GOLD OR GARBAGE? Rating Agencies Emulating Crash Criteria By Lynette Zang

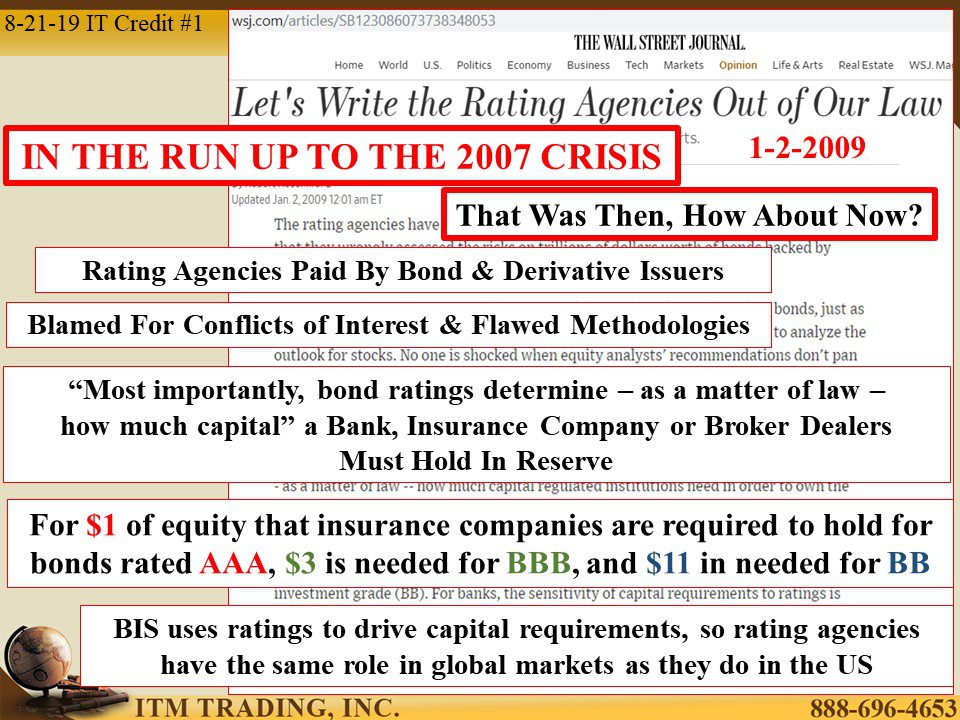

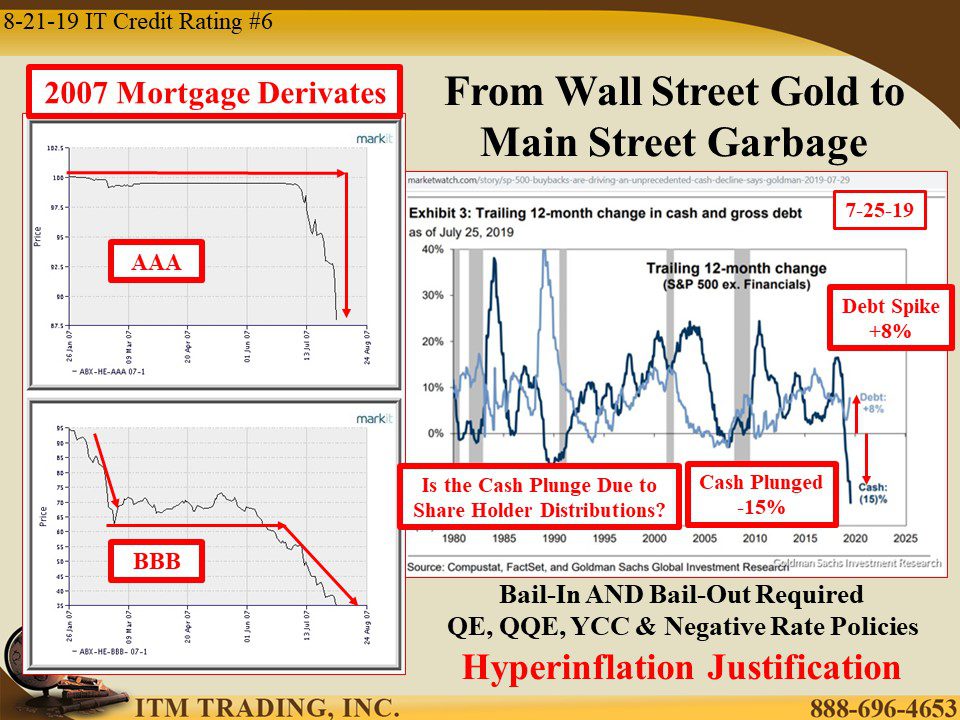

In the run up to the 2007 – 2008 financial crisis, rating agencies used creative models to boost credit rating on debt issuance and newly created, complex speculative derivative bets as they competed for market share. As the crisis unfolded, they were accused of magnifying the crisis as the true value of trillions of derivatives and bonds went to zero. How could a AAA bond, deemed ultra-safe by rating, go to zero? Flawed rating methodologies due to conflict of interest by these private corporations, since it was the issuer of the wall street products that pays the issuers of ratings.

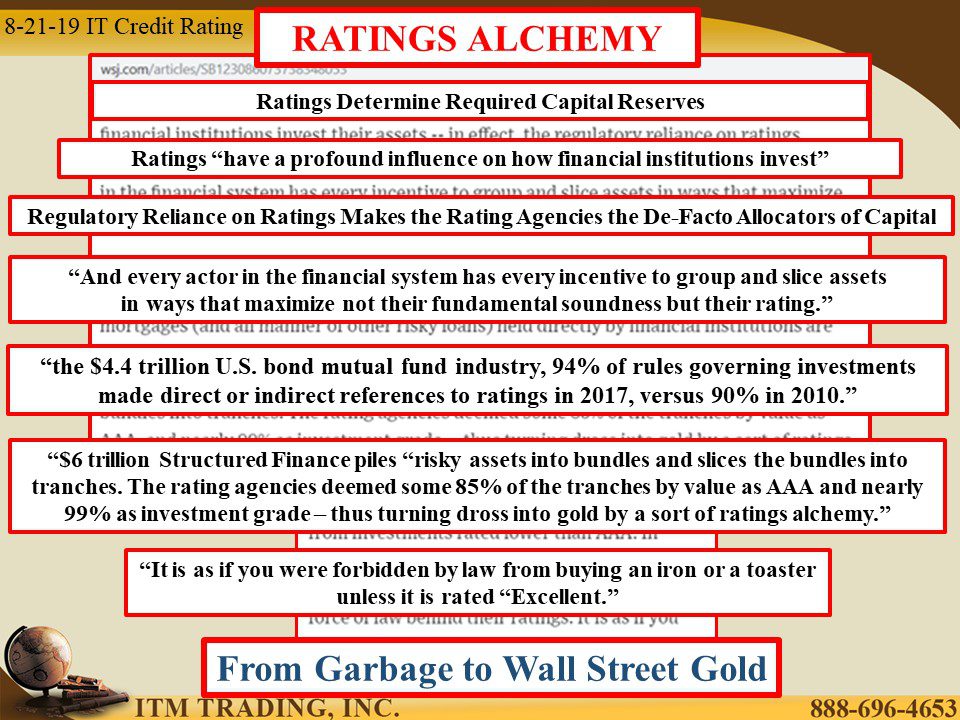

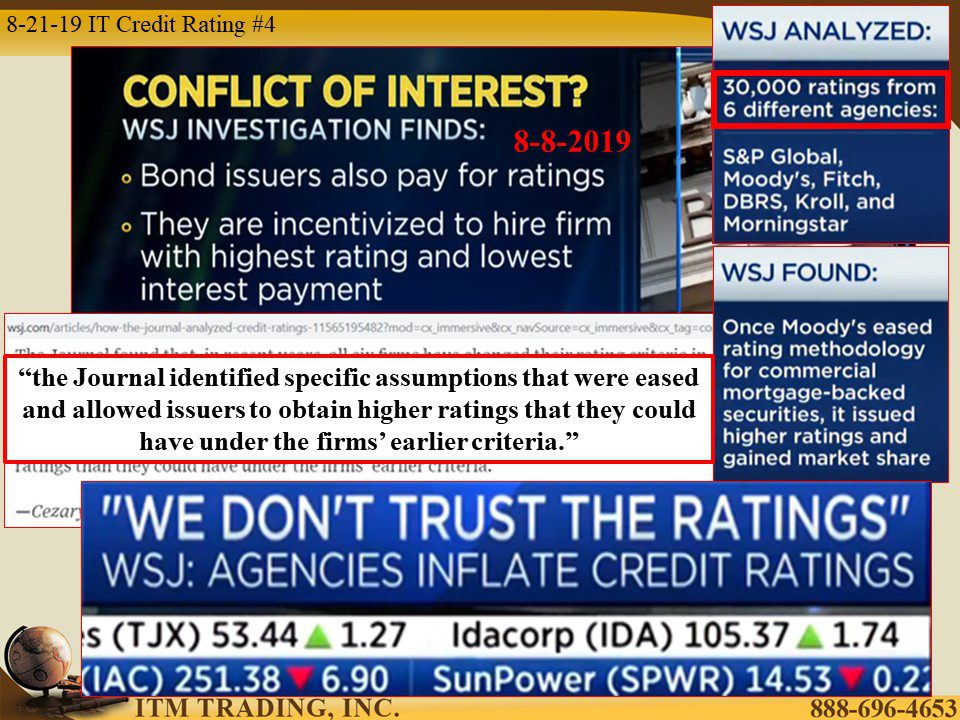

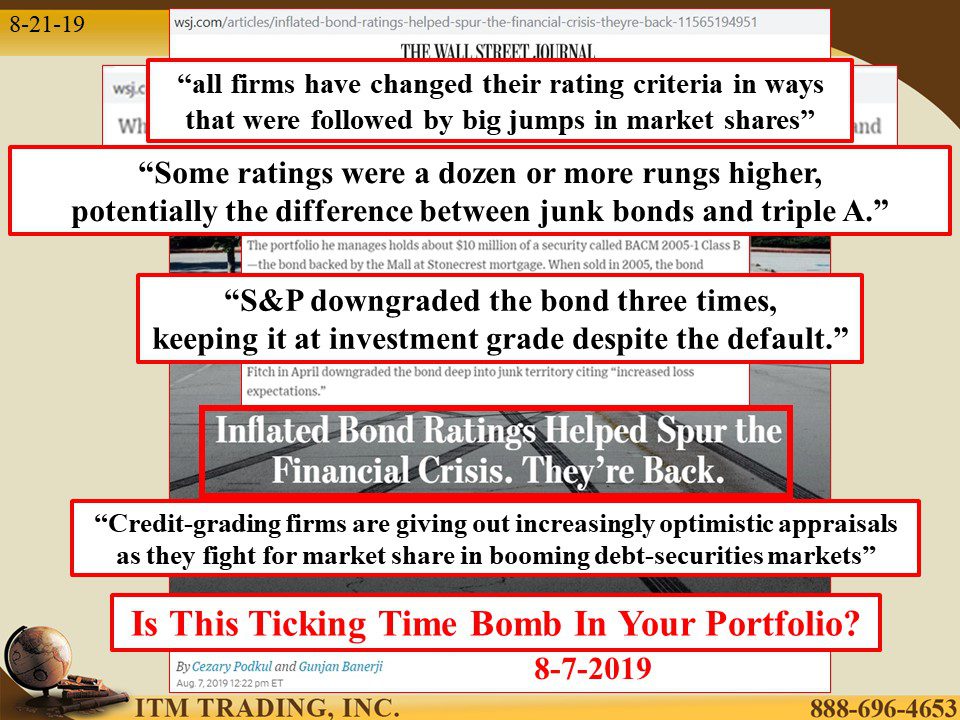

Many reforms were written into Dodd-Frank, though most changes were never implemented. The ultimate answer was more competition and so a few more agencies were born. Other than that, what’s changed? According to a new investigative report in the Wall Street Journal, not much, in fact in 2010 90% of the rules governing investments by US bond mutual funds, made direct or indirect references to ratings in their prospectuses. By 2017, 94% prospectuses referenced ratings.

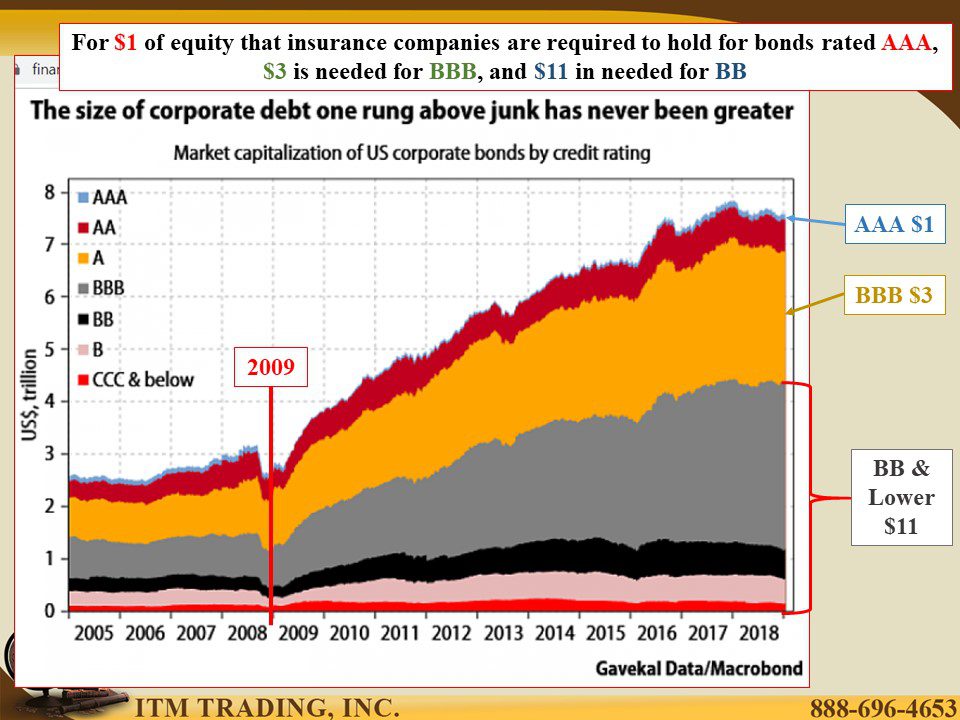

Why does this matter? Because regulatory reliance on credit ratings makes rating agencies the de-facto allocators of global capital since a rating impacts the interest the debtor must pay, and the reserves the holders of that debt must retain. In addition, the size of corporate debt, one rung above junk, has exploded.

Today rating agencies are still compensated by bond and derivative issuers, therefore, “every actor in the financial system has every incentive to group and slice assets in ways the maximize not their fundamental soundness but their rating.â€

The investigators looked at 30,000 ratings from 6 different agencies and “identified specific assumptions that were eased and allowed issuers to obtain higher ratings that they could have under the firms’ earlier criteria.†At times, up to “a dozen or more rungs higher, potentially the difference between junk bonds and triple A.†Since the prospectus outlines acceptable investments, it is probable that inappropriate investments are sitting inside investments that the public perceives as safe, like money market funds.

You might recall that on September 16, 2008, when the Reserve Primary Fund money market (MM) “broke the buck†(fell below $1) and froze, forcing the government to backstop MMFs to prevent a run and then change MM rules to prevent future runs by charging large enough fees to discourage redemptions and barring that, simply stopping redemptions.

Of course, it’s not only MMFs holding this ticking time bomb. These fabricated “assets†are being held in or linked to, many mutual funds and ETFs held in pension plans, 401Ks, IRAs and insurance companies.

The report states that all 6 agencies have loosened criteria and gained market share because of that. Do you think they put your best interest first? Is this ticking time bomb in your portfolio? How can you insure your portfolio against losses?

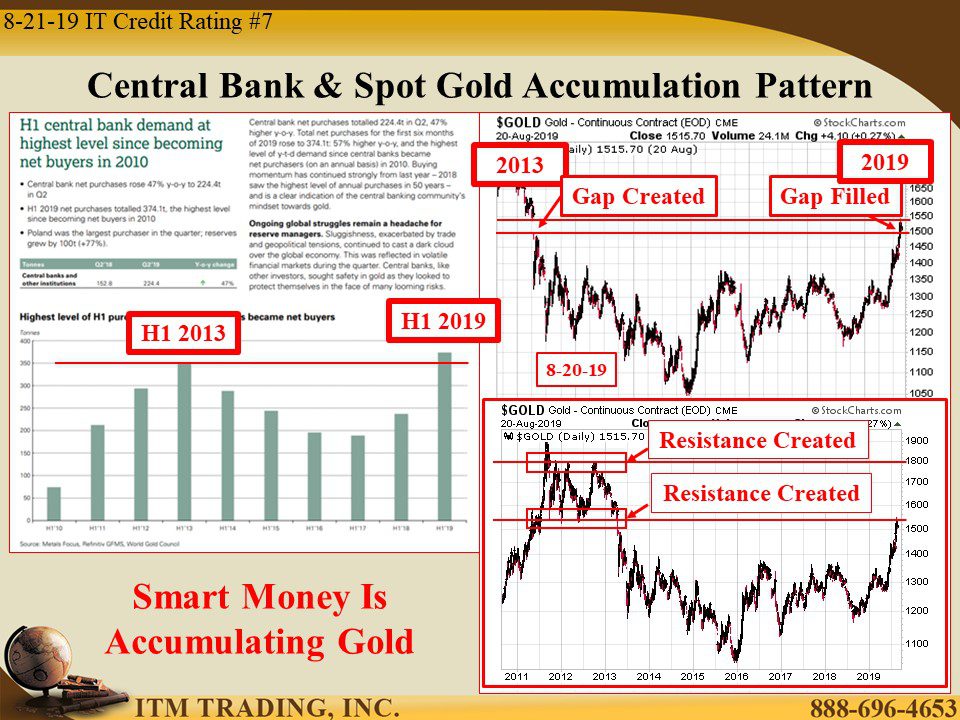

By doing what the smart money is doing, buying physical gold. In fact, for the first half of 2019, central bank gold demand is at the highest level since becoming net buyers in 2010, according to gold.org. In addition, the central bank purchasing pattern is similar to the accumulation pattern visible in the spot gold chart, including the recent break out.

You know I always recommend you do what the smartest guys on any topic, are doing for themselves. I’m buying physical gold, are you?

Slides and Links:

https://www.wsj.com/articles/SB123086073738348053

https://www.wsj.com/articles/how-the-journal-analyzed-credit-ratings-11565195482

https://stockcharts.com/h-sc/ui?s=$GOLD

YouTube Short Description:

In the last recession everyone was “so shocked†when their AAA-Rated Investments went to Zero. Well today I’m going to show you how Credit Rating Agencies are emulating some of the same scenarios that signal the next collapse. It’s these indicators that help people like you protect your future, freedom, and your legacy…if you’re paying attention.

Rating agencies are still compensated by bond and derivative issuers, therefore, “every actor in the financial system has every incentive to group and slice assets in ways the maximize not their fundamental soundness but their ratingâ€.

The report states that all 6 agencies have loosened criteria and gained market share because of that. Do you think they put your best interest first? Is this ticking time bomb in your portfolio? How can you insure your portfolio against losses?

You know I always recommend you do what the smartest guys on any topic, are doing for themselves. I’m buying physical gold, are you?