Insider Trading: YOUR PRIVATE DATA; Facebook, Apple, Google, Twitter…But You Agreed, by Lynette Zang

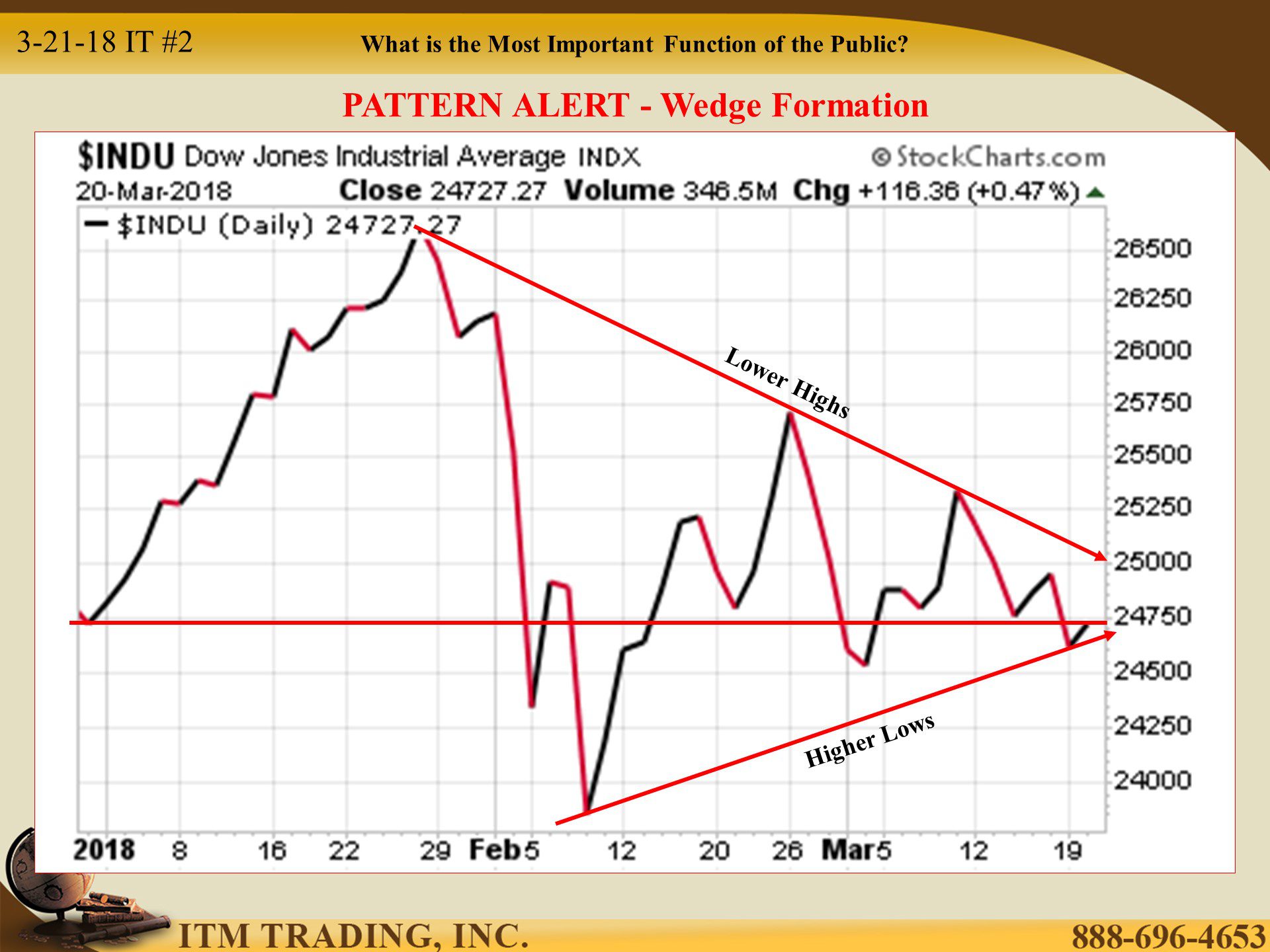

PATTERN ALERT! The Dow is forming a wedge formation, which forms a short-term trend line of lower highs and lower lows. If it breaks below the trend line (presuming no artificial help) the most likely market direction is down to test the February low below 24,000. At this writing, the Dow is exactly flat for the year.

What is the Most Important Function of the Public?

It’s clear that volatility has come back into the markets in a very big way. It is also clear that global central bankers are attempting their next great experiment; reducing liquidity support to the markets as they attempt to reduce their bloated balance sheets. Let us all pray.

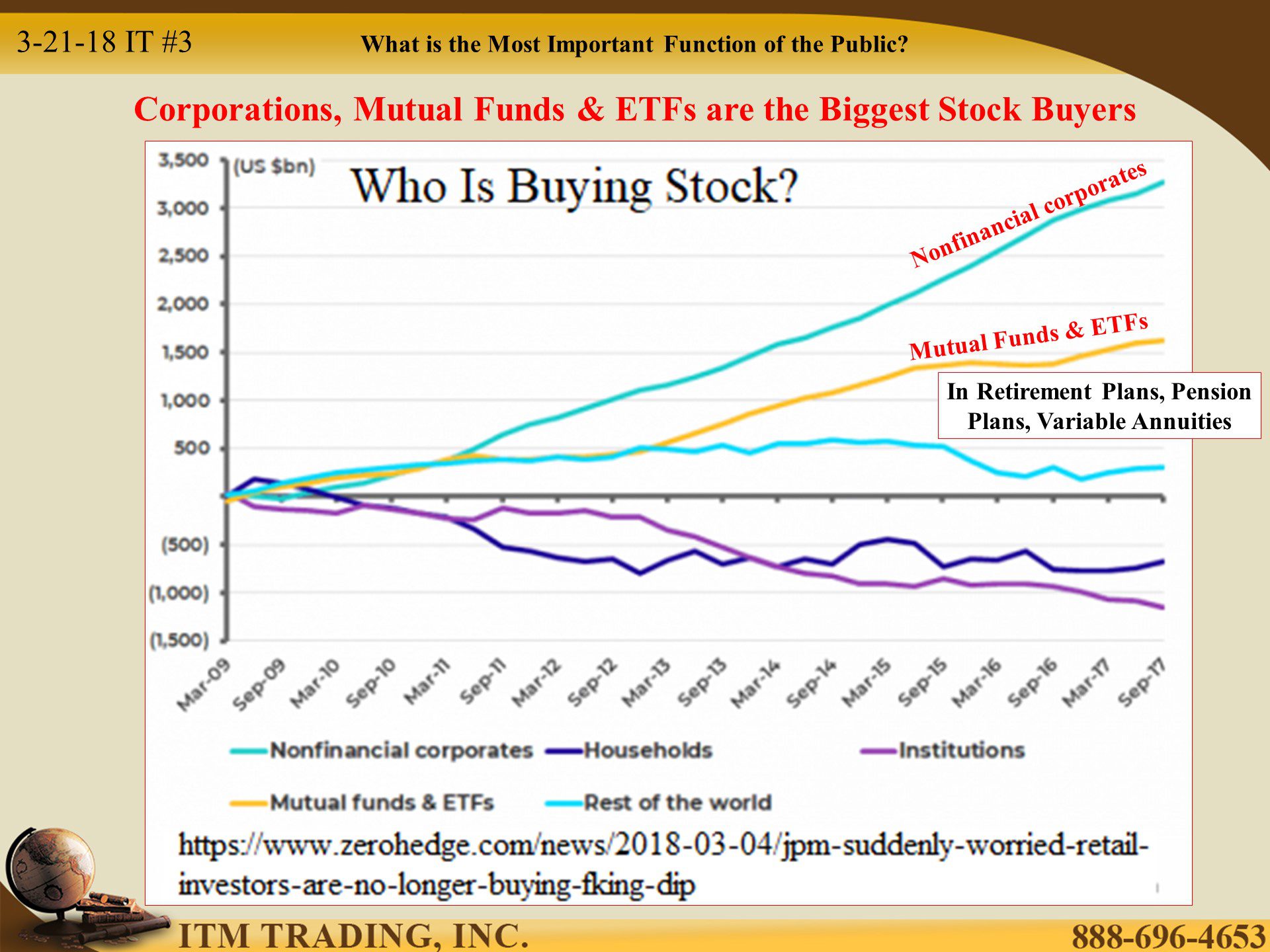

Of course, central bankers had help in creating the most expensive stock markets in history. Corporations have been doing their part as well with the biggest stock buyback spree in history. Good thing too or all the insider selling we’ve been watching might have been more apparent. If the public understood this bit of trickery, might they have stopped buying stocks in their 401Ks, IRAs and variable annuities?

Quite frankly, wall street depends on main street to follow what they say, never taking the time to watch what they do. And they know main street will almost NEVER reads the contracts.

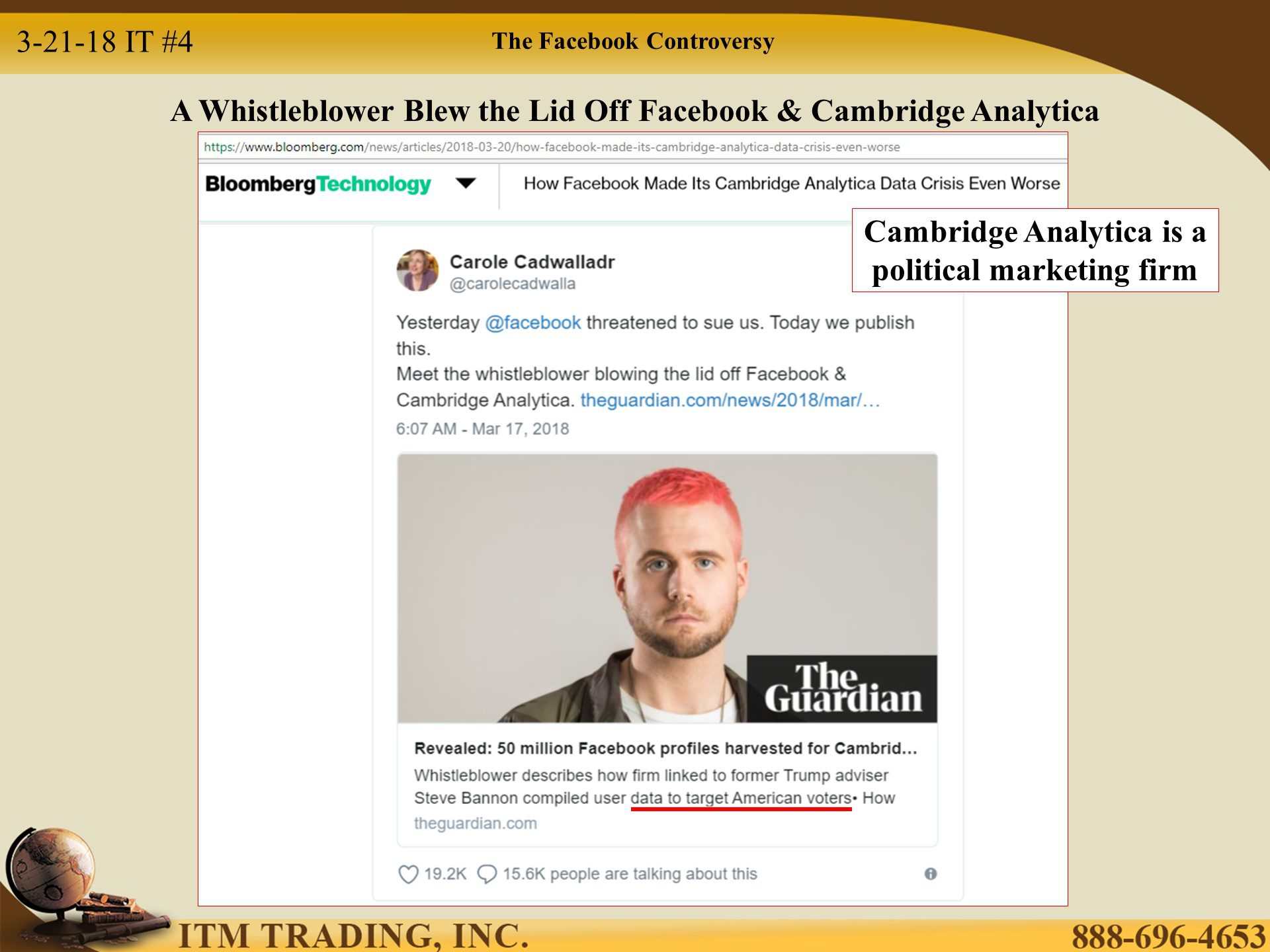

As Equifax can attest to, that’s OK if no issues come to light but, darn those pesky whistleblowers!

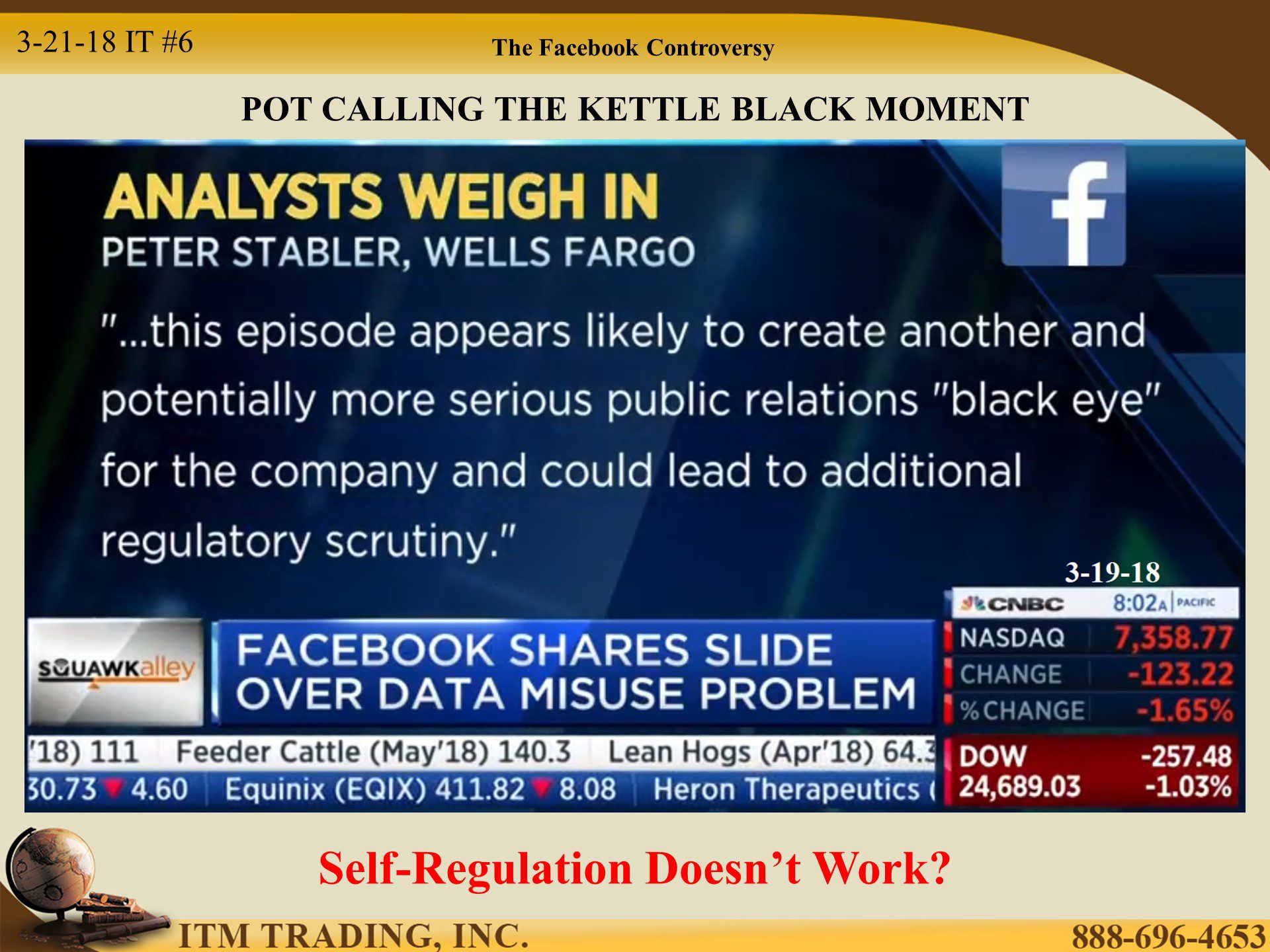

The Facebook Controversy

95% of young adults on the internet use Facebook, which encourages links to friends. In 2014 an app developer used a personality survey to gather data on 270,000 people, but then, had access to all their friend’s data too. It’s estimated that data from 50,000,000 people were harvested.

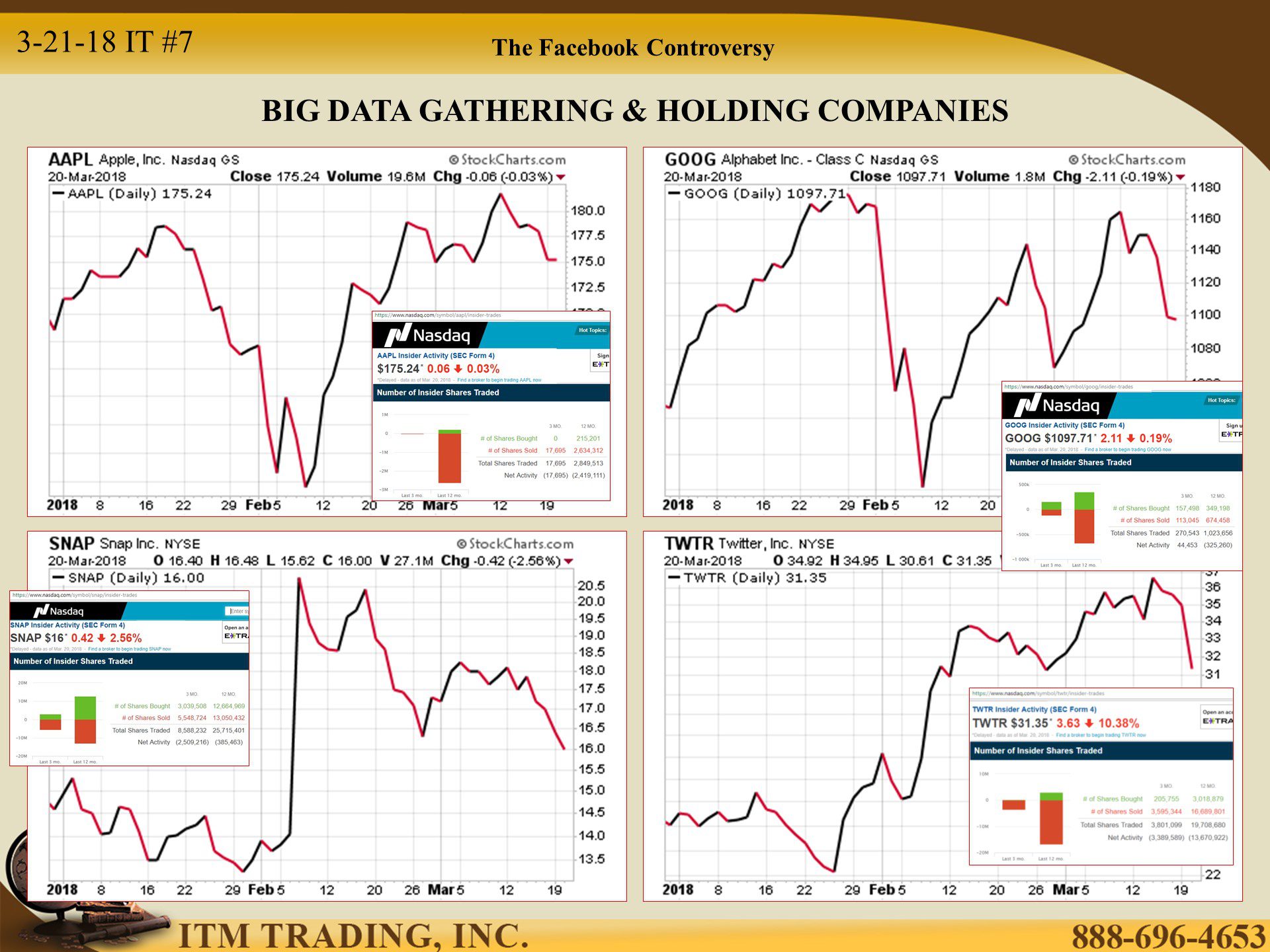

This latest scandal has put extreme pressure on the tech stocks, which has been the key sector driving markets to all-time highs. Good thing many insiders got out near those highs.

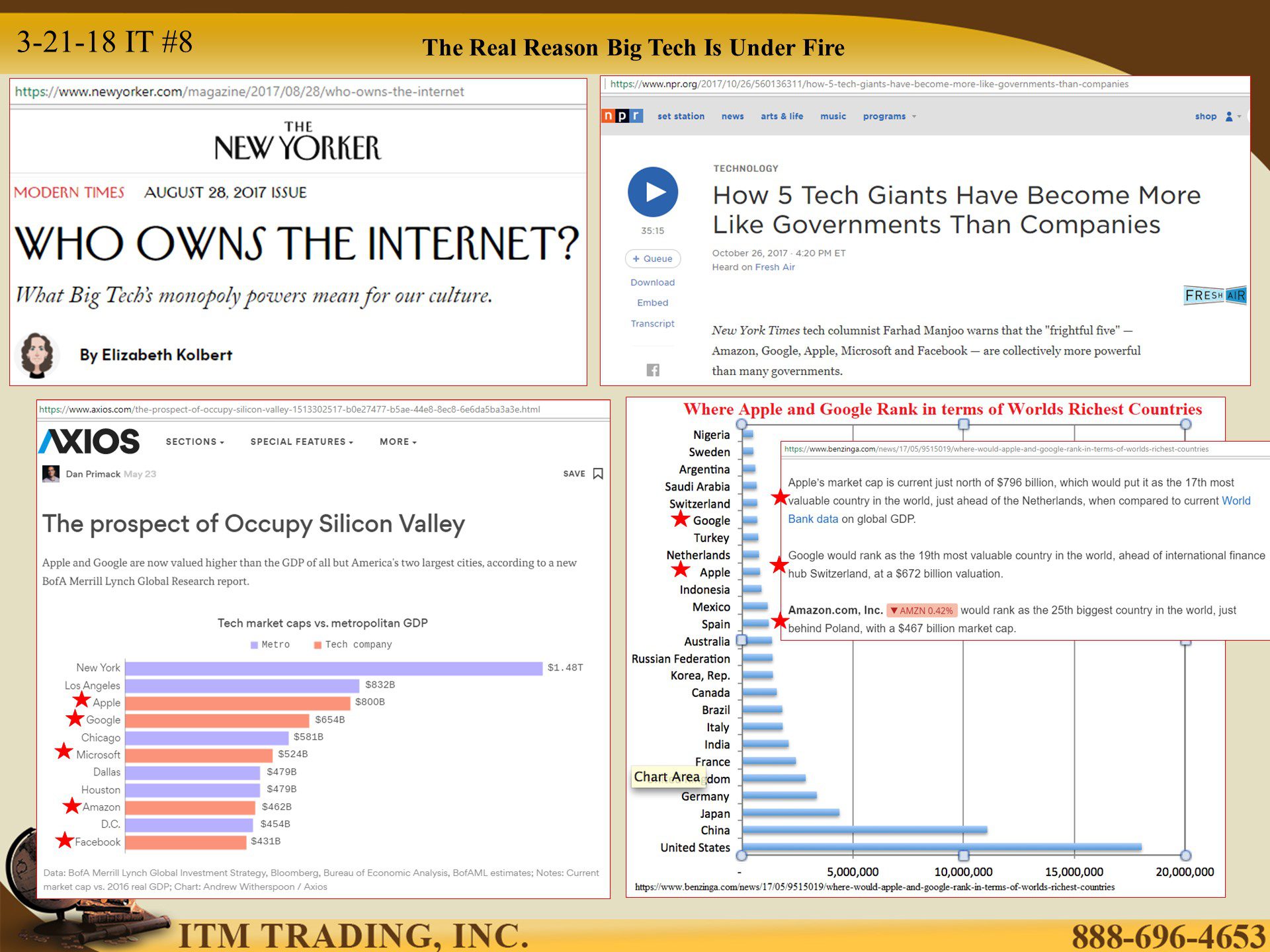

The Real Reason Big Tech Is Under Fire

Keep in mind that data has become a cash crop making tech giants as rich as or richer than many metropolitan cities and even many countries. In fact, only New York and Los Angeles collect more revenue than either Apple or Google (as of May 23, 2017).

This gives giant tech companies huge power and reach. It may also signal the maturity of this sector. Unfortunately, as it was developing, regulations and tax laws did not keep up and now the tides may be changing, with new global regulations and taxes being discussed. There is even discussion around antitrust with some suggesting these behemoths be broken up.

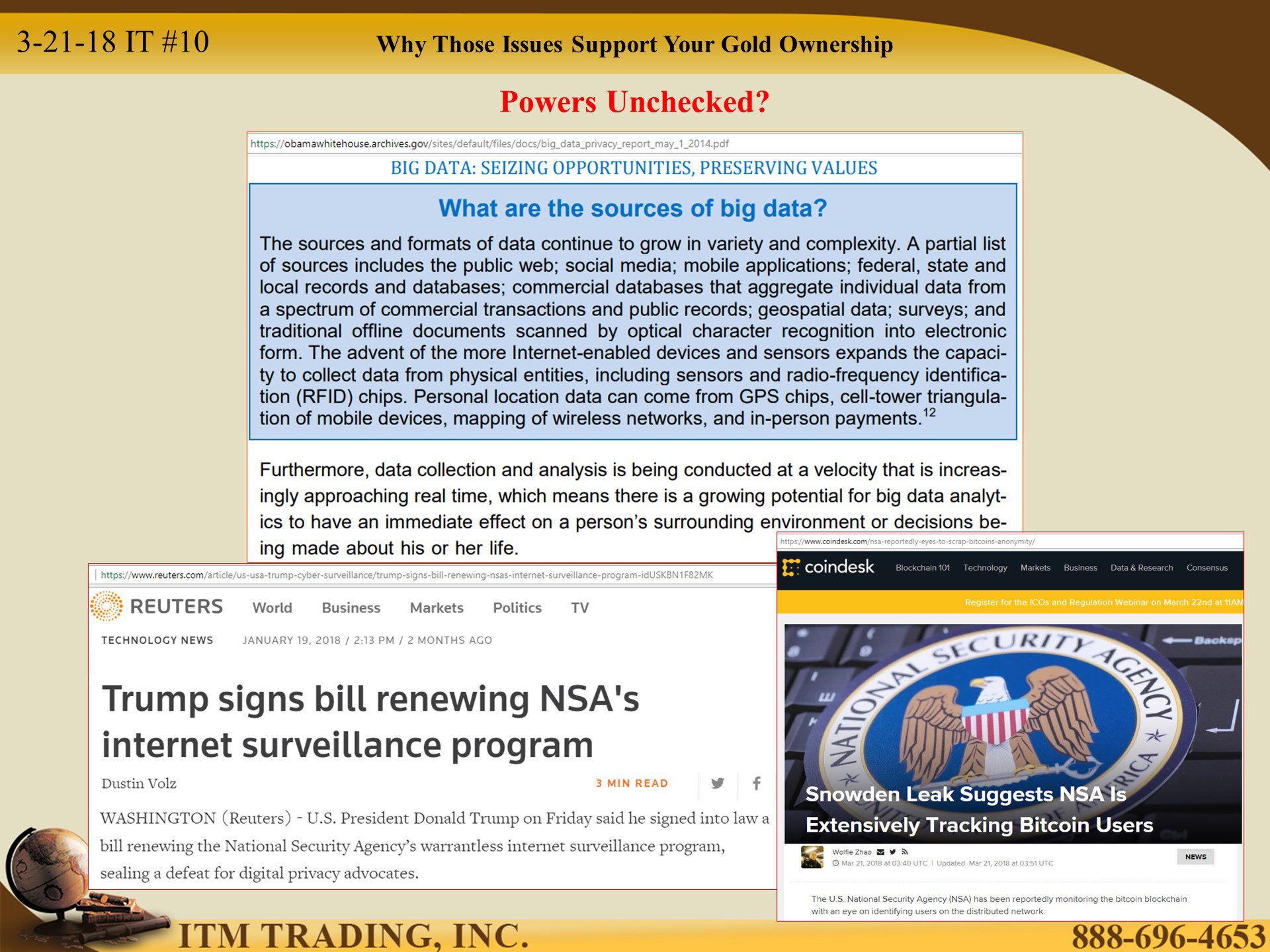

But while these discussions can be heard loud and clear, what we don’t hear much of is how governments gather and use big data.

In a 2014 Whitehouse report, “BIG DATA: SEIZING OPPORTUNITIES, PRESERVING VALUES†the report acknowledged “While big data unquestionably increases the potential of government power to accrue unchecked, it also hold within it solutions that can enhance accountability, privacy, and the rights of citizens.â€

Is there any possibility that these powers might be abused?

Why Those Issues Support Your Gold Ownership

Who is more Wall Street than Warren Buffett? He tells us gold has no use, after all it doesn’t pay any interest so why have it? Every time I hear him denigrate gold I think of his father the Hon. Howard Buffett, US Congressman from Nebraska.

In 1948 he went before Congress to attempt to reinstate the citizens right to convert US dollars into gold. He then published “Human Freedom Rests on Gold Redeemable Moneyâ€. He states,

“Is there a connection between Human Freedom and A Gold Redeemable Money? At first glance it would seem that money belongs to the world of economic human freedom to the political sphere. But when you recall that one of the first moves by Lenin, Mussolini and Hitler was to outlaw individual ownership of gold, you begin to sense that there may be some connection between money, redeemable in gold, and the rare prize known as human liberty.â€

Warren, perhaps you forgot your father’s lesson, gold does not have to pay interest because it is not a debt. Gold represents savings and pays you in liberty. Isn’t that what our founding fathers fought for?

Slides and Links:

https://radiofreethinker.wordpress.com/2013/07/15/the-blurring-of-the-big-data-lines

https://stockcharts.com/h-sc/ui?s=INDU

https://stockcharts.com/h-sc/ui?s=FBhttps://www.Nasdaq.com/symbol/fb/insider-trades

http://stockcharts.com/h-sc/ui

https://www.nasdaq.com/symbol/snap/insider-trades

https://www.nasdaq.com/symbol/twtr/insider-tradeshttps://www.nasdaq.com/symbol/goog/insider-trades

https://www.nasdaq.com/symbol/aapl/insider-trades

https://www.newyorker.com/magazine/2017/08/28/who-owns-the-internet

https://www.wsj.com/articles/the-antitrust-case-against-facebook-google-amazon-and-apple-1516121561

https://www.coindesk.com/nsa-reportedly-eyes-to-scrap-bitcoins-anonymity/

https://obamawhitehouse.archives.gov/sites/default/files/docs/big_data_privacy_report_may_1_2014.pdf

http://csinvesting.org/wp-content/uploads/2013/06/Howard_Buffett_explains_money.pdf

Ron Paul I only buy numis @3 min 10 sec http://video.cnbc.com/gallery/?video=3000163445 Â Â Â Â Â Ron Paul Testifying before Arizona Senate Finance Committee

Ron Paul I only buy numis @3 min 10 sec http://video.cnbc.com/gallery/?video=3000163445 Â Â Â Â Â Ron Paul Testifying before Arizona Senate Finance Committee

At 8:50 Rep. Farley questions Ron Paul on the value of gold and numismatic collector coins. This is the typical public misconception.

At 10:42 Dr. Paul provides an educated truth. https://www.youtube.com/watch?v=7gyGb4-KbHI&t=923s