PSM: The Market is in Trouble…Are You?

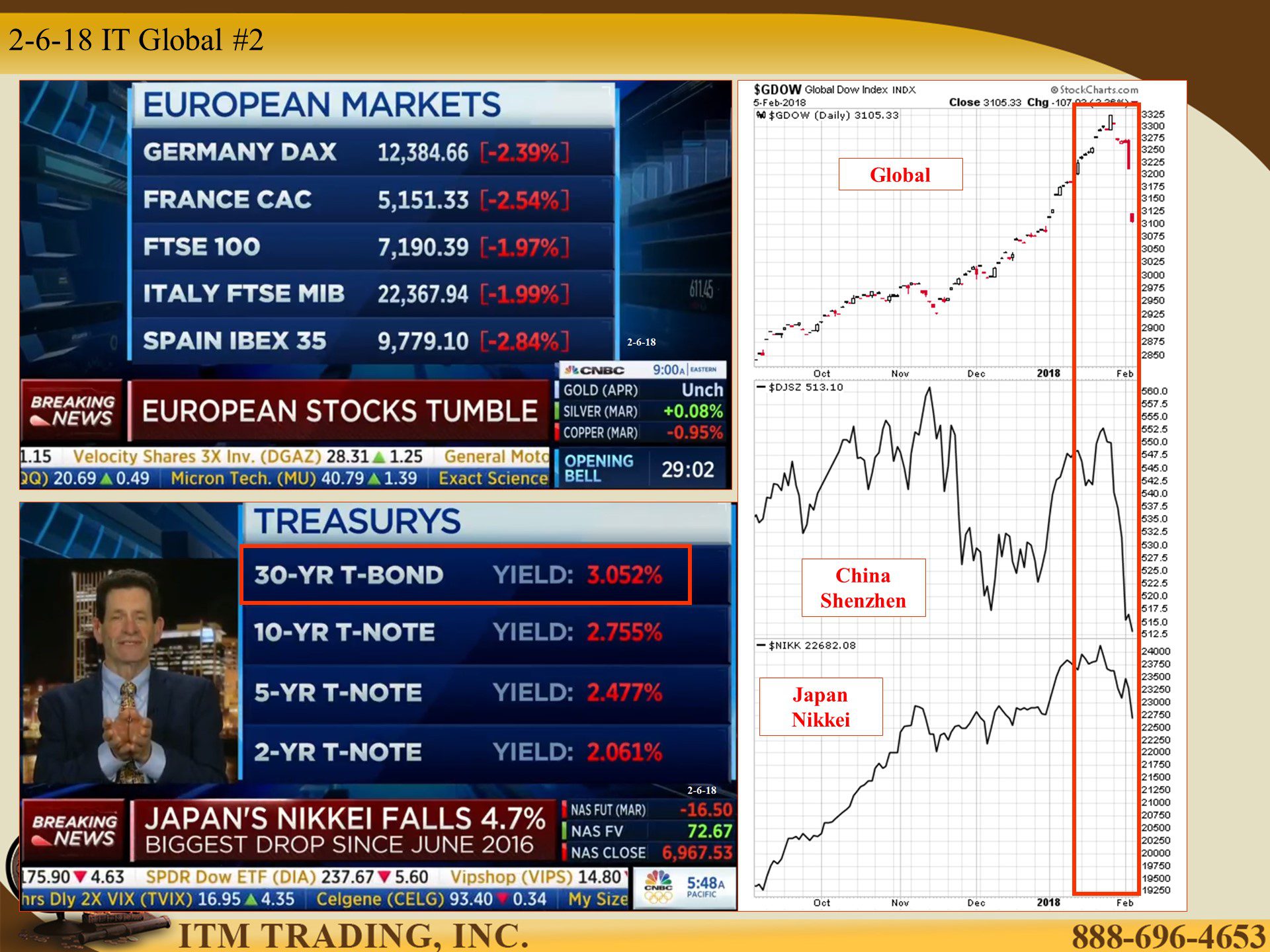

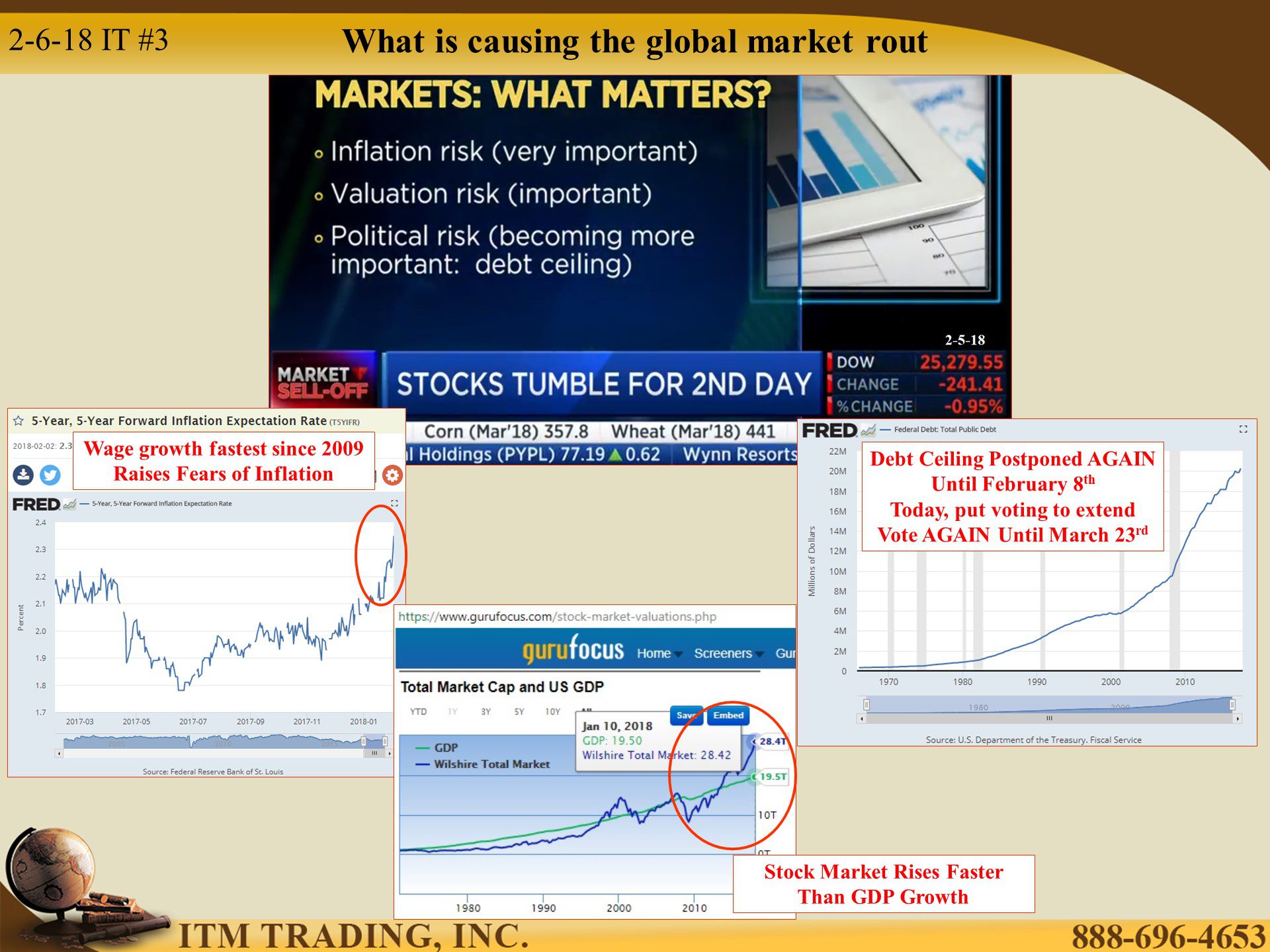

The last time the S&P had gone 564 calendar days since its last 5% correct was 1945. The Dow saw over 69 new highs in 2017 and went up over 7% the month of January alone. The good news was that global central banks were coordinating a global recovery from the crisis that became apparent in 2008. The wage increases announced on February 1st was the most seen since 2009 and the new tax laws insured a huge increase in corporate profits that could be used to justify the most expensive stock markets in history. The repatriation of overseas cash hoards are expected to encourage M&A activity, additional stock buybacks and other corporate investments.

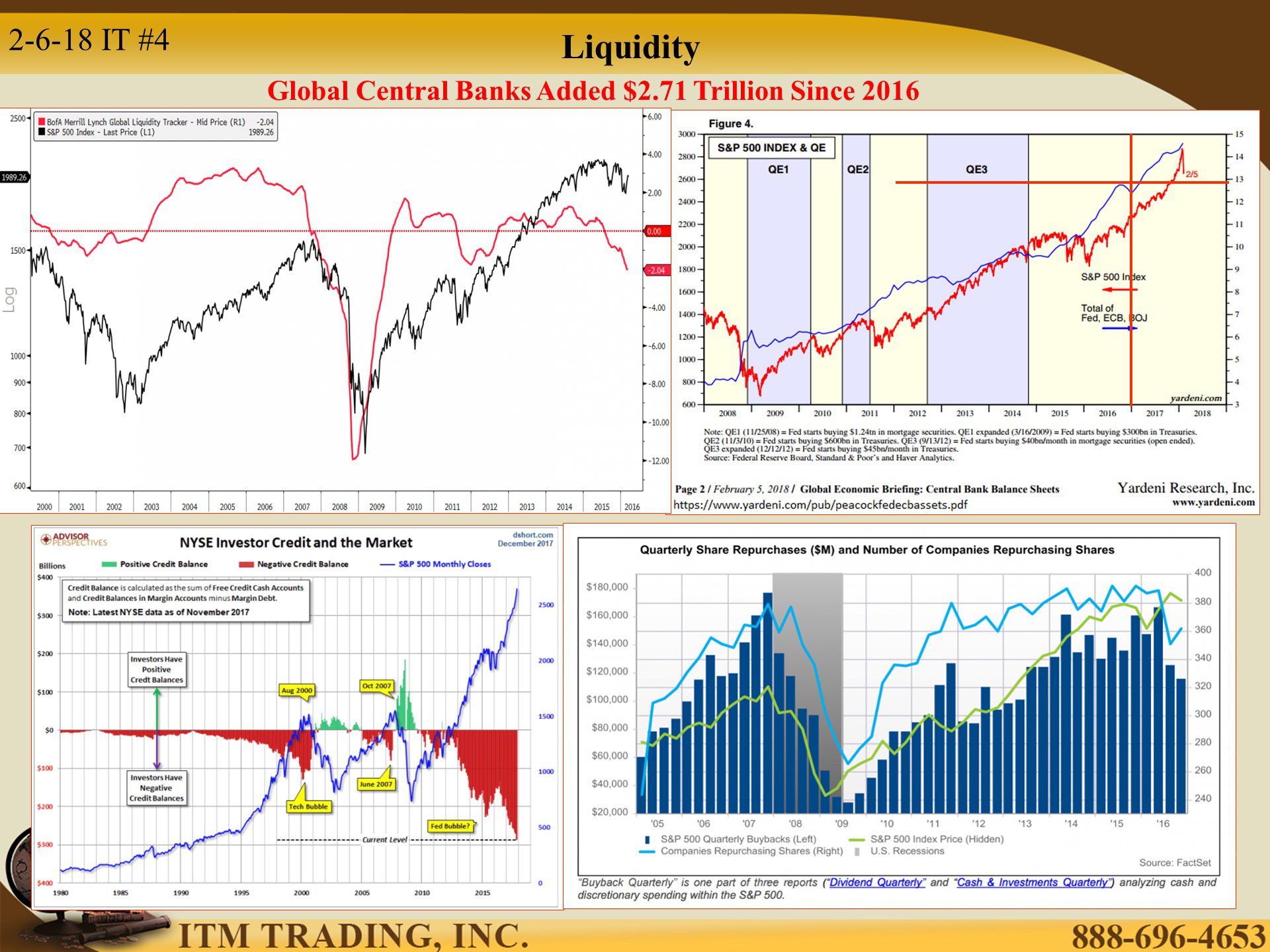

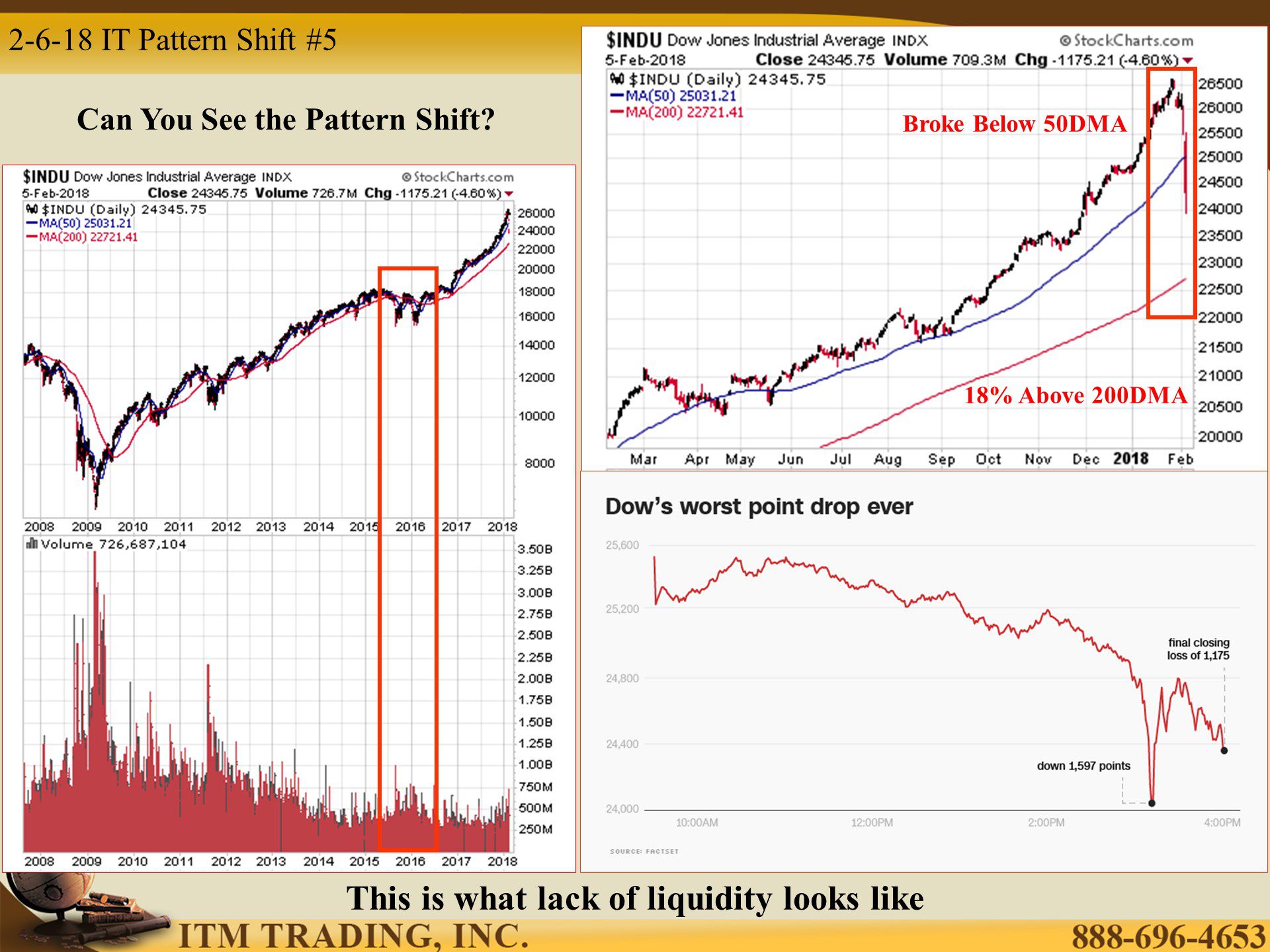

The average investor forgets the lessons of the past believing they can sell their holdings whenever they want. But many new financial products that have been created over the last several years have never been tested during a liquidity crisis. They’ve been tested over the last few trading days and failed.

This is just a tiny taste of what the lack of market liquidity looks like.

January looked fabulous, then February came, and market sentiment changed, and global stock markets dropped like a stone as selling pressure rose and buyers were nowhere to be found. Robo-Advisory sites at Vanguard, Fidelity, Wealthfront and Betterment had “technology†issues and investors lost access to their accounts.

At the low, the Dow had plunged 8.5% from its high and volatility exploded sending the VIX (volatility index) from around 12.5 to 50 in three days and products designed for a low volatility environment collapsed 85% or more as trading was halted. Some have already announced that they will be shut down. The most current figures suggest that over $4 Trillion in market value was gone.

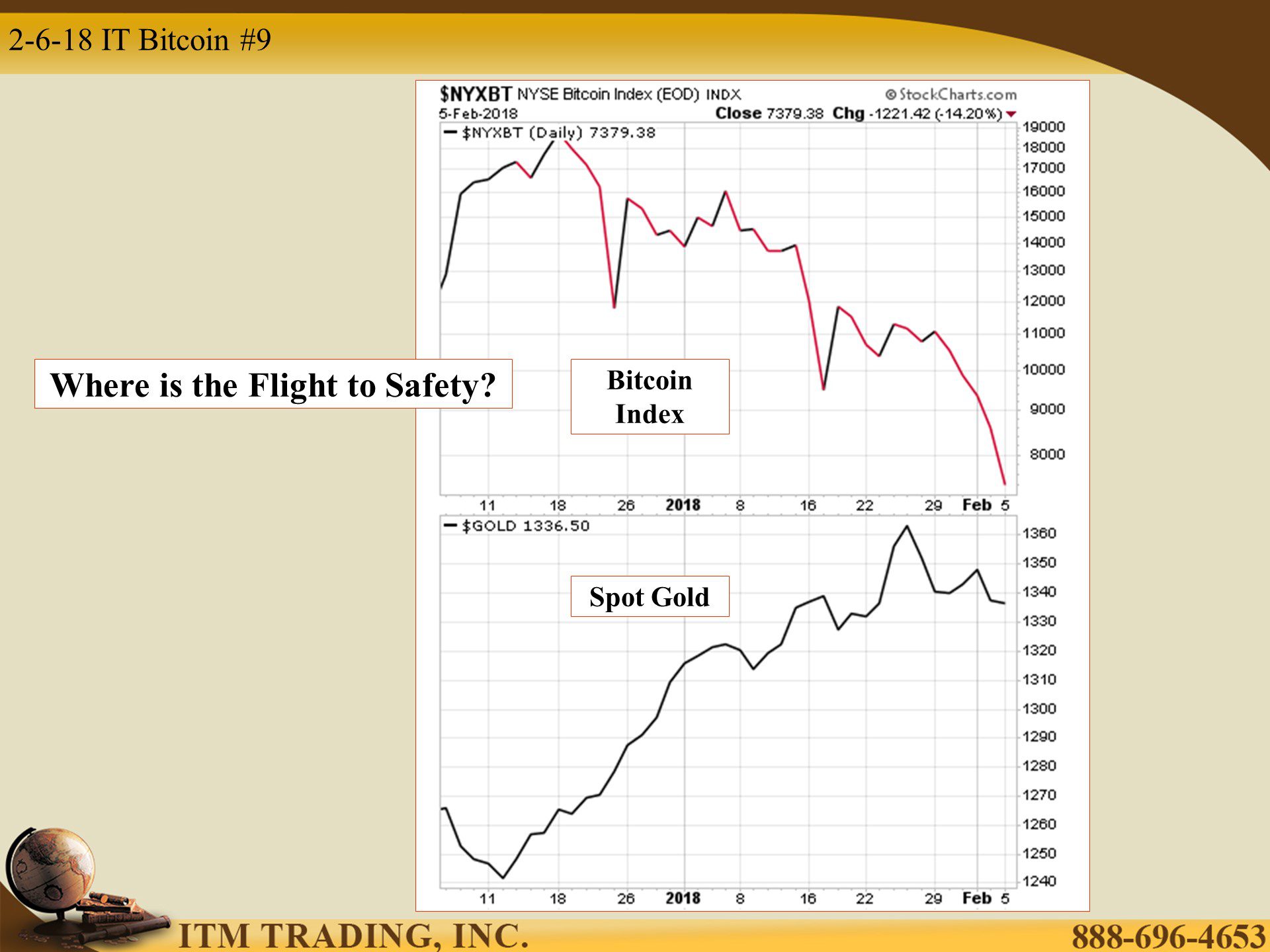

So with stock markets plunging, where did investors go for safety? Traditionally, we would have seen that flight to safety into treasuries, cash and gold, but that didn’t really happen this time. Bitcoin has been touted as the “new†gold and flight to safety asset but it’s market value has dropped from about $19,000 to below $7,400 as the stock markets were plunging, so it clearly did not pass that test.

At this time, in terms of the intangible fiat markets, I cannot tell you where all that wealth fled to, but what I can tell you is that gold numismatic coins are building a cup formation.

The cup formation is a very powerful accumulation pattern that indicates that “smart†money is quietly accumulating an asset. These coins are outside the system and, in my opinion, the true flight to safety asset.

So while this may or may not be the start of the visible financial system collapse, at the minimum, this should be a wake-up call. If central bankers can regain control of the markets in the short term, if you have not already done so, I strongly urge you to take advantage and re-position your wealth now, while we still have choice. Tomorrow may be too late.

Slides and Links:

http://money.cnn.com/2018/02/05/investing/global-stock-markets-tuesday/index.html

http://money.cnn.com/2018/02/02/news/economy/january-jobs-report-2018/index.html

https://fred.stlouisfed.org/series/T5YIFR

https://fred.stlouisfed.org/series/GFDEBTN

https://www.gurufocus.com/stock-market-valuations.php

https://www.financialsense.com/global-liquidity-2008-crisis-levels

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://fred.stlouisfed.org/series/TREAST

https://fred.stlouisfed.org/series/MBS10Yhttps://fred.stlouisfed.org/series/FEDFUNDS

http://money.cnn.com/2018/02/05/investing/stock-market-today-dow-jones/index.html

http://stockcharts.com/h-sc/ui

http://stockcharts.com/h-sc/ui

http://stockcharts.com/h-sc/ui

Â