Could Gold Confiscation Happen Again?

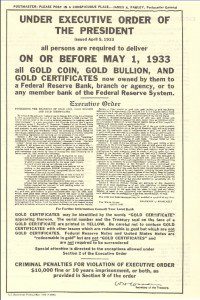

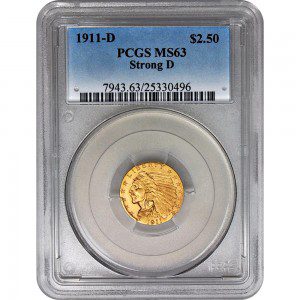

Some say gold has absolutely no value other than for it’s industrial uses. Others say gold is the purest form of money and a true currency. Somewhere in-between these two camps lies the truth. Think about this for a moment though; the government of the United States has confiscated the gold from it’s citizens before, and why would they go through that much trouble if gold were truly just a “useless mineral� Gold coins and gold bars were subject to the gold confiscation ordered by Franklin Delano Roosevelt back in 1933. This confiscation, which was put into force by Executive Order 6102, did exempt some gold coins from confiscation, however, and some of the gold coins that were specifically exempted were rare gold coins and unusual gold coins.

By today’s standards, numismatic gold coins that are both rare and unusual in nature would probably be exempted from confiscation should another confiscation occur, and there are a few reasons this idea is commonly upheld, and I’ll discuss a couple of them further in this article-blog. Compensation For Confiscated Gold, And Powerful Rich People Back in 1933, Executive Order 6102 demanded that Americans take all but a few ounces of the gold they held to an approved bank and turn in the gold for paper money. Being that the price of gold at the time was fixed at just over $20 per ounce, Americans were given paper Federal Reserve Notes and non-gold coins in remuneration for the gold they turned in according to the face value on the gold coin, and the government could claim that everyone was fairly compensated through these transactions.

New to gold? Get A Free Guide To Gold Investing Delivered To Your Home

Today, the price of gold is allowed to fluctuate against the dollar, and this fact would make compensating Americans for their gold during another gold confiscation much more difficult. Trying to gauge and compensate for the value of rare and unusual gold coins during a future gold confiscation would be much more difficult still. It has been estimated that rare and unusual gold coins account for a very small single digit percentage of existing gold today, and generally, it is the wealthy and influential in this society that have large and substantial holdings of rare and unusual gold coins. Time has taught us that for a myriad of reasons, the wealthy and influential tend to get their way, time and again. Should there be another gold confiscation in the United States, one may reason that once again, certain types of gold will be exempted, and I am apt to believe that the rich and powerful will exempt themselves and their gold coin collections from confiscation once again, since this truly seems to be “The American Wayâ€.

“Will Gold Be Confiscated Again?â€

We touched upon Executive Order 6102, which directed Americans to turn in all but five ounces (about $100 at the time) of their gold coins. This gold confiscation was announced as necessary to stave off financial collapse and prop up the American economy. Today we constantly hear about the dangers the American economy and the U.S. Dollar is in. For this and other reasons, many believe that the government may come once again for the gold bullion and gold bars and gold coins held by private individuals of the United States, and many experts, such as Jim Rickards have been vocal about another possible gold confiscation.

Recently, Jim Rickards was a guest on a very popular overnight radio show, and I’ll share some of the conversation he had on the subject:

Jim: … A good example in 1933, on his first day in office President Roosevelt was sworn in and one of the first things he did was confiscate all the gold in the country. Now you say – Well, how did he do that? He did it by executive order – and you’re like OK – executive orders need a statutory basis. What was the statutory basis for confiscating the gold? He used something called The Trading With The Enemy Act of 1917. Now The Trading With The Enemy Act was enacted during World War I so we could seize German assets that were in America. That’s how we got Bayer Aspirin; it used to be owned by a German company.

George: Yeah. That’s right.

Jim: Okay, so who was the enemy in 1933? There was no war going on. But the President used The Trading With The Enemy Act to seize the gold; he must have said the American people were the enemy. By the way there is some more powerful statutes on the books today and, you know, when I say this stuff George I want to be very specific with listeners because it’s not just, you know, scary talk – you can look it up. The International Emergency Economic Powers Act of 1977, enacted in the Carter Administration – a funny name – IEEPA – I – E – E – P – A – but International Emergency Economic Powers Act. It gives the President dictatorial powers in the event of an international economic crisis. Well, show me an economic crisis today that’s not international. They’re all international.

George: They all are. That’s right.

Times Change, But Things Stay The Same As you can tell from Jim’s conversation above, the legislation enacted to begin a new gold confiscation may have changed, but the end result will be the same. When the government comes for the gold of private Americans in order to help balance government debt and prop up the failing U.S. dollar, would you rather be holding common gold bars and gold coins, or would you rather be holding rare gold coins and graded numismatic gold coins? We shared a small snippet of a recent Jim Rickards radio interview.

Jim has authored books on currency wars and the cyclical rise and failure of fiat currencies. If you are not aware of what a fiat currency is, it is a currency that is backed only by decree and no tangible asset or wealth. It is often said that the U.S. dollar is backed by “The full faith and credit of the United Statesâ€. Unfortunately, the rest of the countries in the world are losing their faith in the United States, and the credit of the United States has been downgraded and it is on shaky ground at best. If you are considering buying gold coins or gold bars, perhaps the current state of affairs regarding the United States economy and the precarious position of the U.S. dollar is your reason or catalyst for diversifying out of financial and banking products and into tangible currency metals such as gold and silver.

Before you commit to a gold or silver trade please take a few moments to continue reading this article-blog, or better yet, reach out to an ITM Trading representative to discuss in-depth the different ways you can participate in the physical gold and silver market.

They Will Never Get My Gold!

In the past, as I stated before, rare and unusual gold coins have been exempted from gold confiscation. However, these rare coins cost more than generic gold bars and common gold coins, and for this reason alone there are those that will not even entertain the notion of buying and holding rare gold coins and numismatic gold coins. Sometimes these people try to convince themselves that there will never be another gold confiscation in the United States, or that if there is, they will hide their gold coin hoard and die defending it if necessary.

To summarize the “teeth†in Executive Order 6102, Americans were faced with a fine of $10,000 (about 500 ounces of gold at the time) AND / OR 10 years in prison if they were convicted of failing to follow the government decree issued solely by one man, Franklin Delano Roosevelt, who had been in office for only a very short period of time. While history shows that very, very few Americans were ever prosecuted or convicted for not turning in their gold coin holdings back in the 1930’s, we know that the 1930’s was a different era, and the nation was more unified and the average American was more trusting and perhaps obedient than the average American of today is.

New to gold? Get A Free Guide To Gold Investing Delivered To Your Home

What Would A Modern Gold Confiscation Look Like?

“Will Gold Be Confiscated Again?â€, we began discussing gold confiscation in practice, and the penalties for not turning in your gold coins and gold bars if the government demands you do so. Perhaps back in 1933, the threat of fines and / or incarceration was enough to get the average American to comply and trade their beautiful gold coins for the new “Greenback†or Federal Reserve Note that we still use today. Perhaps one reason that the modern-day American would or will be much less cooperative during a new gold confiscation is that the U.S. government was extremely deceptive and underhanded during the last gold confiscation, let me explain…

What Happened Last Night? Why Am I Broke?

During the gold confiscation of 1933 as ordered by Executive Order 6102, Americans were told that they would be justly compensated for the gold coins they turned into the banks, and many Americans believed this and cooperated only to find out that the government had a rotten trick already planned and placed “up the sleeve†so to speak. When the government felt that they had enough of the gold coins confiscated, the raised the official price of gold from just over $20.00 an ounce to $35.00 an ounce. This move effectively cut the purchasing power of the new paper currency by a very large percentage – 50% to 75% depending on the markets – overnight! Today’s savvy American will remember this bit of history and perhaps be rather reluctant to voluntarily conform and comply with a new gold confiscation. However, those that held their gold back in 1933 saw the relative value of their gold increase by 75% overnight! This fact alone can be taken as a strong argument for owning rare gold coins and graded numismatic gold coins should another gold confiscation occur. After all, sitting on rare gold coins would be much easier during a confiscation than hiding or trying to sell gold coins that the government has ordered you to turn in, wouldn’t it? We’re Not In 1933 Kansas Anymore Toto… Perhaps the biggest difference between 1933 and modern America is the amount of information that is available and being collected on financial transactions. It used to be that perhaps your neighbor or local banker was the only one privy to your financial history or statistics. Today that is no longer the case. Every debit and credit transaction is logged. Banking and credit histories are extremely detailed and very accessible to anyone willing to pay to access it, legally or illegally. Government agencies and private entities alike collect millions and millions of records of financial transactions daily. In short, their is very little financial privacy left, and soon there may be even less. Rare gold coins and graded numismatic gold coins, however, still offer a very fair amount of financial privacy.

To discuss this, please call an ITM Trading representative at 1.888.OWN.GOLD.

Could Gold Confiscation Happen Again?

What a new confiscation of gold coins and gold bars may look like, and earlier parts of this article-blog made a substantive case for why another gold confiscation may be deemed necessary in the United States. Part two of this article-blog offered a snippet from a recent Jim Rickards radio interview, and now I will share some more of Jim’s insights from the interview and where he sees things headed.

Jim:…And – I like to when I summarize it – you know my friends in Washington and I say the President has the power to enact a seize, freeze and not say please. Meaning he can just seize any asset, freeze any bank account say “we’ll get back to you later on compensation if there is going to be any.†And by the way, this is what they use in this financial war with Russia. When the Treasury issued sanctions today – freezing the assets of Igor Sczcsen, that’s – he’s the guy behind Putin. They used this International Economic Powers Act. They can use that whenever they want and they can use it against Americans if, if they deem the circumstances warrant it. So, the President already has dictatorial powers in financial space – he just has to decide when to use them so of course I’m sure you’ve had other guests on talking about that. Militarization of the police I mean you see the local police force

George: Â uh hum.

Jim:Â They look like — well they are SWAT teams and not just specialized big city SWAT teams but now your average small town now has probably got an armored personnel carrier, you know, body armor, flash-bang grenades.

George:Soon they’ll have drones.

Jim: Drones, night vision goggles, you name it to arrest, you know, somebody for jay-walking. Well combine that with these statutory powers I’m talking about with money riots when the system breaks down and that is a recipe for Neo-fascism and I don’t think it’s that far away.

So What Is Going To Happen?

There is no way of knowing for sure how things will play out regarding the American economy, the U.S. dollar, and a potential gold confiscation, but we have all heard the old adages “History repeats itself†and “Those that don’t study history are doomed to repeat it.†If you would like to discuss owning rare gold coins and graded numismatic gold coins, there is a team of highly educated professionals at ITM Trading

waiting to take your call. Now is a great time to own gold, and if you have not yet diversified out of fiat currency banking and investment products, then your opportunity to do so may be passing. If you would like to hear more of what Jim Rickards has to say about Gold and the dollar cycle, you can listen to Craig Griffin, President and Founder of ITM Trading, interview Jim Rickards by following this link.

Avoid Common Gold Buying Mistakes

Get A Free Guide To Gold Investing Delivered To Your Home