GLOBAL CONTROL: Or Social Revolution, The Choice Is Yours

Everyone Wants to Know: Will those that hold physical gold be those that hold the power of real money as the fiat money financial system collapses?

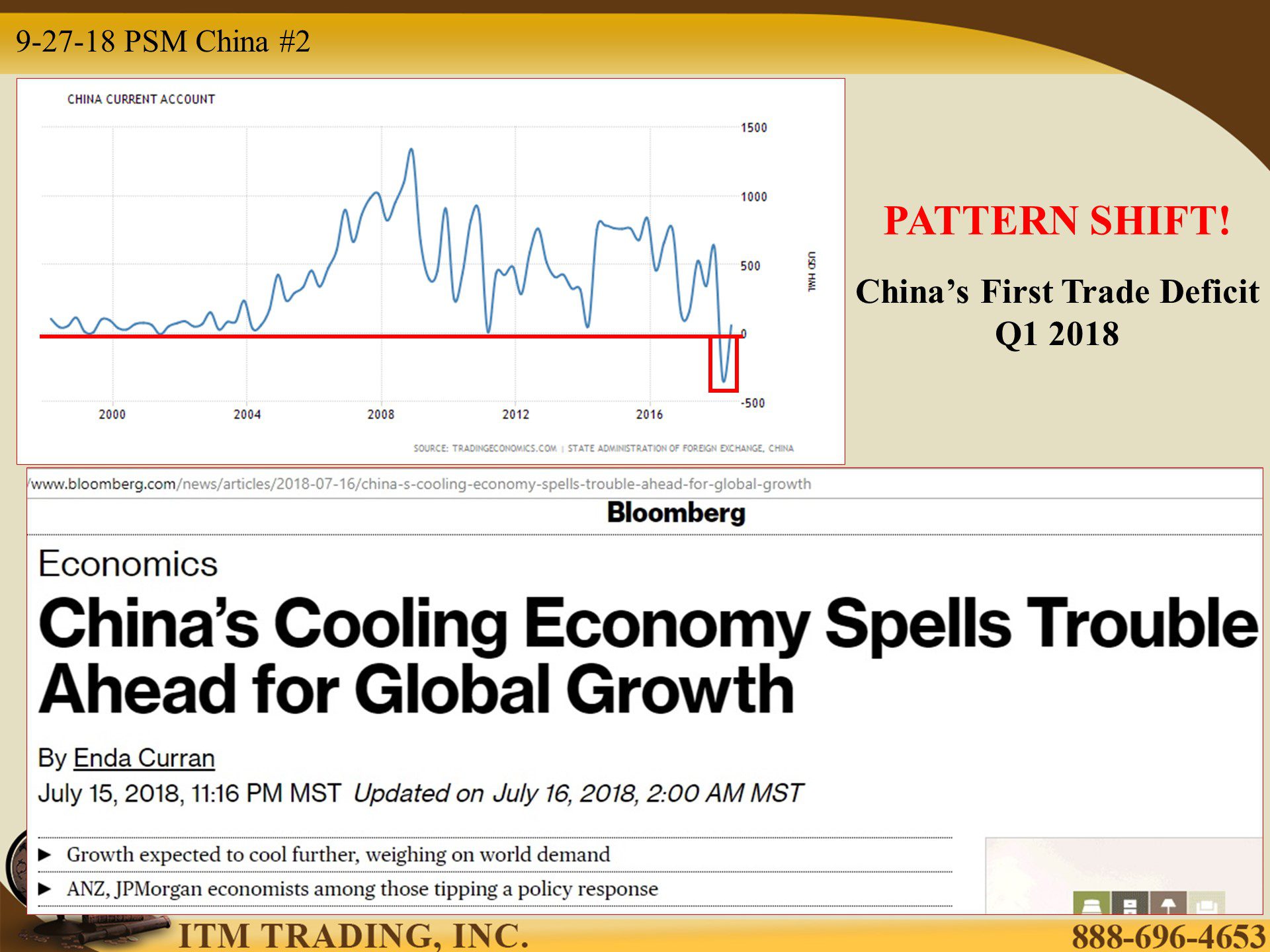

On September 24th the trade war between the US and China escalated, as the US levied an additional $200 billion in tariffs on Chinese imports. Of course, China retaliated. The IMF and BIS sees growing danger on the horizon, but neither country seems to see much impact from the tariffs yet, with both sides claiming the ability of its citizens to absorb the most price pain.

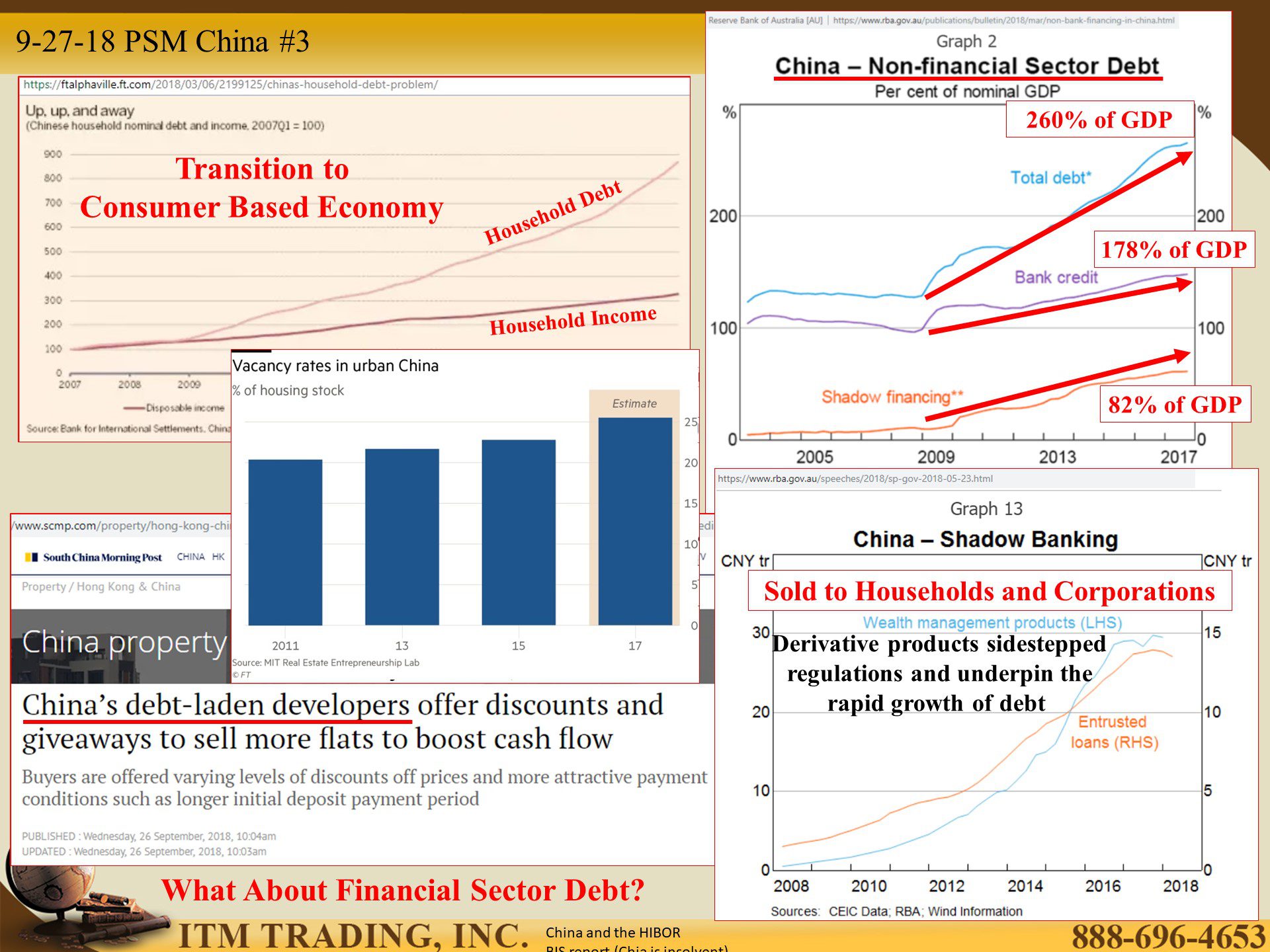

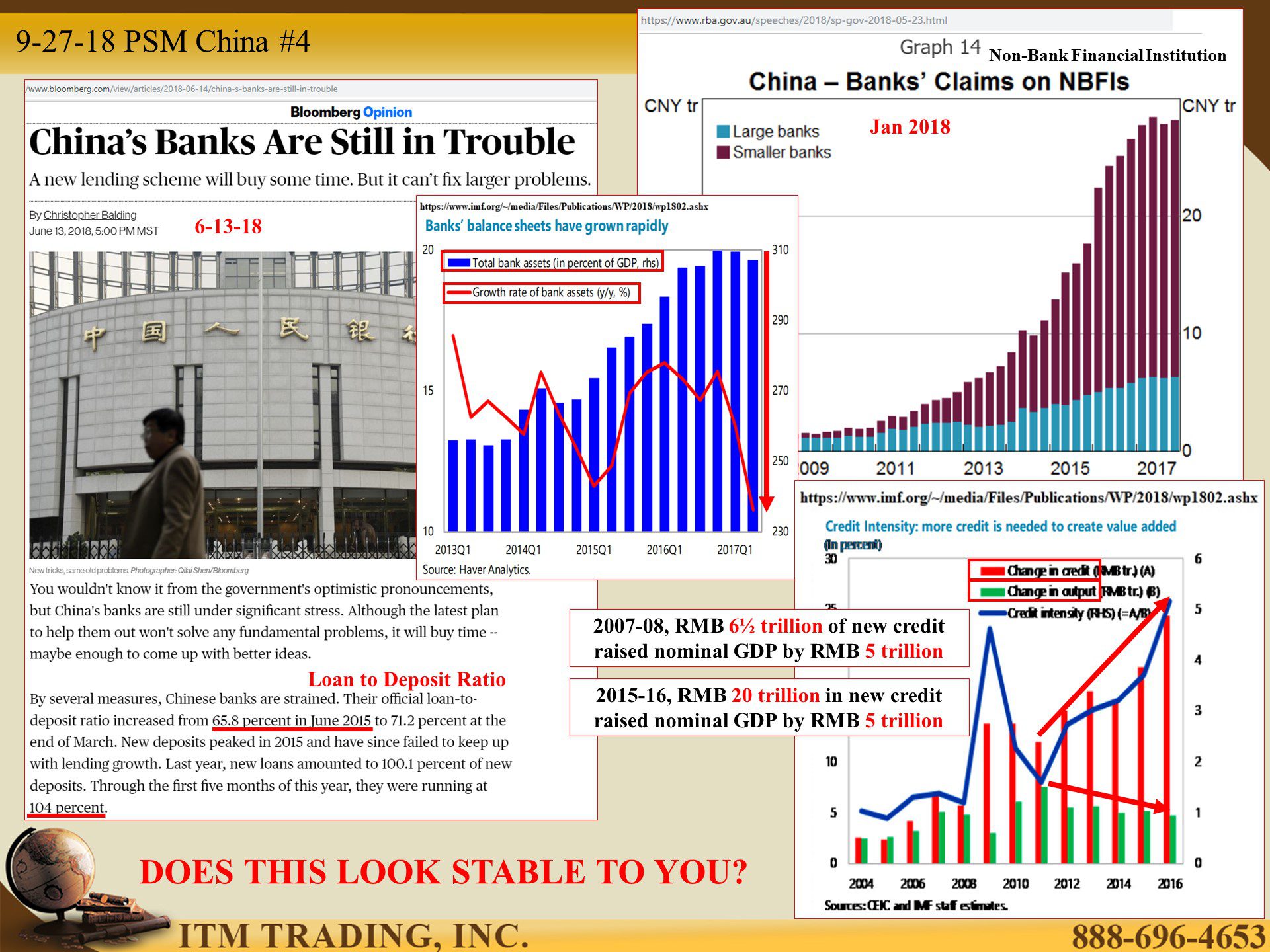

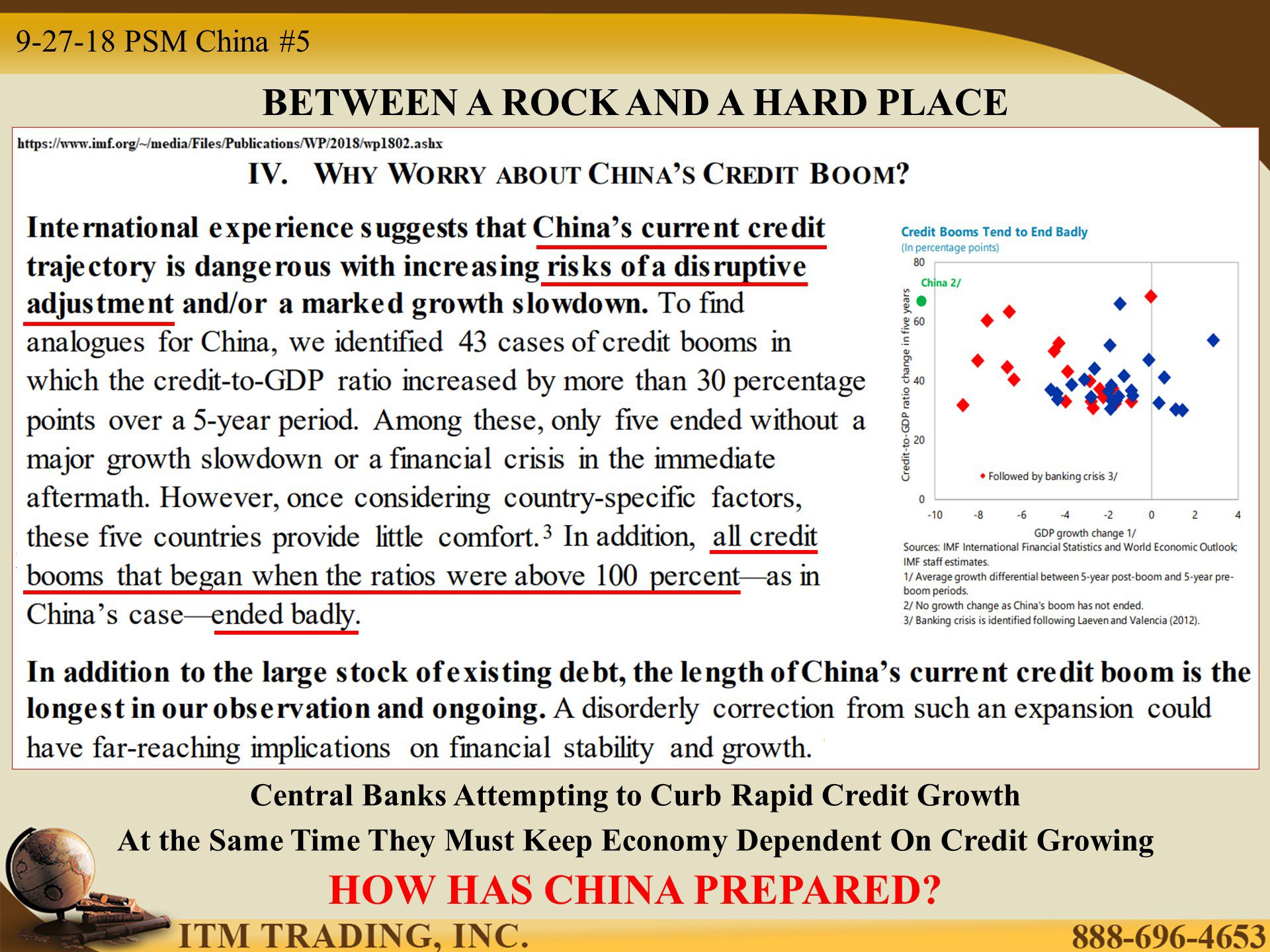

The danger the two most important banks in the world see is far deeper than just a cooling global economy, as witnessed by the first trade deficits in China’s history. Or even the bursting of the biggest debt bubble in history. It’s the social unrest these events would unleash that threatens their sovereignty over the global financial system.

They know they’ve used up the control tools created at the start of this fiat experiment; Interest rates that control the cost of credit and level of debt and therefore, the rate and speed of inflation (loss of value in the fiat money) with the US dollar’s official value under 4 cents in purchasing power out of the original 100.

They know the system must reset into a new system. They’ve done it successfully before and managed to remain in power, in 1913 and again in 1971. Will this time be the same? Will this time be different?

The stated goal is for the SDR to be the Worlds Reserve Currency, with China as the global economic power. One thing we know about China is that they are strategic and patient. They also were the original creators of paper money and know the value of gold as a store of value (savings).

That’s why, in 1949 when the communists came into power, they confiscated gold to consolidate government power. The ban was lifted in 2003 with citizens encouraged to accumulate gold, though the Chinese gold market remains under the tight control of the government.

In this way, China, as a whole (citizens and government), have been able to accumulate an unknowable amount of real money, physical gold.

This real wealth savings would come in quite handy in jump starting the next leading global economy because they would have the ability to buy global assets cheaply.

At the same time, power was consolidated, and surveillance programs were put in place to control their citizens, (though this is a global trend).

Was this strategic positioning for the shift in power from the US to China?

But what happens to public psyche when the middle class is plunged into abject poverty? Social unrest that threatens the sovereignty of the current power regime, even in China.

Can the current global power regime maintain enough public trust and confidence to remain in power on the other side of the financial system reset?

Will China’s control experiment be successful and become the global blue print to maintain power inside of the global financial system collapse and reset?

The big question is this: Will those that hold physical gold be those that hold the power of real money as the fiat money financial system collapses?

Our research says…YES!

https://www.bbc.com/news/business-45622075

https://www.rba.gov.au/publications/bulletin/2018/mar/non-bank-financing-in-china.html

https://ftalphaville.ft.com/2018/03/06/2199125/chinas-household-debt-problem/

https://www.rba.gov.au/speeches/2018/sp-gov-2018-05-23.html

https://www.imf.org/~/media/files/publications/WP/2018/wp1802.ashx

https://www.ft.com/content/fc825300-7e44-11e6-8e50-8ec15fb462f4

http://news.goldseek.com/GoldSeek/1516111380.php

YouTube

9-27-18 PSM GLOBAL CONTROL: Or Social Revolution, The Choice Is Yours by Lynette Zang

On September 24th the trade war between the US and China escalated. The IMF and BIS sees growing danger on the horizon, but neither country seems to see much impact from the tariffs yet, with both sides claiming the ability of its citizens to absorb the most price pain.

Could the trade wars pop the global debt bubble and force the financial system reset?

What happens to public psyche when the middle class is plunged into abject poverty? Social unrest that threatens the sovereignty of the current power regime.

Can the current global power regime maintain enough public trust and confidence to remain in power on the other side of the financial system reset?

Everyone Wants to Know: Will those that hold physical gold be those that hold the power of real money as the fiat money financial system collapses?