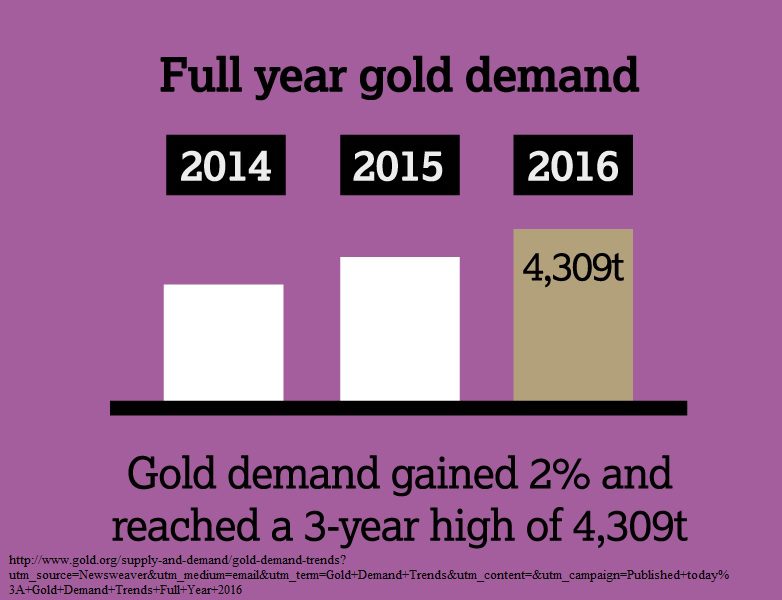

I want to talk about goal and a little bit about silver kids ok this is a very interesting chart that I came across that I want to share with you and you can see right here boom where the stock market went up and the divergence in the gold and the silver spot market now this line represents both gold and silver alright does that make any sense well when you know who’s using who’s manipulating the market or maybe it’s not manipulated always that to your opinion i think it is but this is the full year by of goals for and you can see that that too is increasing even as the spot market declining say so that makes the whole lot of sense so you wonder alone how could that be what this this is on supply and you see the part that I have boxed out right there ok that is producers selling gold that they haven’t produced yet and you can see that that year over here is ninety-five percent are they helping out the market info but in the meantime Germany finished repatriating its goal they have something going on and now we come across this where London bullion banks are talking about for the first time error reporting providing data on how much gold is traded but here’s where it gets a little interesting this part talked about they never let you know how much gold is being traded and down here they’re talking about how much is left in the in the volume bank vault the belt physical gold I can’t wait to see that report my that is was probably going to look pretty similar to to the Olmecs exchange where is the most current data that I’ve seen is for everyone out of bold available for delivery so that would be what they would evolve in the wall there are and what was that ers or something like that of each is each out the bolt available for delivery telling you guys it was very hard for me to choose exactly what to talk about today the news is coming faster and faster but one of the things that I do want to talk about and i will on Friday i don’t think people really quite understand inflation and you know I mean we’re told that it’s good at cetera so i’m going to talk about that in relation to bond and relationship stock in relation to you on Friday and they have to do it in a couple of sessions but that’s it for today remember to subscribe to our YouTube follow us on twitter like us on Facebook and give us a call in ad by you guys.

That was Insiders selling stocks – Flash in Five

ITM Trading America’s Trusted Source for Precious Metals since 1995

Finding ITM Trading Online

Website – https://www.ITMTrading.com

Shop for gold and silver online http://bit.ly/2c02VIn

YouTube – https://www.youtube.com/user/itmtrading

FaceBook – https://www.facebook.com/ITMTrading/

Twitter – https://twitter.com/ITMTrading

To learn more about the benefits of gold please call us at 1-888-own-gold and ask for a free gold kit. Or you can order your free gold information kit online by clicking this link http://bit.ly/2bIjYOI