Hyperinflation In The US?

Sometimes in the news, you hear about hyperinflation happening in another country. Hyperinflation is the rapid loss of the purchasing power of a currency. Sometimes hyperinflation is more recognizable as rapidly rising prices, or even the complete lack of items available for sale. Can we experience hyperinflation in the US? Could shelves in America go bare?

Sure, there can be hyperinflation in the US. There has been hyperinflation in the US before, more than once, in fact. There can be bare supermarket shelves, too. Below is a little easy to understand example of how shelves quickly go bare during hyperinflation.

Empty Store Shelves Can Be A Sign Of Hyperinflation.

Our collection of gold bullion  coins and bars

During rapid hyperinflation, a shopkeeper may sell a can of food for $2. The next time the shopkeeper places an order for the same item, the can costs him $3. Now the shopkeeper has to add $1 of his own money to replace the can of food he sold for $2. Say he does, and then sells the can of food for $6, making a three dollar profit. But, when he goes to order stock again, the prices have increased once more, and a can of food now costs $7.

Not only has the price increase (caused by a quickly devaluing currency) erased the shopkeepers profit, he must now take money out of his own pocket again to purchase new stock. The shopkeeper can’t afford to do this for long. Even if the shopkeeper raises the price to $10 a can, chances are that by the time people are willing to pay $10 for a single can of food, the shopkeeper will not be able to replace that can of food for $10. By the way, when shopkeepers do try to “out-price inflation†this action only feeds hyperinflation and hoarding.

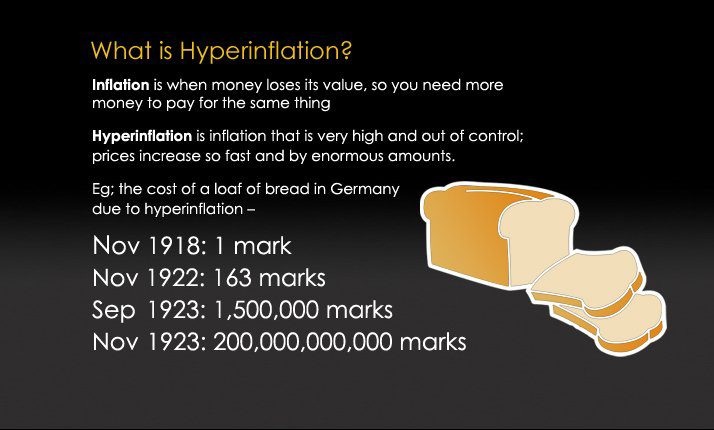

Hyperinflation In The US? What Is Hyperinflation?

Hyperinflation is technically and economically defined as prices increasing (purchasing power of the currency decreasing) by 50% or more in a single month.

During Hyperinflation The Declining Value Of A Currency Is Most Often Expressed In The Rising Cost Of Food.

When you try to envision prices increasing 50% in just four weeks perhaps understanding why the shopkeeper can’t afford to refill his shelves makes sense. In the US, hyperinflation will hit hard and swift. Why, you may ask? Because in the United States, we really don’t have shopkeepers anymore. In The US, we have giant corporations that are traded on the stock market.

Investors and business people understand that as soon as the currency begins to break down, commerce and profitability begins to break down just like it did for our shopkeeper. The stock prices of food retailers and their vendors and suppliers will plummet as the market decides that these companies are no longer capable of generating profits, only losses.

Hyperinflation Will Hit Major Retailers Very Hard.

Even if credit is available to these companies, they may not choose to continue operating at a loss. Using your ability to borrow to operate at a loss is not a good long-term business strategy.

Can hyperinflation in the US happen? Well, hyperinflation in the US has happened three times before, and we’ll briefly go over those times later in this article. The next time the US goes through hyperinflation, however, everything will be very different.

Hyperinflation In The US? The US And War.

Historically, countries often abandon the gold standard type of economy in order to finance wars. A true gold standard requires either a gold currency (silver is also used in order to help make change and enable small purchase) or a paper “gold note†that is instantly redeemable upon demand at any bank or merchant.

A US Gold Certificate From 1922. Buy Rare Gold Coins

When war either breaks out or is engineered, government expenses skyrocket. Armies and navies must be bolstered and manned. Production must increase, and prices must be contained. Governments often use war as an excuse to issue paper currencies or script, and the gold of the people eventually ends up in another country through international commerce.

War requires natural resources, and oftentimes, natural resources and even technology must be imported from other countries. Other countries tend not to trade their natural resources or military technology for war-time script or paper currency. Other countries would, however, sell these items for gold.

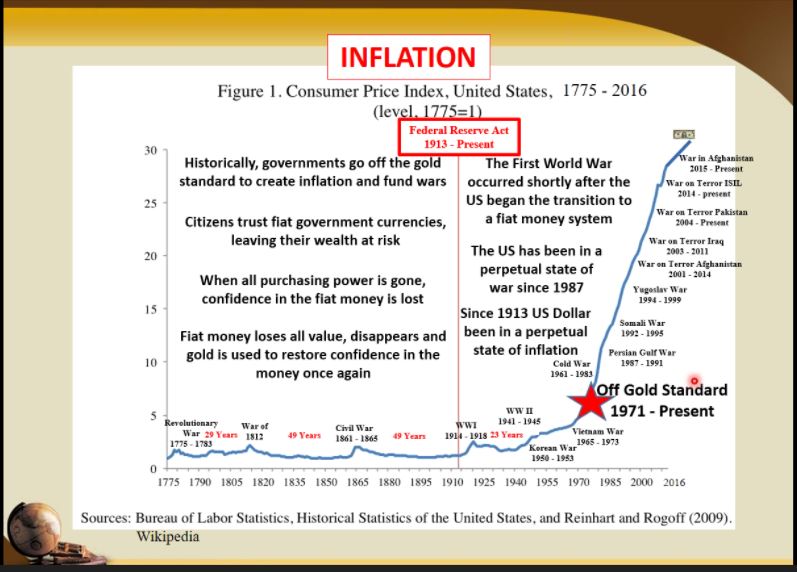

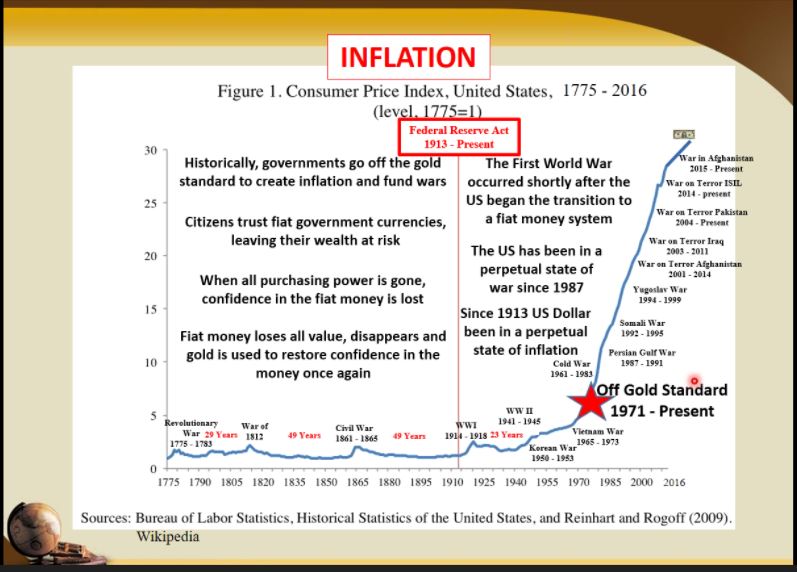

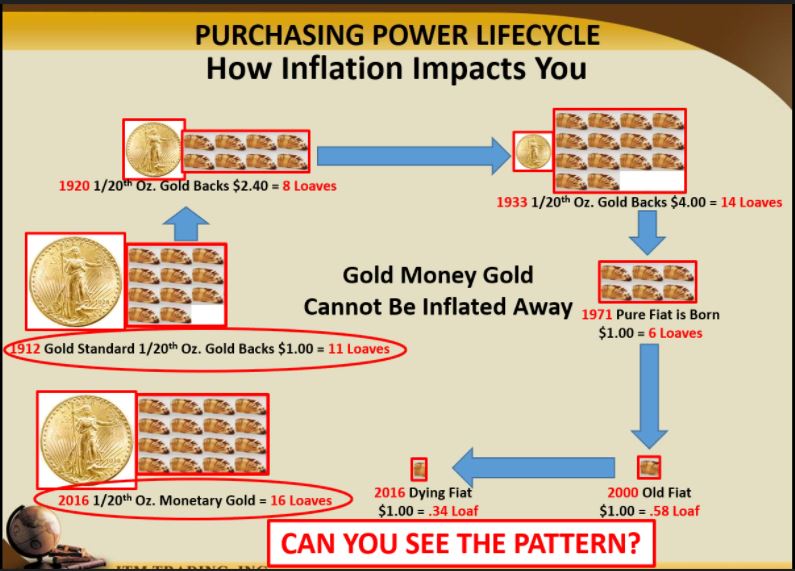

The United States is really no different. The three times that the US experienced hyperinflation (prices rising 50% or more in a month) had to do with war. Below is an ITM Trading graphic which illustrates on a timeline the devaluation of the US dollar.

Note The Hyperinflation During War Times.

As you can see, during the Revolutionary War, the War of 1812, and the Civil War, there were little peaks that formed in the graph. Those peaks looked so little because the hyperinflation started when the gold standard was abandoned and paper scripts were issued, and then inflation was tamed again once the war was over and the gold standard was re-installed.

The Next Time The US Experiences Hyperinflation…

The next time the US enters technical hyperinflation again, we will not begin by leaving a gold standard. The US “temporarily†left the gold standard in 1933, and abandoned it all together in 1971. This time, the US will enter hyperinflation with a very weak and completely unbacked currency.

The US will also enter hyperinflation with more debt than any other country in the world has ever seen. Add to this the problematic situation that publicly owned companies and their stocks will face during hyperinflation, as discussed earlier, and the outlook darkens even further.

Hyperinflation In The US? Own Gold.

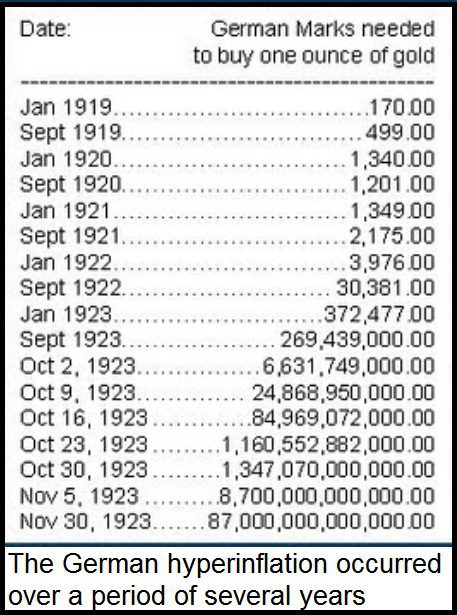

Gold is an inflation fighter. The price of gold rises against a weakening currency, just as a can of food or a loaf of bread does. Gold and silver are able to do this because gold and silver are not just physical assets. Gold and silver are currencies.

Gold Vs. The German Mark During Hyperinflation.

If you would like to study hyperinflation more in depth, and see exactly how ITM Trading can help you benefit from the current financial trends, rather than be crushed by them, then I suggest you begin by watching our past webinars available here. If you would like to attend ITM Trading’s next webinar, please call Lynette Z. at 1.888.OWN.GOLD.

Gold And Bread Both Hold Their Value Against Inflation, But Bread Is Not A Currency.