Gold Market Secrets

Investing In Gold

Recently I was reading through one of the reports that Lynette Zang of ITM Trading authored. Lynette has an uncommon ability to sift through mounds of economic data, and come up with solid information relevant to the gold market, and sometimes what she finds are the little gold market secrets that you are not supposed to know. What I’m about to share with you ultimately is true of gold futures, but when you buy gold coins, or buy numismatic gold coins or gold bullion, or even if you buy old gold coins, there can be a divergence between the physical gold market and the gold futures market, and this divergence can change very rapidly, like it did during the market crash in 2008. This is why owning physical gold and owning paper gold contracts are very different.

Is Investing In Gold Futures A Good Idea?

For instance, did you know that when you see or hear the price of gold reported every day, that price is for the future delivery of un-mined gold? In the industry these are called gold futures, and many things from pigs to oranges are sold as futures, so this is not terribly unusual, but this next little piece of information is; they sell a lot more gold contracts than they actually have gold available to deliver on those contracts. This is done for a few reasons, but there is one ultimate result; gold prices are therefore manipulated lower because the laws of supply and demand are canceled out.

Let Me Explain

For instance, there are only 168 hours in a week. Imagine if you hired a two man painting crew to paint your house, and they charged by the hour. After 1 week, they came to you and told you your house was finished, and everything was painted with two coats, and the work was immaculate. Then, they proceeded to hand you a bill charging for 400 hours of painting. Even if the two men painted night and day for 1 week straight, they would only be able to bill for 336 hours, so where did the extra 64 hours of labor come from? When you ask the painters how they could possibly charge for more hours of labor than there were hours available to work, they tell you, “We don’t have to go by the clock because there really are not any rules that say we have to.†Well, though this is a simple interpretation, the gold futures market works very much the same way.

The Way You Think Things Get Done Is Not Always The Way They End Up Happening

We  began explaining how gold futures contracts varied quite dramatically from the way most of us perceive how business gets done. After all, if you ordered a product online, and it was never delivered to you, and then you called up to inquire as to why you never received your item and you were told that, “We sell one hundred of these for every one we actually have.†your next call would probably be to the Better Business Bureau or the Attorney General’s Office, and you would have a valid complaint. This would especially be true if you were trying to buy gold coins, or gold bullion, or if you were trying to buy numismatic gold coins! But, the gold futures market does not work that way. Click Here To Get YOUR FREE Gold Guide or If your ready to BUY visit our online store

Why?

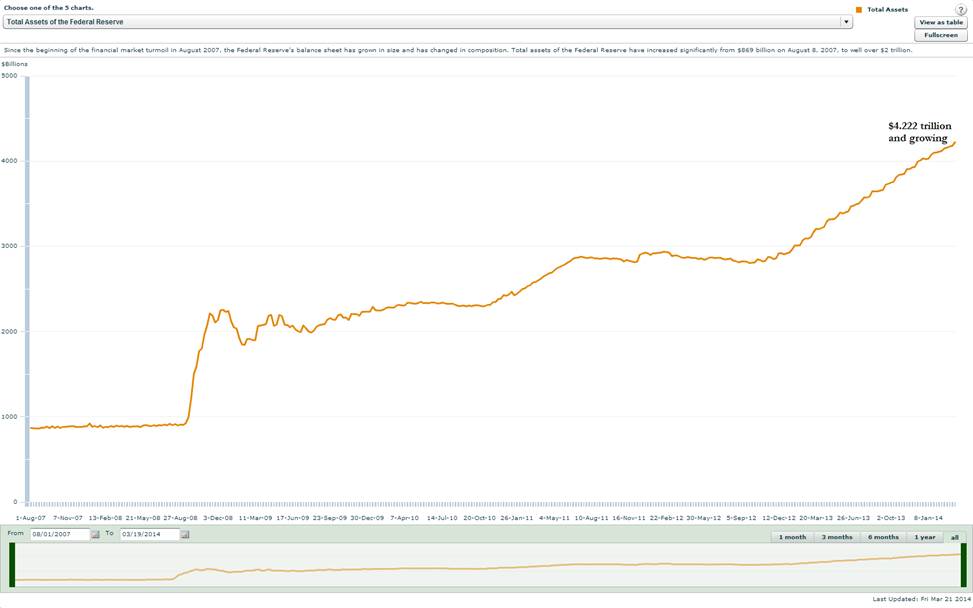

When traders buy gold futures contracts, they very seldom ever take physical possession of the gold. In fact, the vast majority of gold traders don’t want gold, they want profits. It works something like this. It is completely possible to buy forward gold contracts, or futures, on margin. Buying on margin means you are simply buying on credit. Large investment houses and hedge funds have multimillion dollar credit lines with the commodities exchange, and they also have deep checkbooks which can cover the cost of the trades if indeed they do decide to actually pay for the trades at some point. Those at these firms that are charged with creating profits, look for opportunities in the gold market when they think they can buy low and sell high. When this happens they purchase gold futures contracts, and wait for the price of gold to go up. When gold does go up, therefore producing a profit, they sell the gold futures contracts on the open market and take their gains, without ever having taken physical ownership of the gold. In some instances they sell the gold contracts before the gold that is supposed to fulfill the contract is ever created! When was the last time you bought something and then sold it before you ever even took possession of the article, or before the article was ever even produced?! While this may seem quite unusual to you, this is an everyday occurrence in the gold futures market. The graph below comes from the report that Lynette Zang wrote that I referenced in the first part of this article-blog. It shows that early this year, there were more than 100 owners for every ounce of gold that the commodities exchange had available for delivery. Lynette wisely states that if you have a gold contract, you better br the first in line to have it filled, or there will be no gold for you.

How Gold Prices Are Manipulated

According to Lynette Zang, Senior Analyst at ITM Trading, there are and have been two sets of gold prices in the United States for some time now. There is the price of “paper gold†which is what you hear reported on the news or see reported online or in the business section of the papers, and then there is the the price of physical gold available for immediate delivery. While the price of the paper gold contracts do have some current bearing on the price of physical gold, the difference, or “Spread†between the two as it is called in the industry, can and does vary widely depending on the actual availability of physical gold. For instance during the market crash that began in 2008, the price of paper gold plummeted as stock traders had to sell whatever they could in order to cover losses, meanwhile, the prices of gold coins and gold bullion became further and further distant, in an upward trend, from the price of paper gold contracts as reported in the gold market. In fact, during this time, it became difficult to buy gold coins or to buy gold bullion for immediate delivery. If you wanted to buy numismatic gold coins, there were times when these coins were experiencing very dramatic positive price swings while the stock markets on the other hand were losing hundreds of points in a single day! As a Senior Analyst myself at ITM Trading during this time, I can remember several days when the trading floor had to be shut down temporarily while the Trade Manager had to adjust prices upwards for all of the numismatic gold coins because our suppliers would contact us and report increases in prices as well as simultaneous decreases in available inventory. There were also days when this happened more than once!

The Next Secret

In the last part of the article-blog I explained not only how hedge funds and stock traders can buy more gold than is available for actual refining and delivery, thereby canceling true supply and demand economics, I said that the buyers of these contracts look for gold to increase in price when they buy. This is really only half of the story! The other half comes in when large financial institutions purchase gold “Shortsâ€. By purchasing these gold short positions, these very wealthy institutions are betting that gold will go down in price, at least momentarily, in order to create profits. Before I get into the nuts and bolts of this not widely known or understood side of trading, let me point out that there have been times, and there will be times again, where the price of gold coins and gold bullion available for physical immediate delivery has been increasing while the price of paper gold contracts has been declining. Old gold coins, rare gold coins, and numismatic gold coins have outpaced the increases in gold coins and gold bullion during these times. There are more gold market secrets that I can tell you about.  I am referencing in this article-blog, than call Lynette Zang at 1.888.OWN.GOLD and ask her for her report entitled “The Coming Collapse Of The International Monetary System”.

How Gold Market Shorts Work.

How Gold Market Shorts Work.

I promised to let you in on how gold market shorts work, and I will, and then I’ll tie everything together with a neat little bow and give you some things to ponder that will give you good reason to buy gold coins, or buy old gold coins, or better yet, buy numismatic gold coins rather than participate in the rigged paper gold market where you will be too small, too uninformed, and too late to win against the big guys, so here we go.

How Gold Shorts Effect The Price Of Gold Contracts

Gold shorts effect the price of paper gold contracts, and from time to time there are long inquiries into the market looking for misdeeds, graft, and theft, but like many rigged games, no one ever gets found guilty of wrong doing and has to go to jail, and if any fines are ever levied, they usually only amount to a fraction of the profits generated through the crooked dealings. But onto gold shorts… Suppose you bet football with a friend, and your friend really likes the Washington Redskins, but for whatever reason you really don’t like the Washington Redskins. You may decide you want to bet him that the Redskins will lose every game they play away from their home field. This is a good analogy simply because you really are not betting on the team that the Redskins are playing, you are betting on the Redskins to lose. Well, in the paper gold market, there is really only one team, the gold team.

There are also people who really like the gold team, and they bet on the gold team to win for the entire season. These people are said to have “Long†positions in the gold market, which means that they are planning on holding onto their gold contracts for a relatively long time, through the ups and downs. Now say you want to bet against the gold team next week because for whatever reason you see gold going down in price. Here is where it gets tricky. In order to make your bet, you need to go to someone who has a long position, someone who is not interested in selling their gold contracts next week. Then, with your good name, credit, and the promise of a fee, you convince them to sell their contracts to you at today’s price, with the promise that you will sell the contracts back to them next week, again at the same price, and you will also pay a fee to them for their cooperation. Now you could do this with gold coins, or gold bullion, or if you were to buy old gold coins I suppose you could also enact this trade, but it would be much more difficult and cumbersome to acquire, transport, and store the physical gold, let alone sell it and then buy it right back, but trading gold futures contracts digitally is much easier, and that is why these trades happen in very large quantities, all the time.

Buy Gold Ingots Online at the ITM Store.

Look at the analogy between betting against a football team and betting against a rise in gold prices, or more specifically, betting on a decrease in gold prices, through the use of gold shorts. The article-blog also touched on how the digital trading of paper gold contracts allows this to happen much more easily than trying to effectively simulate shorting gold with physical gold coins or gold bullion. When you buy numismatic gold coins, or if you buy old gold coins, there are often rarity and scarcity premiums attached to the pricing of these gold coins, so they are even less likely to be considered for these types of gold trades. Paper gold contracts that represent gold that doesn’t exist above ground yet are the common instrument for effecting these “ghost trades†and since the contracts can exist in virtually unlimited numbers, so can these short trades.

Back To How To Short Gold

So, you have found someone who is “long†on gold, and you have convinced them to sell you their gold futures contracts. As soon as they do, you go to the market and sell them for the best price you can. And then you hope, and them you may begin to pray. You see, the whole premise of this trade is that you will be able to go back to the market, before you have agreed to return (or sell back to) the gold futures you bought or borrowed to the original owner, and buy back the gold contracts for less than you sold them for to begin with, and therefore realize a profit after all costs and fees have been covered. If this is hard to follow in words (it can be), I’ll try to put it together in numbers for you.

The Number Version

Let’s say that the price of gold today is $1000 per ounce, and you think gold will go lower. So you go to an acquaintance who owns gold contracts, and either with your credit or your cash, you buy his contracts from him for $1000 per ounce, with the agreement that you will sell him back the contracts, at the same price, one week from now, and give him a fee for the use of the contracts. Then, as soon as you get the contracts, you sell them for $1000 an ounce. Now, you wait. If gold goes down, to say $960 an ounce, you can go into the market and buy back the contracts for less than you sold them for, thus generating a profit, and you can return the gold contracts to your acquaintance, pay the fee due him, and still have some profit left over.

Do gold contracts effectively manipulate the price of gold lower?

Do gold contracts really lower the gold price, lower than it truly is? and how owning gold bullion or gold coins, or how making the decision to buy old gold coins or to buy numismatic gold coins can take advantage of the artificially low current price of physical gold and produce stability and profit in your financial portfolio down the line.  We explained the process of short selling gold futures, and it mentioned that trying to short the price of gold could be possible using gold coins or gold bullion, but that trying to buy old gold coins or buy numismatic gold coins to in effect short the gold market would be much more difficult because these types of gold coins can and usually do carry significant premiums over the value of just the gold contained in the coin. Because paper gold contracts for future delivery carry the lowest costs to purchase and transfer, and because they are nearly limitless in their availability, they are the instrument most often used to trade gold. This combination of factors also factors heavily into why these trades in effect push the price of gold futures down below their actual value. A Perfect Gold Storm Imagine being able to sell more of something than you can possibly produce. Now imagine that the people you sell to begin selling amongst themselves before you can possibly even deliver the item you sold. Now imagine that some of these people start borrowing contracts for delivery from others, with the express idea of selling the contracts and then buying them back in order to return them to the person they borrowed the contracts from in the first place. If it all sounds confusing, it is. But, this is how gold markets work everyday, and these are just some of the gold market secrets that are not widely known or understood. Now look at how normal retail markets work. When you buy something, you expect to actually receive it when you pay for it, or within a reasonable time frame. Very seldom in the real world would you buy something and then sell it before you ever took delivery of it. When have you ever bought something, sold it, and then bough it back before the item was ever produced? In alot of markets, these actions would constitute fraud, but not in the gold futures markets. Another little gold market secret.

We explained the process of short selling gold futures, and it mentioned that trying to short the price of gold could be possible using gold coins or gold bullion, but that trying to buy old gold coins or buy numismatic gold coins to in effect short the gold market would be much more difficult because these types of gold coins can and usually do carry significant premiums over the value of just the gold contained in the coin. Because paper gold contracts for future delivery carry the lowest costs to purchase and transfer, and because they are nearly limitless in their availability, they are the instrument most often used to trade gold. This combination of factors also factors heavily into why these trades in effect push the price of gold futures down below their actual value. A Perfect Gold Storm Imagine being able to sell more of something than you can possibly produce. Now imagine that the people you sell to begin selling amongst themselves before you can possibly even deliver the item you sold. Now imagine that some of these people start borrowing contracts for delivery from others, with the express idea of selling the contracts and then buying them back in order to return them to the person they borrowed the contracts from in the first place. If it all sounds confusing, it is. But, this is how gold markets work everyday, and these are just some of the gold market secrets that are not widely known or understood. Now look at how normal retail markets work. When you buy something, you expect to actually receive it when you pay for it, or within a reasonable time frame. Very seldom in the real world would you buy something and then sell it before you ever took delivery of it. When have you ever bought something, sold it, and then bough it back before the item was ever produced? In alot of markets, these actions would constitute fraud, but not in the gold futures markets. Another little gold market secret.

Are Markets Gold Inherently Manipulated?

Imagine for a moment that the gold futures market was forced to reform. Imagine that the gold had to actually be produced before it could be sold. Imagine that instead of the commodities exchange being able to hold one ounce of gold and sell contracts for many times that amount, they had to play by the real world rules of supply and demand. Imagine that if someone bought a contract for 1000 ounces of gold (about $1,300,000 at this writing) they not only had to pay for it, but they had to take delivery of it!

Supply Vs. Demand

I remember when gasoline was approaching $5.00 a gallon. Hybrid cars that were getting nearly 50 MPG couldn’t be found on the car lots. If you wanted one, you had to pay a premium of thousands of dollars over full sticker price, put down a non-refundable deposit, and wait for your car to be built and delivered. That is how true markets work, because they are grounded in reality. In reality, if you want gold, you need to buy physical gold coins, or gold bullion, You can also buy old gold coins, or you can buy buy numismatic gold coins, and take possession of them in a reasonably short time span. Otherwise, you can buy paper contracts, and hope, and play the paper game, but when the paper game folds, those holding physical gold will be the winners.

Click Here To Get YOUR FREE Gold Guide or If your ready to BUY visit our online store

[youtube width=”480″ height=”360″]https://www.youtube.com/watch?v=ZeVorZhhXh8[/youtube]

Controlling the Beginning Stages of Hyperinflation by Manipulating the Gold and Silver Prices

We don’t live in ‘the real world,’ we live in a world where everything financial is manipulated.