Friday Market Update 8/26/2011

This week’s wrap up:

By: Lynette Zang

Before we begin, I know we are all wishing luck and safety to every one impacted by hurricane Irene.

It appears that the Greek “bailout†is falling apart. With EU countries asking for collateral to secure additional loans to Greece, some of the questions raised would be:

1. Will this be a requirement for other EU countries requiring a “bailout�

2. What would Greece use as collateral? In the current “Austerity†package they are already required to sell assets to pay down debt. What would they have left?

3. Will Greece just say “Forget it†and do an outright default and walk away from the EU?

Greece has been forced to activate an obscure emergency fund for its banks because they are running short of collateral that is acceptable to the European Central Bank.

Funds parked in the ECB’s “deposit facility” are rising, which means they aren’t being lent between European banks (they make more interest when they do this). This is what happened during our “Credit Crisis†and possibly shows a lack of trust that the banks will have the ability to repay those loans. In addition, the cost to insure the debt of several major European banks is hitting historically high levels, even higher than during the US financial crisis that began in 2008.

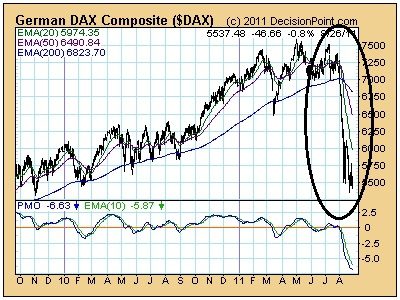

The Bundesbank is questioning the legality of the ECB purchase of Spanish and Italian debt. With Germany’s debt to GDP now at 83%, they question who will bail them out should the need arise. The chart below is the German Dax, but is very representative of all European Stock Markets. You might notice that the EMA 50 has crossed below the EMA 200 in what looks like a definitive way. We’ll give it another week to see, but this chart clearly reflects the turmoil in the European debt markets. Not pretty at all. (Chart below)

Moody’s downgraded Japan’s credit rating one notch to AA+. Their debt is over 200% of their GDP (all transactions conducted). In the same breath, (let’s see if this makes sense to you), the Japanese yen is trading at highs against many currencies and Japan is considering creating a loan fund to entice corporate investments overseas. In essence, selling yen and buying other currencies, in a move to weaken the yen and spur exports.

In miscellaneous news, Steve Jobs steps down as Apple’s CEO. Warren Buffet rides to the rescue of Bank of America, with a $5 billion dollar infusion. Ben Bernanke, speaking from Jackson Hole, said no QE3, but with GDP all but stalled they will be reviewing options in September.

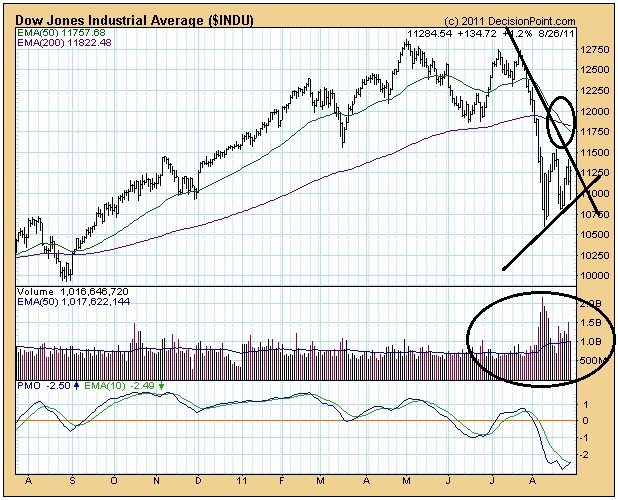

Let’s look at the DJIA chart below. Notice that the EMA 50 crossed below the EMA 200 (circled) the beginning of the week. We have to see what evolves, but if it stays this way, it is most likely going to get more negative. You might also notice the possible wedge formation, with a series of higher lows and lower highs. If this formation progresses, at some time soon, we will have either a breakdown below the wedge, or a breakout above. Let’s hope for a breakout above, which might help turn the stock market positive. Time will tell and I’ll keep you posted.

The US dollar remains range bound and for some reason, neither of the charting services that I use show today’s close, which was down 49 basis points to 73.74. While this does not signify a breakdown, it certainly shows a test of the bottom support levels as the wedge continues to evolve.

With gold sloughing off the first margin increase of 22%, the CME has again raised the margin (amount you have to put up to borrow) another 27%, pushing gold into a much needed correction for a day. Then the spot market sloughed that off as well. But the daily volatility is wild, with recent price swings between $50 and $100 almost on a daily basis. And while gold still remains overbought (not over valued) it is only 19% above the 200 Day Moving Average today, vs. 24% last week. This is a good thing. Let’s turn to the chart below.

This is one of the most interesting times to pay attention to the markets. We are watching a major paradigm shift around debt unfold and yet most people do not have a clue. We are watching the possible undoing of the Euro Dollar and people are not interested. This is amazing to me. But remember, ignorance does not make you immune, it just leaves you vulnerable. Physical gold and silver, in your possession, are the safest places to be as these events unfold. I am happy to be your guide through this once in a life time transition.