Insider Trading: Trade Wars and Tax Cuts

The stock market roller coaster continues into March. In January cash repatriation and corporate tax cuts sent the stock markets to all time highs.

The Gift That Keeps on Giving

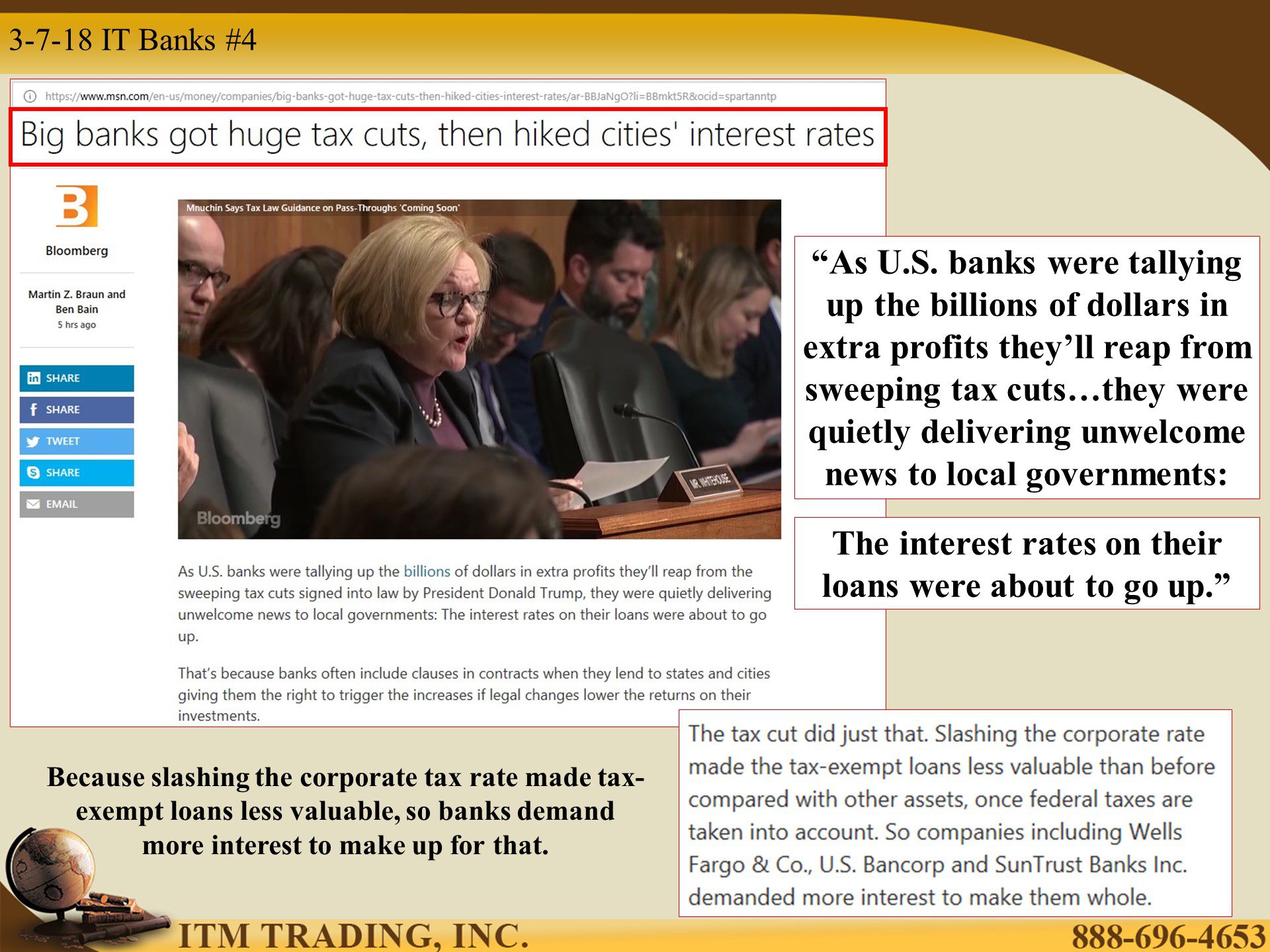

This government gift to corporations is expected to cost taxpayers trillions, but as an added benefit to the banks, because the tax cut made tax-exempt loans less valuable, many banks increased the interest rates on loans to local governments. Who pays for that additional interest? Taxpayers.

In addition, for Wall Street, volatility creates trading opportunities, particularly for high speed trading. The CME Group was supposed to correct a defect in its systems that gives high speed-traders a heads up in market direction. Surprise, it isn’t corrected. Could that be because their biggest customers are those investment banker traders?

Why is it a big deal anyway, who gets hurt? Just those that hold mutual funds, ETFs or other financial products that use futures (derivative) contracts, which is almost all of them.

So Why is the Stock Market Roiling Now?

The threat of tariffs. Wall Street and globalists lost an important White House voice in Gary Cohn, (Chief Economic Advisor and Director of the National Economic Council) a former Gold Sachs executive and investment banker who specialized in debt. Wall Street was not happy to lose this connection.

The US is about to issue hundreds of billions in debt to cover those tax breaks and additional infrastructure spending.

Who will buy this debt? The Fed is supposedly reducing their treasury bond portfolio. Foreign governments have been reducing their purchases for years. In addition, the EU has plans to retaliate if tariffs are placed on their exports, so will they step up to buy this new debt?

Let the Trade Wars Begin

President Trump has threatened to put global tariffs on steel and aluminum. Some say this is to get back at China who subsidizes industries such as steel and aluminum and therefore can undercut American companies. Some say we buy so little from them that this won’t hurt them but would hurt our allies.

The problem with that argument is that globalization has blurred the manufacturing boundaries so a car shipped in to the US from Canada may have parts manufactured in China, so if Canada does not have to pay the tariff, it’s a way around for China.

If the US puts on tariffs, the most likely outcome would be a global trade war because everyone is fighting the deflation brought on by globalization.

What About Gold?

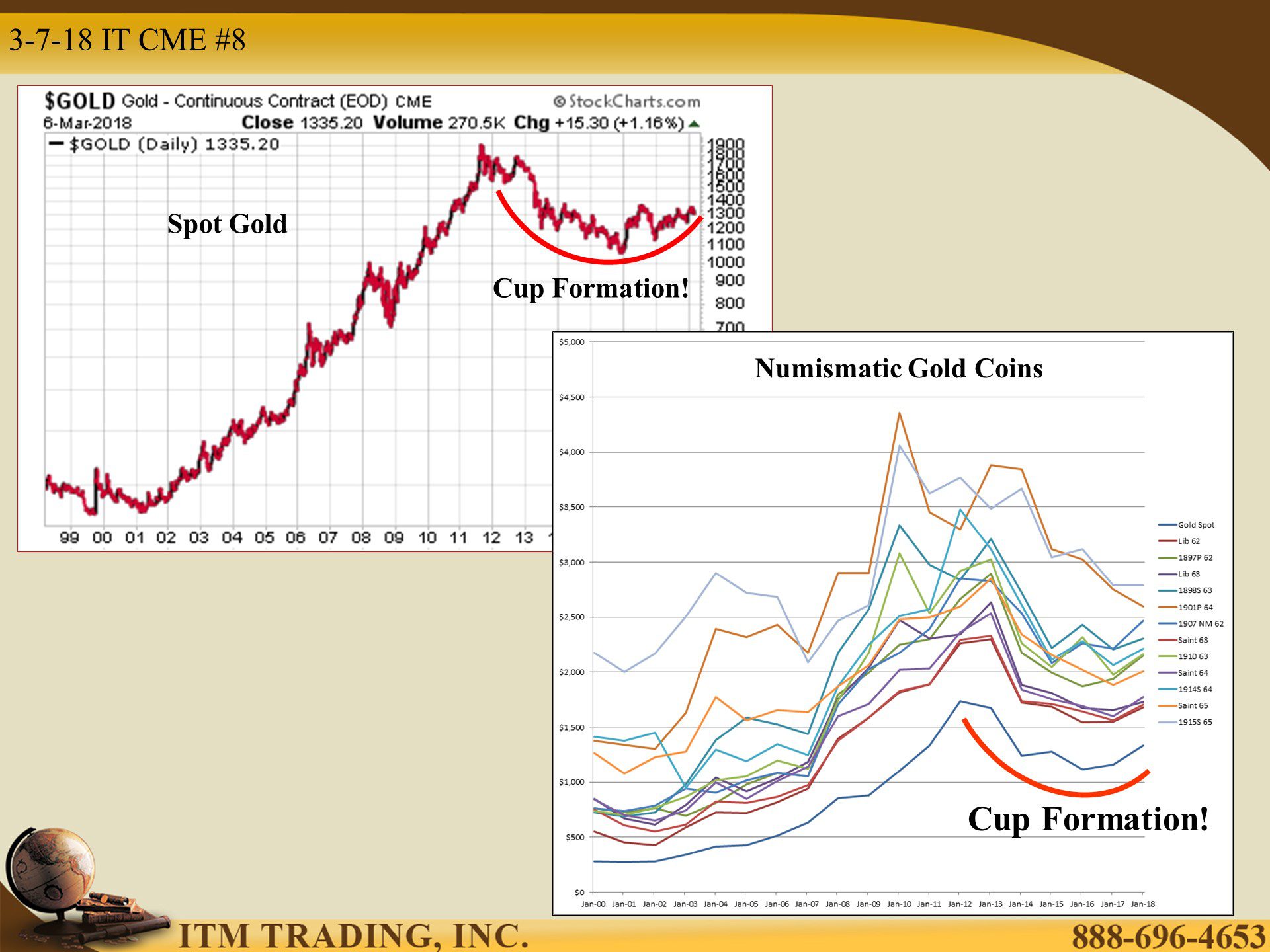

The smart money has recognized an undervalued situation in gold. We see that a cup formation (accumulation pattern) is building. I believe that the bottom in both the spot and the physical gold market is in. This may well be the last opportunity to convert fiat money into honest money at these severely undervalued levels. I’m taking advantage of it, so are the central bankers. Shouldn’t you?

2. https://www.cnbc.com/2018/02/15/companies-buying-back-stock-at-record-pace-since-trump-tax-bill-may-aid-markets-comeback.html

http://stockcharts.com/h-sc/ui

https://www.marketbeat.com/stock-buybacks/

3. http://www.spdrgoldshares.com/media/GLD/file/SPDR-Gold-Trust-Prospectus-20170508.pdf

http://www.spdrgoldshares.com/usa/regulatory-filings/

4. http://www.spdrgoldshares.com/media/GLD/file/SPDR-Gold-Trust-Prospectus-20170508.pdf

5. http://www.spdrgoldshares.com/media/GLD/file/SPDR-Gold-Trust-Prospectus-20170508.pdf

https://www.bullionstar.com/blogs/ronan-manly/the-funding-model-of-the-world-gold-council-gld-fees-and-gold-miner-dues/

6. http://www.spdrgoldshares.com/media/GLD/file/SPDR_Gold_Trust_Form_10Q_Q1_2018.pdf

7. http://www.spdrgoldshares.com/media/GLD/file/SPDR_Gold_Trust_Form_10Q_Q1_2017.pdf

http://www.spdrgoldshares.com/media/GLD/file/SPDR-Gold-Trust-Prospectus-20170508.pdf

8. http://stockcharts.com/h-sc/ui