Friday Market Update 9/2/2011

This week’s wrap up:

By: Lynette Zang

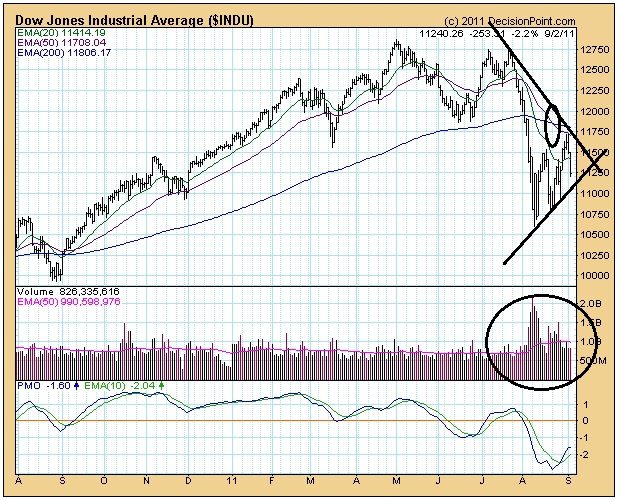

The Dow began the week at 11,254.44 and ended at 11,240.26, so while there were lots of gyrations during the week the market finished basically flat. You can, however, see a clear wedge formation occurring, with a series of higher lows and lower highs. (See the chart below) We’ll probably know by the end of next week, if we’ll get a breakout above or a breakdown below. I’ll let you know. Having said this, next week there are some very important meetings happening in Europe and these meetings are certain to have a very large impact on the global markets.

Senator Corker just wishes that everyone would stop paying attention to Washington. He blames the very visible debt ceiling debate for consumer sentiment coming in at the lowest levels since April 2009. Business sentiment is also at extremely low levels as shown by only 17,000 jobs being created in August, which was basically no job creation, which has not happened since WWII. Jobless claims (unemployment) remained flat and officially, the unemployment rate remains at 9.1%.

Speaking of debt and since currencies are created from debt, let’s look at the US Dollar index below:

The US Dollar began the week at 73.73 against the standard weighted basket of other fiat currencies. It ended the week at 74.48, up just a few basis points. Though up only slightly, it was enough to break out above the wedge. Monday will tell us if this move is pervasive, therefore most likely to continue up against those currencies, but I would bet yes. (putting my technical neck on the line)

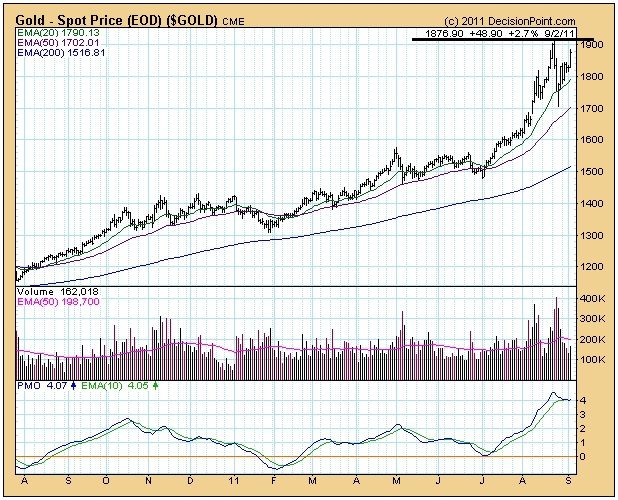

Now let’s see how the dollar did against the primary currency metal, gold. Last Monday gold opened at $1,797.30 and closed today at $1,876.90 up 4.43% on the week. The daily swings are amazing to watch and probably impossible to call, so if you’re looking for a pull back to get in, good luck. It is probable that the top above $1,900 will be tested next week. It is also possible to have a new breakout on our way to $2,000. We are now 23.74% above the 200 Day moving average, which is overbought (not overvalued), but we could certainly go higher before we get a pull back. Gold is the flight to safety asset as the markets digest the sovereign debt crisis. I will say again, sovereign debt = government bonds. The governments and central banks seem to think this is a liquidity crisis, when gold is telling them it is a solvency crisis. Sigh, when will they learn? See the chart below.

Let us not forget silver. Let’s take a look at the chart below.

Silver began the week at $40.95 and ended at 43.07, a 5% gain on the week. Silver is the secondary currency metal and is most likely to test the April highs near $50.

The banking sector continues to be a drag on the markets as the federal agency that oversees Fannie Mae and Freddie Mac is set to file suits against more than a dozen big banks. They are accusing them of misrepresenting the quality of mortgage securities and seeking billions of dollars in compensation. See a video on this here: http://video.cnbc.com/gallery/?video=3000043494

European stock markets continue under pressure with 48 out of 50 markets down sharply for the month of August. The biggest banks in Europe are promoting a bond restructuring plan for Greece in this long festering debt crisis. While the restructuring is touted to share the pain with the Greek and EU taxpayers as well as the banks, in reality, it is asking the Greek Government to give up any future bargaining power and keeping the financial pressure on the Greek taxpayer. Here’s the article

http://www.cnbc.com/id/44371597/

Additional stress is coming out of Italy and Spain with Italian and Spanish bonds selling off after the ECB bought lots of them. On September 7, the German constitutional court will be ruling on the

legality of the EU’s bail out mechanism. If they rule that it breaches Treaty law or undermines German fiscal sovereignty, it is likely to ignite challenges for the EU monetary union.

Next week is most likely to continue the volatility path, but there are some significant shifts in Europe coming to a head, so it could be a game changing week. I’m excited to see and share it with you. I am also relieved to have a nice long weekend to recoup. Please have a safe and happy holiday weekend.