Has Hyperinflation Begun? Is Your Strategy Ready?

They say that inflation changes or is changing the way people are thinking about money? Well, I hope it is because it’s about darn time, but it’s also changing the way they’re thinking about those in power.

TRANSCRIPT FROM VIDEO:

They say that inflation changes or is changing the way people are thinking about money? Well, I hope it is because it’s about darn time, but it’s also changing the way they’re thinking about those in power, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer, specializing in custom strategies. And quite honestly, in these very uncertain times in these very inflationary times, you need real money, physical gold, and physical silver.

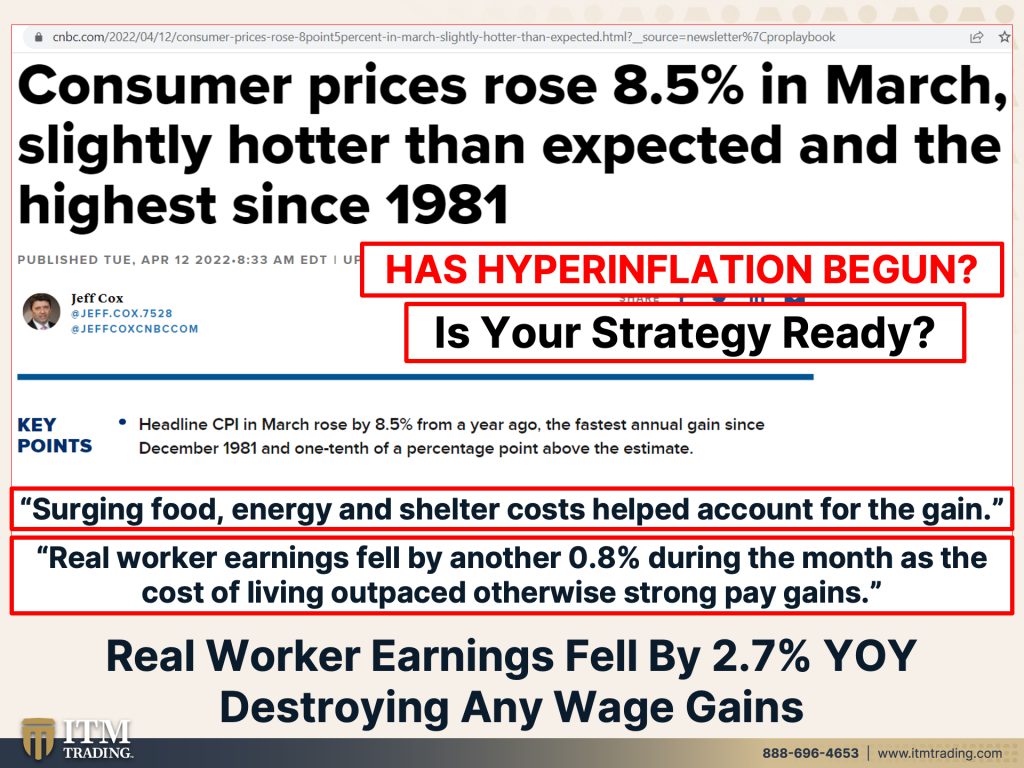

And we’re gonna talk about what’s go on today because they came out with the March inflation numbers. And I wonder, are you surprised? Because consumer prices rose 8.5% in March, the hottest since, oh, let’s see 1981. What was happening then? Oh goodness. We were transitioning into a new monetary system, shocker! I mean, surging food, energy and shelter costs help account for the gain and inflation, but it really doesn’t reflect the really high cost that most people are paying. But there are certainly surging costs in those areas. And think about it. The mantra that I’ve been talking about for years and years and years, Food, Energy, Security, Barterability, Wealth Preservation, Community, and Shelter, and surging, Food, Energy and Shelter cost help for the gain. Shocker! Who knew? Well, how about anybody? And there are not many of us, that have actually studied currency life cycles because we see these same repeatable patterns over and over? Can you see these patterns now? I really hope so. Not let me know. And I’ll try and figure out another way to show you because real worker earnings fell by another 0.8% during the month, as the cost of living outpaced, otherwise strong pay gains, shocker! because when they first created this system way back in the early 19 hundreds, the government wanted to be able to tax you without you realizing it without having to go through legislation. There’s the inflation tax. If they can keep it at 2%, you are still losing that purchasing power, but you don’t know it. You don’t complain. Well, it’s kind of high. Now people are noticing and they’re complaining. And number two, Corporations wanted to be able to pay you less and less and less, but they knew that if you were getting 10 bucks an hour, you were not going to agree to five, but if they could make that 10 bucks spend like five, then you’re working for five. You don’t realize it. So the average wage, 1971 $9500 bucks, average wage today, something like $58,000, let’s say $60,000, let’s say a hundred thousand. Although it isn’t that high, but it takes two wage earners. And you got stimulus if you made under $150. It’s because there’s virtually no value left inside of this Fiat money experiment. We are at the end, it is dying. There is no doubt about it because in reality, even though they like to put it that way, this with 0.8%, doesn’t doesn’t look so bad, but real workers earnings. This is with all the pay raises actually fell by 2.7% year over year. And frankly, probably more than that too, to be honest. I mean, if you really look at what people buy. So what good were the wage gains? Well, thank God they had them because then it would be a whole lot less. Huh? So I’m thinking, and I’ve been saying this as you know, for a while that I think the hyperinflation has definitely begun. I don’t think they’re gonna be able to put this genie back in the bottle. I love how they always say “but on the second half of the year, inflation, it’s gonna go back down toward our 2% level” but they never say how that’s gonna happen. The supply chain is all of the issues are not fixed. And the biggest issue is now dealing with all of the new money that they pumped into the system when it died, or I should say, since it died in 2008.

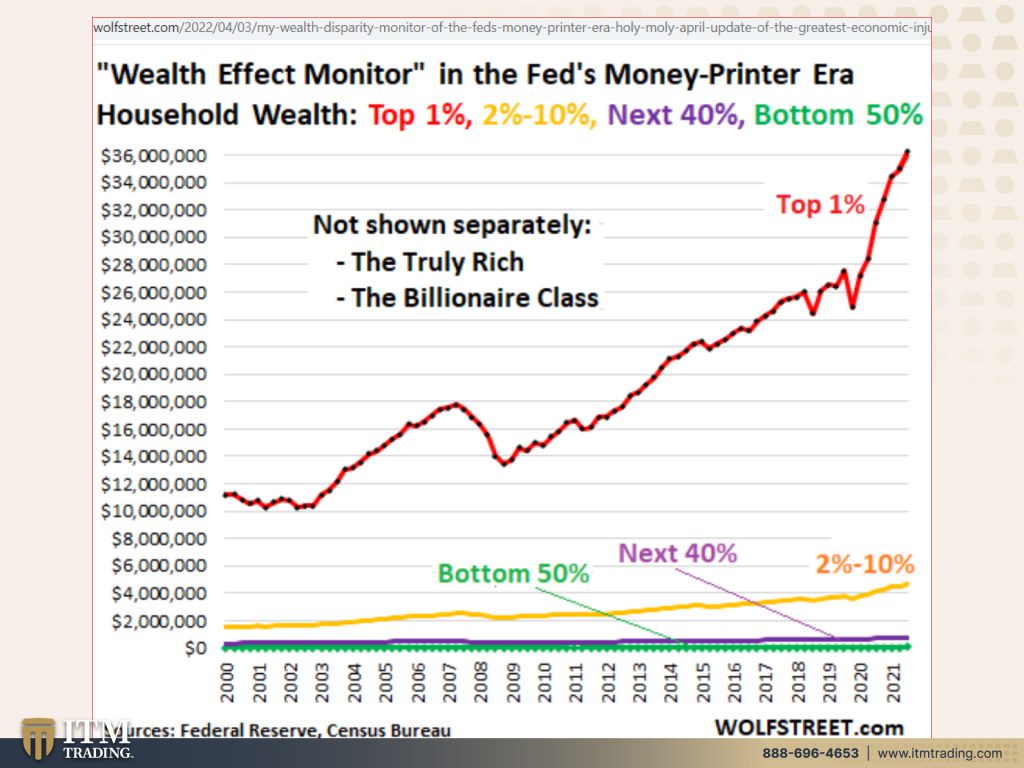

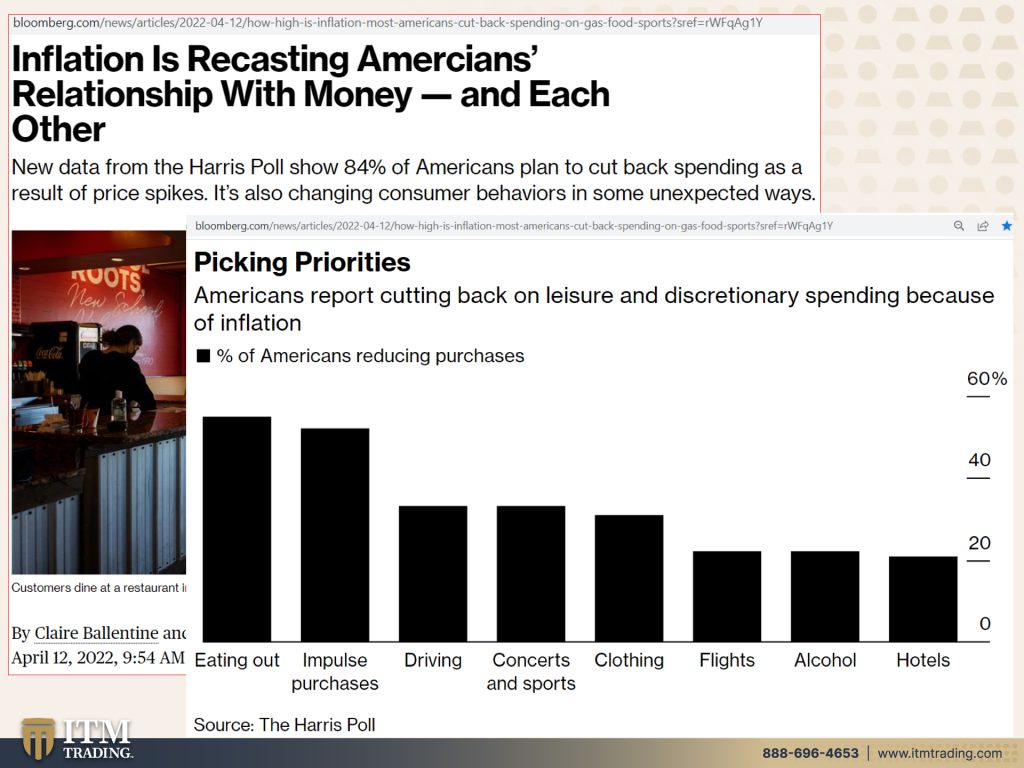

Because what that did was, what the whole Fiat money system, the government based money system does, is it enables income and wealth inequality. As you can see here. Now this goes back to 2000 and this is the top one percenters, right? Here’s 2008 right here. Zoom, zoom, zoom. So you think the inflation bothers these guys at the top? Not really. So what they have to pay a little bit more for their Food, their Energy, their travel, whatever. They’ve made so many gains in their wealth and in their income. But do you think that’s gonna matter to people down here at the bottom, especially the bottom 90%? Yeah. That’s gonna matter. They’re now having to make choices between putting food on the table or a tank of gas in their car. And what they’re saying that it’s doing is re-casting Americans’ relationship with money and with each other because they are going and it new data. I mean, certainly it’s impossible to be logical. And to say, if everything costs more and you don’t have at least that level of income, then your spending has to go down. Now you can take on debt to accommodate it, which is really what has happened actually since the seventies. However, at some point there is no choice and you have to make really hard choices because you need necessities.

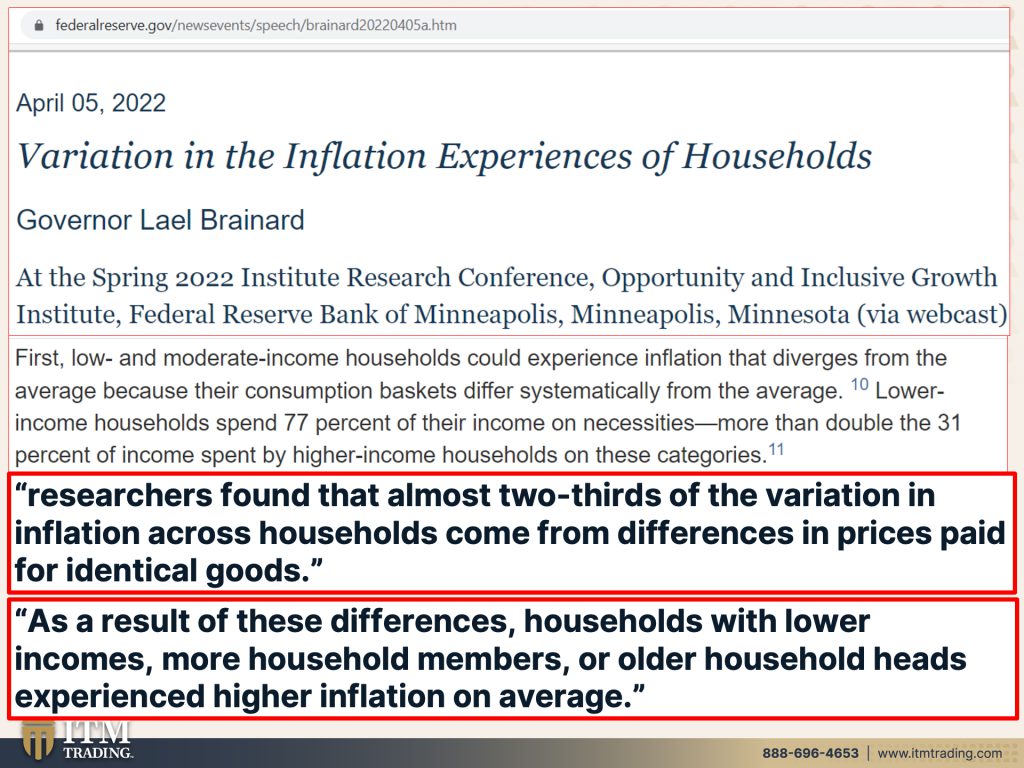

So what are these choices? Okay. 84% of Americans, 84% of Americans plan to cut back spending as a result of price spikes. It’s also changing consumer behaviors in some unexpected ways. I’m gonna tell you there’s gonna be lots of unexpected ways. And we will talk about gold backs, the end of this. Okay? So you’ve gotta pick your priorities eating out. So this is what they won’t be doing. Reducing purchases, going out, impulse, driving concerts, sports, clothing, flights, alcohol, hotels, and many other things, cause they simply won’t have the, but they need studies because these guys are their ivory towers. I mean, they don’t know what it’s like to live in the real world. So they’ve gotta do their studies. and Fed governor Lael Brainard. I mean, she just did this whole great talk on variation in the I and experiences of households. Well, why wouldn’t they work? You know, inflation work for everybody? Well, I just showed you why, but first, low and moderate income households could experience, could experience inflation that diverges from the average because their consumption baskets differ systematically from the average lower income households spend 77% of their income on necessities, 77%, maybe even higher than that. Maybe even higher than that. Gotta have a roof over your head. You gotta have food in your stomach more than double the 31% of income spent by higher income households in these same categories. But of course with it’s in the category, can vastly be different too. Researchers found that almost two thirds of the variation in inflation across households comes from differences in prices paid for identical goods. Well, wait, if there are identical goods, why would the prices be different? Well, first of all, it, you know, if you can buy, like when I go in and if you watched my, if you watched the video that I just put out on Beyond Gold and Silver on how to make hemp milk. Well, what you saw was a big five pound sack of hemp seeds, which are, you know, pretty expensive, but I can afford to buy five pound sack. If you’re, if you don’t have as much income as me, well, you’re gonna buy a smaller package and I buy the five pound sack. Number one, cause I go through it fast. But number two, because then per ounce, it’s a lot cheaper to buy five pounds versus just 16 ounces, one pound. So that happens a lot. Plus when there’s a sale I can afford to stock up. But if you are on a fixed, if you have a fixed amount of money to put on food, to pay for food, you can’t do that. I mean gazillion years ago, a gazillion years ago. Thank goodness. When I was first going through my divorce and my babies were little, you know, I’d have $20 to go to the grocery store with. And I had to make that $20 last, as long as I possibly could. Fortunately, my children never experienced that hunger cause I always made sure that they had food to eat. I was an adult that that was a different story. And that’s another story for another day.

But if you haven’t experienced having to make those hard choices, you have no flipping clue. And I would say these central bankers and these government elites have no flipping clue, even if they grew up in that arena, they’ve been so far removed for so long. But as a result of these differences households with lower incomes, more household members or older household heads experienced higher inflation on average. Plus, when they’re looking at a category, you can have vastly different things in the same category, which goes into the inflation numbers. So the example that Lael Brainard used in this, in this speech of hers was that a can of tuna fish and a can of caviar are in exactly the same category, but apparently tuna fish inflates more. It’s used more so bigger demand than caviar. I don’t know. She didn’t quite say that, but she used the example in the same category between tuna fish and caviar. Yeah. When was the last time you bought caviar? Been a really long time. Did I ever buy caviar? I don’t think I ever have. And I’m kind of fancy. I don’t think I’ve ever bought caviar. I mean you, Edgar’s laughing, but you guys know it. I’m a little fancy it’s okay. It’s my nature.

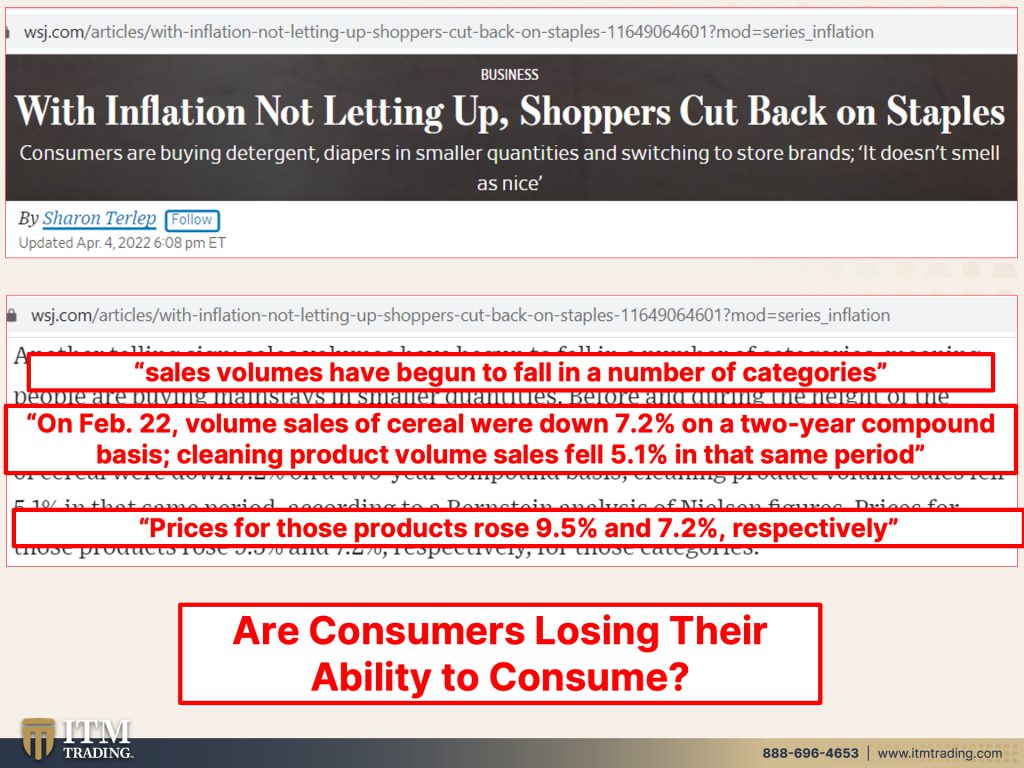

Okay. So with inflation, not letting up, shoppers cut back on staples. Another telling sign sales volumes have begun to fall in a number of categories that you would not necessarily expect. So on February 22nd volume sales of cereal were down 7.2%. So that’s how much cereal you’re buying. On a two year compound basis. Cleaning product volumes fell 5.11% in that same period while the prices for those products rose 9.5% and 7.2% respectively. So people are having to even cut back and we’ve seen what happens in Venezuela and these other places that are, are experiencing hyperinflation with not just the food in security, but you know, if you used to buy steak, now you’re buying hamburger. The hamburger gets too expensive. You’re buying hot dogs. The hot dogs get too expensive. You’re not eating meat at all. And that’s what we’ve witnessed time and time again, this is why, this is why the mantra and you know why I have an Urban Farm here. And I’m so happy to say that our experiment with crawfish actually worked. We thought it was a failure, but it wasn’t. We actually have. So I have crawfish. I have tilapia have chicken eggs. I have even chickens. I don’t use my laying hens for that, but we have meat, chickens. We have quails, we have ducks, we have duck eggs. So you see all of this animal protein. And really frankly, most of that is self-sustaining. So it’s just gonna keep providing and providing and providing. You gotta think about it. Food is the biggest issue for most people during these transitions, but in a consumer driven economy, the consumers are losing their ability to consume.

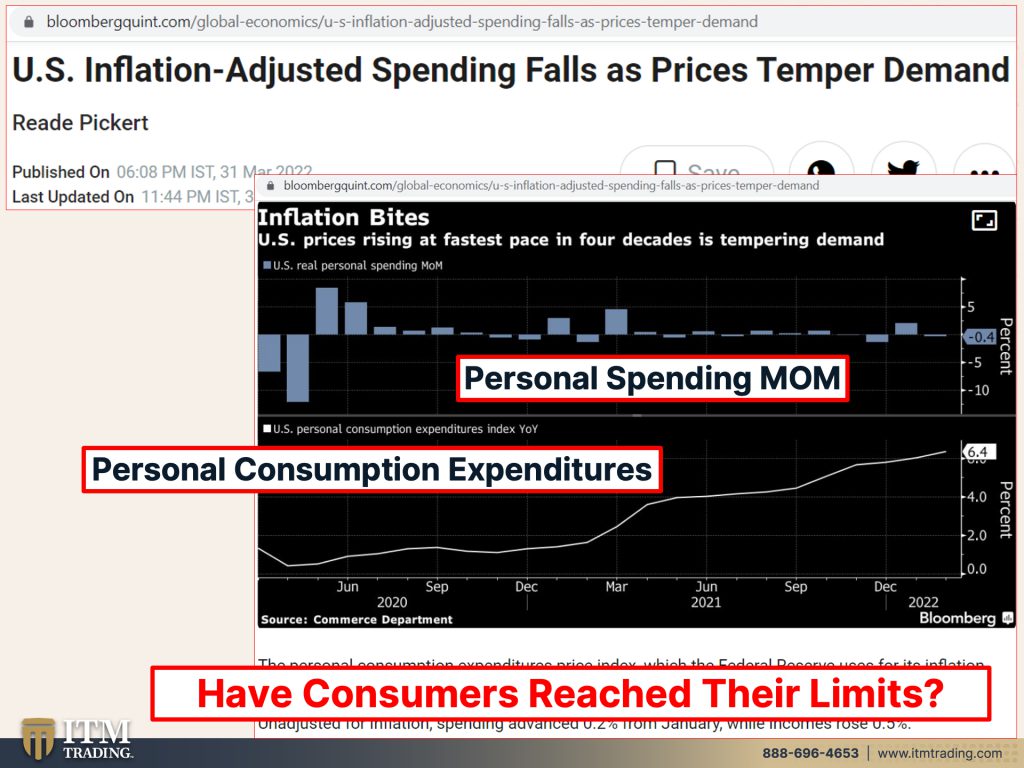

Now we heard and we’ve seen, I didn’t put it in this one, but we’ve seen that corporations have been making a massive, massive amount of profits taking advantage. So all of that stimulus money that was given to the masses who did it really go back to? The corporations, right? Because if you have lots of money, you’re not as sensitive to price increases. So corporations were able to raise their price increases more than the added costs. But now what you’re hearing is, oh, what we’re seeing happen with the fall in consumers spending? Well, it’s not the dollar amount. It’s the quantity amount, cause they’re actually balking at these higher prices. They can’t afford them. So this is gonna hurt corporate profits. I’m so sorry for those corporations…not! I mean let’s face it. Whoever is closest to the central banks, which is a private corporation and guess who’s closest private corporations. They always benefit. That’s why you gotta your own bank. You’ve gotta make sure that you could protect your purchasing power because there’s nobody else that’s gonna do it. I mean, it’s just a fact. So up here is personal spending month over month and you can see this was June, May and June of 2020. So this is a full, this is not really quite a full year. So April, May you know it was down. And then those stimulus checks really kicked in. But only for like a minute. I mean I think this is a super interesting chart. Even when they managed to get it up a little bit, it still fell all back. So that’s personal spending, but the expenditures because of inflation, they’re, they’re really spending the same thing, but the prices are going up, up, up, up, up, up, up, yeah, it’s gonna temper demand. If you have a limited amount of money, you’re gonna have to make choices. You’re not gonna be able to do everything that you wanna do. Last time that I reported on this, we were talking about people at Macy’s having a problem. Macy’s is driving a problem because they tried to raise the price on some mattresses and some other stuff. And their consumer said, no, we’re not gonna pay that. And they were forced to lower the prices back down. Something’s gotta give, they can’t make record profits if they can’t keep raising the prices, but the corporations have a lot more money than you and I, they have access to a lot more money than you or I, and it really looks like the consumers have reached their limits.

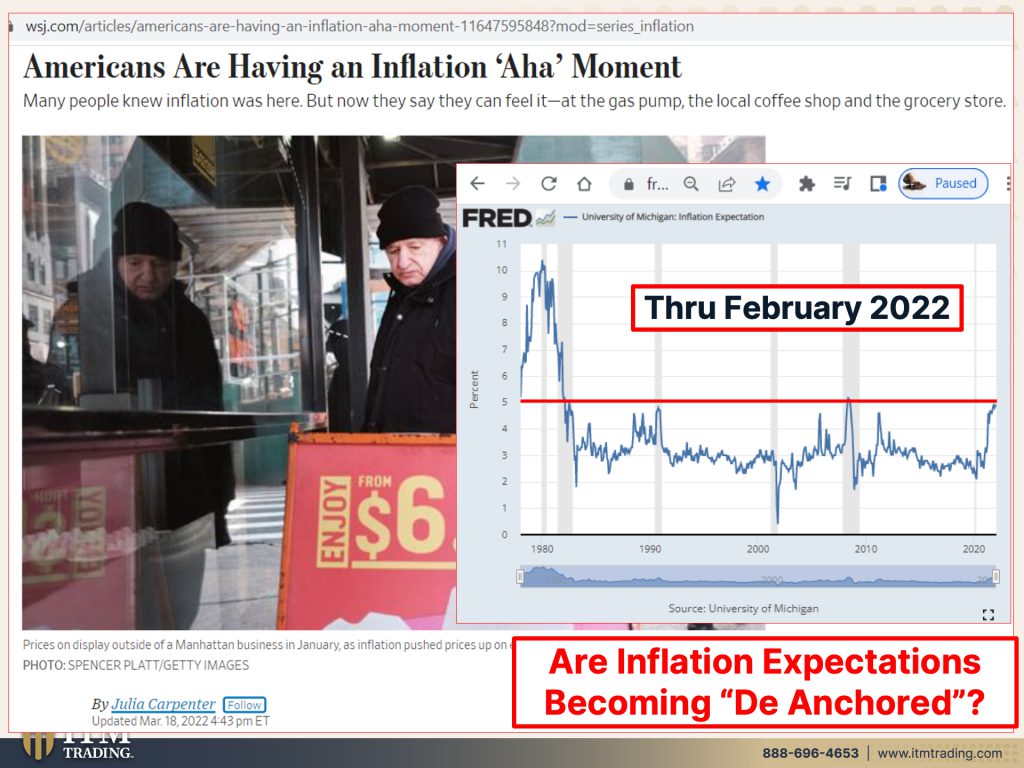

It also looks like, and I’ll tell you the truth. I’m thankful for this because I think that this high inflation is starting to wake more people up. Americans are having an inflation ‘aha’ moment because as long as it’s held around 2%, they’re getting what they want. But you’re the frog in that pot of water that slowly increases, increases, increases until you are boiling. We are not yet at that boiling point. That’s the hyperinflation, but we are definitely at the point where it’s starting to bubble up now. It’s starting to become more noticeable. Those are not jacuzzi, bubbles people. Those are cooking bubbles. You need to have this (gold and silver) so that no matter what you have the ability to purchase, you need it along with Food, Water, Energy, Security, Barterability, Wealth Preservation, Community, and Shelter. Get it done, get it done, get it done! Now, this is actually kind of interesting because this is the university of Michigan inflation expectations, right? What’s real. I believe it was Henry Kissinger and I’m gonna paraphrase. I know I’m not gonna remember the quote exactly, but he said “it is not what is true that matters. It is what is perceived to be true that matters.” And our government spends, and central bankers too, spend an awful lot of time on perception management and they’ve gotta track it because this is a con game. And so it’s that confidence piece. Now this only goes through February of 2022. So not through March, but even at February, we were at the peak of the inflation expectation when this whole big QE money printing. I don’t have to do that. cause I got this with a new battery, but oops. But when this whole big money printing experiment started and people say, oh inflation, well, where’d the inflation go? Hmm. How about the stock market? How about the bond market? How about the real estate market? And now they have to unwind that. Well, they don’t have to unwind that, but they’re gonna try to unwind that. And they’re only gonna go so far until it gets until the stock markets and the bond markets and the real estate markets get really bad. And then they’re gonna try and undo it. But once this genie is out of the bottle, there, ain’t no putting it back in. So I, I think they, I think they’re already done because what I’m seeing is that inflation expectations are becoming de-anchored. Now, if you think, “ah, this is just temporary, it’s just a little bit” then you’re not gonna change your spending patterns. But if you think that inflation’s gonna go up more, you are going to change your expectations and they, meaning central banks, meaning the government will have lost control of you. And there are way more of you and me, us, than there are of this little handful of the elites. And that’s what they’re scared of because your confidence in them is what keeps them in control. That’s what keeps you in this funny money because the dollar could never go away. What are you talking about? They keep the name the same. They make the transition. So that it’s as much, it’s as close to what you’re used to as possible. I, you know, I was like, what 17 years old in 1971. And I could tell you $20 bill in my pocket in July, $20 bill in my pocket in September, I had no idea that anything had really changed when in reality, everything had changed. Now back in 1971, you could only hold gold in this form period. The it’s it, this was the only form you could hold it in legally. You could have five ounces up to five ounces in any other, you know, any other form, but it needed to be collectibles in order for you to utilize it. Thank you Uncle Al. I thank him all the time for this lesson. It was absolutely brilliant. Today. You can own, at least at this moment, you can own as much of this as you want. And I’d get it started sooner than later because you couldn’t protect yourself. Then now you can. What are you going to do about it? Choice is yours. I’m just about trying to help you make, make these educated choices.

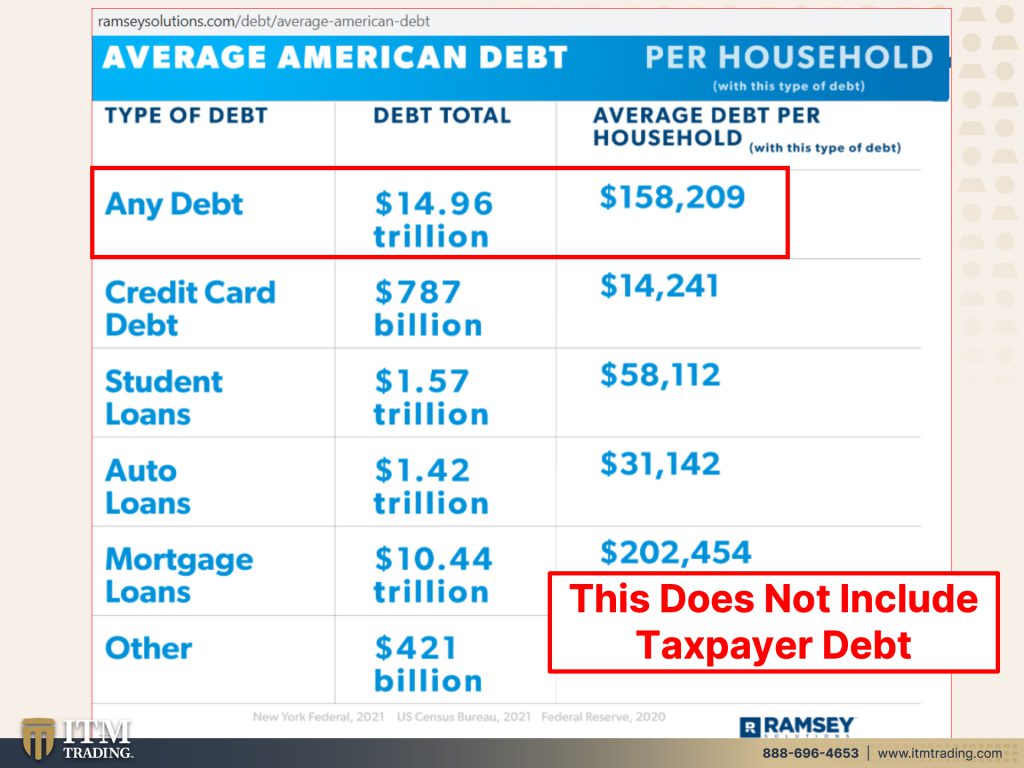

The average American look at the debt that they’re in, any debt. So it could be credit card, student loans, autos mortgages, $158,000 is the average debt per household. Well, that’s not gonna matter too much if you make a million dollars a year, but if you make $50,000 a year, that matters a lot. And this does not include all of the debt that the government incurs on your and my behalf, which I think is somewhere north of $158,000. And you don’t even realize that you owe it and that debt will transfer down and down and down. This is why they have to hyper inflate all the debt away.

Because when, and if not really, if cause it’s already happening, but when the global public loses all confidence in the ruling class. Now we know that there were a lot of rising global protest after what happened in 2008 happened. And when people are hungry and hopeless, they make choices. They would not otherwise make people are getting pretty darn hungry and pretty darn hopeless. And so let’s see over 230 significant anti government protests have erupted worldwide. More than 110 countries have experienced significant protests. And we’re even seeing that in Shanghai these days. 78% of authoritarian or authoritarian leaning countries have faced significant protests. And what did we see that recently happened? Wasn’t that anocracy? Which is a combination that, that we are officially, the U.S. Is officially an anocracy and that is loosely that you have qualities from an author author, sorry, authoritarian regime with a democratic regime. There are combinations of both. So we’re transitioning there too. And that breaks my heart. But you know, it doesn’t really surprise me. And over 25 significant protests, well have been directly related to coronavirus pandemic. This comes out of the Carnegie Endowment for International Peace. Yeah. Loss of confidence, public confidence equals loss of power. They’re trying to stay in power. So they’re gonna have to do something about this loss of confidence. I don’t know what could they do? Hmm. We’ll take a look at that because they gotta keep the public calm. How can they do that?

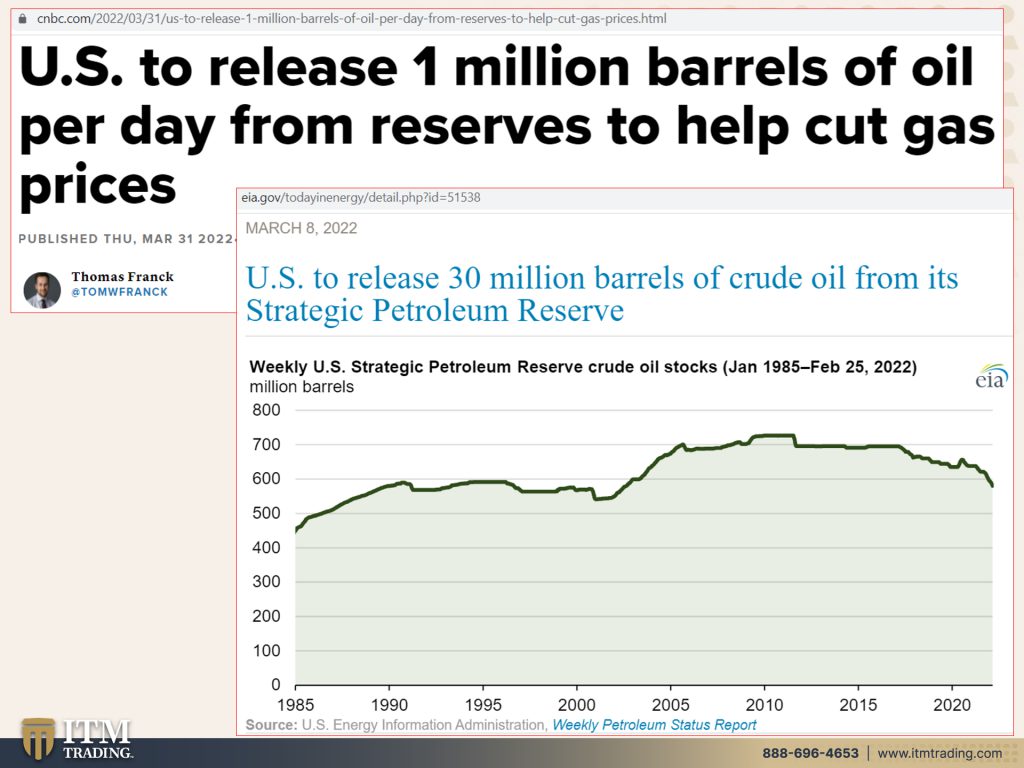

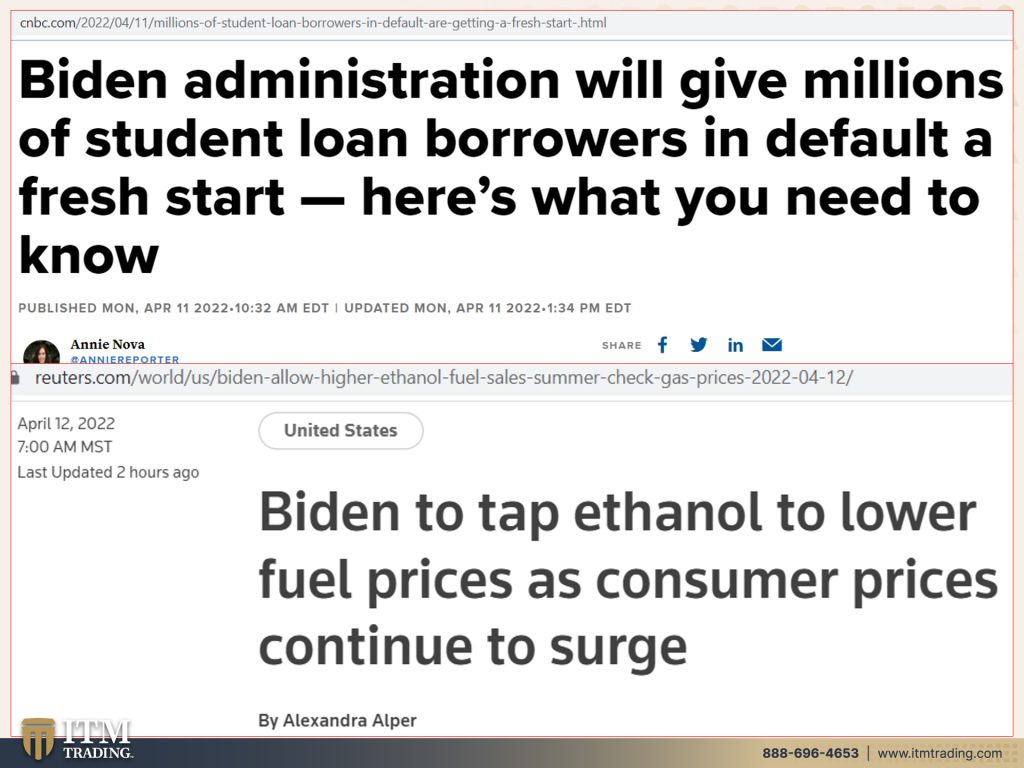

All right. Well paying at the pump we know that. So the U.S. releases a million barrels of oil a day to cut gas prices. And the price of oil has been hovering around a hundred dollars, a barrel, which is still pretty high, honestly. And now the Biden administration announces new actions to lessen the burden of medical debt. And look, whenever they say increase consumer protection you really need to rethink this because what they’re doing is if you are in arrears on your medical debt, they’re not wiping out the medical debt. They’re not doing that. No, no, no, no, no, but it will come off your credit report so you can borrow more! Great idea, take on more debt when you can afford the debt that you already have. And you’ve got inflation and oh, by the way, interest rates moving up, which means it costs more to service that debt. But they will give millions of student loan borrowers that are in default, a fresh start. You know what that is, again, just marking it, not in arrears so that it doesn’t hurt your credit score and you can go out and take on more debt. Woo-hoo! Happy days are here again! Are you flipping kidding me? You can’t make this stuff up. And now he is going out to tap ethanol to lower the fuel. So they are working hard on helping you maintain that perception that they’re really doing things that are in your best interest. But the reality is that it’s in their best interest. If they can keep you calm, if they can keep your confidence, because then they remain in power. And my personal goal is for those that got us into this mess and the way the system is structured on the other side of this mess, it’s a more fair system and we have more sound money and they will have to do this by the way. That’s one of the things that happens every time, once all confidence is lost, then they go in and they put a component of gold in the new currency.

Yeah, we could trust. It’s got gold. And then they start to wittle that away and do all of that again. So this is, and I want you to know, I am not getting political on any of this because honestly, my feeling is with politics that it’s just a sideshow to distract you. And it’s a way to legalize the theft. So I don’t care. Who’s in power. It is how is in my opinion, <laugh> they ain’t gonna change anything cause that’s not. Who’s driving the bus. It’s the central banks that are driving this bus, but they know that you’re gonna wanna fly to gold. So here’s an ETP, which is basically the same thing as an ETF. So it’s the contract and those inflows hit record high because the perception is that, you own gold. You don’t own gold. You own a piece of paper contract, but you have no access whatsoever to the underlying gold. And these things are designed to imitate or mirror or yeah, no imitate. <Affirmative> the spot, the manipulated easily and manipulated spot price of gold. And we’ll talk about when that’s gonna stop too, because if they’ve got to talk you, I mean, if you’re just dead set on getting gold, well they want you to do it in the a way that’s easiest for them to control. So the easiest is if it’s paper gold, that doesn’t mean anything cause you don’t really have any gold anyway, but the next easiest is bullion, monetary gold, the gold that you can hold in your IRA because at least, for the most part at this point, that will flow or reflect what’s happening in the manipulated spot market. And since most of this kind of gold is held inside of IRA’s retirement plans, it’s the easiest kind of gold. Should they choose to do a confiscation? Which I don’t know whether or not they will. Personally, I think they will, but I could be wrong. I mean, we do have a history of it and we have seen it happen in other parts of the world. You know, not that long ago recently even, but maybe they won’t. I don’t know. I personally think they will. So this is not the choice that I make, cause these are the most easily controlled form of gold.

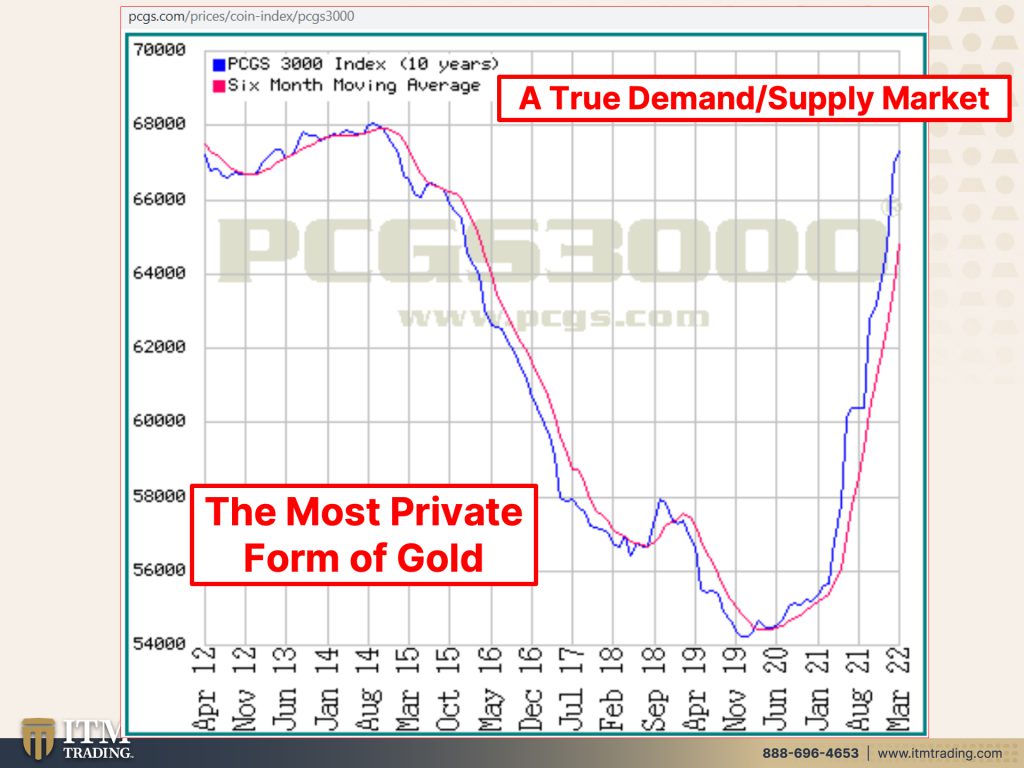

So what kind of gold do I buy? I buy the collectibles because this number one is a true supply and demand market. That’s what, this is, really simple. There are only so many of these out there and based on population and demand and all of that. That’s how these prices move like it or lump. It it’s a real market. It’s actually a real market. What a concept, instead of a wall street manipulated market, what a concept. Additionally, it is the most private form of gold. You have to do whatever you’re comfortable with. Everybody’s gotta do what everybody’s comfortable with regardless of what anybody says. But I saw, I lived through, I experienced my Uncle Al with two saves, probably at least 3000 ounces of gold when you couldn’t own more than five. And I know that gold is severely undervalued. So is Silver they’re both severely undervalued because a rise in gold prices is an indication of a failing currency. Do they want you to think the currency’s failing? No, let’s prop things up so that you’re looking at those numbers and going, woo-hoo look at how much money I’m making when all it really is, is nothing it’s garbage. It’s nothing. Does that benefit you? Mm, no.

So let’s talk about these two questions that came in because they’re good ones. And the first one is what are gold backs? Gold backs is a form of currency where, because gold, you can make it super, super thin. So they embed these wafers of gold depending upon the denomination, you know, tiny, little, etcetera. So it’s actually a bill that has physical gold embedded inside of it. That’s what a gold back is. I don’t personally own any of them. I can’t tell you that I think it’s a bad idea because I don’t think it’s a bad idea. I think you have to pay attention to the premiums and I’ve chosen to address that in a different way. And if you wanna understand that you can call our consultants and they can explain how you can do that. But that’s what a gold back is. And I kind of like it, I’m not gonna lie. I kind of like it. At least. I really like the concept of it because it’s physical gold in bill form. And hopefully more and more states and businesses will accept them so that they become a form of tender.

And JN asks, when will the manipulation of Gold and Silver stop? That will stop when all confidence in the currencies and in the leaders is over. That’s when that will stop. And then when they have to reset the currency, like we’ve seen in many other countries, Venezuela being one just cause it’s the easiest one for me to talk about. They revalue this funny money that has no value, no intrinsic value used one place in the economy. They revalue it, reset it against physical gold. And that’s when you will see gold express to its somewhere near, at least the first time somewhere near its fundamental value. In Venezuela. I think that the first overnight reset, it went up something like 3500%, but they’ve subsequently had two more resets overnight. So it’s not over when they do that first reset. It’s not gonna be over when they bring in the central bank, digital currencies, it’ll be over when they put a component of gold in the new currency to stabilize it. And even then, because they will start to degrade that probably pretty quickly thereafter, especially since they’re gonna do it, you know, we’re gonna go to everything being digitally, digitally held. You know, I’m not going to be converting a big chunk of my gold or silver into the new CBDCs. Not going to I’ll convert it. Maybe monthly, maybe quarterly. I don’t know. I’ll have to think about that and see how it, everything is working. But I will convert it as I need it, not before, because this is programmable money. This is not programmable money. This is the broadest base of buyer and the broadest base of functionality money. So is this, CBDC’s will have use in one place, just like dollars euros yen, all these things they have used in one place. That’s it. So when that demand goes away, that’s what you’re seeing right now. The demand for these dollars going away. Well, they go away too.

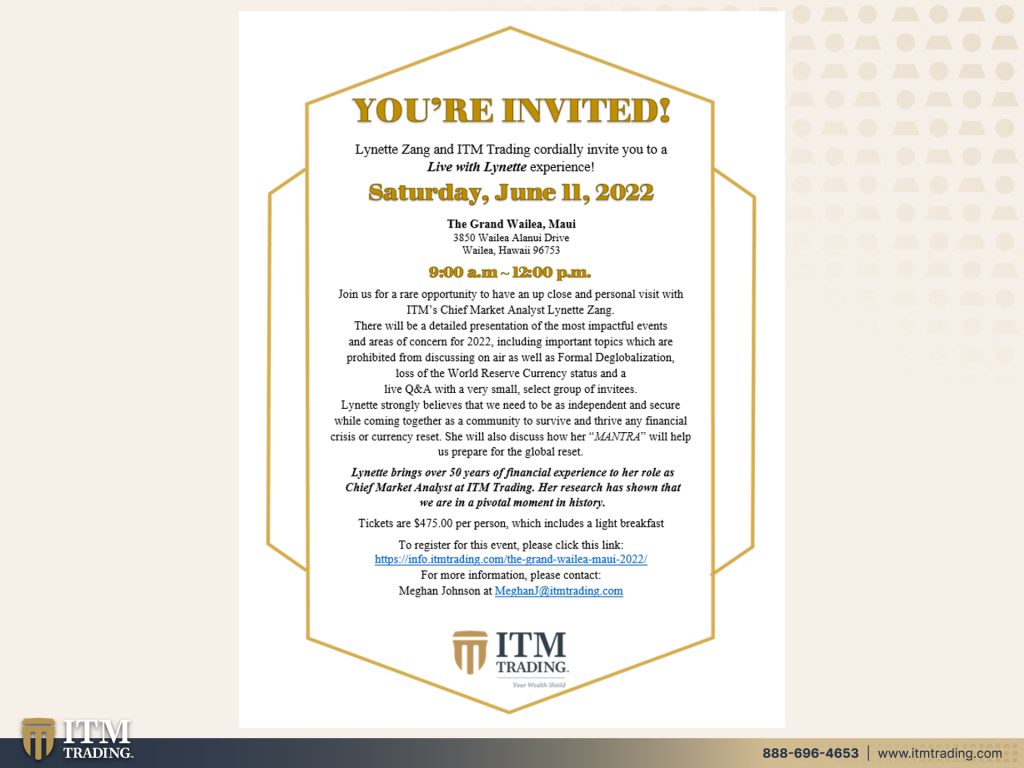

But I have have some good news. I need a vacation. <Laugh> I work really hard, I need a vacation. So we are going on a family vacation in June and I decided that since I’m out there on June 11th, I’m going to be doing a very small, intimate group meeting. I mean really small because I want everybody to be able to talk about anything that they wanna talk about and I wanna have enough time to spend time with everybody, but here’s the thing. Yes. I’ll keep you up to date with where we’re at on everything, but I’m gonna be able to, since we’re in person, I’m gonna be able to talk about things that I’m not able to talk about on air. So the link for the event is below it’s at the, I always wanna say this one place, I know Grand Wailea, on Maui and come join us. It should be a lot of fun and I could really use a vacation and I bet you could too.

So watch my backyard pond tour with my very, good friend who just recently passed. I’m so glad we did this. I’m so glad we did this on the Beyond Gold and Silver channel on YouTube. The video is out now, but this man handpicked every single river rock that went into this pond and I consider him a very good friend of mine. He is sorely missed Ernie. I always loved Ernie. What a character, what a nice, nice, nice, nice, nice human being. So you wanna watch that? I think it’s an important video anyway, cause it’s on water and we all need to figure out how we can ensure that we have the water or we need to drink to grow our food, to take care of our animals, etcetera. Also, make sure to leave us a review and listen to our podcast on any and all major podcast platforms that helps boost that. So I would really appreciate it if you would do that for us, but to start your gold and silver strategy, if you haven’t done it already, please stop procrastinating and get it done. I mean the handwriting is on the wall and it’s like lipstick red in front of you. Just click that calendly link below and have a conversation with one of our consult. They can help you understand why this is the only kind of Gold that I personally buy that has not always been true. But once we hit a certain part in this trend cycle, I no longer trusted bullion. So I don’t own any of it. But if you like this, please give us a thumbs up. Leave us a comment and share, share, share, share, cause it is so time to cover your assets on so many levels. And until next we meet, please be safe out there. Bye bye.

SOURCES:

https://www.federalreserve.gov/newsevents/speech/brainard20220405a.htm

https://www.ramseysolutions.com/debt/average-american-debt

https://carnegieendowment.org/publications/interactive/protest-tracker#