Insider Trading: Have the Stock and Bond Markets Begun to Breakdown?

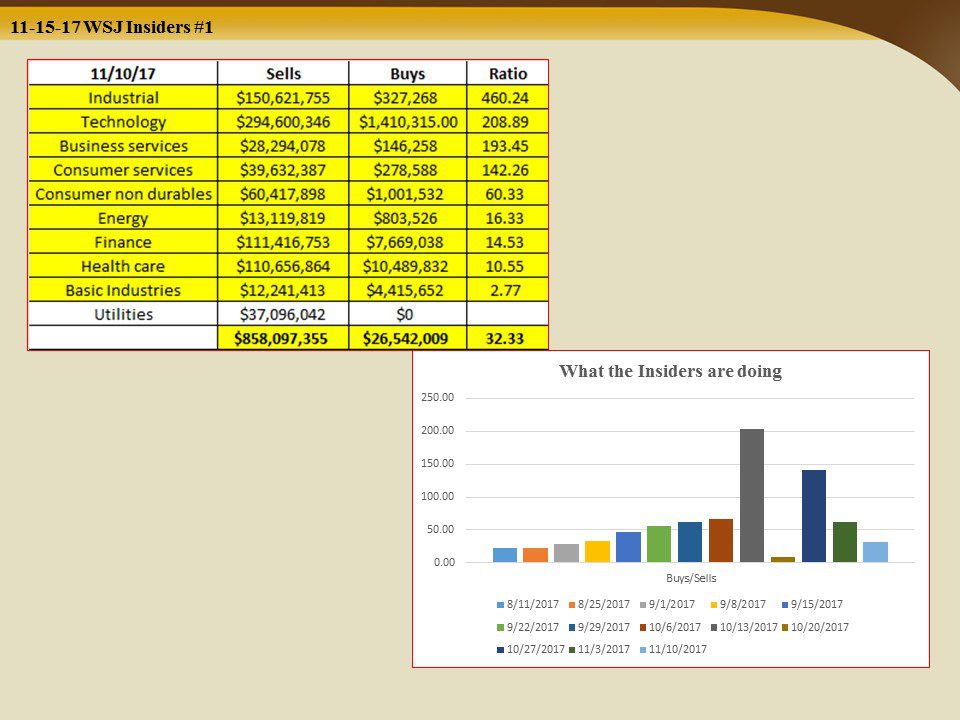

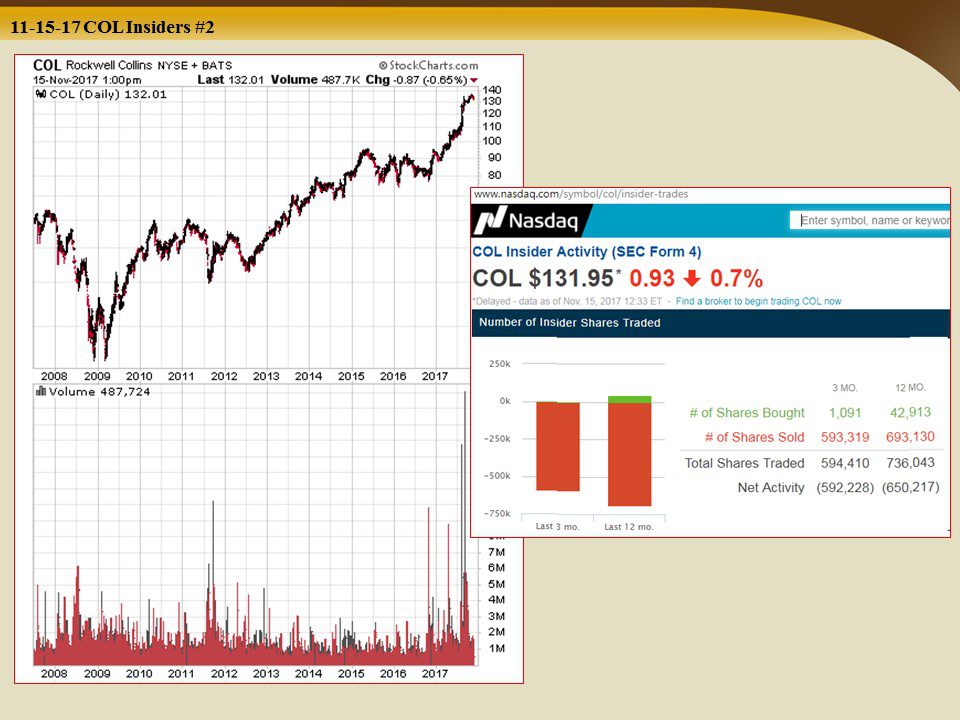

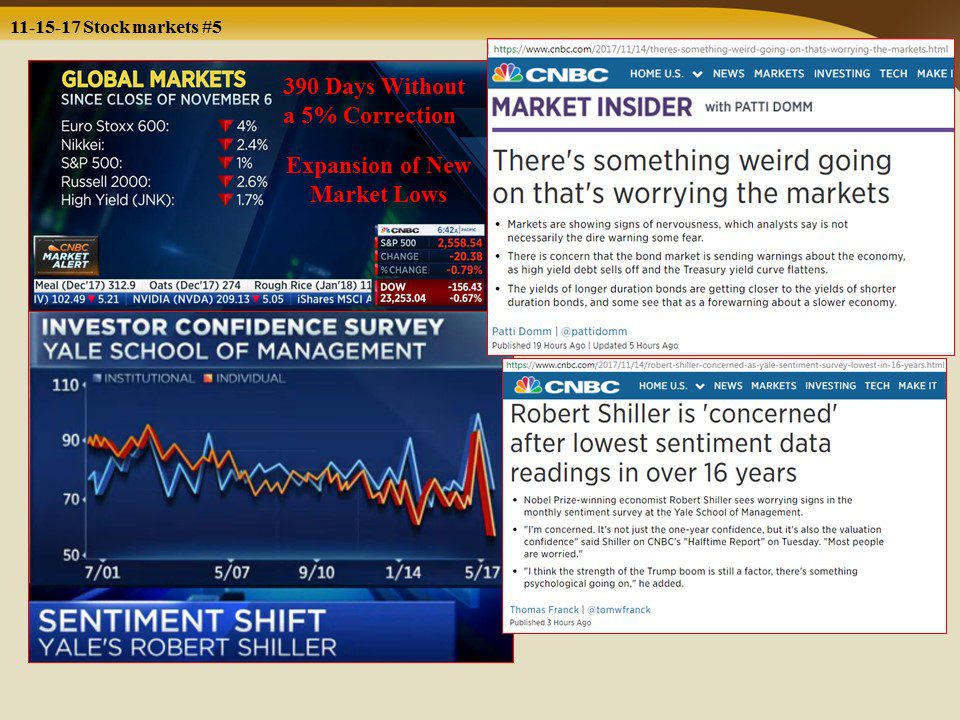

Perhaps we now know what the surge in insider trading has been about. There has now been 390 days without a 5% correction in the stock market and up until recently, market euphoria has reigned. But recently, both the bond and stock markets behavior has been shifting.

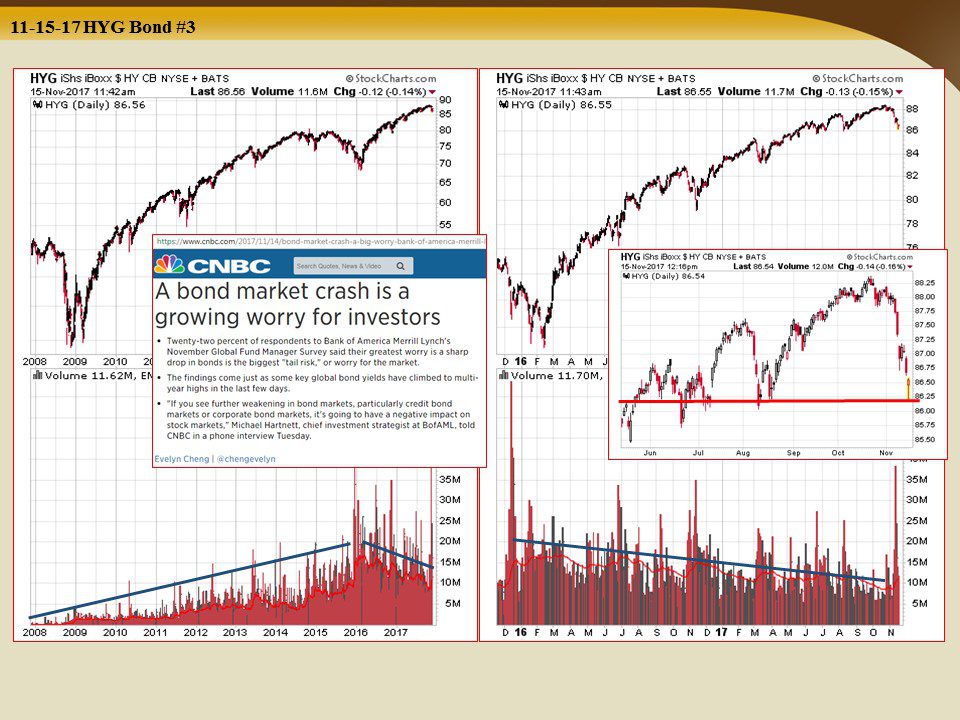

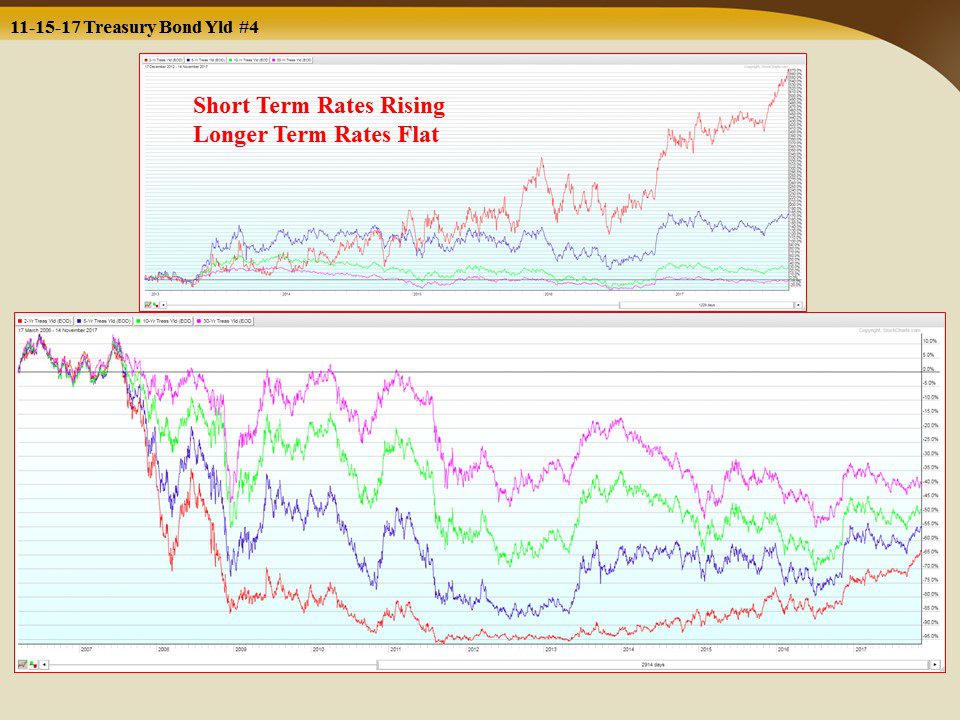

The shift began in the high yield market with a sell off to levels last seen in January. In the US government bond market the yield curve has been flattening sparking fears of an interest rate inversion. This kind of behavior has proceeded the last seven recessions. With interest rates at all-time lows, how will the Fed “Stimulate†the economy? QE 4?

Over the last several days US stock markets have opened at lows, then eased or erased those lows during the trading day. But there has been a recent shift in investor confidence showing the lowest sentiment data readings in over 16 years.

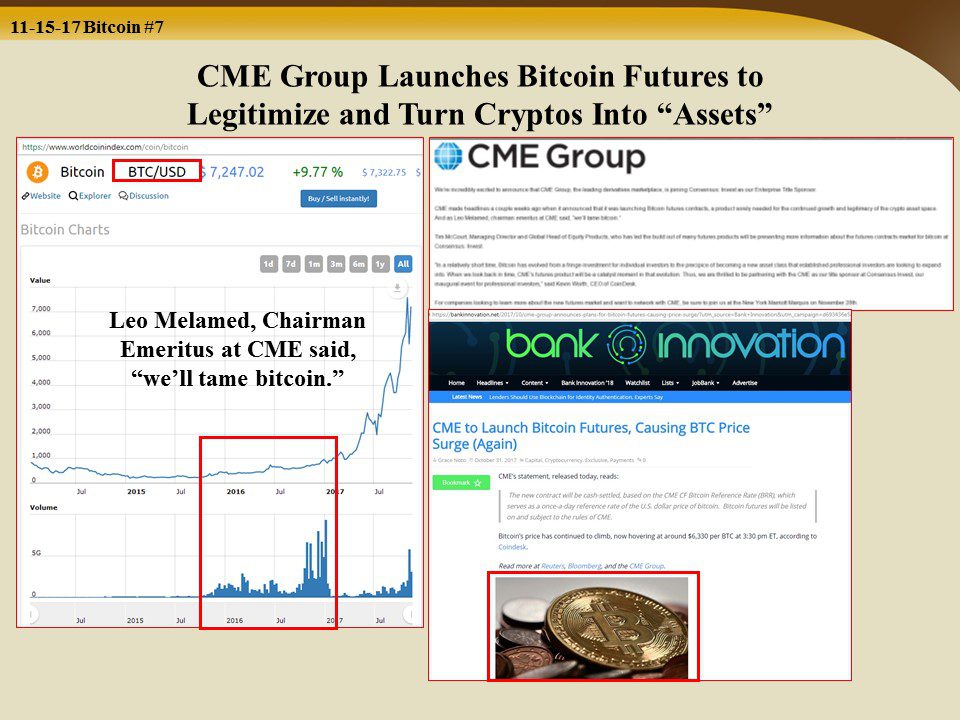

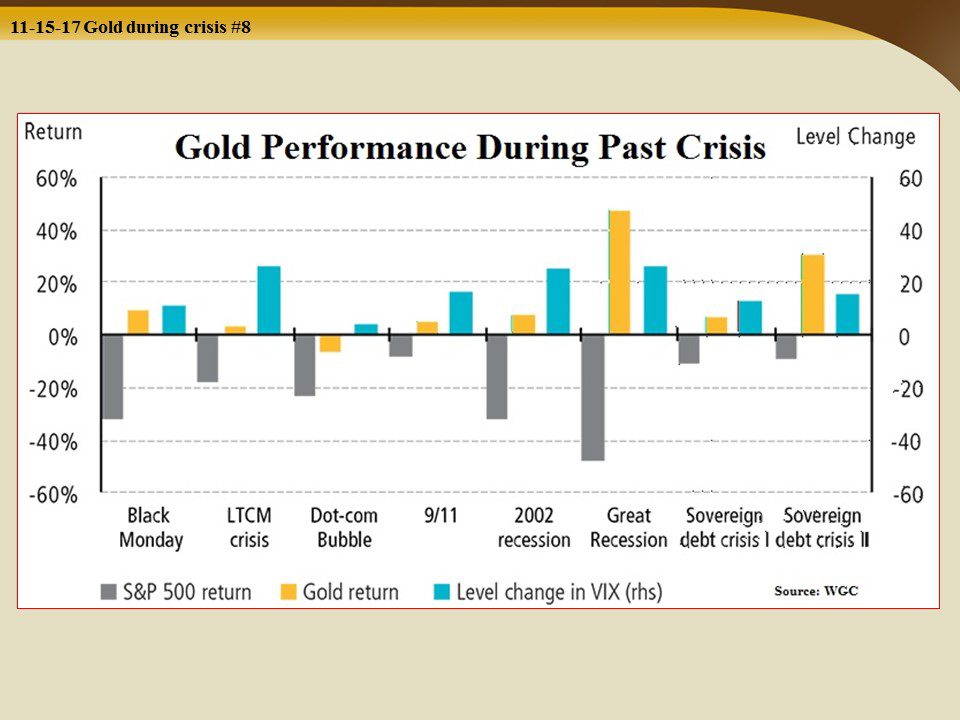

If this is truly the market corrections everyone has been waiting for, how will this impact the fed balance sheet tapering that began in October? Will US government bonds still be the flight to safety trade? If not, will bitcoin be the new flight to safety? How about gold?

Is this time different? Join us for this very important discussion.

Slides and Links:

http://www.wsj.com/mdc/public/page/2_3023-insider.html

http://www.wsj.com/mdc/public/page/2_3023-insider.html

http://stockcharts.com/h-sc/ui?s=col

http://stockcharts.com/h-sc/ui?s=col

http://www.nasdaq.com/symbol/col/insider-trades

https://www.cnbc.com/2017/11/14/bond-market-crash-a-big-worry-bank-of-america-merrill-lynch-survey.html

https://www.cnbc.com/2017/11/14/bond-market-crash-a-big-worry-bank-of-america-merrill-lynch-survey.html

http://stockcharts.com/h-sc/ui?s=hyg

Https://www.bloomberg.com/news/articles/2017-11-13/the-u-s-yield-curve-is-flattening-and-here-s-why-it-matters

Https://www.bloomberg.com/news/articles/2017-11-13/the-u-s-yield-curve-is-flattening-and-here-s-why-it-matters

http://stockcharts.com/freecharts/perf.php?$ust2y,$ust5y,$ust10y,$ust30y

https://www.cnbc.com/2017/11/14/robert-shiller-concerned-as-yale-sentiment-survey-lowest-in-16-years.html

https://www.cnbc.com/2017/11/14/robert-shiller-concerned-as-yale-sentiment-survey-lowest-in-16-years.html

https://www.cnbc.com/2017/11/13/asia-markets-focus-on-china-data-sterling-oil.html

https://www.cnbc.com/2017/11/14/theres-something-weird-going-on-thats-worrying-the-markets.html

https://fred.stlouisfed.org/series/MBS5T10

https://fred.stlouisfed.org/series/MBS5T10

http://www.businessinsider.com/fed-statement-balance-sheet-interest-rates-september-meeting-2017-9