How Currencies Collapse, Part 3: The Dangerous Rise of U.S. Debt

In the first two parts of our series, I considered two critical elements in currency collapses: inflation and the transition of money to currency. Today I’ll add a third key ingredient: debt.

The Role of Debt in the Modern Economy

Overall, debt is important. It’s an inescapable part of any economy past the barter stage. It greases the wheels of commerce. Without it, everything grinds to a stop.

In the modern world: Consumers usually have to incur long-term debt in order to buy big-ticket items like cars and houses, and tend to also finance everyday purchases by charging them to credit cards; entrepreneurs who aren’t already wealthy must take on debt to realize their dreams of becoming small business owners; commercial banks have to create debt in order to generate interest payments from borrowers; and the federal government increases its debt whenever it runs a deficit, i.e. spends more than is covered by tax income.

The Consequences of Unpayable Debt

Debt is good. What is not good is debt that cannot possibly be paid back. This is a primary life lesson. If you borrow beyond your means to repay—either with cash on hand or even with potential future earnings—you will find yourself with what is politely called a “solvency problem.” If it is insoluble, there will be a reckoning, and the consequences will be severe. You’ll be forced to default. You could lose all you have. You’ll likely wind up in bankruptcy court. You will be forever known as a credit risk.

But what if, faced with financial ruin, you simply bought the finest color printer in the land, and began making Federal Reserve Notes in your basement? This wouldn’t work. You’d quickly be exposed as a counterfeiter and would be arrested, unless…

The Myth of Government Money Printing

You’re a central bank—and conjuring money from nothing is actually your job. (Note: because it’s common parlance, I will revert to using the term money when I’m actually talking about currency, as explained in Part 2, but keep the distinction in mind.)

Which makes this a good point to dispel one of the most enduring misconceptions the public has. And it’s not just the general public. The financial ignorance extends to the highest levels of governmental power. Just have a look at this recent quote:

“The US government can’t go bankrupt because we can print our own money… The government definitely prints its own money. The government definitely prints money and lends that money… The government definitely prints money…It then lends that money by selling bonds. Is that what they do? They sell bonds and then people buy the bonds and lend the money. Yeah…”

You would be forgiven if you thought this was the response of a ninth-grader being quizzed on how the bond market works. But, dismayingly enough, these are words from Jared Bernstein, chair of Joe Biden’s Council of Economic Advisers (CEA), as interviewed in the film, Finding the Money. And how did Bernstein prepare to become the administration’s top “economist”? He got a bachelor’s degree in music from the Manhattan School of Music, a Master of Social Work from Hunter College, and a doctorate in social welfare from Columbia.

I am not making his background up. It’s from his Wikipedia page, which also helpfully notes that “Throughout the ’80s, Bernstein was a mainstay on the jazz scene in NYC.” What finer training?

Understanding the Federal Reserve’s Role

Ok, just the obvious part is bad enough. The government does not issue bonds in order to lend money; it issues bonds in order to borrow money. We, the American people (and other bond buyers), are the lenders; Washington is the lendee. But buried in the quote is another major misunderstanding, one that is unfortunately shared by most Americans.

Bernstein states that “the government definitely prints money.” No, it doesn’t. The Federal Reserve (Fed) prints our money (out of thin air) and gives it to the government in return for bills, notes and bonds. The Fed then arranges the sale of the Treasuries to whomever wants to buy. (This is actually a gross oversimplification of how the bond market works, but it’ll do for present purposes. Plus, you are now better informed than the president’s top economic advisor.)

The Fed is not a government agency. It is a consortium of private banks. What that means is complicated and must await explanation in a future post. For now, all we need to know is that the federal government habitually contracts for spending that it doesn’t have the cash (raised through taxes) to pay for. Thus it engages in deficit spending, a/k/a piling up debt. A lot of debt. At this writing, it amounts to $34.7 trillion. (It’s good to remind ourselves that, if you had somehow been able to spend a million dollars a day since the birth of Jesus, you’d still be more than $260 billion short of a trillion. That’s how big a number it is. Now multiply by 34.7.)

The Alarming Growth of U.S. Debt

Moreover, the debt is growing really fast. You can follow if for yourself, in real time, by going here: https://www.usdebtclock.org/

Despite government assurances that its spending is crucial and fosters growth, the opposite is true. Debt is now growing way faster than GDP. Since the beginning of 2020, GDP has grown by about 30%, but the debt clicker is up nearly 50%. This is what you and I would call a very poor return on investment. You’d fire your broker for results like that. Yet the government and the Fed continue on their merry way, as if this will all magically turn around. Are they just deluded, or do they not care so long as their buddies on Wall St. are rewarded? You decide … but I know which way I’m leaning.

The Debt-to-GDP Ratio: A Key Indicator

So how big a problem is this runaway debt? Well, that depends on whom you ask. There are those like Bernstein who argue that we needn’t worry about it because “we can print our own money.” That’s the essence of modern monetary theory (MMT), an argument I’ll examine in a future post. MMT is very influential at the moment.

More traditional economists believe—and history supports the idea—that you can’t print your way out of debt. At some point, the system cracks and a crisis develops where inflation explodes (hyper-inflation), users then completely lose faith in the value of government “money,” and the currency fails.

Generally, that happens over time, until it happens all at once. Luckily, there are signposts along the way. The most widely accepted one is the ratio of public debt to a country’s gross domestic product (debt/GDP). Why is it important? Investopedia.com explains: “[debt/GDP] reliably indicates that particular country’s ability to pay back its debts… the number of years needed to pay back debt if GDP [were] dedicated entirely to debt repayment.”

Historical Context and Recent Trends

In a vibrant economy, the ratio is low; the economy doesn’t need much government monetary intervention (which is what federal debt is). As it widens, though, so does the danger. It’s the same as it would be with your personal accounts. If you keep accumulating debt beyond your ability to make good, your creditors will call in the debt and you’ll go bust. At the national level, going bust means a currency collapse.

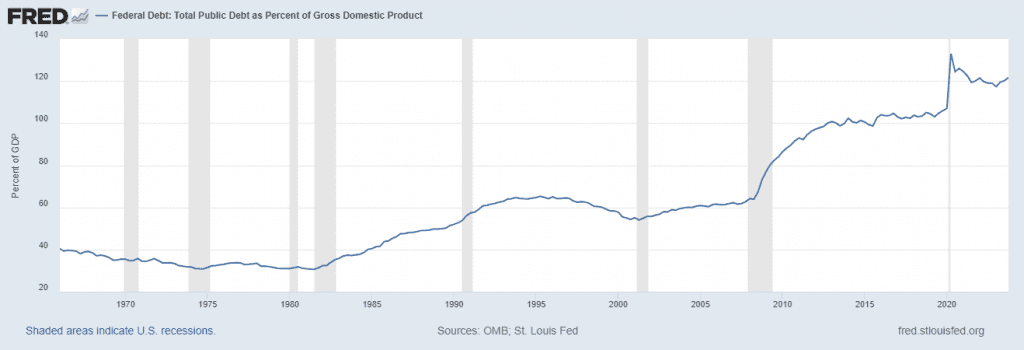

So, where are we in the U.S.? The line on this chart shows federal debt as a percentage of GDP:

You can see how from 1965 to the early ’80s, the ratio was 30% or less, even through recessions (shaded areas). That means the economy was humming. Little need for extra government “support.” Then Ronald Reagan arrived. His administration tripled the national debt, and debt/GDP shot up from 30.9% to 49.8%. That was a wrong-way trend, but still not into the danger zone, as defined on Investopedia.com:

“A study by the World Bank found that countries whose debt-to-GDP ratios exceed 77% for prolonged periods experience significant slowdowns in economic growth. Pointedly, every percentage point of debt above this level costs countries 0.017 percentage points in economic growth.”

The key takeaway is that once past the 77% mark, running up government debt has the opposite effect of its intent. That is, the more money the government spends that it doesn’t have, the less effective those dollars are. Instead of boosting GDP, they impede growth.

By Q2 of 2001, debt/GDP stood at 54%, just above the last of the Reagan years but still not worrisome. That, unfortunately, proved to be the low point.

Two wars added to the debt, and then it skyrocketed with the Financial Crisis of 2008-09, hitting 77% of GDP in 1Q09. And it didn’t stop there. The Fed—fearing recession would turn into depression—responded to the crisis by slashing interest rates to zero and blasting trillions in debt-based money into the financial system. By 2012, for only the second time in U.S. history, public debt exceeded 100% of GDP.

(The only other time was during WWII, when the ratio hit 112.7 in 1945, because a lot of debt—including War Bonds, now only dimly remembered—was needed to win the most massive conflict in world history. Post-war, we began paying down the debt, and by 1974, debt/GDP was down to a very healthy 23%.)

Debt/GDP hit a Covid-fueled peak of 133% in 2020, declined to 117% in 1Q23, but has been on the rise again. It’s around 122% today.

The Implications of High Debt-to-GDP Ratios

History warns us that this uptrend cannot continue indefinitely, despite what MMT zealots would like us to believe. As noted earlier, 77% is the breakpoint above which the effect on growth is negative. But where does the system completely implode?

No one knows. However, a study released by investment management firm Hirschmann Capital in 2022 provides a less-than-encouraging prediction. Their research found that, since 1800, in 51 out of 52 countries where the debt-to-GDP ratio was greater than 130%, the result was either an outright default, a severe devaluation of the currency, or a de facto default in the form of chronic, ruinous inflation. Pick your poison.

The Uncertain Future of U.S. Debt

So, are we doomed?

The optimistic view is that we aren’t, yet. That’s because of the one exception in the Hirschmann Capital study. Modern Japan has had a sky-high debt-to-GDP ratio for decades (currently around 260%). Recent currency weakness in the Japanese yen suggests that their government’s ability to keep all the balls in the air may be coming to an end. But how they managed it for so long has led to much conjecture by economists, and no real agreement.

Thus we don’t know whether an ongoing debt/GDP ratio of 130+% will be disastrous for us. Or … might it be possible to formulate a strategy that mitigates the effects of this imbalance, based on some variation of how the Japanese did it?

We seem destined to find out. Because, assuming no change in Washington’s fiscal behavior (always a good bet), analysts at Statista.com project that our debt/GDP ratio will hit 130% again in 2025 and grow from there to 137.5% in 2028. Beyond dangerous.

Conclusion and Preview of Part 4

I’ll have a closer look at the possibility of a U.S. currency collapse in Part 4 of this series. It can no longer be dismissed as just idle speculation.

By Doug Hornig

Contributing Author, ITM Trading

www.itmtrading.com

P.S. Worried about the impact of inflation and unstable monetary policies on your financial security? Don’t wait until it’s too late! For over 28 years, we’ve guided thousands in safeguarding their wealth and securing their retirement against potential currency collapses. Schedule your free consultation today to explore protective strategies tailored for you. Call 866-953-7929 or click here to schedule your consultation now.