Friday Market Update 9/30/2011

By: Lynette Zang

I’m sorry to say this, but it appears that we are about to enter a new recession, though many think the old one never ended. This morning Lakshman Achuthan of Economic Cycle Research Institute, who is absolutely brilliant, announced on CNBC that there is a situation whereby 100% of the leading economic indicators are saying that we are heading into a new recession. For the past 20 years ECRI’s track record has been impeccable. Achuthan further said that even if some shock is averted we are headed into recession, and if there is a shock the recession will be much worse than the last one. (See the interview here http://www.businesscycle.com/#)

But we are still feeling the results of the old recession as witnessed by the peaceful protest “Occupy Wall Street,†which has finished its second week and has drawn hundreds protestors in front of the New York Stock Exchange.

St. Louis Federal Reserve president, James Bullard said “Should economic performance deteriorate, monetary policy will respond.†With interest rates near zero, Bullard said the Fed can support the economy through creating inflation, which he calls a “potent tool.†So I suppose we are in for another round of money printing, which is not a good thing for savers or those living on a fixed income.

Europe continues to capture headlines and create turmoil in the markets as inflation hits a 3 year high. Germany, Estonia and Cyprus approve an expanded role for a Eurozone bailout fund, which is simply a continuation of the transfer of risk from the private banking systems to the taxpayers. Some German officials want the private banks to take more of a loss, but the overruling driving force is preventing a Greek default. So the next most likely outcome is to give them the second round of funding. But since they are not meeting the fiscal requirements laid out with the first round of “bailouts†and in efforts to show the ECB (European Central Bank) that they are serious, the Greek parliament voted to approve the new property tax on top of all the other austerity measures they are currently enduring. http://www.ft.com/intl/cms/s/0/b795bf5a-eab7-11e0-ac18-00144feab49a.html#axzz1ZSjKDzC2

It seems like every week there are more government debt downgrades. New Zealand lost its top credit rating at Standard & Poor’s and Fitch Ratings, the first Asia- Pacific nation in a decade to have its local-currency debt cut from AAA. As a result government bond yields rose by the most this year.

So let’s see how the markets are taking all of this news. The third quarter’s 12 percent stock market decline is the worst since the depths of the financial crisis, and the extreme volatility is likely to continue. The Dow lost 1500 points in this last quarter making this the worst performing quarter since 2008.

The following chart indicates a continued deterioration in the stock market. Notice the increase in volume during this sell-off.

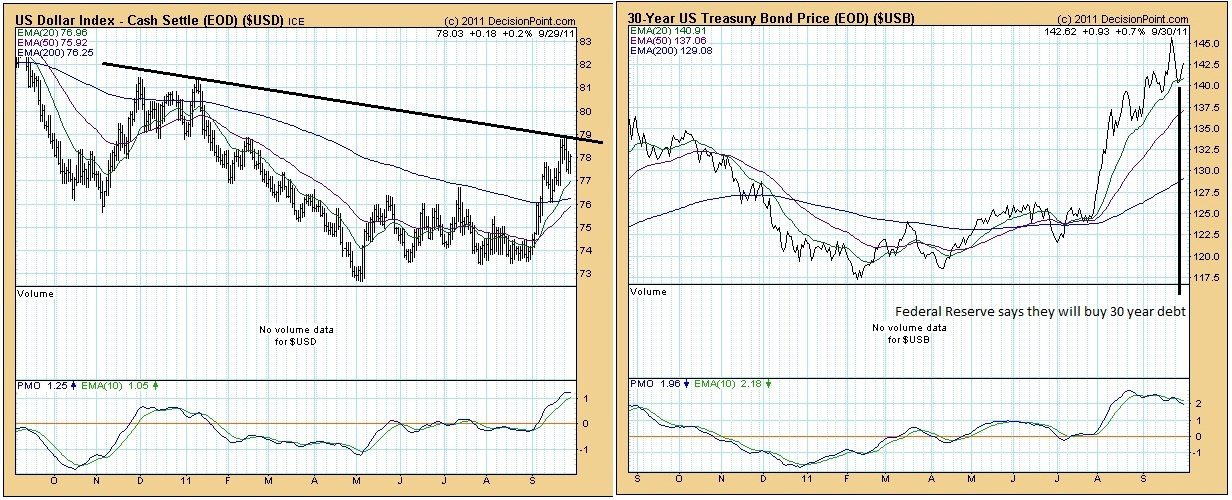

Since wealth never disappears, it merely shifts location, let’s see where the sell-off in stocks flowed into. The following charts show you the continued flight to safety into traditional instruments. The US dollar and the Treasury (bond) markets capture the wealth that is fleeing the stock markets. That will change as the markets digest the truth, that fiat currencies and bonds are both pure debt instruments and that the problem is too much debt. But for now the markets continue to use these two asset classes as a safe haven, thus we will call this the “Habit Trade.†Traders pushed more funds into long-term bonds when the Federal Reserve announced their intentions to buy the 30 year bonds. Thank you Bennie and the Feds.

This week the Shanghi Exchange raised the margin requirements on gold which put pressure on the price of the spot gold market. That makes 3 margin increases over the past month. Since spot is primarily a digital market, it is easier to control with a change in requirements and/or a push of a button. In addition, with the stock markets dropping so dramatically, gold is used as a “liquidity trade†when traders need to come up with cash to meet margin calls.

Let’s look at the following chart. Spot gold remains stubbornly above the 200 day moving average by 4%, working off all of the overbought froth, and is now testing a bottom support level. Considering everything, pretty good action and an overall excellent positive close to the quarter.

Now let’s look at the physical market. According to my favorite wholesaler, bullion coins and bars remain tied to the spot market with price action in lockstep with the spot market and normal premiums above spot intact. But delivery on gold bullion shifted this past week as short sellers (those that sold gold they didn’t own) scrambled to cover (buy gold) their positions and take advantage of the price drop. At this time, delivery on coins is 2 weeks out and gold bars are 1 month out. Delivery on silver is worse, silver American Eagles are 2 weeks out but other 1 ounce coins and bars are at least a month out for delivery and I’m told that 90% bags are getting harder to come by.

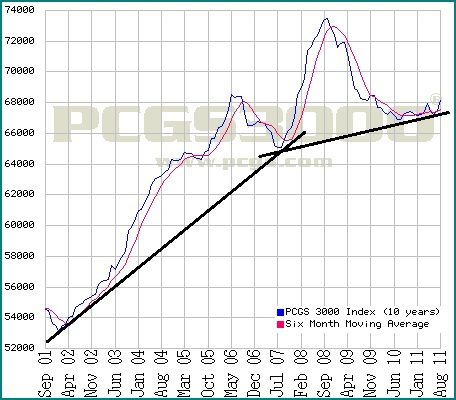

The following chart reflects the numismatic growth coins. You can see that at this time the “liquidity trade†in the spot market is not reflected in the current price action of the numismatic coins. The numismatic coins remain in a positive trend, with higher and higher lows, even though we have been experiencing a correction. You might also notice that the moving average (red line) in now moving quite nicely upward, which is positive and very good action.

And so closes another interesting week in the markets. One of my wonderful clients shared a quote with me that I would like to pass on. “Patience is sustained courage.â€