Insider Trading 6-8-2017

Mc Donalds Stocks – Insider Selling and Buying

Video translated by YouTube

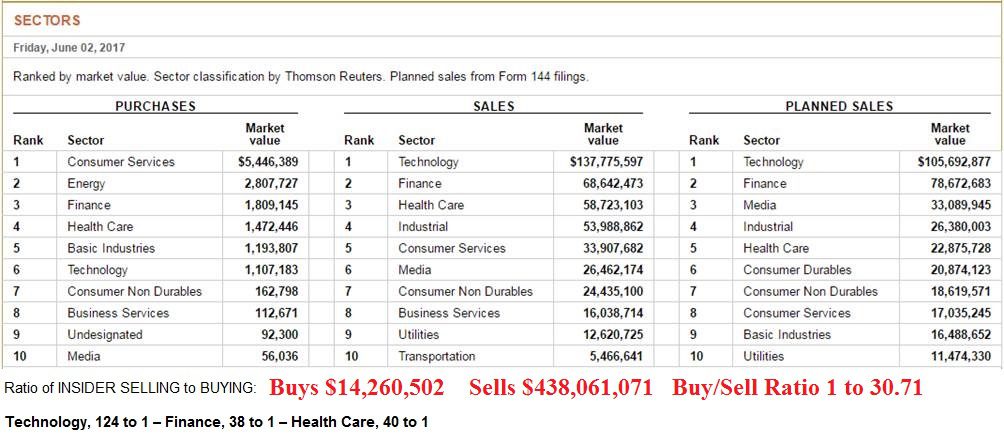

hi everyone Lynette Zang chief market analyst here at ITM training a full-service physical precious metals brokerage house so it’s time for our insiders what are you doing this week well as you can see overall let’s see it’s a for every dollar buy it’s it’s a $ to $ in selling but specifically in technology for every dollar is so I need that I can’t remember dissolve above a head thank you and Finance is to and in healthcare it’s to now someone asked me to show them what was happening with McDonald’s so here you go and again the very similar pattern where the prices are going up where the market is going up with on declining volume and you can certainly see that their their life L ratio is for every one dollar buy they’re selling almost dollars worth of stock.

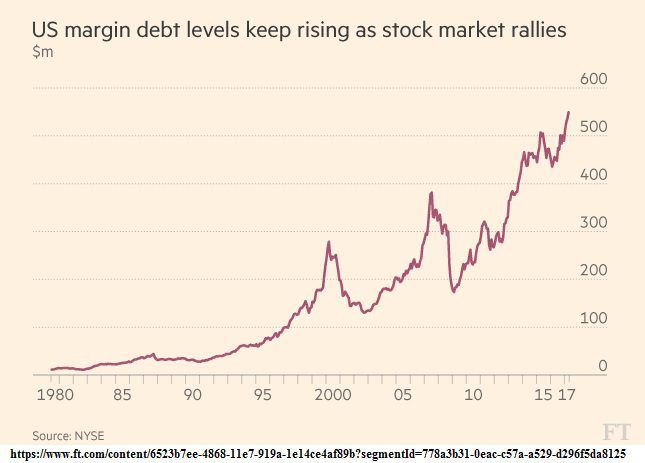

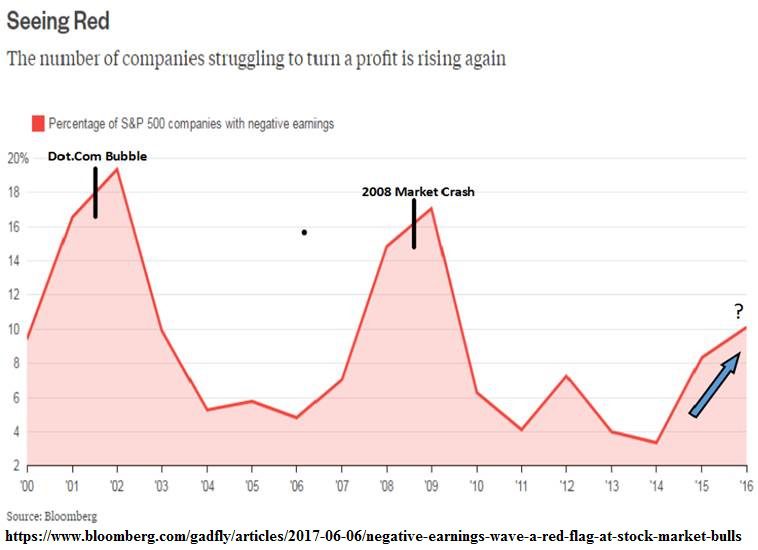

what do you think so who’s holding this okay how is it going up a site from all the debt and all of that well margin levels that means borrowing to buy stock is at the highest level ever so when this market corrects down that means there’s a lot of margin calls or other people that bottom on margin that will then have to liquidate to meet those calls this is dangerous people dangerous in addition there are a number of companies that are having trouble you hear about all this great earnings growth well you know you’ve got to really look a little beneath the skin in the market because what’s also growing is the inability to service all of that debt and these are the percentage of SMP companies with negative earnings see how that’s growing we need to pay attention to that that doesn’t support these lofty levels but let’s talk about what happened today in the gold and silver market there were three key things that were coming out today Comey was testifying in front of the Senate

You have the UK vote which is still out and then you also have the EU announcing whether or not they would change their interest rates which of course they didn’t so just before congress testimony you and I definitely want you to pay attention to this area there someone came in and sold a tremendous amount of contracts now each contract controls a hundred ounces of gold so there were , I’m going to read this forty eight thousand six hundred and twenty seven contracts so that’s four million eight hundred sixty two thousand seven hundred ounces of gold it costs them fifty three thousand four hundred eighty nine dollars and seventy cents to sell all of that gold.

That does not exist but was at fifty-three thousand bucks they controlled over six point oh six point three billion dollars worth of physical gold well they did the same thing in silver just before the testimony someone came in and sold , over , contracts of silver I have a cost of roughly , a little bit more than , now when silver each contract controls ounces so let’s see I can’t kind of read that high down sorry about that but that would be a nine point seven million ounces of silver cost of twenty one thousand to control a market value at spot at that time of one hundred and seventy two million eight hundred thirteen thousand six hundred and eighty dollars now Eric was asking me well maybe they just had a large position and they wanted to get out well actually it’s that we’re case then you don’t want to take the lowest price you want to maintain the price so you can see the level of these bars that could indicate some profit taking but when you see something like this which you would you typically do whenever there’s going to be a shift I know I did this back when China’s yuan was entered into the RMB basket as well when you see a big dump like that that’s about moving the price that is not about taking a profit because you’re getting out and low so for those of you that haven’t seen this before this is from the CME Group and particularly on the bottom but this is the central bank incentive program and it costs them a dollar ten to control a hundred ounces of physical gold.

five hundred ounces of physical silver of five hundred barrels of physical oil it does not cost very much and it’s anybody that they want to all of their different minions so it could be central banks themselves or offshoots of the central bank’s if you go to the CME Group and you google central bank incentive program they’ll give you a whole list of everybody that can fill those contracts for a dollar ten even a dollar fifty so yes it’s legal somebody couldn’t believe that that was legal well when you write the rule you can write anything you want and people look at Wall Street go oh well that must be the truth that’s amazing to me

That’s it for today and follow us on Twitter like us on Facebook subscribe to us on YouTube if you like this give us a thumbs up please and give us a call eighteen eighty six nine six four six five three and be safe out there bye bye

Buy Gold and Silver OnlineÂ

ITM Trading Online

Website – https://www.ITMTrading.com

YouTube – https://www.youtube.com/user/itmtrading

FaceBook – https://www.facebook.com/ITMTrading/

Twitter – https://twitter.com/ITMTrading

Images