Insider Trading: The Benefits of the New Tax Plan

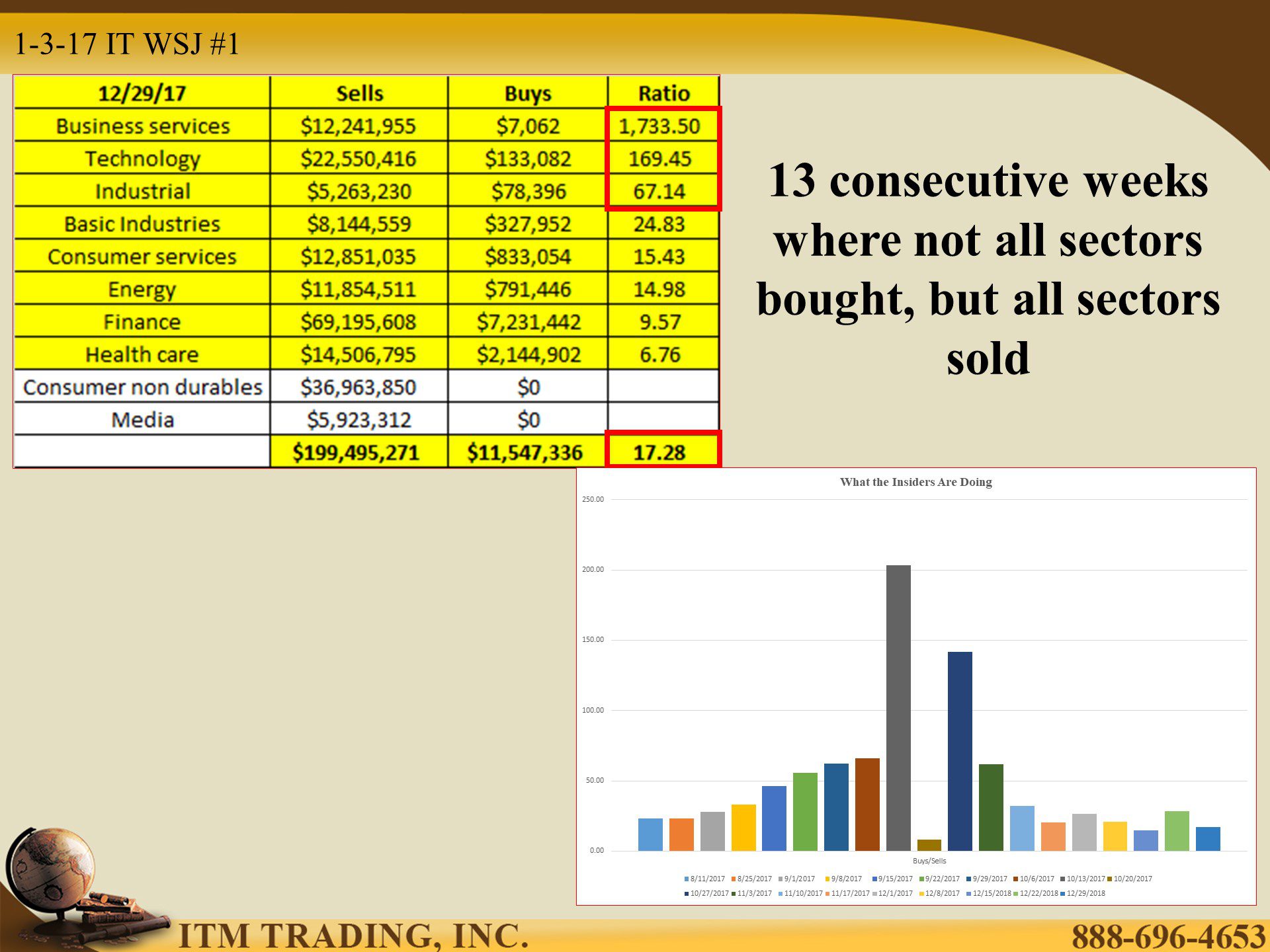

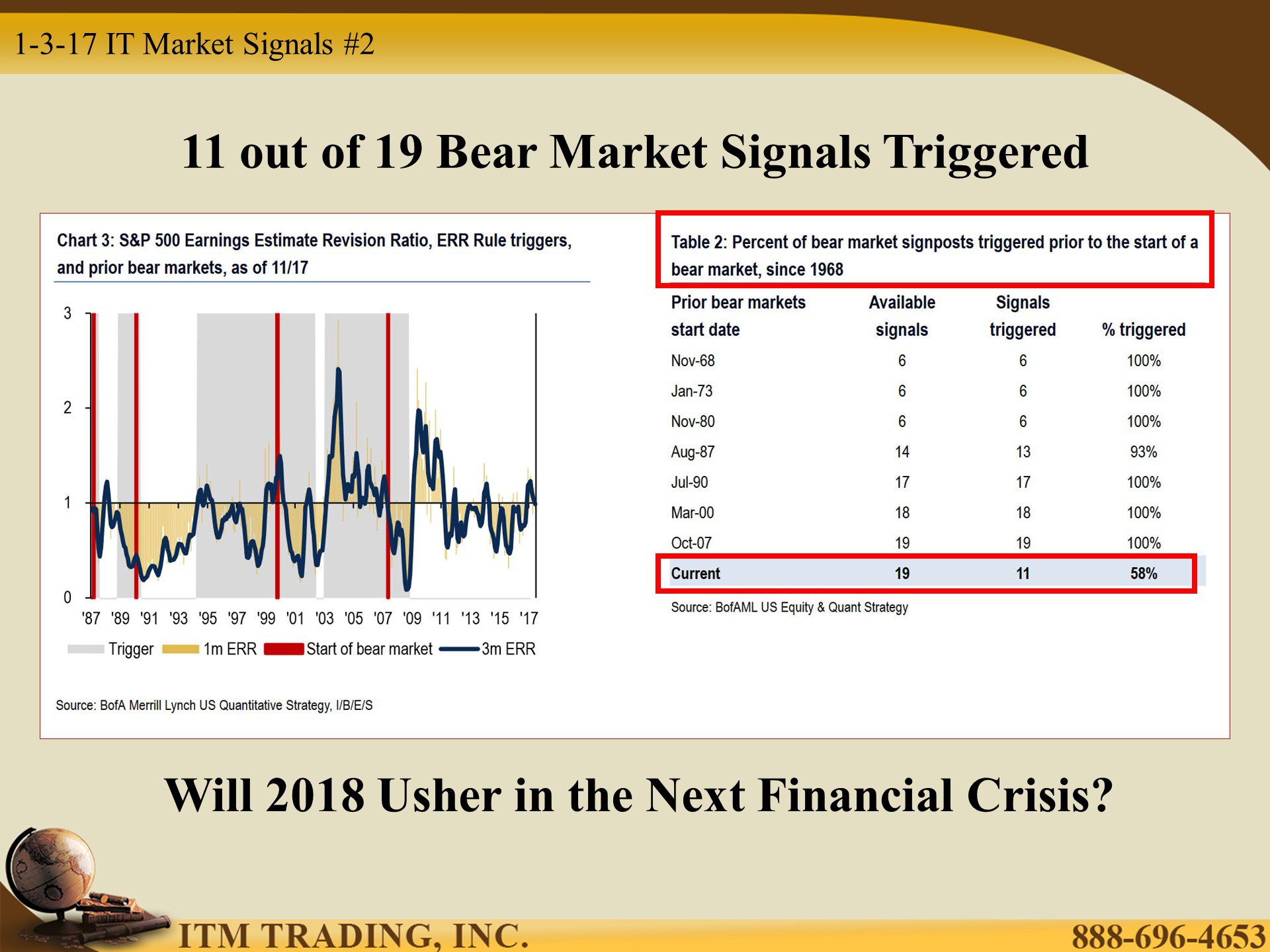

The pattern shift first noticed the end of September is now in it’s 13th week as Business services Buy/Sell ratio exploding to 1,733.50 shares sold for every share bought. BofA Merrill Lynch confirms the shift with 11 out of their 19 bear market signals being triggered. Are the Feds ready?

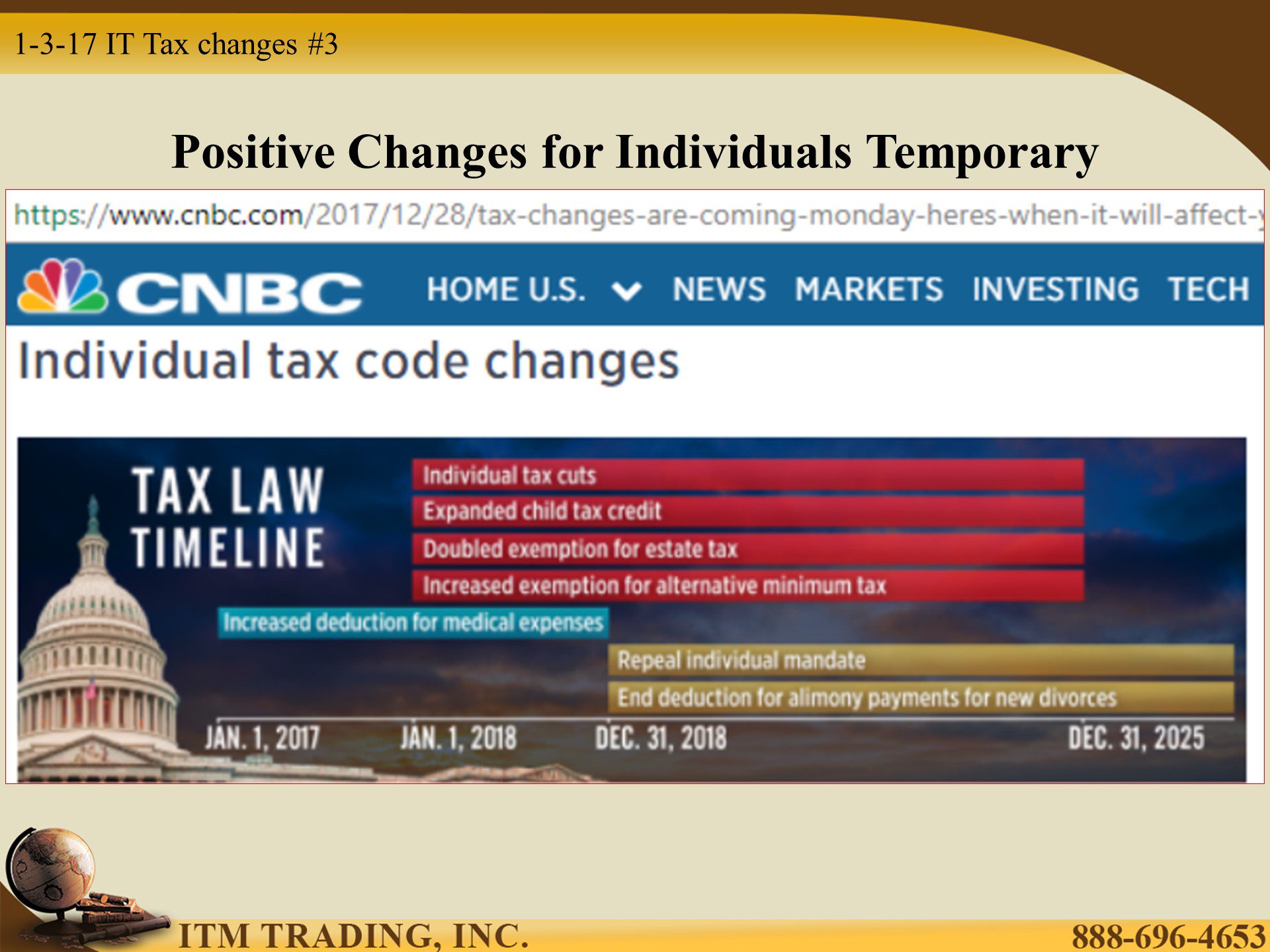

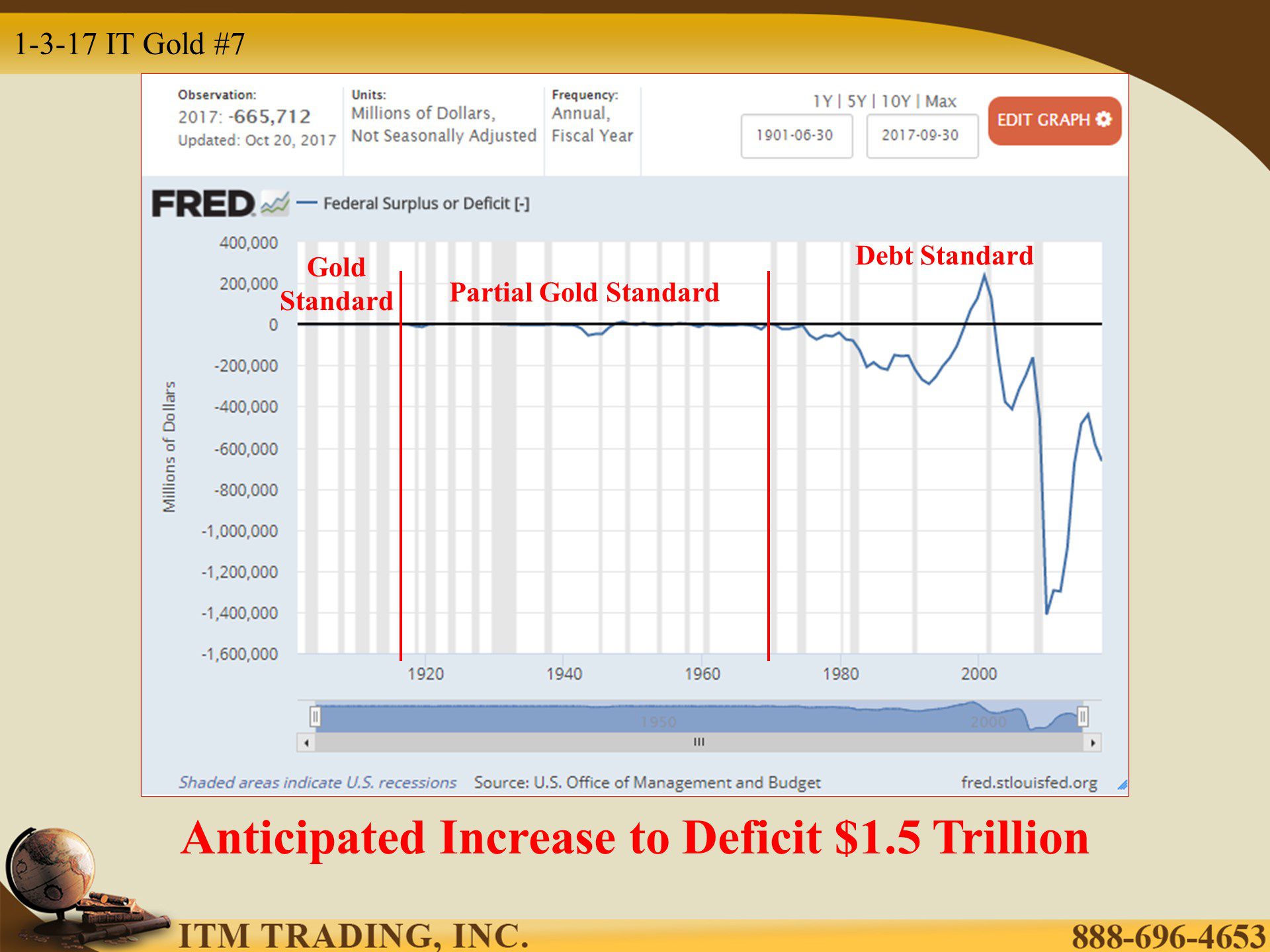

My bet is no since tax law changes and repatriation provides fuel to push stock and bond markets higher. Of course, there are some positive changes for individuals that should put more money in their pockets and (hopefully) stimulate spending, but those changes are temporary.

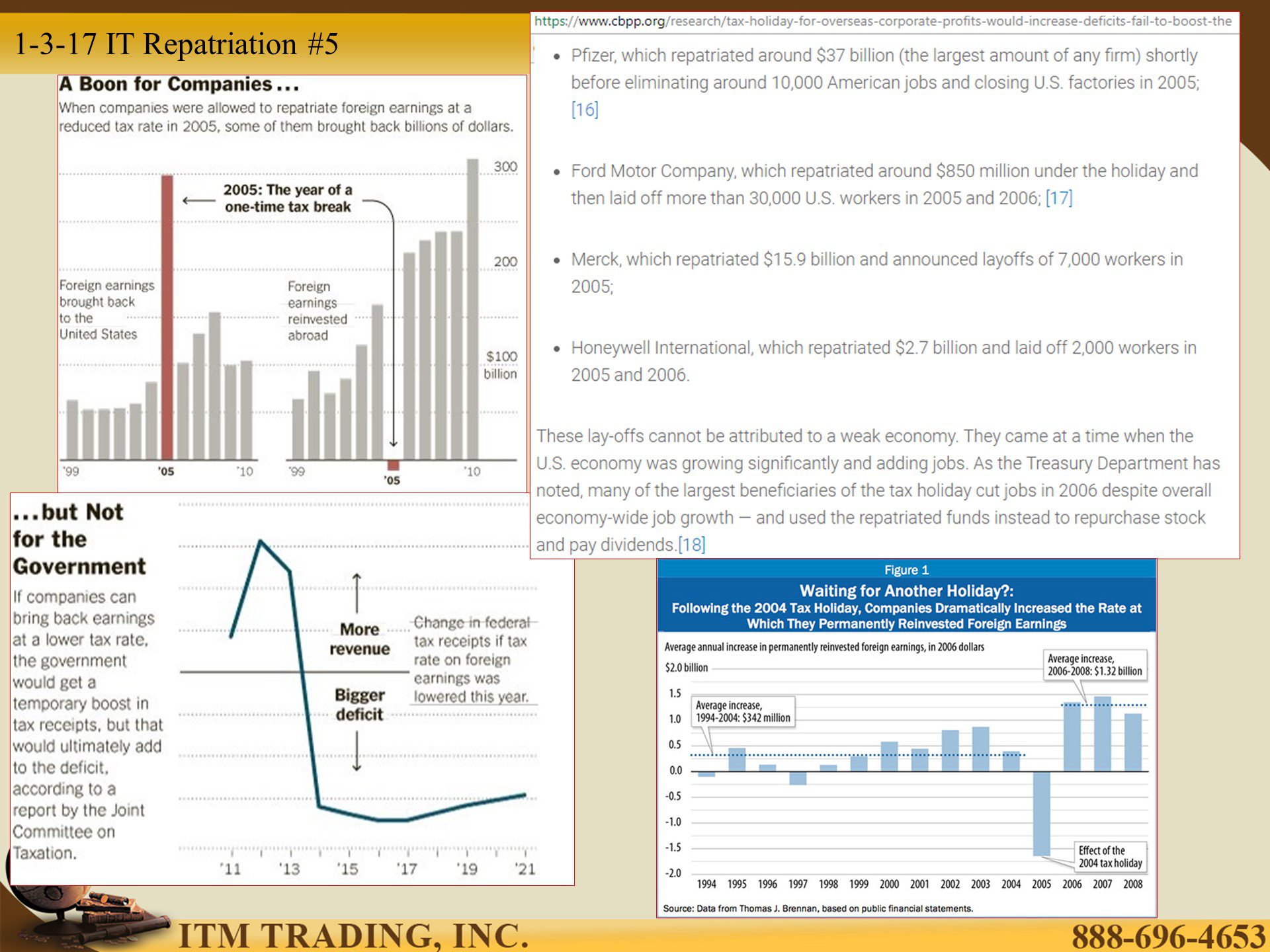

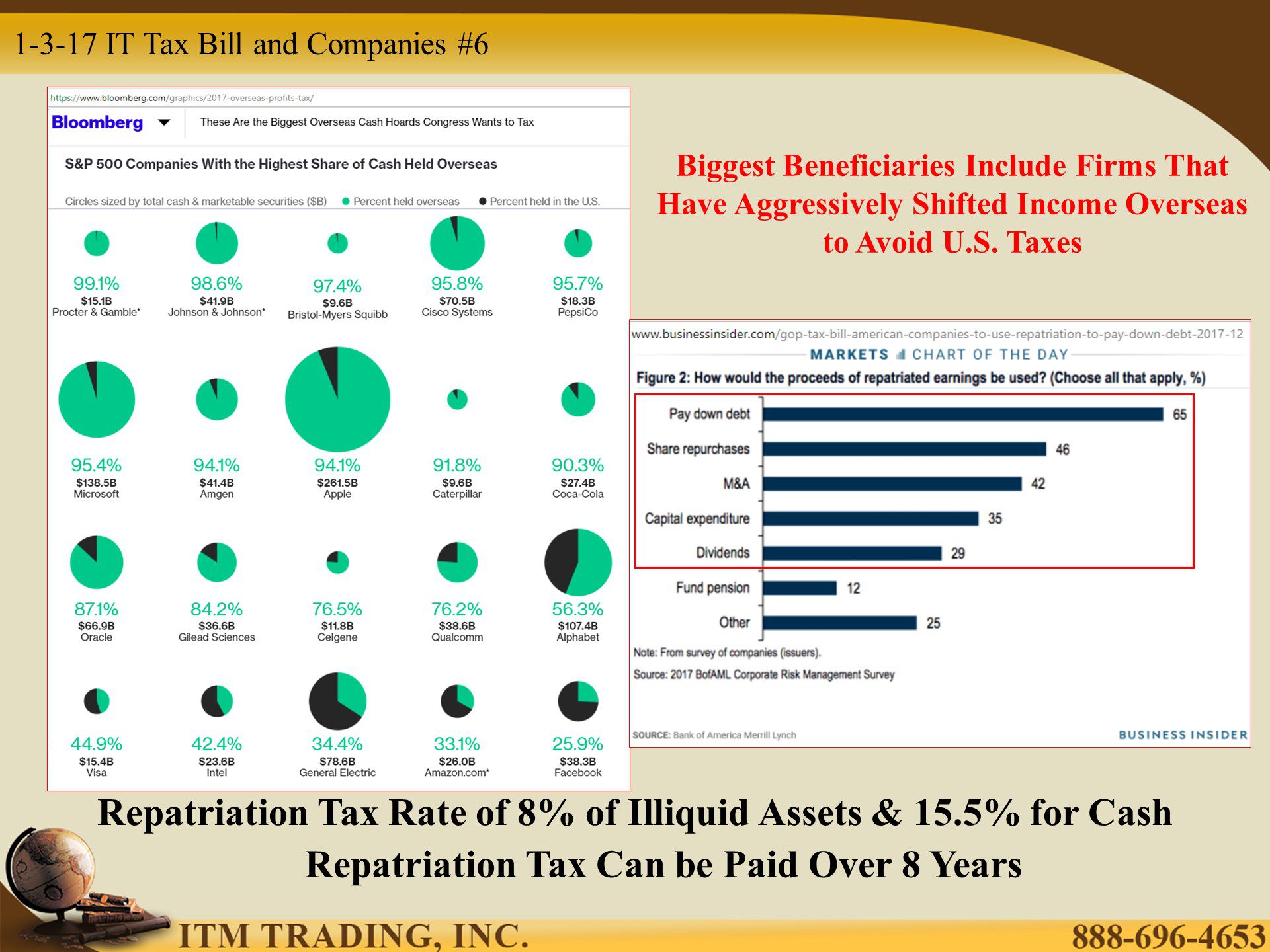

For corporations, most of the benefits are permanent. Wall Street anticipates that the lower tax rates will boost corporate earning up to 21.5%. But lowering the corporate rate from 35% to 21% and allowing full and immediate expensing is not enough. Multinational corporations also get to repatriate trillions held overseas at a 15.5% tax rate. In addition, this tax bill can be paid over eight years.

This has been sold to the public as increasing wages and a hiring boon, but a BoA Merrill Lynch survey paints a very different picture. So does history.

The 2005 tax repatriation (which was sold the same way) saw corporations use those funds to buy back stock and issue a special dividend. In addition, some of the biggest corporate beneficiaries actually laid off thousands of US workers. Will this time be different?

So how has spot gold responded? Quietly up year over year, because frankly, that is the real flight to safety trade.

Slides and Links:

http://www.wsj.com/mdc/public/page/2_3023-insider.html

https://www.cnbc.com/2017/12/28/tax-changes-are-coming-monday-heres-when-it-will-affect-you.html

https://www.cnbc.com/2017/12/28/tax-changes-are-coming-monday-heres-when-it-will-affect-you.html

https://www.bloomberg.com/graphics/2017-overseas-profits-tax/

https://fred.stlouisfed.org/series/FYFSD