The Hidden Threat of Derivatives, What the FDIC is NOT Telling You by Lynette Zang

When derivative bets on mortgages failed in 2007 and 2008, we all learned who was “Too Big to Fail†as Banks were bailed out on the backs of the taxpaying public. No one disputes the central bank led synchronized reflation market rally, designed as a cover up to a dying financial system and finalize/legalize the ultimate wealth transfer that will take place.

We’re told that the banks and financial system is so much safer and more resilient and that the problems that created “The Great Recession†have been fixed. Is that true? We know that the TBTF banks are now a lot bigger, but is the system really safer?

The Hidden Treat of Derivatives

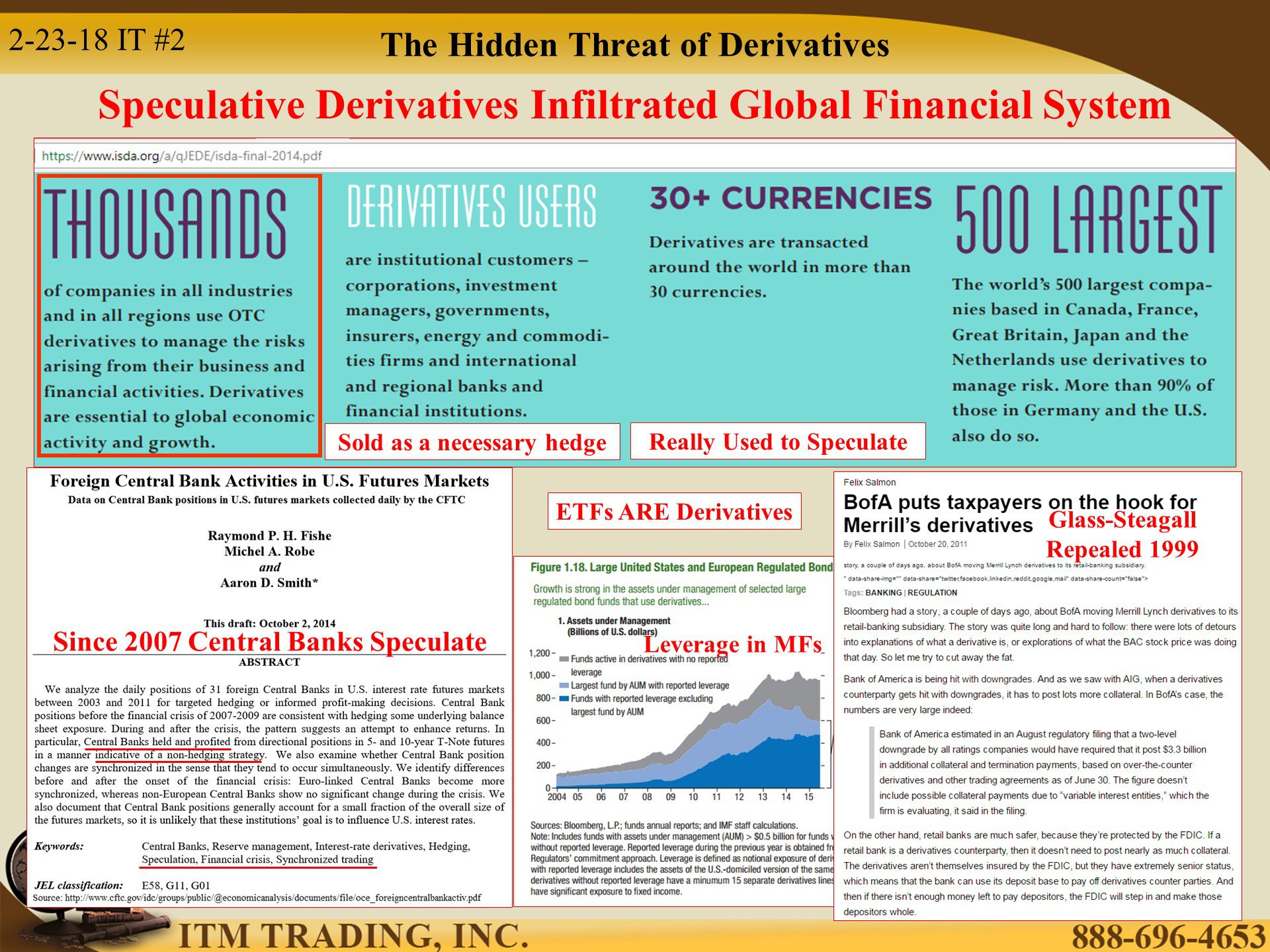

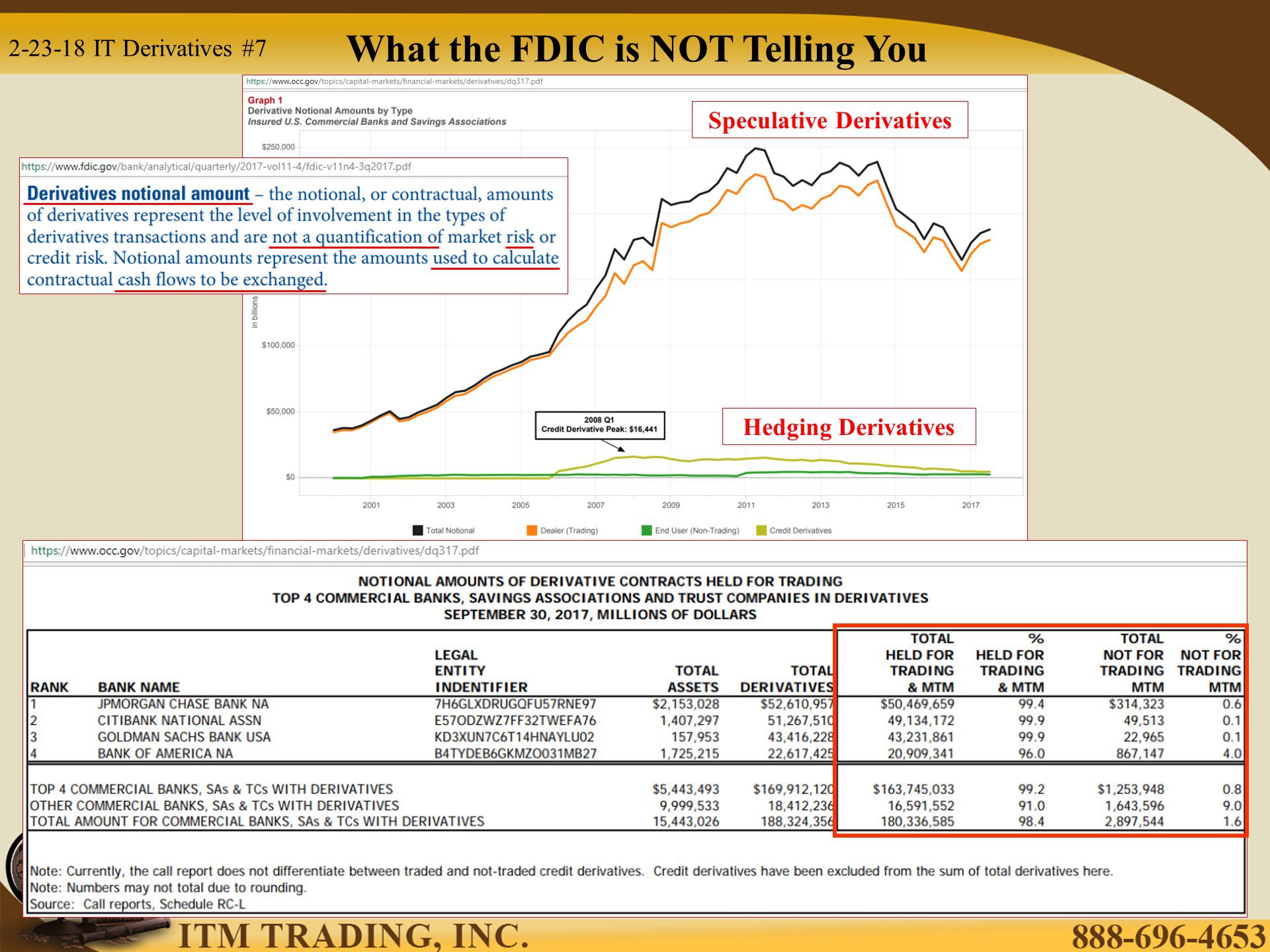

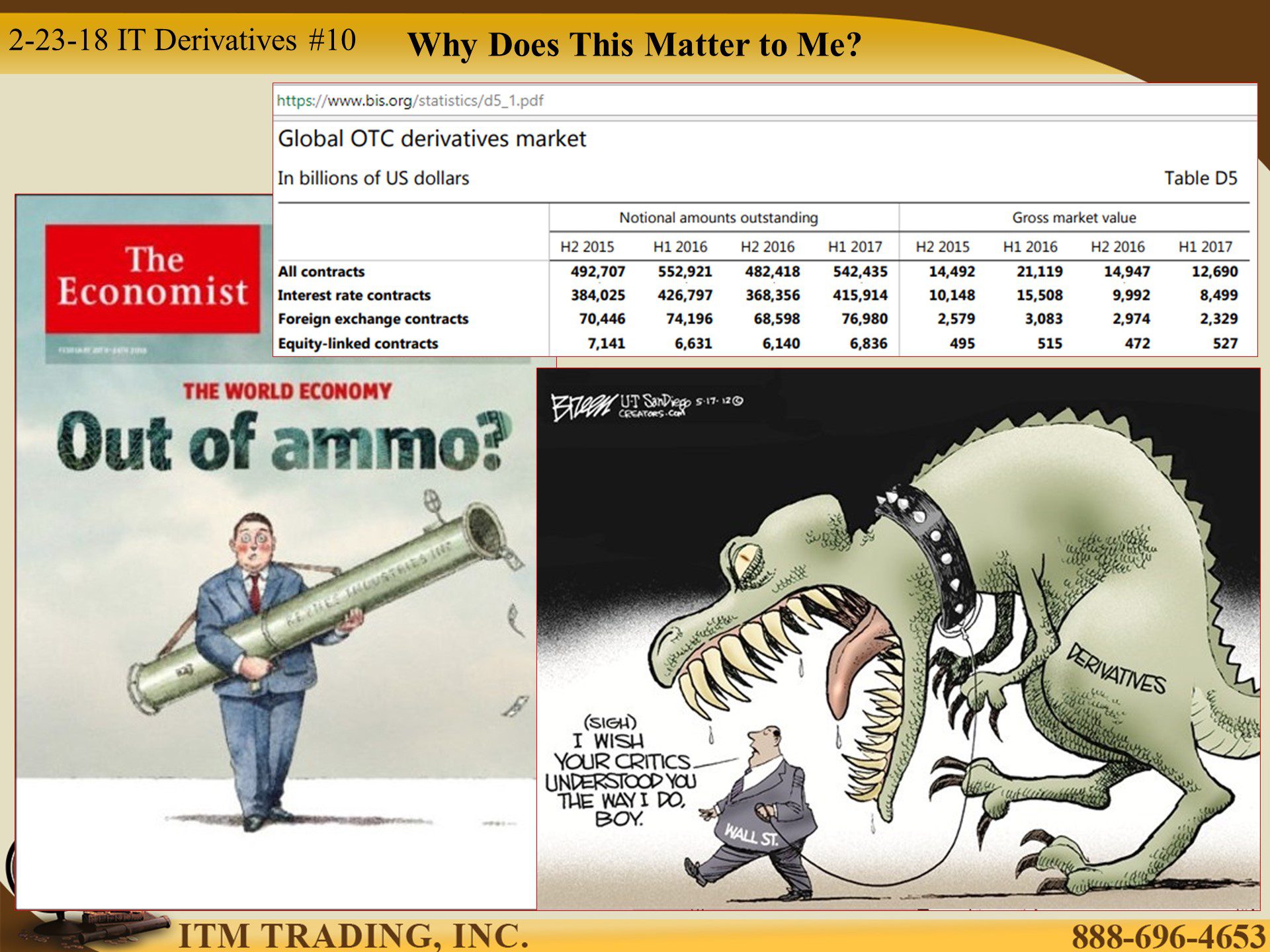

Up until “The Great Recessionâ€, speculative derivatives were primarily traded between large financial firms. Central banks used derivatives minimally as a hedge against currency fluctuation. Today, according to the ISDA (a self-regulatory body of bankers) there are thousands of derivative users; corporations, investment managers, governments, insurance companies, energy and commodity firms and financial institutions. In fact, the CFTC did a research report showing that since 2007 central banks used synchronized activities to profit!

And profit they can when all markets are manipulated.

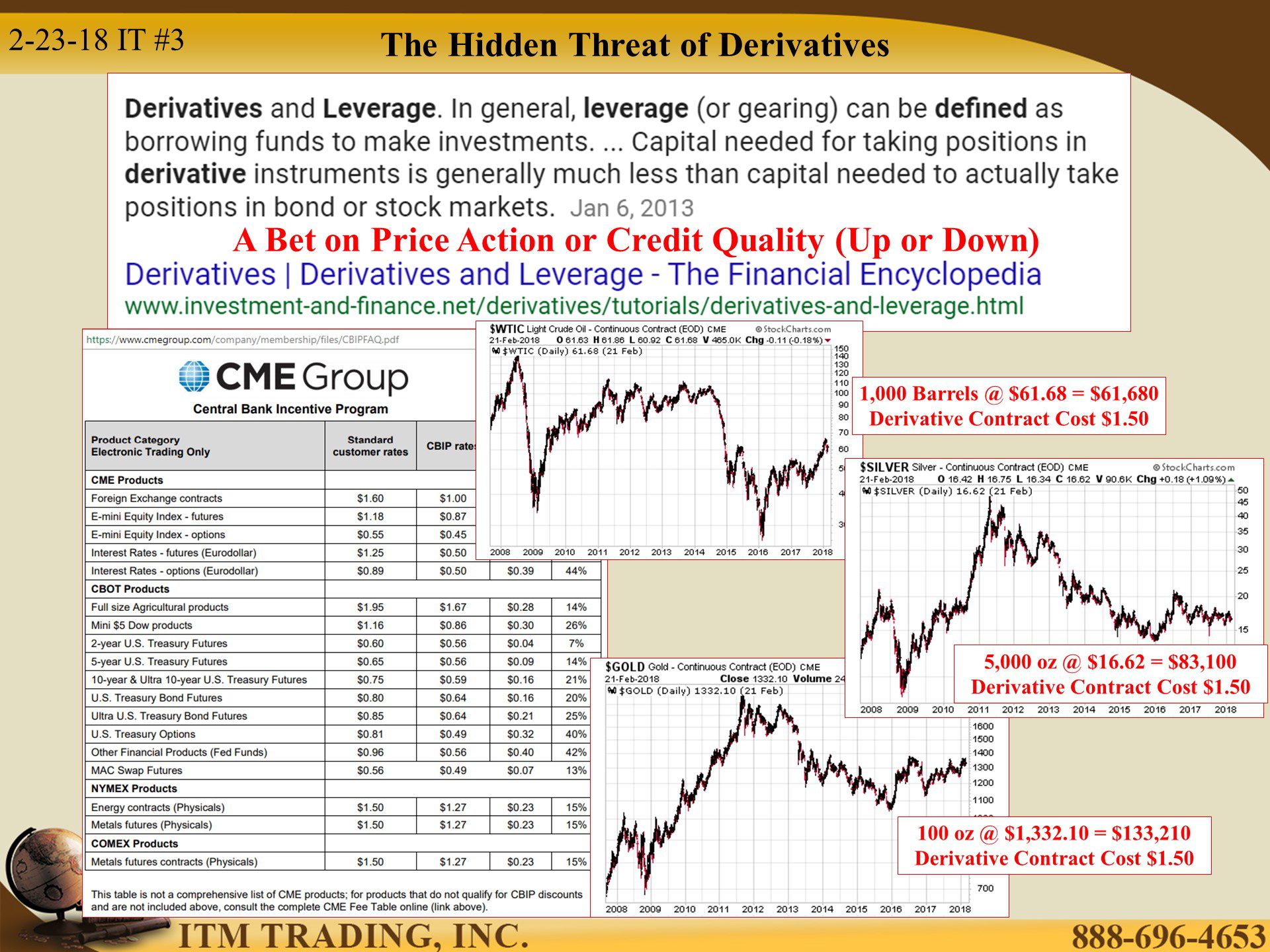

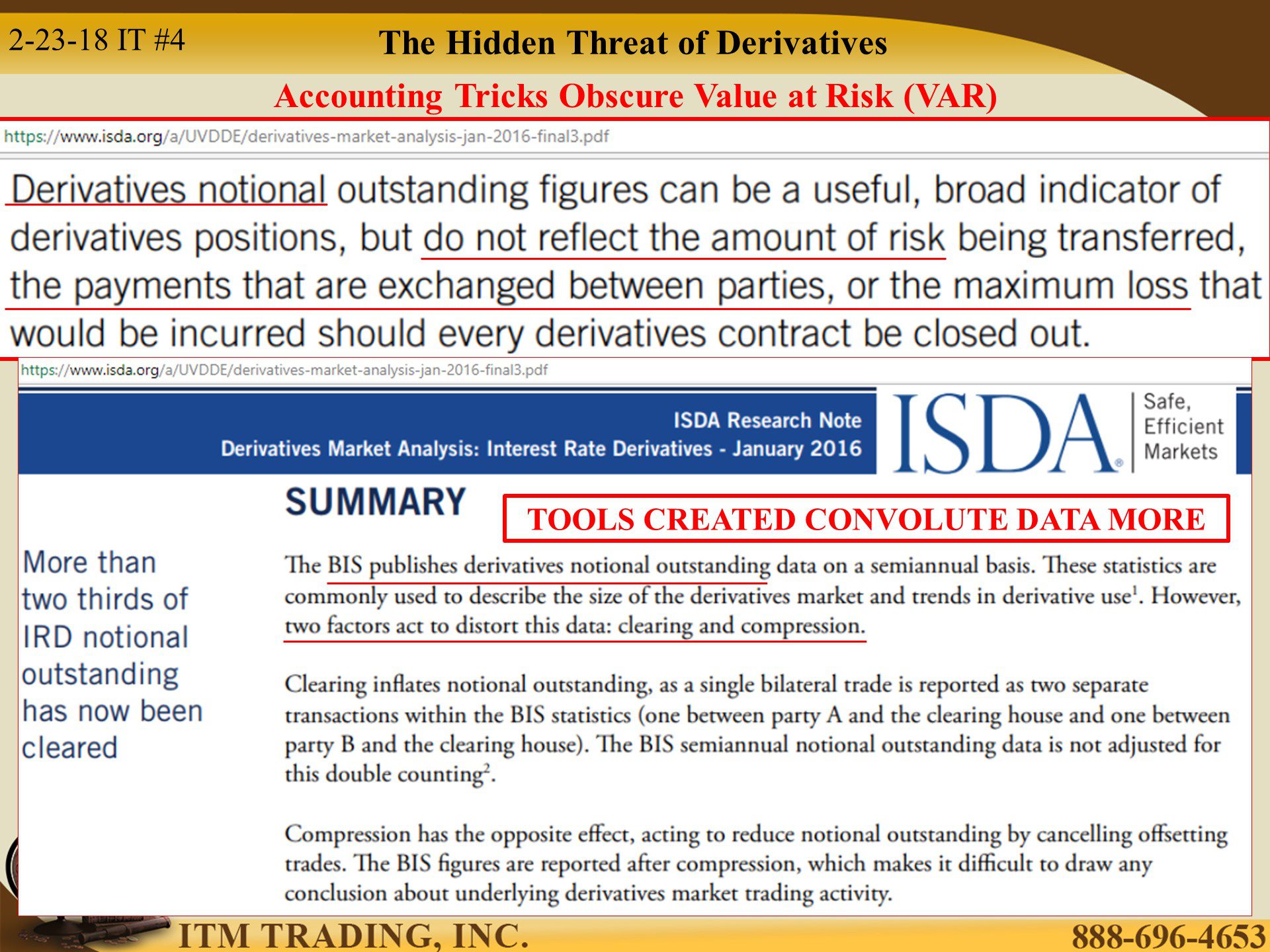

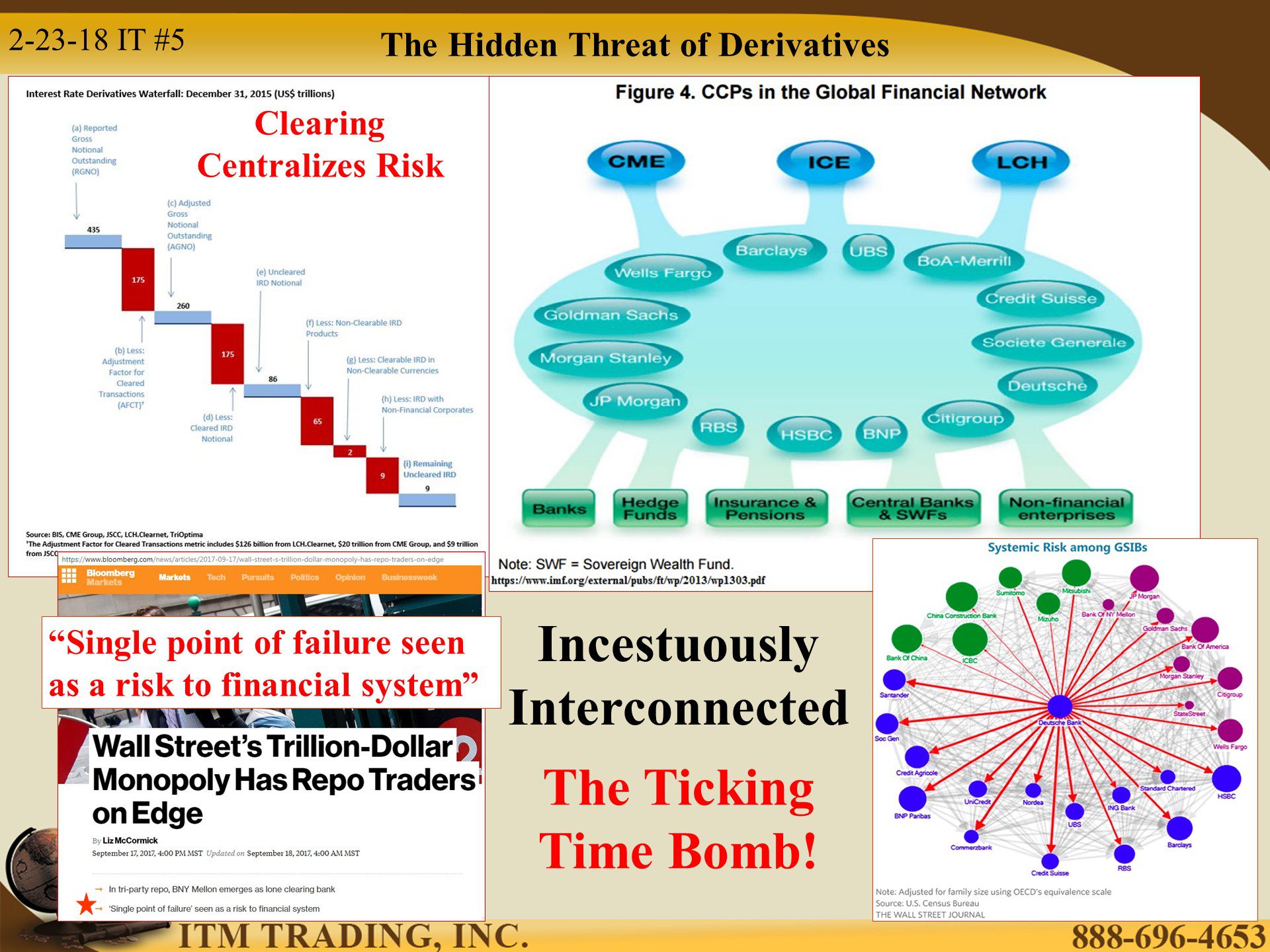

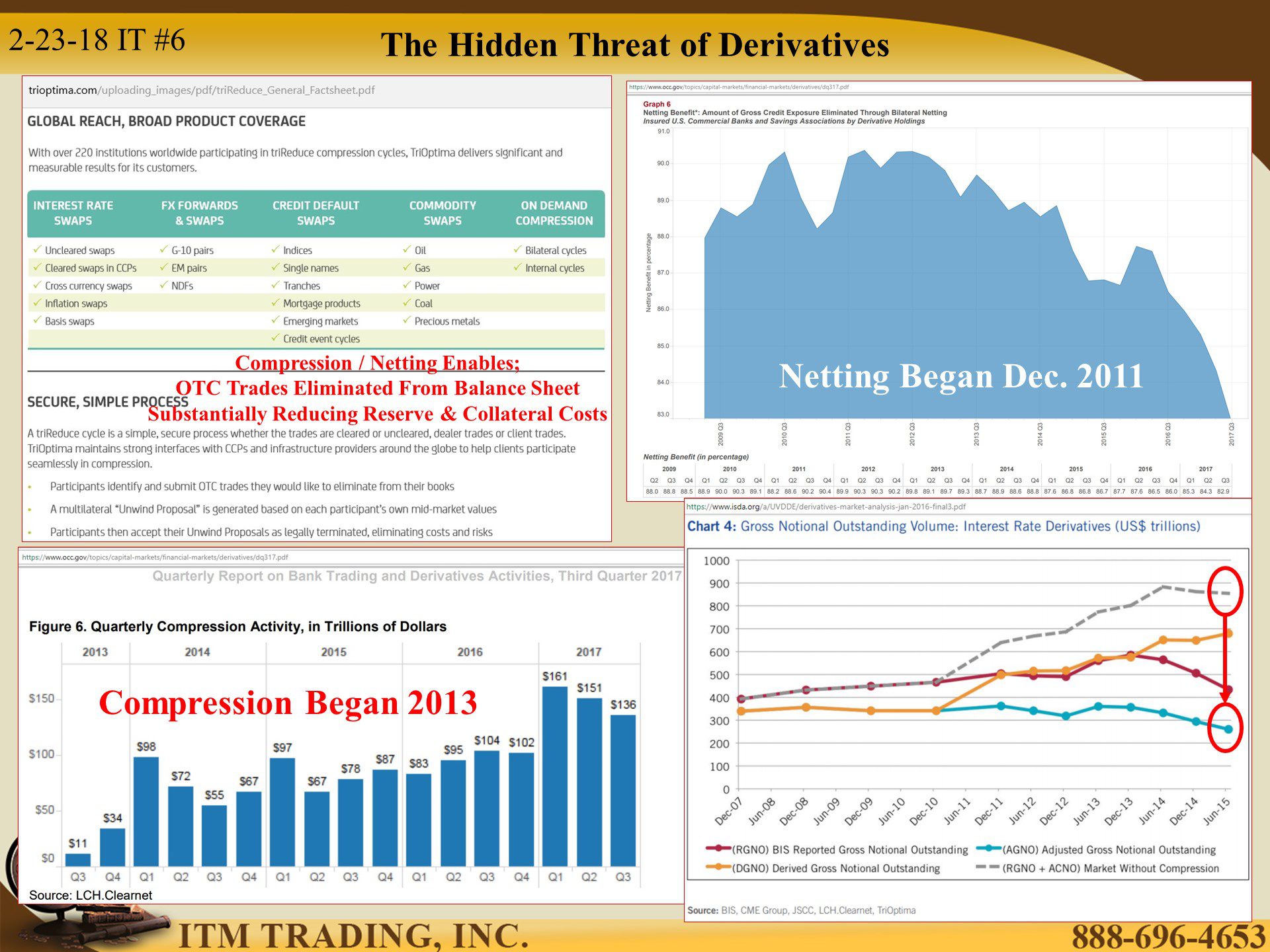

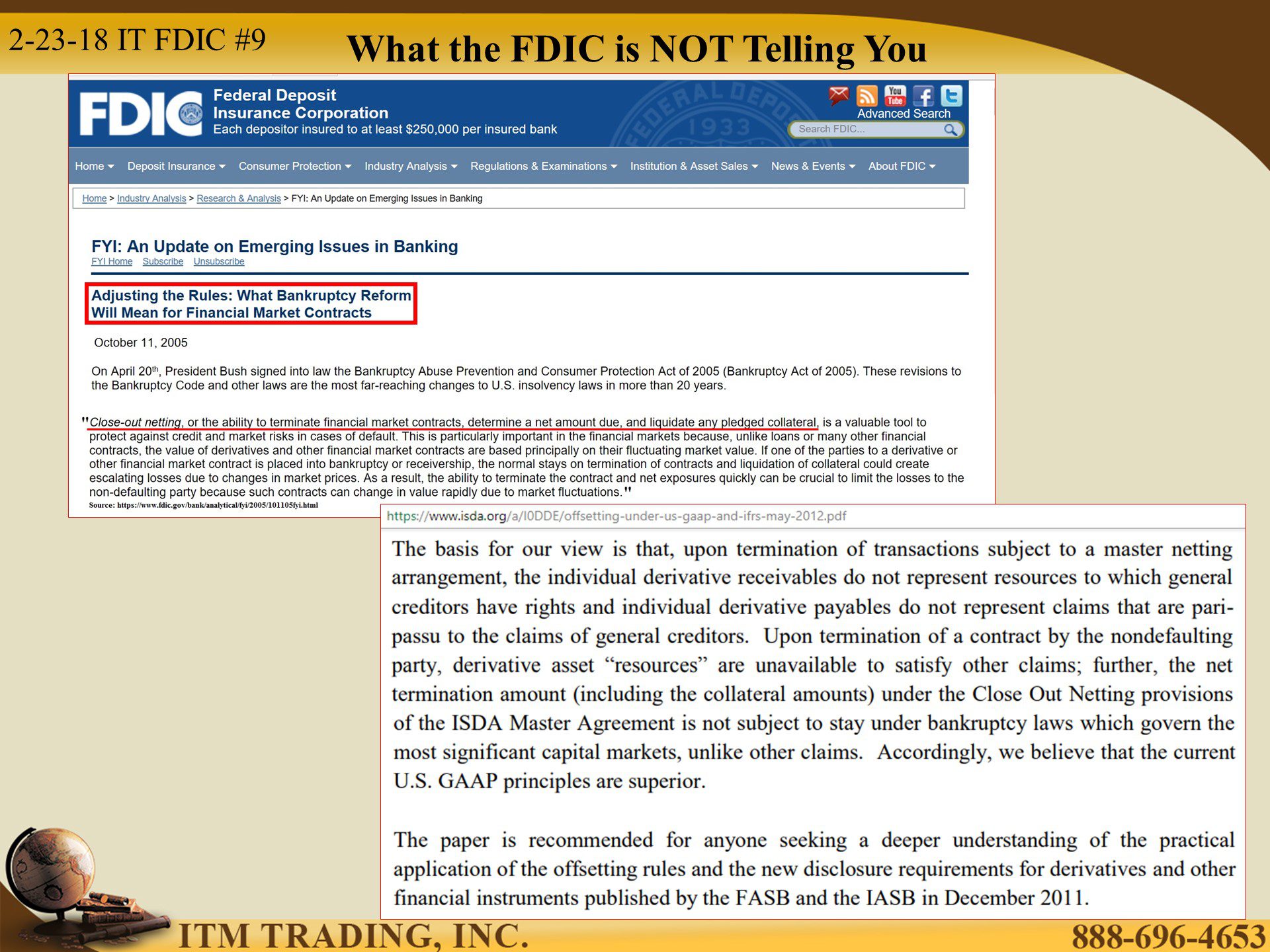

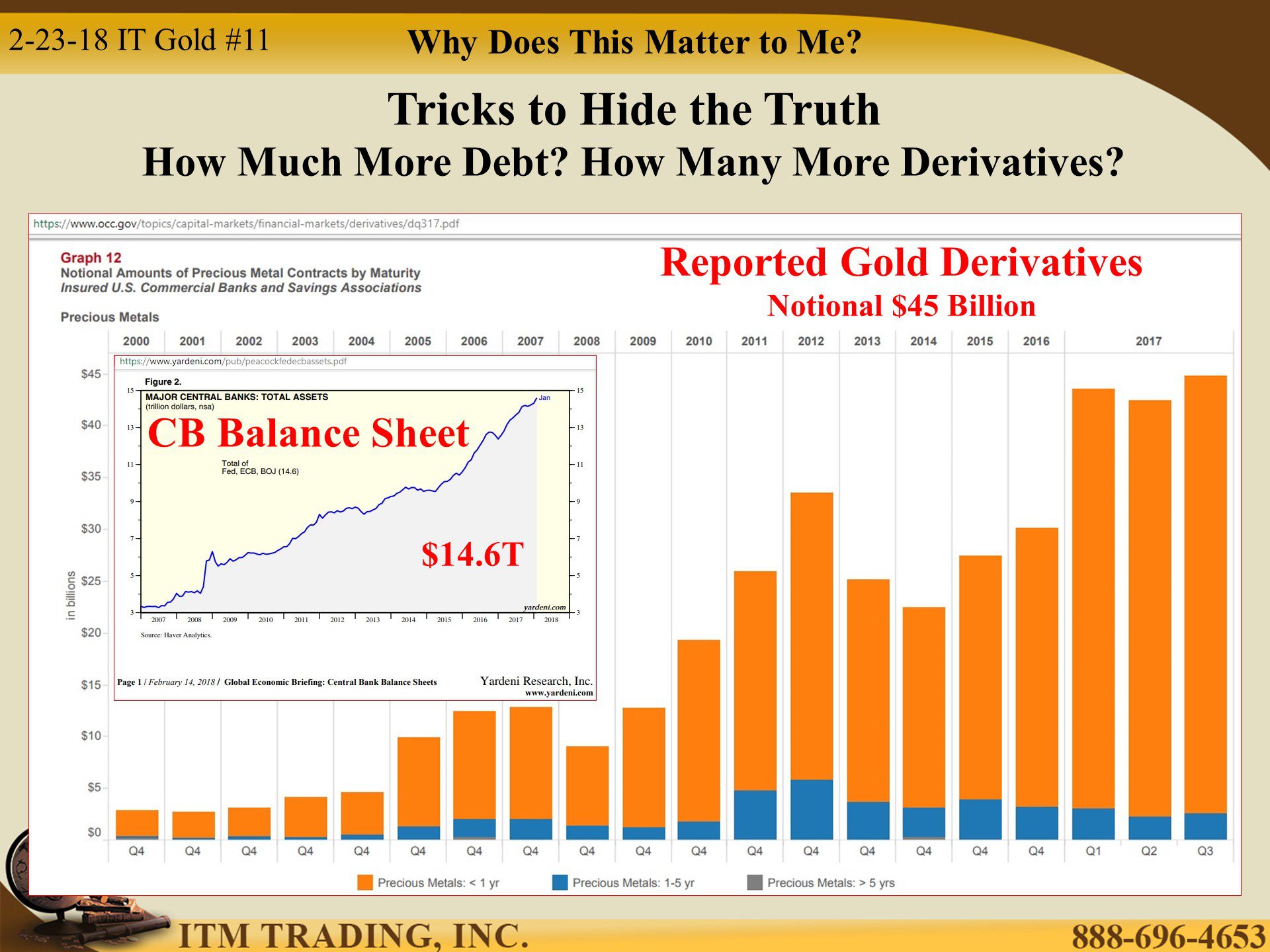

The problem is that, since derivatives are bets on price actions and other than bankruptcy cannot actually be converted into REAL assets the accounting tricks used to create this “product†hides the real risk, as was evident in 2008. And since then, rather than change behavior, they simply changed the laws (derivatives have super seniority in bankruptcy), accounting rules (clearing, netting and compression) and injected derivatives into many fiat financial products. Admittedly, NO ONE knows how much is really at risk but everyone agrees, it is much more than the global GDP (all the money that flows through the global system).

What the FDIC in NOT Telling You

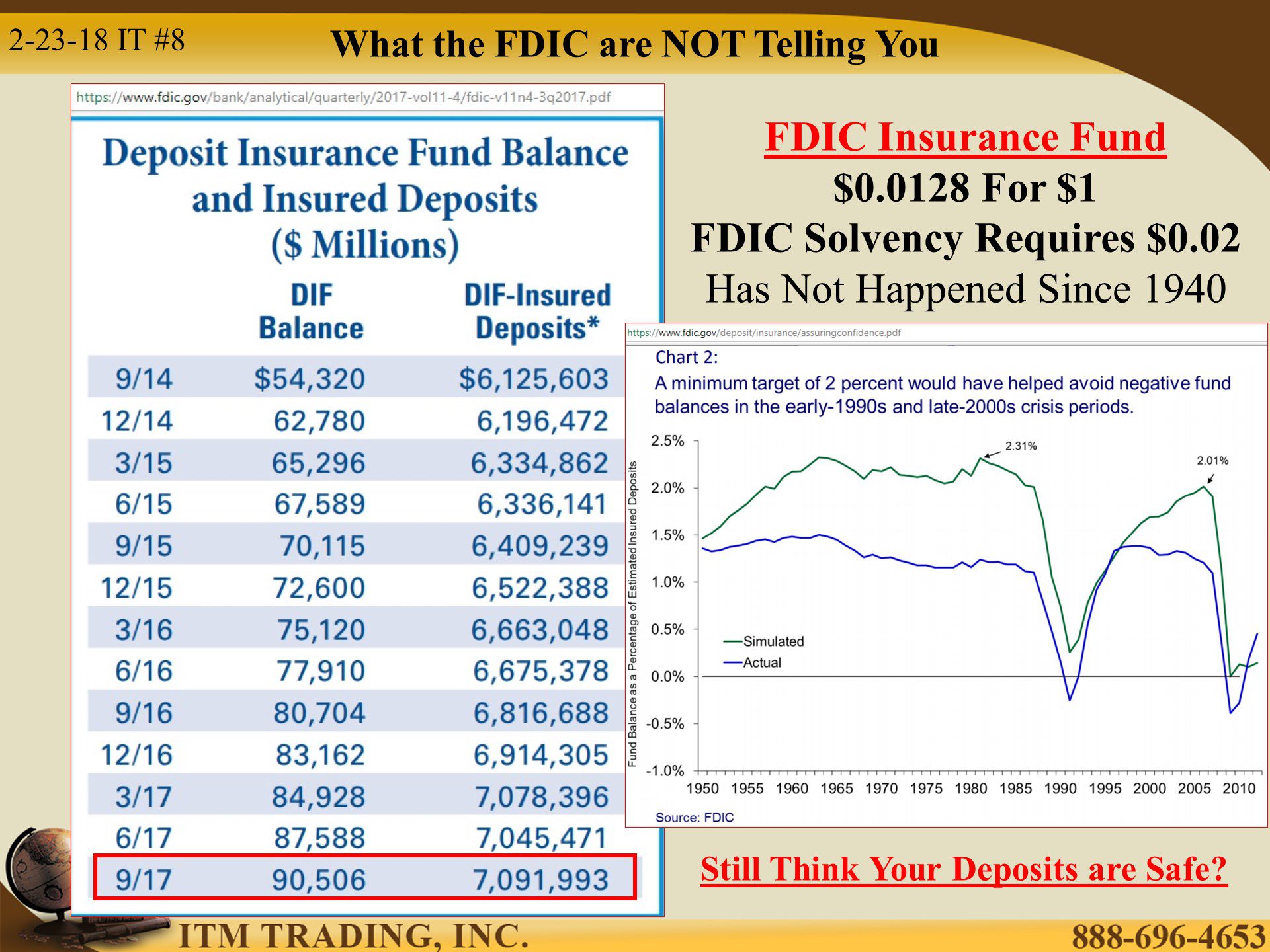

The FDIC deposit insurance scheme was put in place during the “Great Depression†to inspire public confidence in the banking system. In the most current DIF (Deposit Insurance Fund) balance shows they have barely over 1 penny for every dollar of insured deposits. That’s OK as long as there are no bank runs, but during the 2008 crisis, they ran out of money. They stated that had one more bank failed, even a small one, that the public would have become aware that the FDIC was insolvent.

Remember the bail-in laws? As first tested in Cyprus, bail-in is the new global blueprint. Bank stress tests show both Deutsche Bank and Morgan Stanley are insolvent if their assets fall below 3.9% (your deposits are their assets) Do you really feel safe in the banking system?

Why Does This Matter to Me?

Because the global reflation trade created by the central banker’s old tools (interest rates and debt) appear to be used up and the size of the derivative market has exploded making the entire global financial system one big casino with bankers making these bets, which are secured by YOUR wealth. When it gets too expensive to keep things floating, credit will dry up. That’s what happened with the derivative market in 2008.

So I ask you, do you feel lucky? I do, because I have physical gold and silver in my possession and that’s a sure bet.

Slides and Links:

https://www.isda.org/a/qJEDE/isda-final-2014.pdf

https://blogs.imf.org/2015/12/17/the-specter-of-risk-in-the-derivatives-of-bond-mutual-funds/

http://blogs.reuters.com/felix-salmon/2011/10/20/bofa-puts-taxpayers-on-the-hook-for-merrills-derivatives/

https://www.cmegroup.com/company/membership/files/CBIPFAQ.pdf

http://www.investment-and-finance.net/derivatives/tutorials/derivatives-and-leverage.html

http://stockcharts.com/h-sc/ui

https://www.fdic.gov/bank/analytical/quarterly/2017-vol11-4/fdic-v11n4-3q2017.pdf

https://www.isda.org/a/UVDDE/derivatives-market-analysis-jan-2016-final3.pdf

https://www.isda.org/a/I0DDE/offsetting-under-us-gaap-and-ifrs-may-2012.pdf

https://www.isda.org/a/UVDDE/derivatives-market-analysis-jan-2016-final3.pdf

https://www.imf.org/external/pubs/ft/wp/2013/wp1303.pdf

https://www.isda.org/a/I0DDE/offsetting-under-us-gaap-and-ifrs-may-2012.pdf

https://www.isda.org/a/UVDDE/derivatives-market-analysis-jan-2016-final3.pdf

Trioptima.com/uploading_images/pdf/triReduce_General_Factsheet.pdf

https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/dq317.pdf

https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/dq317.pdf

https://www.fdic.gov/bank/analytical/quarterly/2017-vol11-4/fdic-v11n4-3q2017.pdf

https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/dq317.pdf

https://www.fdic.gov/bank/analytical/quarterly/2017-vol11-4/fdic-v11n4-3q2017.pdf

https://www.isda.org/a/I0DDE/offsetting-under-us-gaap-and-ifrs-may-2012.pdf

https://www.fdic.gov/bank/analytical/fyi/2005/101105fyi.html

https://www.bis.org/statistics/d5_1.pdf

https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/dq317.pdf

https://www.yardeni.com/pub/peacockfedecbassets.pdf