Friday Market Update 8/19/2011

This weeks wrap up:

By: Lynette Zang

Disappointing economic news around inflation (up), jobs (fewer), and manufacturing data (down) as well as the fear that the sovereign debt (government bonds) crisis in Europe is expanding, which has kept the market volatility high again this week. There was hope that France and Germany would support a common Euro Bond, but they do not. There was hope that Greece’s sovereign debt issue was put to bed for a minute or two, but it is not. And so, that paradigm shift regarding the safety of government promises to repay loans continues to be questioned and is reflected in the global stock markets which dropped an average of 2.75% today, technically expanding into bear market territory.

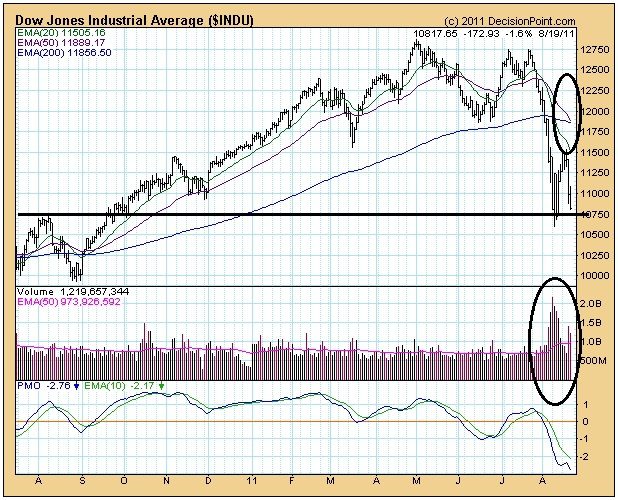

Let’s look at the Dow. Notice that the EMA 50 (purple line) is likely to cross below the EMA 200 (blue line). The EMA’s are moving averages. They remove the emotions from the markets and show you the underlying trend. I’ll do a blog on this in more detail next week, but as an indicator; when the shorter term moving average crosses below the longer term moving average it is an indication that the markets are most likely going to continue moving down. In addition, notice the spike in volume in the center of the chart. This is an indication that selling pressure has risen and there isn’t enough buying pressure underneath to support the market. The solid line just under where the market closed is showing you where technical support is. At this time the Dow is testing support. Let us hope it holds. If it doesn’t, the next support level on the Dow is 10,500, only 317 points away.

Let’s look at the dollar. You can see that the wedge is coming to conclusion. We will probably know the outcome, either a breakout above or a breakdown below, by the end of next week. I’ll talk more about it then. But remember, with the sell off in the markets today, some of that wealth shifted to cash, so today was an up day for the dollar.

Even though debt is the issue, the markets have still not fully realized that debt is the bubble. So as wealth flees the markets, some of it flows to bonds, lulling the unaware into a false sense of security. Notice the trend in the chart below.

Now onto the currency metals; first let’s look at silver. We had a breakout in silver today as you can see from the price closing above the resistance level in the chart below. The next most likely outcome is for silver to test the next resistance level up. That number is $49.00. Notice the increase in volume as the increasing 50 day moving volume average of 42,986,196 is bettered by today’s volume of 49,007,608 as the flight out of stocks and into currency metals as a safe haven escalates. Also, remember that the CME raised the margin requirements (the amount you have to put up for collateral to borrow) 7 times during the recent run up in silver. It looks like those speculators might be shaken out and silver is poised to continue its run. I’ll keep you posted.

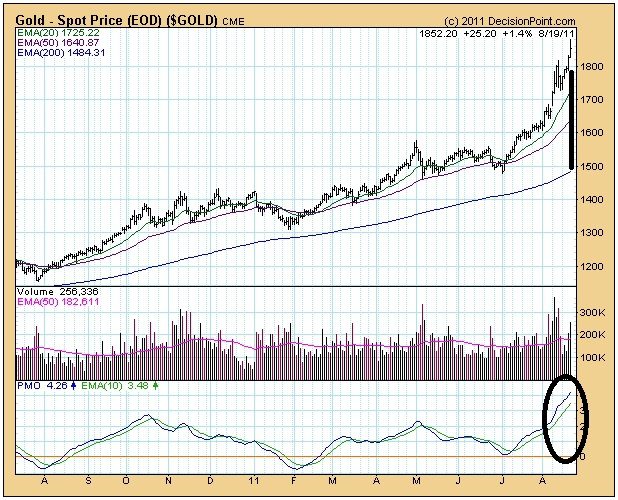

Gold is now 24.75% above the 200 day moving average (see chart below) and is technically over bought. That does not mean over valued, in fact it is extremely under valued in terms of fundamentals, it just means that it has moved up too far, too fast. In addition, volume is consistently increasing as gold’s status as a currency begins to shine once again.

When an asset enters an over bought condition, several things might happen: It can continue moving up, extending the over bought condition (the furthest away from the 200 day moving average that I have ever seen is 70%). It can pull back toward that 200 day moving average, working off the over bought condition. It can move within a trading range, giving everything a chance to catch up. Time will tell and I’ll let you know. But this is not a bubble, as many pundits would have you believe. I can say that because bubbles occur when something is over owned and over valued. Neither is the case with gold, in my opinion, it is under owned and under valued, and again in my opinion, the biggest bargain you will find.

So ends another exciting week in the markets.