Government Debt and the Inherent Problem

I cannot stress this enough, “Sovereign or Government Debt†is “Government Bonds.â€Â This debt problem is a global issue and like anyone else, when you continuously grow debt, your income needs to keep pace in order to service that debt. If it does not, sooner or later you will have a problem.

By Lynette Zang:

Today Greek Government two-year notes are yielding 42% and they were really upset when the yields were at 6.75%, so you can imagine what they must be feeling now. The ECB and IMF rushed in and “bailed them out†by loaning them tax dollars (so easy to spend someone else’s money) so they wouldn’t miss a current interest or principal payment.

Most of the countries in the EU don’t really seem to think that Greece will be able to pay their debt. Finland recently announced that it wants collateral in order to loan them more tax money and that puts a crimp in the ECB’s plan. Source:http://www.bloomberg.com/news/2011-08-22/finland-open-to-new-collateral-model-after-austrian-rebuke-katainen-says.html

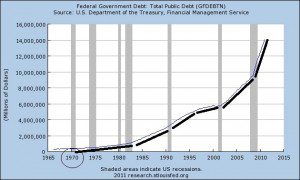

Think we’re better off than Greece? Below is the debt chart from the Federal Reserve. The grey bars represent official recessions. Notice how the velocity or speed at which we have grown debt has escalated, particularly between 2001 and 2008 and then from 2008 and now.

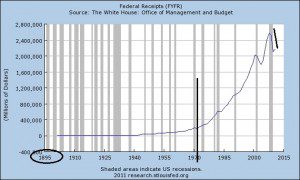

Now let’s look at the income via taxes to service the debt in the chart below. Notice that when we were on the gold standard we did not have to generate tax revenues to pay the interest on debt. After 1971 when we went to a fractional reserve system (debt based currency) we did. Also notice that the current drop off in tax income is the greatest that we have experienced since 1900!

Now let’s think about this, if we are growing debt more quickly than we have in history and losing income at the fastest rate in history, I’m thinking sooner or later, we’re going to have a problem, and actually we already do.

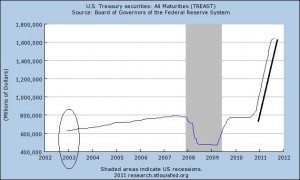

Governments fund deficit spending (spending money they do not have) via sovereign debt sales (government bond). But we have not attracted enough interest in our bonds since late 2002. Therefore, we have utilized quantitative easing (buying back our own debt) to fill the funding gap. In this way we have been able to keep interest rates artificially low. Because Greece is part of the EU, they do not have the ability to use quantitative easing as a tool.

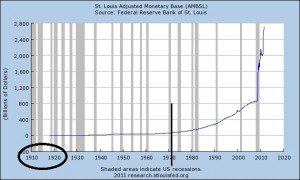

The chart above represents Quantitative Easing in the US (debt chart). Remember, in a fractional reserve system we have to create debt in order to create money. The Federal Reserve gets to create money out of thin air. The chart below (money chart) depicts what how much money the Fed has created in the last 100 years.

The adjusted monetary base does NOT reflect all of the money injected into the system. They used to report that on the M3, but discontinued reporting in 2006, so this is just a portion of the real amount.

Now you might be saying, Ok so how does this impact us. Well, first of all, once this money is created it must go some place; stocks, bonds, cash or tangibles. That’s why the stock market moves up when they talk about quantitative easing. In addition, when the Federal Reserve buys bonds with the money they create the interest rates go down. And while all of this sounds great, it has an impact on your purchasing power by devaluing the dollar making everything you buy require more dollars to do so, otherwise known as inflation.

Since gold is the primary monetary metal and maintains your ability to purchase the same goods and services over time, this activity also impacts gold moving the spot market higher against every single fractional reserve currency.

I know I am redundant on this, but the bottom line problem is too much debt at the same time that we are losing the ability to generate greater income to pay this debt. Governments only have two ways to attempt to service this debt; taxes and currency devaluation. Currency devaluation transfers your purchasing power to the government and central bankers by way of inflation.

While your attention may travel from country to country as this fractional reserve ponzi scheme unravels, it is important to understand that we are all in the same boat. In an attempt to deal with all of the debt, governments are growing; there is a race to the bottom in currency devaluation. While gold spot may reflect this, physical gold protects your purchasing power and does so invisibly, if you have possession. In this intrusive environment, it is where I feel most comfortable and less consumed about government debt.