THE GLOBAL TRIGGER: Are Trade Wars Just a Cover? by Lynette Zang

Everyone wants to maintain a certain standard of living. If your income rises at the same rate of inflation, no problem. But if it doesn’t, debt can make up for the short fall, at least as long as you can accumulate more debt. But what happens when no one will lend to you anymore? That is where we are in the current financial system.

How to Justify Rapidly Rising Inflation

War is ALWAYS a component of a money standard shift because it justifies inflation and hides the shift. Since this is a repeatable pattern, I’m wondering if this “Trade War†is THE war that will be used as a cover for the hyperinflation that will be used to justify the shift into the new cashless fiat financial system.

Main street media talks about what tariffs the US are putting on its allies; Canada, Mexico, European Union, China and then what retaliation tariffs are being put on the US, as if this is purely a political issue, and certainly, it may be. But if you step back and look at the hyperinflationary debt money creation that has pushed the fiat markets into the most expensive markets in history, an alternative picture begins to emerge.

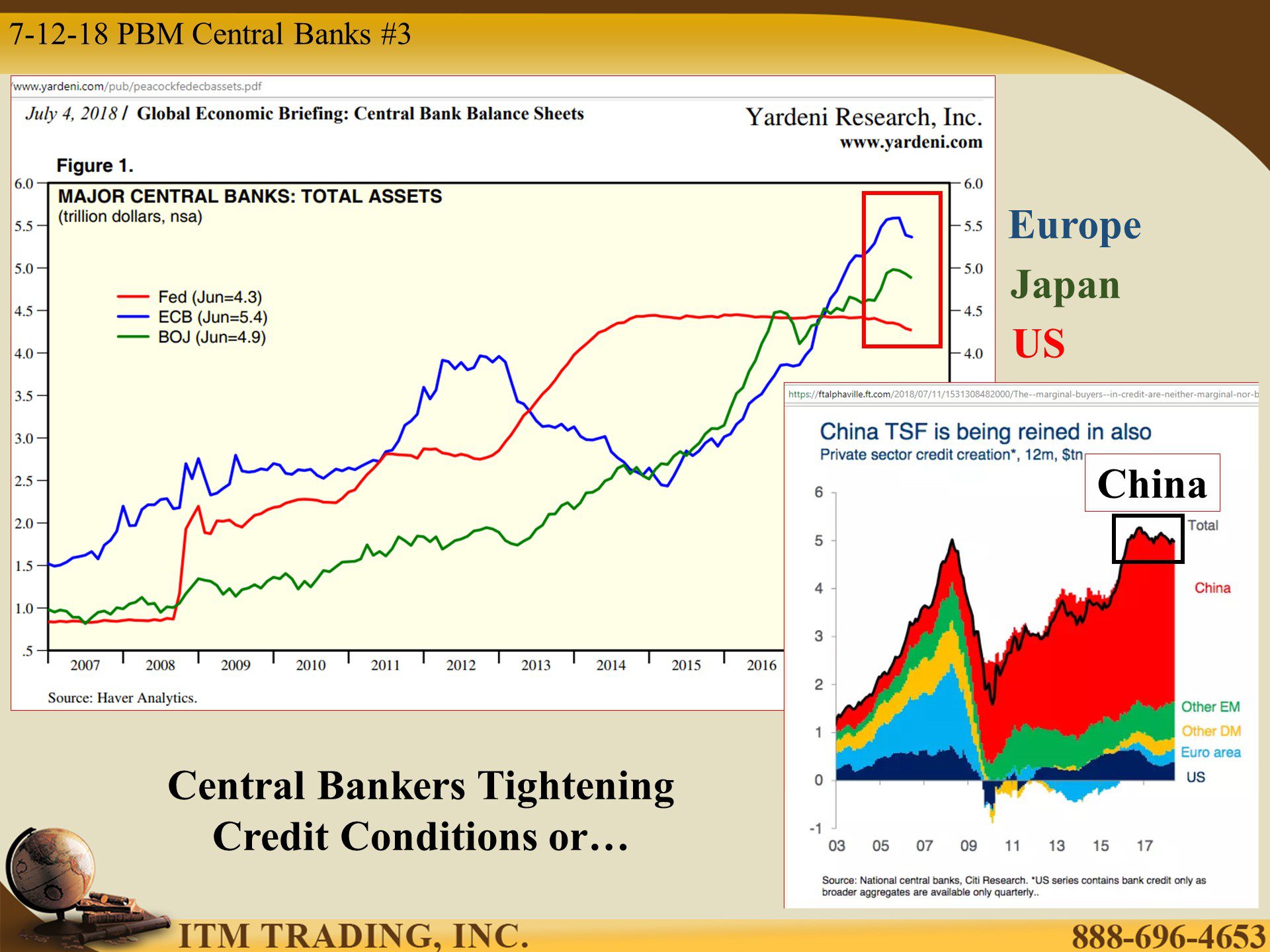

The debt/credit bubble has begun to pop. Perhaps that has something to do with central bankers attempts to reduce the size of their balance sheets. Since they were the biggest buyers supporting and pushing up the fiat markets, if they’re no longer buying as heavily, this would impact those markets.

And who would step into that role? It would seem as if the corporate windfall brought about by tax law changes would do it, and with the increased public selling, at least so far, corporate share buybacks with tax and repatriation windfalls have prevented a catastrophic market implosion. But there is still that massive debt overhang created when rates were near zero that must be serviced.

We all know that debt service must come from savings, income or more debt. While many corporations rolled over higher cost debt into lower cost debt, rather than maintaining the same level of debt, most took on a lot more debt while low interest rates kept their payments the same. But interest rates have been rising since mid-2016 and so have their debt service payments, making it harder to take on or roll over new debt.

In addition, as corporate profits explode, rather than paying off debt, that money is being paid out in the form of bonuses, dividends and stock buybacks.

Why Should I Care?

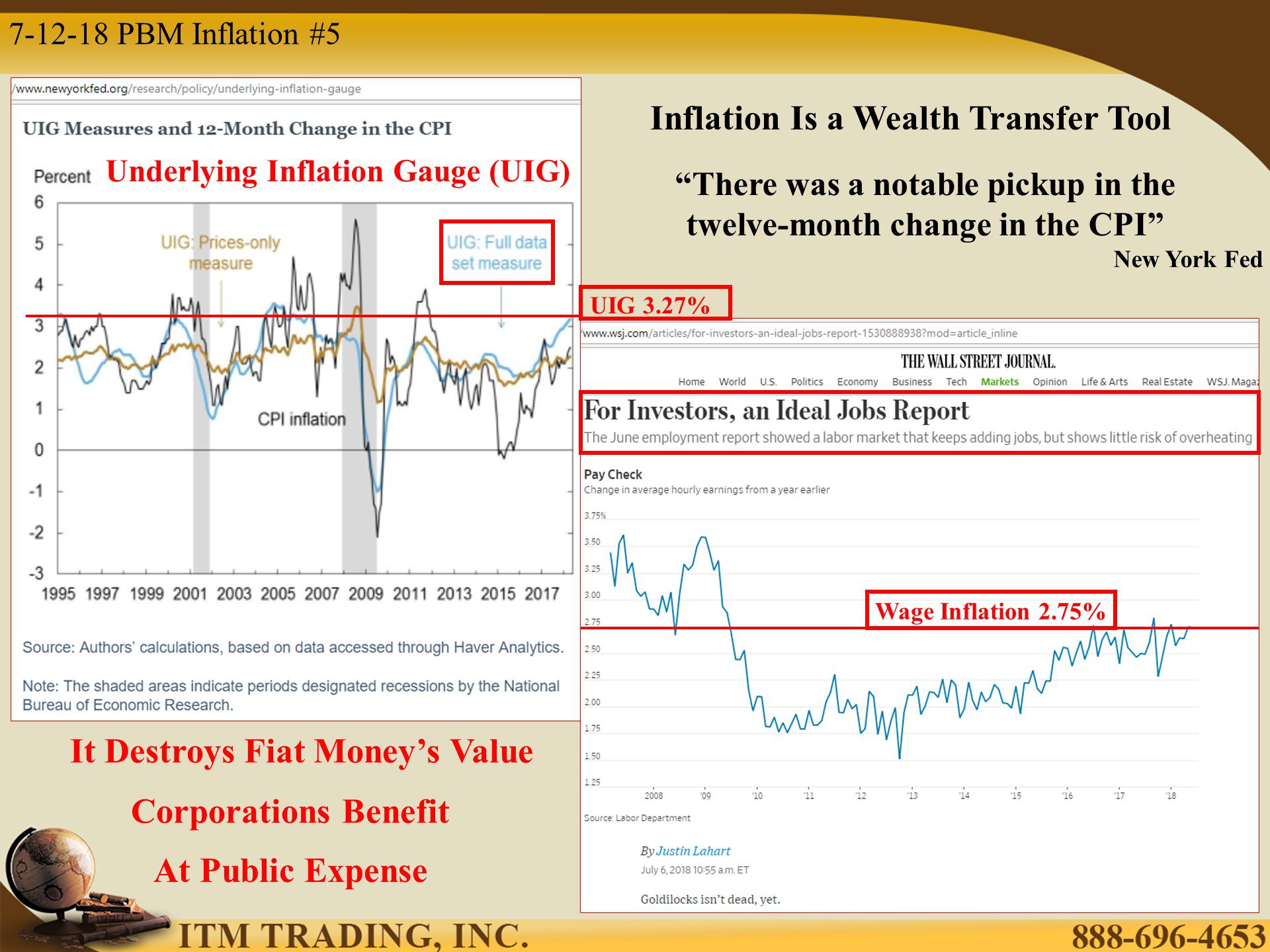

Because the global financial system, of which you are a part, is based on constantly compounding debt and the repayment of that debt with fiat currency that has less value. For governments and corporations, that is the beauty of inflation.

If central banks can control the rate and speed of inflation at the 2% target level, the loss of value happens slowly, hence the US dollar has lost 96.11% of its value over 105 years but the public does not lose confidence in the system.

However, if the inflation rises faster, it is more noticeable.

Public confidence in governments and banks has been waning for years. If inflation rises too quickly, the bit of remaining confidence in the system is likely to be lost. Unless that inflation can be justified.

That’s where the trade wars, that inflate prices rapidly, can be used to justify a rise in prices and, perhaps, maintain public confidence in a bloated system. If you have confidence, you hold most wealth in the system rather than converting fiat into real money, gold and silver.

And just as inflation hides the true value of fiat money, intangible fiat products are used to hide gold and silvers true value from the public. At least until it is time for the big reveal…the reset.

Now you know the truth, what will you do about it?

Slides and Links:

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://stockcharts.com/h-sc/ui

https://www.wsj.com/articles/u-s-inflation-hits-six-year-high-in-may-1530278981

https://www.wsj.com/articles/for-investors-an-ideal-jobs-report-1530888938?mod=article_inline

https://www.newyorkfed.org/research/policy/underlying-inflation-gauge

https://www.bis.org/banking/balsheet/statofacc180531.pdf

https://www.occ.gov/topics/capital-markets/financial-markets-derivatives/dq118.pdf