Insider Trading: Oh Snap, What’s the Fed Hiding Now? By Lynette Zang

Insiders have been busy leading up to February. In fact, Goldman Sachs reports that, during the recent stock rout, they had their busiest week ever as buybacks surged 4.5 times last years average corporate buying. The hope was support the markets, which wasn’t successful at the time with stocks flopping into correction territory and continuing the roller coaster ride ever since. Perhaps the flood of repatriated funds will be of help.

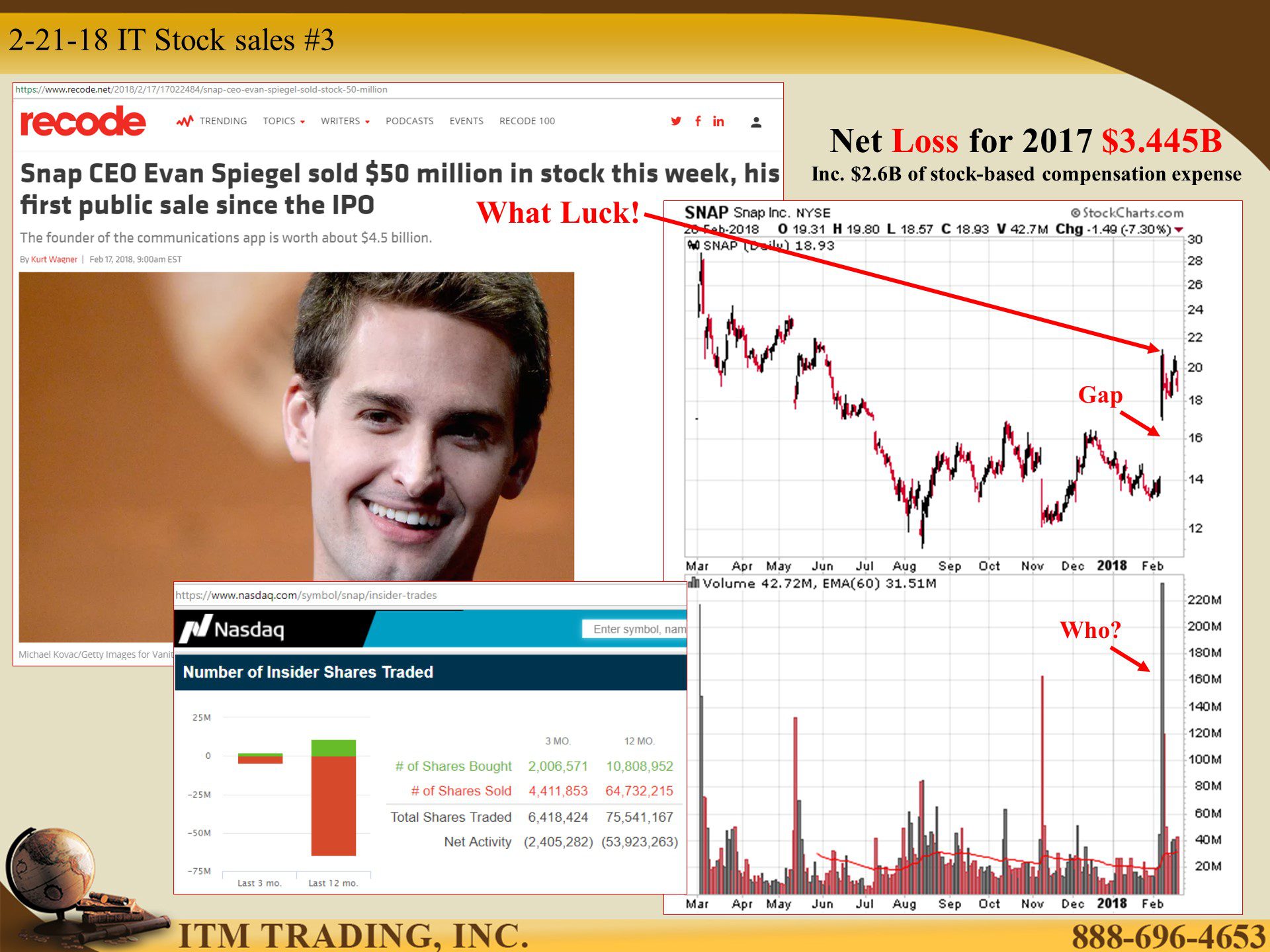

But of course, not every stock fell off a cliff the first week of February. Snap has made Evan Spiegel a very wealthy man and apparently, a very lucky one too. On February 3rd some huge buyer made Snap stock gap up from $13ish to $21ish. Perhaps they know something we don’t since Snap’s loss widened from 2016, to $3.445B in 2017. No worries though, even with those losses, Wall Street values this unicorn near $4.5B. Oh Snap!

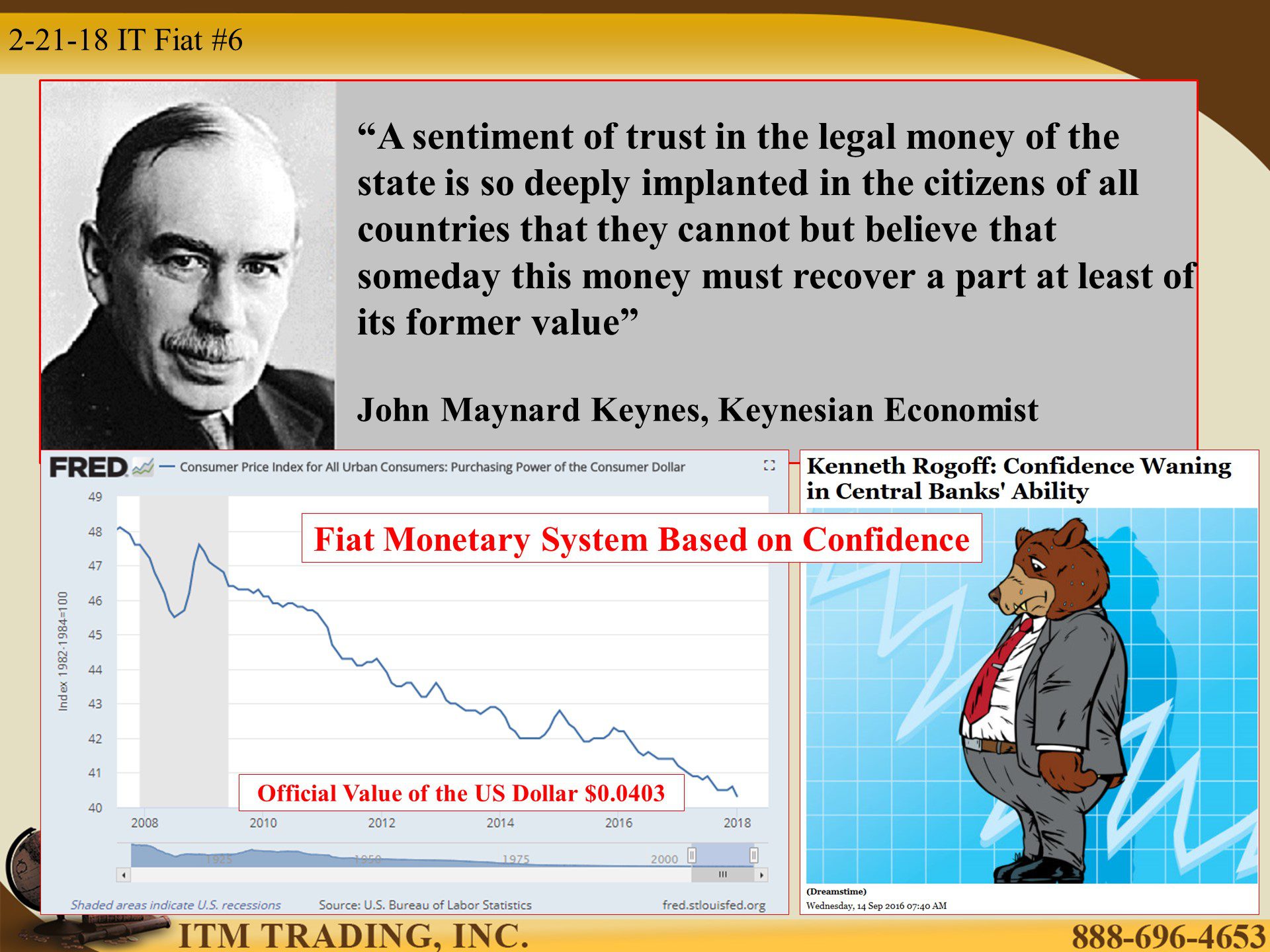

It’s All About Confidence

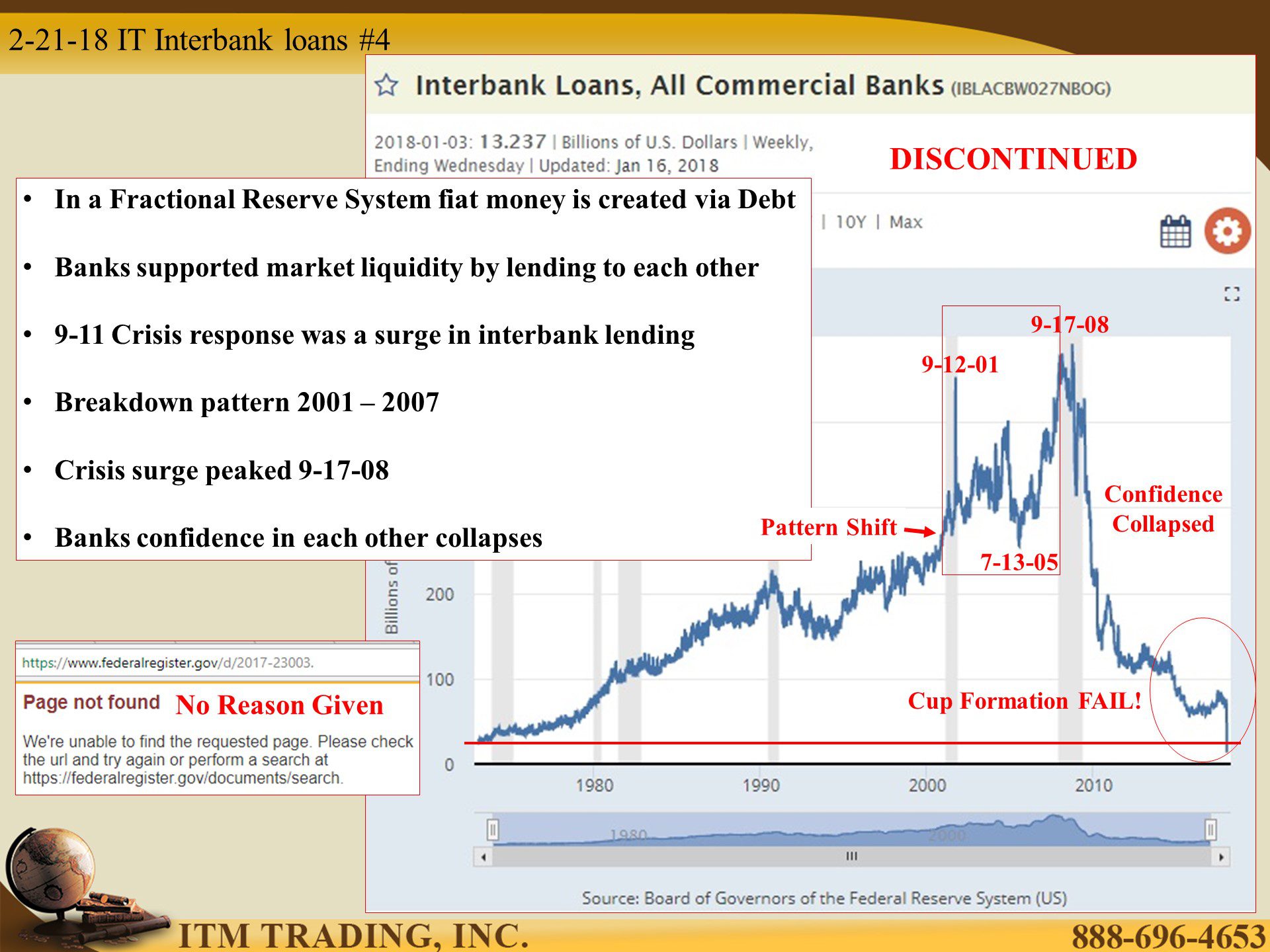

And for the Fed’s next magic trick…Interbank Lending is discontinued. Over the years the Fed has stopped or changed how they report data almost fourteen thousand times, so this is one more data point that we will be in the dark about (unless you’re willing to do quite a bit of digging).

Keep in mind that bank lending to each other provided liquidity during past crisis. But that support dried up during the 2008 crisis leaving central banks, as the lender of last resort, to load up on all sorts of debt and derivatives to make markets look like all is good.

And while we’re told everything is fine, this graph tells a very difference story. Keep in mind that fiat is intangible and as such, requires confidence. And this interbank lending graph clearly shows the loss of confidence banks have in each other’s solvency (ability to repay a loan).

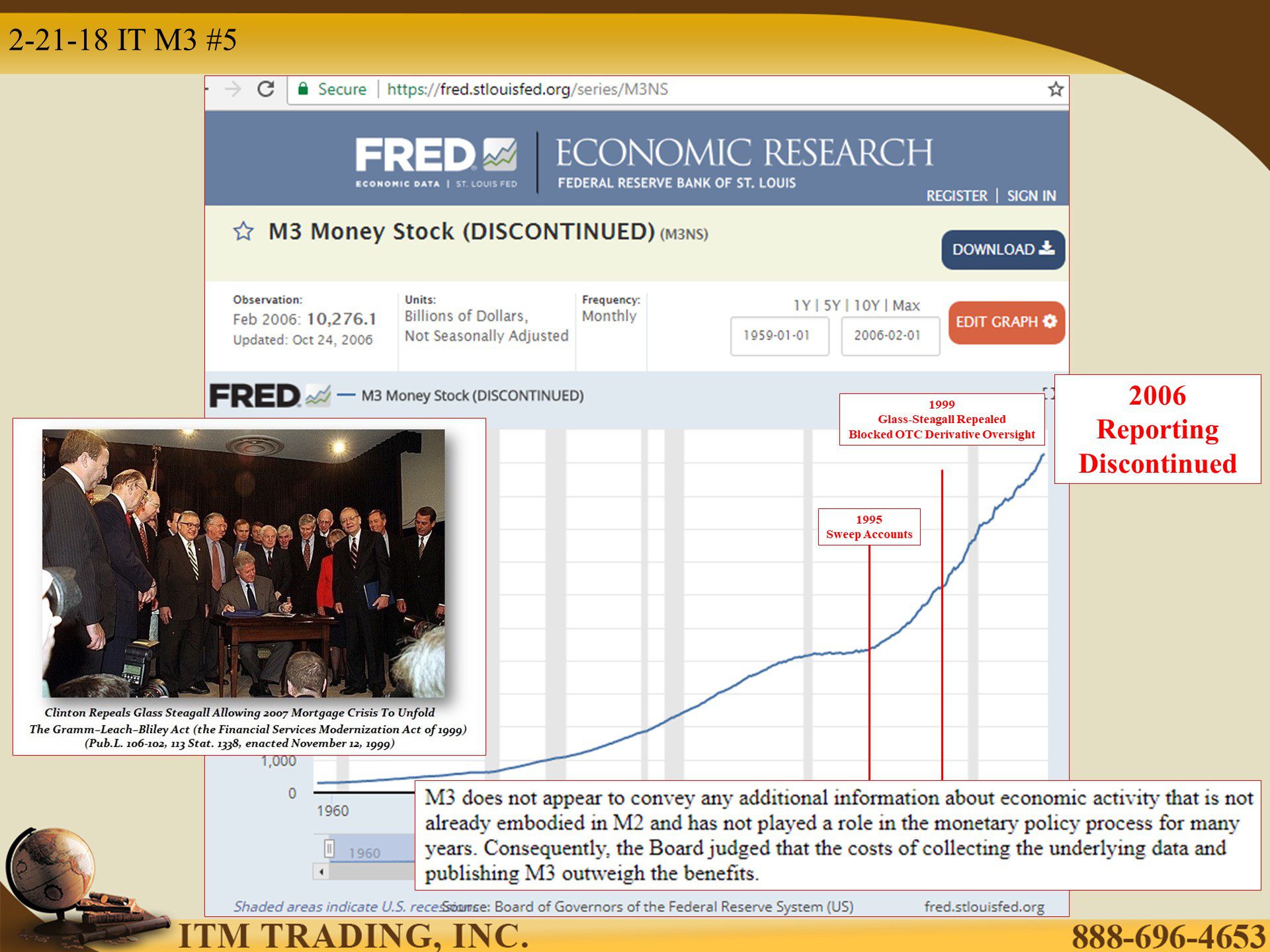

Maintaining public confidence was likely the reason they discontinued reporting the M3 money supply in 2006, just before the great recession hit.

It’s All About Wealth Transfer

Inflation is the most important job of a fiat money system and many people understand that as you create more fiat money via debt, that the value of that money declines. Central bankers and governments use nominal confusion to keep us in the system voluntarily and hide the truth, that 96% of the value of the US dollar is gone.

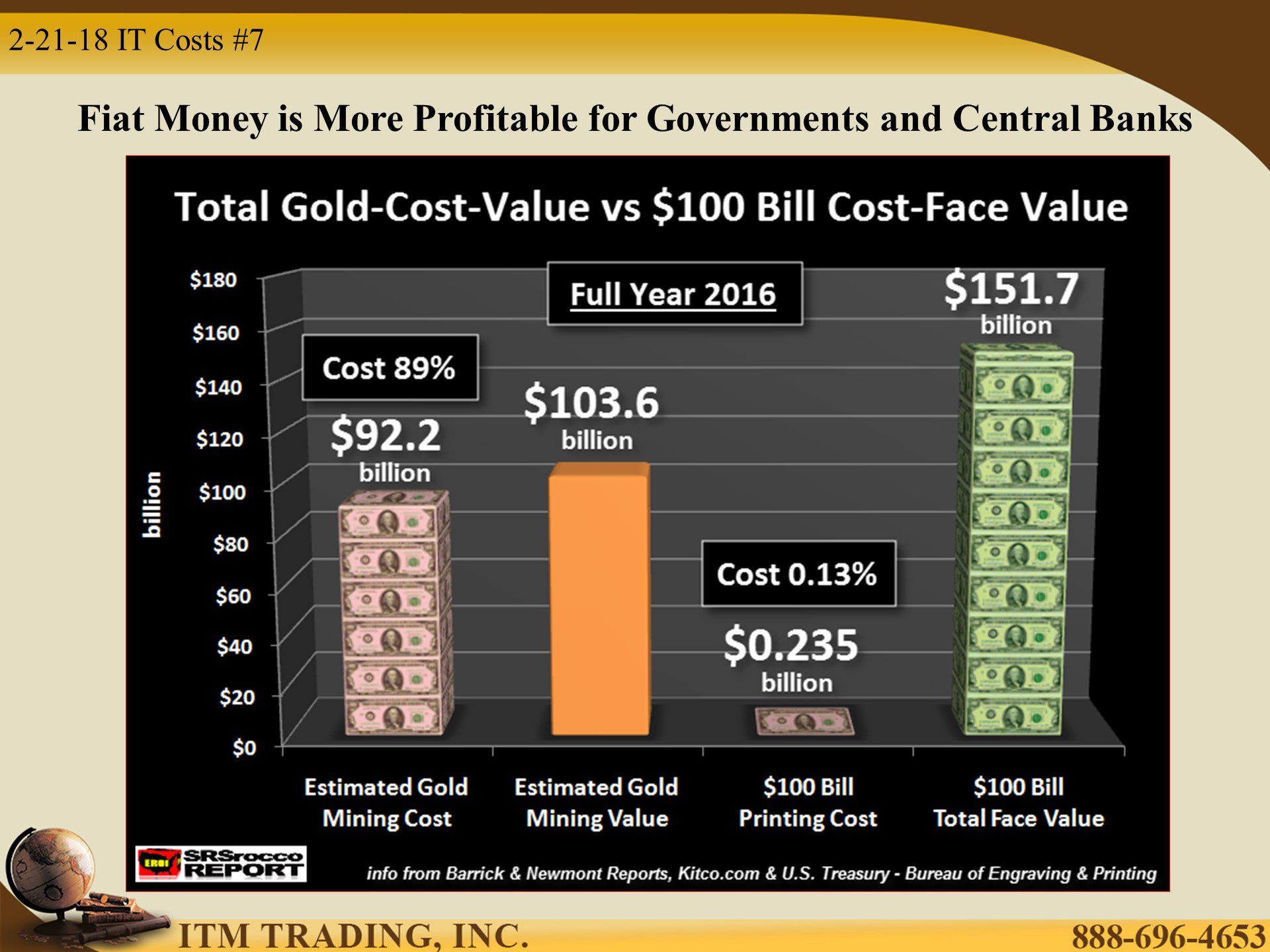

In addition, creating fiat money has almost no cost since it is a computer key stroke. Even the cost to print cash is minimal. In fact, it costs the same to print a $1 as it does to print $100, but you and I have to work a lot harder for that $100 bill.

Real Money Gold

There is an infinite amount of fiat money, but a finite amount of physical gold. So while fiat gold markets can be easily manipulated, the cost to mine puts a hard floor under the value of gold, as does global use and demand.

Central banks have been calling for a financial system reset since at least 2013. They know the old system has been on life support since 2008. They’ve been using this time to accumulate gold.

Wouldn’t it make sense to follow their lead?

Slides and Links:

http://stockcharts.com/h-sc/ui

https://www.recode.net/2018/2/17/17022484/snap-ceo-evan-spiegel-sold-stock-50-million

http://stockcharts.com/h-sc/ui

https://www.nasdaq.com/symbol/snap/insider-trades

https://investor.snap.com/~/media/Files/S/Snap-IR/press-release/q4-17-earnings-release.pdf

https://fred.stlouisfed.org/search?st=interbank+loans

https://fred.stlouisfed.org/series/IBLACBW027NBOG

https://fred.stlouisfed.org/series/M3NS

http://www.nytimes.com/1999/11/13/business/clinton-signs-legislation-overhauling-banking-laws.html

https://www.federalreserve.gov/releases/h6/discm3.htm

https://fred.stlouisfed.org/series/CUUR0000SA0R

https://www.zerohedge.com/news/2017-05-20/how-will-great-deflation-impact-gold-dollar

http://www.marketoracle.co.uk/Article61453.html