Gold ETF’S Silver ETF’S Buying Paper

Gold and silver ETF’S buying fiat gold and silver.

Finding ITM Trading Online

Website – https://www.ITMTrading.com

Shop for gold and silver online

YouTube – https://www.youtube.com/user/itmtrading

FaceBook – https://www.facebook.com/ITMTrading/

Twitter – https://twitter.com/ITMTrading

YouTube Translation

hi guys let’s hang here chief market out what that itm trading a full-service physical golden silver broker child before we start on the field en flv can be seated yeah this is the last head of cauliflower out of my garden my daughters and I will be eating this this weekend but i’m very proud that’s why i brought it in don’t think they will tell is by caught on they might have an audio find out notice you’re really burning garbage well that and the reason why I’m super into gardening actually that’s more important is because of what’s happening in the monetary system and so the mantra is food which becomes the absolute top issue food water energy security vulnerability and wealth preservation.

Gold and silver ETF’S buying fiat gold and silver.

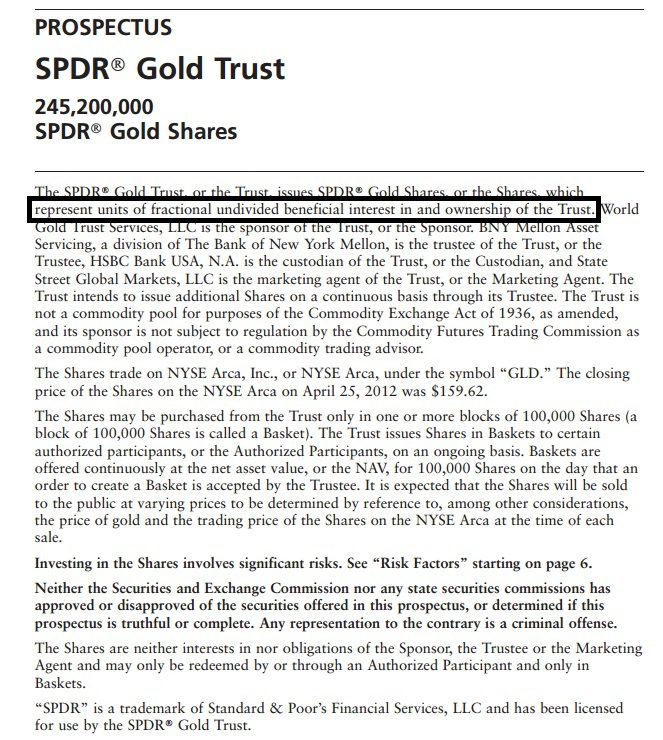

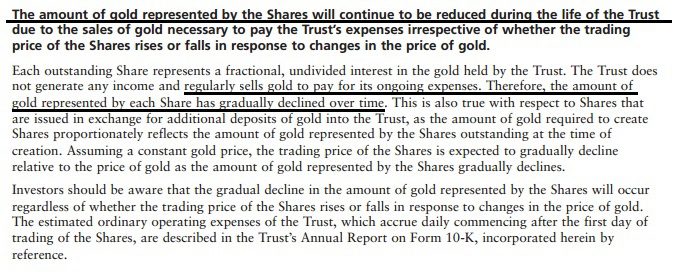

It’s the last years of our durability and while preservation that golden silver performed but isn’t this is our food and this is why I never really was the gardener until so I’m definitely still learning but that’s why I’m doing this really more than any other reason ok so thank you like so now on to the point now lbn flv these are gold and silver etf a lot of people have the misconception that if you buy gld or flv you are now buying gold or silver well you know in my opinion this is just one way to manipulate the market so i’m going to show you first of all from the perspective you know you’re going to buy a fiat money product do yourself a favor and actually take the time to go through the perspective because when you do that what you’re actually buying our shares of a trust you’re not buying gold or silver you can’t convert those shares into gold three silver you’re not an authorized participant but the other thing is that i’m going to show you this I’m going to tell you in person that show you everything you hold this up because  I like agree the amount of all represented by the shares will be reduced during the life of the trust and basically is to pay their fees so over time is actually a diminishing as that or instruments not even it hello ok that’s a matter of opinion but it’s diminishing instrument because over time there’s less and less bold and or silver in per share in there so that’s where some of the misconception it has been that they don’t have any gold or silver in there of this is just a little with a sum of their different seeds ok but now let me show you what I just told you first of all we’re going to start with with gold and this is a list of all of the difference of gold etf ps exchange-traded funds the reasonably new product of the interesting thing for me about this chart in Pierce potholed ok which is Wall Street manipulated version.

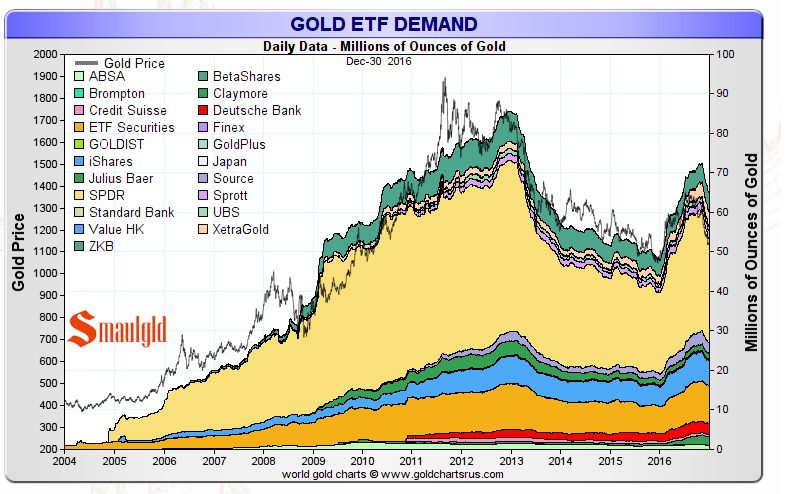

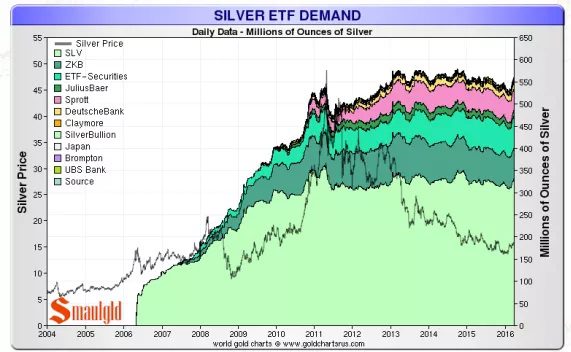

anyway i can you see the pattern and how they track face now i’m going to tell you some of this is going to be my opinion that i cannot prove but i’m pretty sure that’s what it is because of the just paper and because most people buy it through a brokerage house if the broker says well you should sell this you are more likely to comply and that can push the price of gold down because we’ve seen over and over again that the that the real physical demand is escalating even as the spot price decline but that also means that the authorized participants like the Big Kahuna’s that always play these games chase well part of you know all the thing name has the ability to buy physical goals somewhere below the spot market let me show you what I’m talking if you hold that up there that is a relative performance chart between spot bowl and gld you will notice the blue line is gld the red line is spot gold and you can see over on the wall high right i’m not sure what that would be but over here on the chart where those two lies are right on top of each other so that’s when that first came out and they were they were not taking scenes out of it for a minute or two to get you used to it so can you see this they divide between here and there that’s because they’re selling off kolten ok and that’s why i say that it is a diminishing instrument so not only can you not convert it but you’re also getting less and less underlying the shares of the trust we see something similar but basically even more interesting is it silver etf these are the holdings of the silver ETF and look at the spot market ok so even if this is kind of interesting that the spot market would be impacted but it’s the same kind of thing because this they’re registered participants or the authorized participants rather have the ability to the same kind of pattern in this particular case you got a lv and red that’s just the way it came out and the spot silver price in blue and so the difference between the two is them selling off holdings and reducing the amount of the metal that underlines eat each share ok so i hope that clarifies gld and SLV I don’t know any i personally don’t recommend it because it’s just a fiat money products and it’s the same thing is held in the system is it is less expensive frankly over time we actually buy a real goals are real out of silver and you hold it in your possession if you tend to hold it long term correct yeah if you’re doing a short-term definitely if you’re doing it as a trade that’s a much cheaper way to do it and there are other ways that are even cheaper to do it and you know if you guys want I could do something on that but we already have pieces written on all the different ways out webinars on all the different ways to do it so yet but it’s this as a long-term whole I mean this should make it just these two charge alone should make it really clear that you know all you have is a piece of paper that is being reduced value just forget how the spot market moves just by disease alone all of these will be in jpegs that are links underneath this so subscribe to us on YouTube will let you know when we’re doing these live events like us on facebook follow us on twitter and we’ll see in the next time oh by the way to I wanted to let you know that the new with just a warning has been posted to our archive so if you would happen if you click on in the navbar on our website at itm training.com click on the I the little tab warning and then that’s the landing page for the intro and you can click to watch the whole video perfect i’m really proud of it so go ahead and take a look if you have any questions where if there’s any other ways that we can be of service we’re at itm trading work together in eating three and

i’ll see you next time bye