GLD vs. Physical Gold

In the simplest way to differentiate the two, GLD is paper gold that says you own a percentage of gold held in a trust, like a stock; Physical Gold is tangible, you hold it in your hand and own 100%.

By: Lynette Zang

One should always use the right tool for the job, so the first thing you need to do is establish your goals, only then will you know what is right for you.

Here is the prospectus for GLD, the first gold ETF:Â http://www.spdrgoldshares.com/media/GLD/file/SPDRGoldTrustProspectus.pdf

GLD is an ETF (exchange traded fund) and trades on the stock exchange, making it an easy way for stock brokers to put clients into gold since it they don’t typically have access to the physical gold market. As a short-term trade on price speculation GLD might work great. It is easy to enter and exit the market quickly (like a stock trade), making it easy to trade. But there are challenges with GLD as a long term hold.

GLD was established to trade as if it represents 1/10 ounce of gold, but they sell off some of their gold holdings to meet management and marketing expenses. This quote is from page 4 of the prospectus. “In order to pay the Trust’s expenses, the Trustee sells gold held by the Trust on an as-needed basis.†And on page 7, “the amount of gold represented by each Share has gradually declined over time.â€Â Therefore, it is a diminishing asset.

The longer you hold GLD the less gold your share represents. This has been reflected in the gap between the value of GLD vs. the spot price of gold. So for a short term trade, that might work OK, but this is a currency lifecycle issue and therefore, requires a long term view. That is why I believe physical gold and silver in your possession are a much better choice.

To see the effect of the “diminishing asset†so far, see the chart below.

Notice that when GLD (blue line) first came out in 2004 and up until mid 2005, GLD traded exactly with the gold spot price (red line). After that time, there was a small but definite change and over time that difference has grown wider and wider as witnessed by the ease in viewing both the red line of the spot market and the blue line of GLD today.

As of November 11, 2011, (page 9) “When the seven year fee reduction period terminates or expires, the estimated ordinary expenses payable by the Trust may increase, thus reducing the NAV (net asset value) of the Trust more rapidly and adversely affecting an investment in the Shares.â€

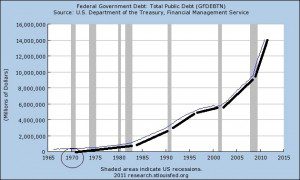

Without exception, no fiat currency system (not backed by any store of value) has ever survived the test of time. These fiat currencies are supported by the “Full Faith and Credit†of the government, in other words, a governments’ ability to grow more debt. The primary function of gold for governments is to deal with all of the debt they are growing (look at the chart below to see how the debt has grown in the US).

There are many indications that governments are beginning to lose the ability to grow more debt. Look at what has been occurring lately, governments requiring bailouts, quantitative easing, etc.

Historically, during currency crises, paper money and paper assets of any kind, do not help you, but physical gold and silver do. Because they are the primary and secondary currency metals that maintain your ability to purchase the same goods and services over time. They rise in terms of fiat currencies while fiat currencies fall in terms of purchasing power. This is why those governments have been net buyers of gold since 2009. And they do it in physical form. Shouldn’t you?

You must always establish your goals first. After that you need to find the right tool for the job. If your goal is a short-term trade, GLD is likely to be a reasonable choice. In addition, it may be the only way to approach the gold market in some 401Ks or other retirement vehicles (you can do physical bullion in IRA’s). Just understand that over time the amount of gold in the trust is diminishing.

But if you are looking to protect your purchasing power, hedge against the transfer of wealth through long-term inflation and do it in privacy with you in control, the best way in my opinion, is with physical silver and physical gold.