Friday Market Update 9/16/2011

This week’s wrap up:

By: Lynette Zang

Sadly, the US now has the highest poverty rate ever recorded since they began tracking it back in the 1950’s. As jobless claims rose this week, unemployment continues around 9.1% and the plan is to extend unemployment benefits out to two years. Not surprisingly, retail sales were flat for the quarter.

Looks like Bennie and the Feds finally got their wish. The CPI (consumer price index) shows core inflation (no food or energy included) running at 2%. Guess that “temporary” inflation in food and energy is proving to not be so temporary, and inflation is an invisible tax on your wealth.

With a Greek Sovereign Debt (government bond) default looming and the next Greek “bailout” (transfer of risk from private banks to public taxpayers) in jeopardy, it is CENTRAL BANKS TO THE RESCUE!

European banks didn’t want to lend to each other because they weren’t sure they would get repaid. This hurt the banking stocks and the global stock markets. The central banks of Japan, Switzerland, Britain, and the US as well as Europe are committed to keeping the European Union intact, at all costs. These central banks came together to promise unlimited US dollar loans and to extend the length of time the banks can borrow, similar to what was done here through TARP. Now all of us generous taxpayers will loan those European banks money.In addition, European leaders and Treasury Secretary Tim Geithner are in meetings to discuss how to give Greece this second “bailout” even though they could not meet the criteria of the first bailout. The final result of “will they or won’t they” will be revealed next month, keeping the global markets on pins and needles until then. Of course, once that “bailout” is complete, 76% of the private banking risk will rest upon the shoulders of the taxpayers.

Also this week, French banks were down graded and the Italian 5 year government bond was forced to yield 5.5%, which is a Euro era high.

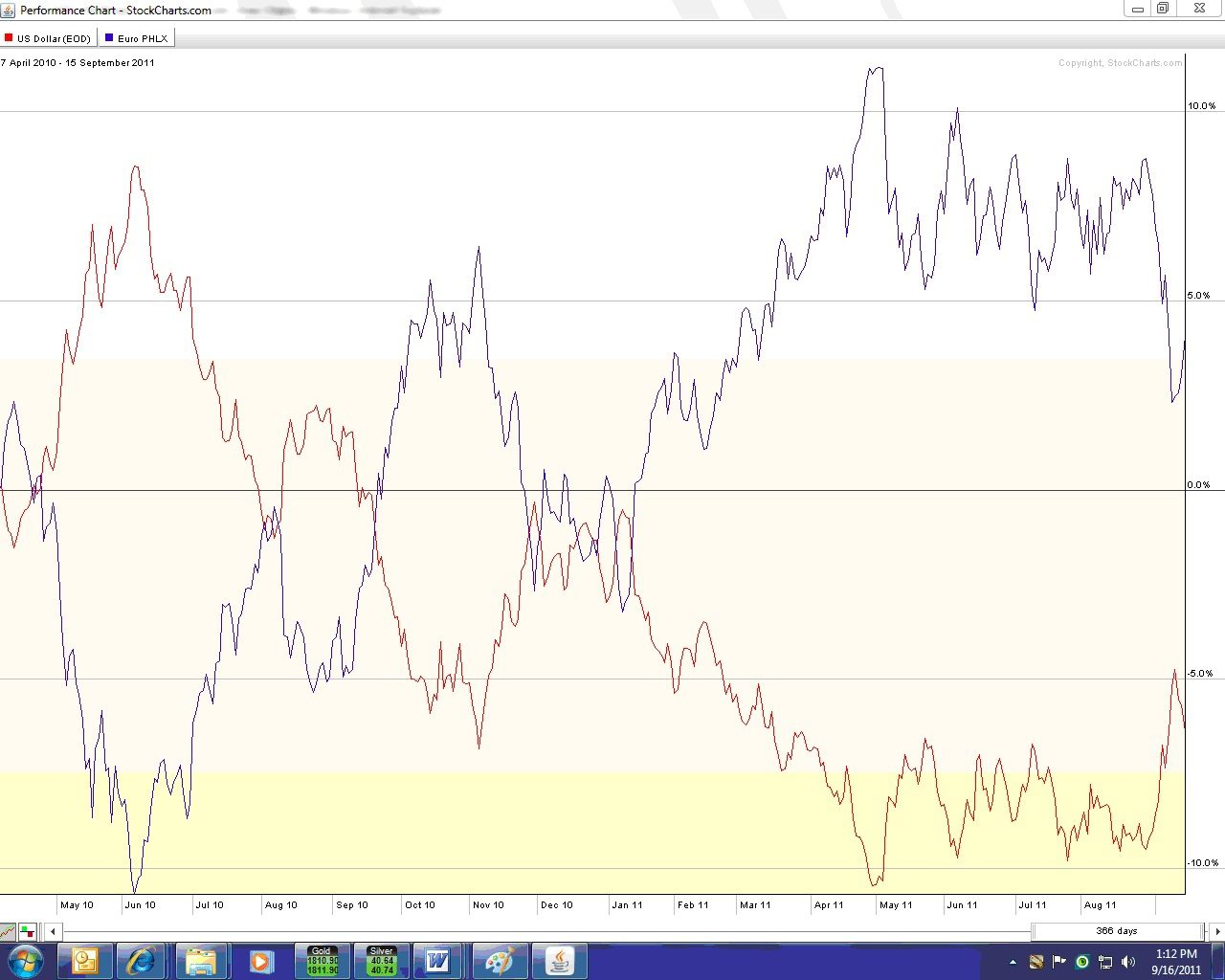

The chart below shows you the story of the US dollar versus the Euro dollar over the past year and is a relative performance chart. As you can see when the red line of the US dollar goes up, the blue line of the Euro dollar goes down. What I find interesting is how weak the US dollar is against the Euro dollar, even though the markets are focusing on the problems in Europe.

The DJIA chart below is reasonably reflective of the global markets. You can see that the Dow has broken above the wedge on the coordinated move by the central banks to postpone the problems in the European banks with unlimited US dollar loans for an extended period of time. We’ll know better next week if this is a pervasive move, but my guess is yes, since we have the central banks working together to try to calm the markets.

At the same time, let’s look at what is happening with the 10 year treasury yield with the chart below. The current direction is up. A bit of bond buying by the Federal Reserve could take care of that though and push those rates back down. In the upcoming 2 day meeting the Federal Reserve will be discussing how to stimulate the economy. With core inflation now at 2%, it will be difficult to justify QE 3 (buying our own debt because there are not enough other buyers). I’ll keep you in the loop on this one since QE has a direct impact on your purchasing power.

The chart below shows gold’s (debt free currency) continuing consolidation (foundation building) pattern. Though still a bit overbought (not over valued) at 17.5% above the 200 day moving average, buyers come in at every buying opportunity keeping gold near the higher end of the trading range (near resistance at the top) during this consolidation. I consider this very good action.

Though not as volatile a week as we’ve been experiencing lately, still it is so fascinating watching history unfold. It seems as if the only tool left for the central banks is money creation. If liquidity was the problem, I am certain they would have solved it by now with the massive amount of liquidity that has been injected into the global banking system. In my well educated opinion, it is really a problem of solvency, having the ability to repay debt. You cannot solve a problem of too much debt with more debt, duh! Unfortunately, the choices they make, impact us all. We all know that the only person we have control over is ourselves, so I suggest you get yourself out of their way by following history’s advice; Physical gold and silver held privately in your possession.