Government Spending Out of Control Creates Need for Competing Currency

Quantitative Easing round two is over as of the end of June, ending a six month long campaign to buy hundreds of billions of Currency in US Treasuries. Meanwhile confidence in the dollar has been on the decline as money printing to bridge the gap in the deficit pushes the national debt to its limit. People are beginning to wake up to the fact that government fiat currencies do not hold their value over time.

Quantitative Easing round two is over as of the end of June, ending a six month long campaign to buy hundreds of billions of Currency in US Treasuries. Meanwhile confidence in the dollar has been on the decline as money printing to bridge the gap in the deficit pushes the national debt to its limit. People are beginning to wake up to the fact that government fiat currencies do not hold their value over time.

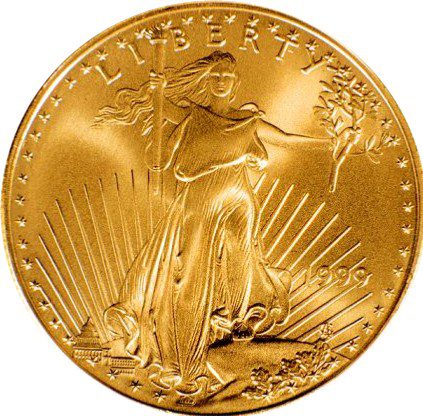

A currency can only exist when people believe in it (full faith and credit of US government). Throughout history gold and silver have been the only real money that has stood the test of time. Like I said in the previous blog we have only been in this fiat money experiment here in the US since 1971. As people are waking up, more and more people are acquiring gold and silver to protect their assets from weak fiat paper. Even central banks are trading in dollars for gold.

What we need here in the US is what Utah has already done, we need to have competing currencies. We need to allow people the ability to use dollars and gold and silver as currency. In the past however, those that have tried have paid the price. Many have been arrested, convicted of counterfeiting, tax evasion and have been subject to confiscation, even though the constitution only recognizes gold and silver as currency.

To allow a competing currency to the dollar such as gold and silver will allow citizens to protect themselves from devaluation of the dollar. Utah passed a law that twelve other states are also considering. If we can take away the tax penalties on gold and silver and encourage their use as an alternative we can take a step in the direction of a sound economy.

The problem I see here is that the Federal Reserve will fight this. They want to maintain control over the currency and monetary policy. Gold and silver as an alternative currency will undermine the Fed’s power. As long as we are forced to use the dollar the Fed and the government can keep debasing the currency at our expense by printing money and increasing the debt.

Republican Congressman Ron Paul recently introduced HR 1098, The Free Competition in Currency Act, which according to Paul will “eliminate three of the major obstacles to the circulation of sound money: federal legal tender laws that force acceptance of Federal Reserve Notes; “counterfeiting” laws that serve no purpose other than to ban the creation of private commodity currencies; and tax laws that penalize the use of gold and silver coins as money.â€

If this bill should pass it will be a step in the direction of returning gold and silver to a position of power in our monetary system, which we so desperately need as our official currency.