INFLATION, NOMINAL CONFUSION AND YOU… By Lynette Zang

There are four key functions that money must perform. It must be able to be used as a unit of account to price labor, goods and services. As a medium of exchange, money must be fungible with one unit identical with another, (any $1 bill will be accepted as any other $1 bill). As a unit of deferred payment, you can commit to buy something today that will be paid out in the future, (i.e. 30-year mortgage) and, in my opinion, the most important function, money must be a store of value over time.

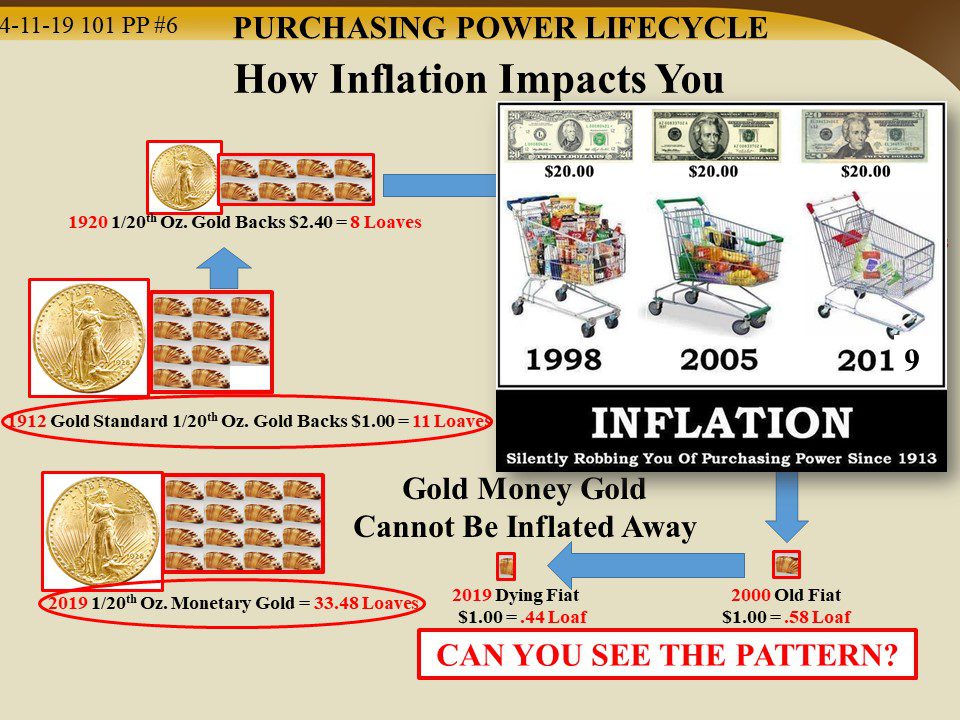

Since money is what we work for, use as our tool of barter and save for retirement, a key goal for individuals is to always be paid fairly for our labor, no matter when we use it. Gold money performs all of these functions. But this created a problem for governments that want to tax and spend and corporations that want to buy your labor as cheaply as possible. Enter the current fiat money system.

“By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.†AND “A sentiment of trust in the legal money of the state is so deeply implanted in the citizens of all countries that they cannot but believe that someday this money must recover a part at least of its former value†John Maynard Keynes, Father of Keynesian Economics.

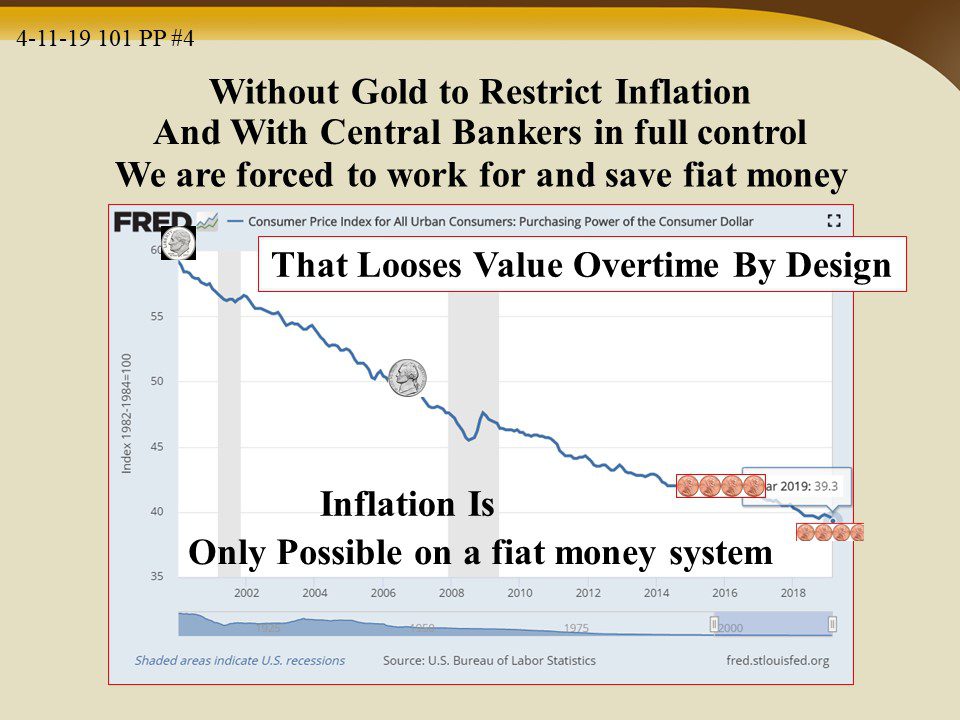

So says the key creator of our current fiat money system. Fiat money is governmentally decreed into existence which mimics most of good money functions but not the most important function as a store of value, because inflation is built into government decreed money by design.

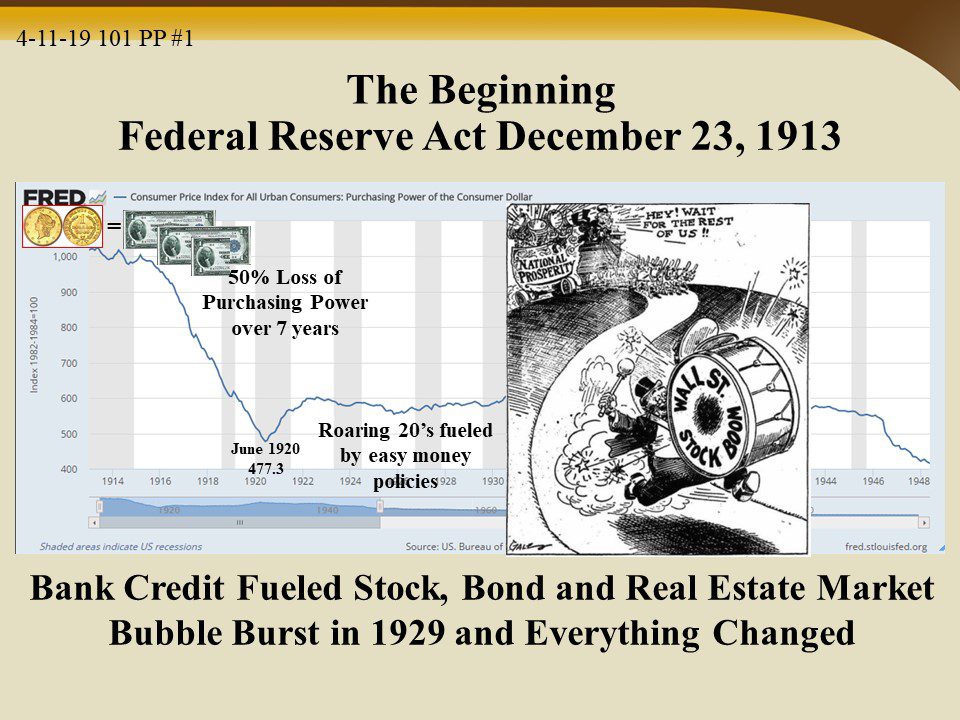

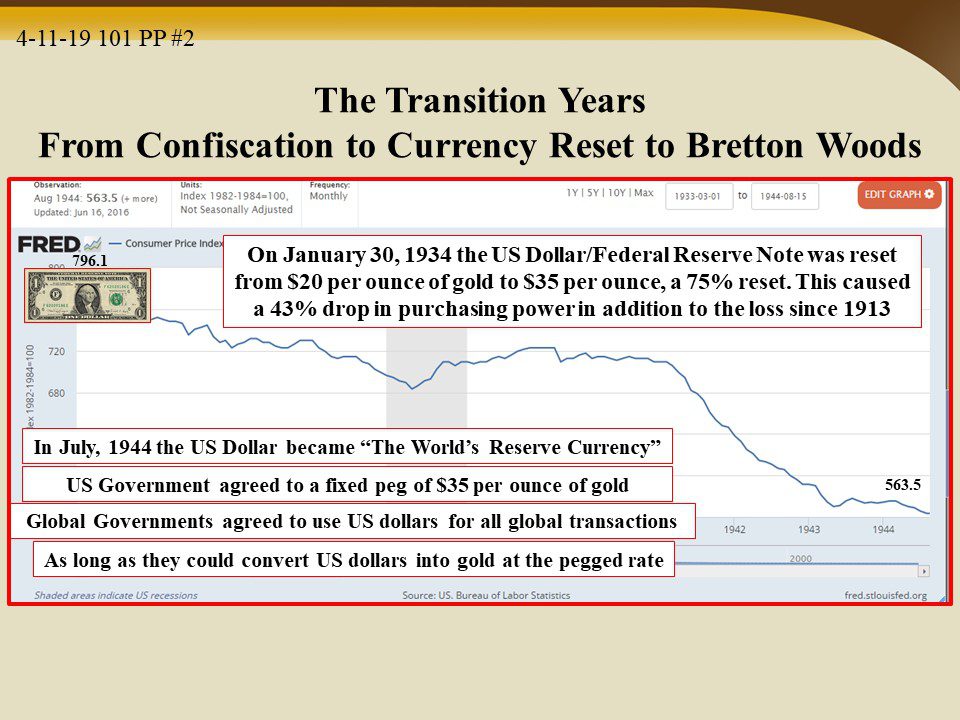

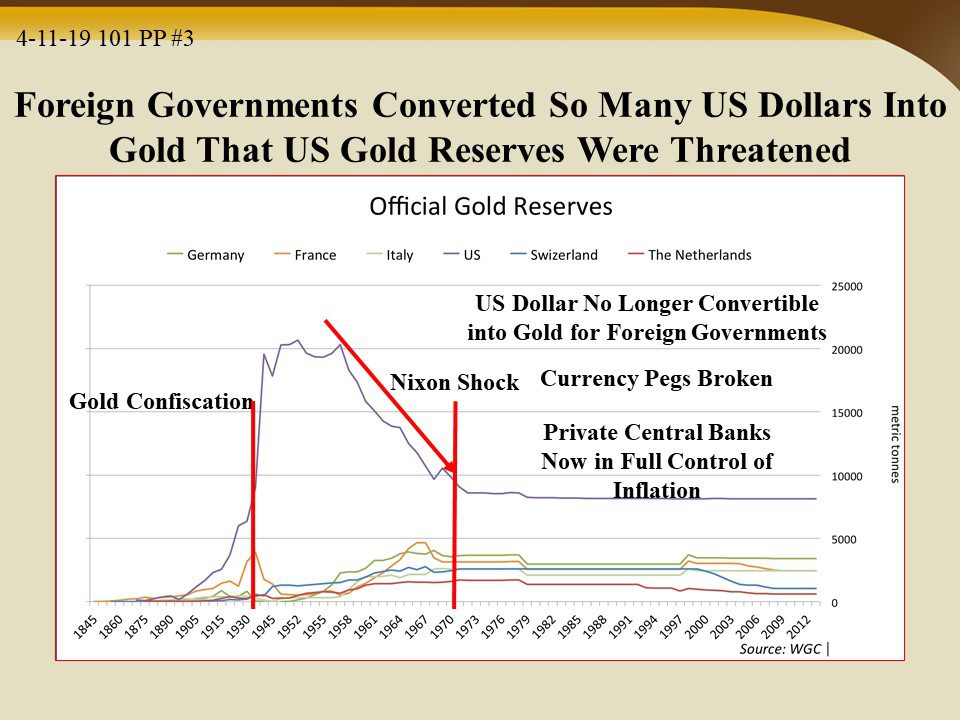

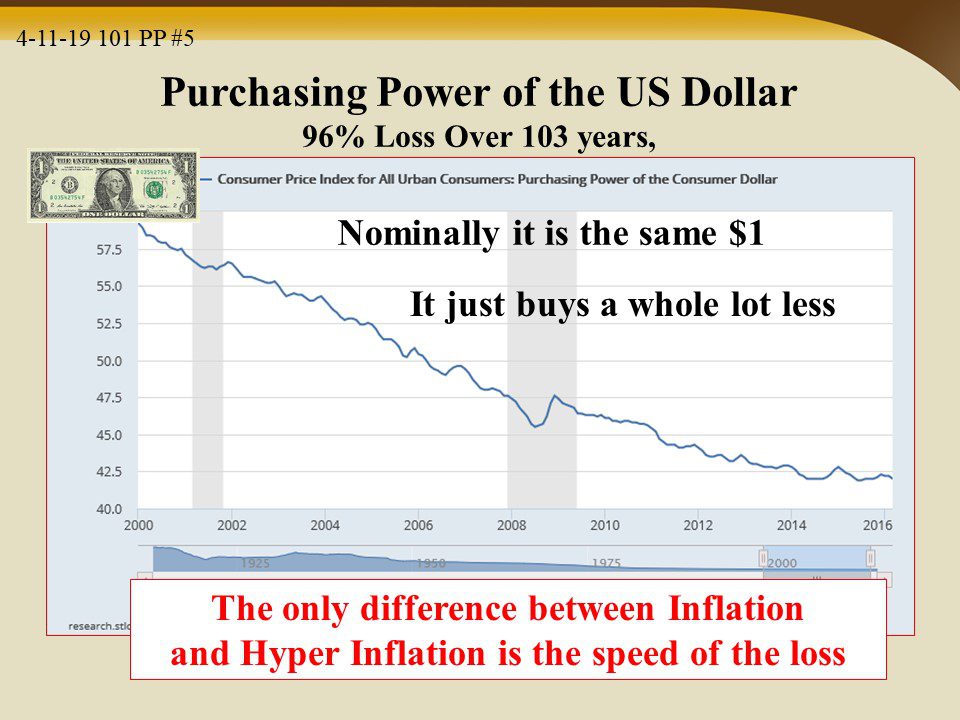

If you really want to understand where we are in the trend cycle and how the current monetary system impacts you, the Fed publishes my favorite chart titled “Consumer Price Index for All Urban Consumers Purchasing Power of the Consumer Dollar†which enables you to track the dollars value in terms of what you can buy with it or the impact of inflation on your purchasing power over time.

Understanding this chart will also help you understand why “this cannot go on forever†and perhaps help you see that we are at the end of this grand experiment and WHY the system MUST reset and how gold can protect the value of your work and wealth over time.

Slides and Links:

https://fred.stlouisfed.org/series/CUUR0000SA0R

YouTube Short Description:

Understanding this chart will also help you understand why “this cannot go on forever†and perhaps help you see that we are at the end of this grand experiment and WHY the system MUST reset, as well as how gold can protect the value of your work and wealth over time.