Insider Trading: GLD/SLV As Good As Gold? By Lynette Zang

Will Corporate Buybacks Keep Stock Markets Bubbly?

The current market rout continues with the worst start to the month since 2016. Many stocks are now in bear market territory and volatility is spiking again. Corporations are doing their part to support the markets with the highest buyback surge in history as corporate insiders continue to sell their stock holdings, capturing gains. Can the corporate buying keep the stock bubble floating?

The Contract, Is This in Your Best Interest?

One of the most asked question is if GLD is the same as owning gold. Well it can be more convenient, after all, you can never even take possession of the certificate, let alone the physical metal. But a gold or silver ETF is very different than having physical gold or silver in your possession.

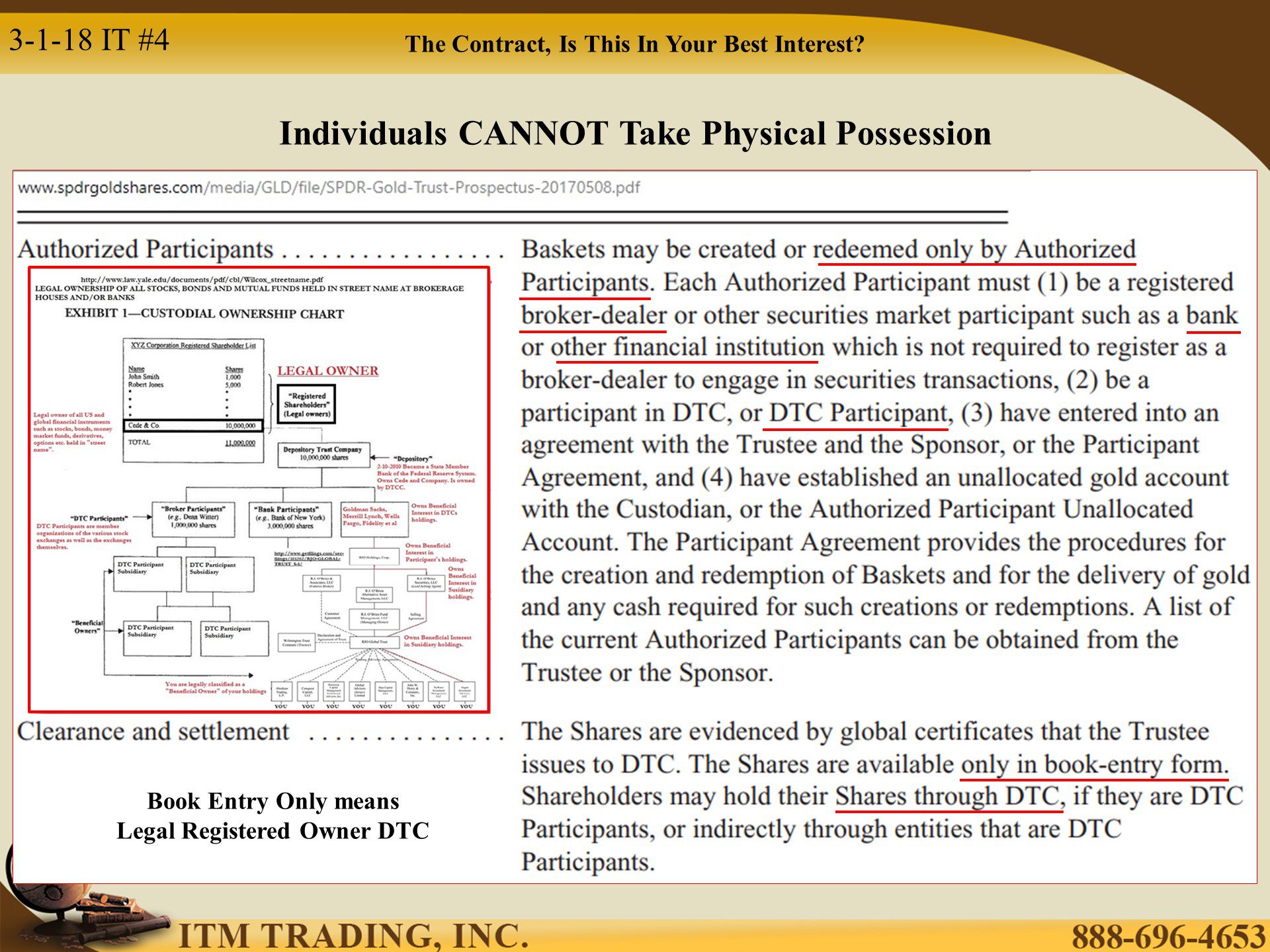

Like all Wall Street fiat money products, ETFs are actually a contract. The prospectus (contract) for GLD is 40 pages long. How many people read the prospectus before buying the product? Yet, when you make a purchase you are legally bound by it. So what are some key things you agreed to?

The Impact on You

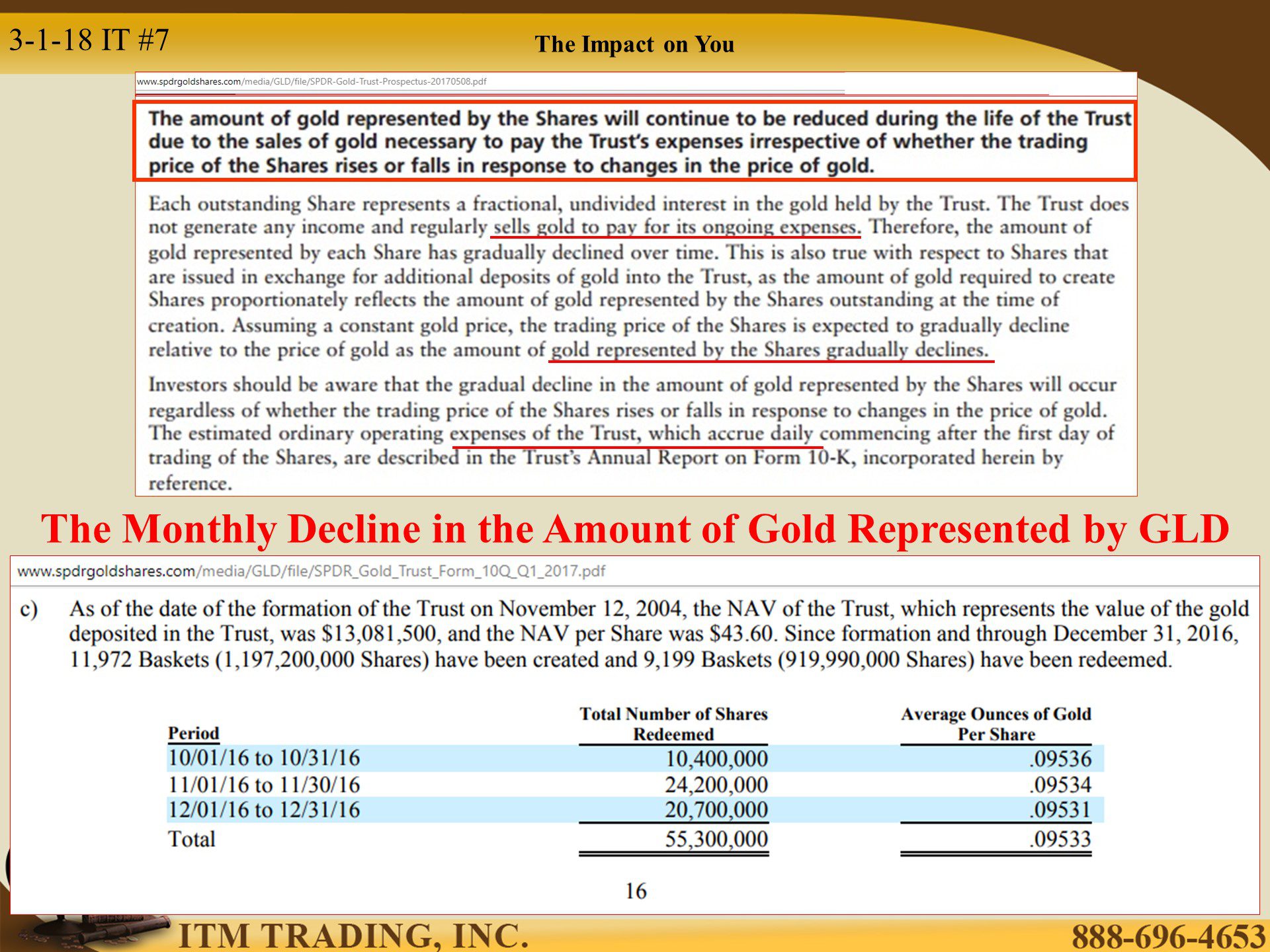

To summarize, you become a beneficial owner of shares of a trust that was created to mimic spot gold or silver. The legal registered owner is DTC. The “Authorized Participant†banks would also be classified as a “beneficial owner.†Therefore, they may have the ability to use YOUR equity for their benefit (see 2008 Was Just a Warning).

In addition, as an individual investor, you can never convert your shares into the physical gold or silver, but you pay fees to the sponsor, trustee, custodian and marketing agent. The shares can only be redeemed for US dollars (in the US) through the “Authorized Participant†as long as they choose to redeem the shares.

In other words, the individual investor pays all the costs, runs most of the risk and owns a contract that diminishes daily. While this might make sense for a short-term trade, in my opinion, it does not make sense for a REAL investment.

Since the most important function of gold is to hold value over time, gold ETFs, by design, do not support the reason most people buy gold. Can you see how different the two are? One is real (physical in your possession) the other is just a fiat money tool. The motto is really just this simple, If you don’t hold it, you don’t own it.

Slides and Links:

http://stockcharts.com/h-sc/ui

https://www.marketbeat.com/stock-buybacks/

http://www.spdrgoldshares.com/media/GLD/file/SPDR-Gold-Trust-Prospectus-20170508.pdf

http://www.spdrgoldshares.com/usa/regulatory-filings/

http://www.spdrgoldshares.com/media/GLD/file/SPDR-Gold-Trust-Prospectus-20170508.pdf

http://www.spdrgoldshares.com/media/GLD/file/SPDR-Gold-Trust-Prospectus-20170508.pdf

http://www.spdrgoldshares.com/media/GLD/file/SPDR_Gold_Trust_Form_10Q_Q1_2018.pdf

http://www.spdrgoldshares.com/media/GLD/file/SPDR_Gold_Trust_Form_10Q_Q1_2017.pdf

http://www.spdrgoldshares.com/media/GLD/file/SPDR-Gold-Trust-Prospectus-20170508.pdf

http://stockcharts.com/h-sc/ui