Market Update 11/4/2011

Surprise, surprise, Wall Street didn’t learn a lesson from the 30 to 1 derivative leverage that brought the biggest banks to their knees in 2008. MF Global’s John Corzine, leveraged MF Global 40 to 1 (derivative leverage) and allegedly co-mingled roughly $700 million of client funds with company funds. MF Global filed for Chapter 11 on Monday and today, John Corzine resigned. Left in the wake is all of those clients whose funds and positions have been frozen since Monday. MF Global was one of the largest market makers in derivatives and until Monday, was one of twenty primary dealers of the Federal Reserve.

Hedge funds had tons of redemption calls this week, thanks in part to MF Global’s bankruptcy filing. This means that they had to come up with cash now and thanks to their gains in gold, gold was again the liquidity trade.

While we are talking about Wall Street lessons, those “too big to fail†banks now have 35% more derivative exposure than they did at the beginning of the credit crisis in 2008 when derivative default triggered the on set of the crisis. What lesson do you think they learned? In the meantime protesting has now spread to 1,700 cities and 80 countries around the world.

At least the federal government has kicked off its foreclosure review process. Consumers have the chance to get their foreclosure cases reviewed for mistakes and potential restitution. They have set up a website at www.independentforeclosurereview.com or you can call 888-952-9105.

Since we are on the topic of foreclosures, Freddie Mac is looking for an addition $6 billion from the Treasury, which was the level of loss from the most current quarter. In the meantime, Senator McCain calls on President Obama to cancel the $12.79 million in bonuses for the top 10 executives at Freddie Mac. I want that job!

Looking more globally, Europe continues to capture headlines with Greece as the single most important country in the world at this time. First Papandreou orders a referendum to allow the Greek people to vote on accepting or rejecting the bailout. Then he withdraws it. The fate of Papandreou and his government will likely be decided in a vote tonight. Either way, the goal is to take the bailout and keep the game going, with Italy and Spain getting set up for their turn in the bailout seat.

Mario Draghi became the new head of the ECB (European Central Bank) and in his first move, cut interest rates by .25% to 1.25%, which surprised the market. This potentially indicates that the ECB will start to look more like our Federal Reserve and possibly take bad debts off banks books, like we did here. In addition, by lowering the rates, it is supposed to make funding new debt cheaper. It would be nice if they realized that this is not a liquidity issue, it is a solvency issue. Really, it is all one big manipulation.

Speaking of manipulation, much has been said about China manipulating their currency, which, in my opinion, is the pot calling the kettle black since every single central bank is racing to debase their currency, isn’t that manipulation? In fact, isn’t that robbery? After all, currency devaluation (inflation) is an invisible tax on workers wealth. But I suppose it’s OK if it’s Japan since this is the second time recently that Japan has announced a planned currency devaluation and sold off Yen and bought Dollars to push down the yen.

So let’s see how the markets reacted to all the news this week.

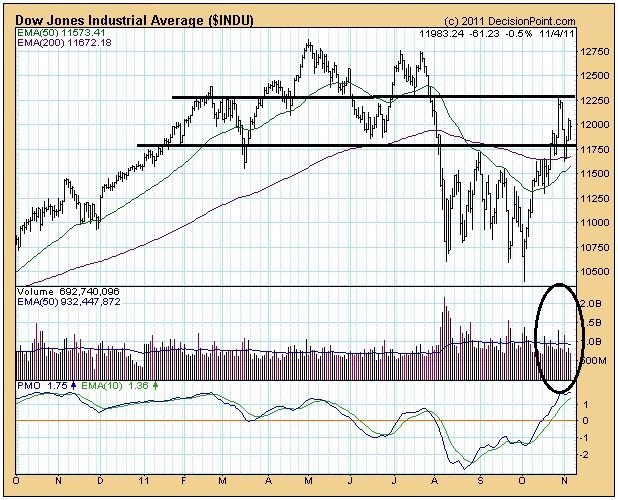

The chart below shows you that the Dow opened this week at 12,231.11 and closed at 11,983.24, so apparently the market didn’t have a great week. There is support on the Dow at roughly 11,755, so we’ll see if the markets can hold. But look at the decline in the volume. It really started to decline last week, but was likely exacerbated by those frozen accounts from MF Global clients. We’ll see how this unfolds next week.

Let’s see what the dollar did this week. You can see in the following chart that the dollar started the week at $75.04 and ended at $76.67, so all of the turmoil in Euro and the efforts of the Japanese central bank have boosted the dollar this week. Having said that, you might notice that the 50 day moving average is kissing the 200 day moving average, though it remains above it. If this move becomes pervasive, the dollar would likely move up. As it is, it seems to be stuck in a trading range in terms of other fiat currencies.

And now on to gold and silver, both physical and digital, let’s start with the spot (digital) market. The following chart shows you that the metal complex had a pretty good week. Spot gold started the week at $1,747.20 and closed at $1,756.10 and is sitting 11% ish above its 200 day moving average. Spot silver started the week at $35.28 and closed at $34.08. At this moment, its 50 day moving average is kissing its 200 day moving average, though still above it. Next week will tell us more. It is interesting to note that both the dollar and gold went up this week and silver was down a tad.

With regards to bullion, my wholesaler said that this past week has been rather confusing because of the volatility in demand, one day crazy busy and the next quite quiet. They felt that a lot of that had to do with hedge fund redemption fall out from the MF Global bankruptcy. Both gold and silver bullion availability was good this week but large silver bars are still tight.

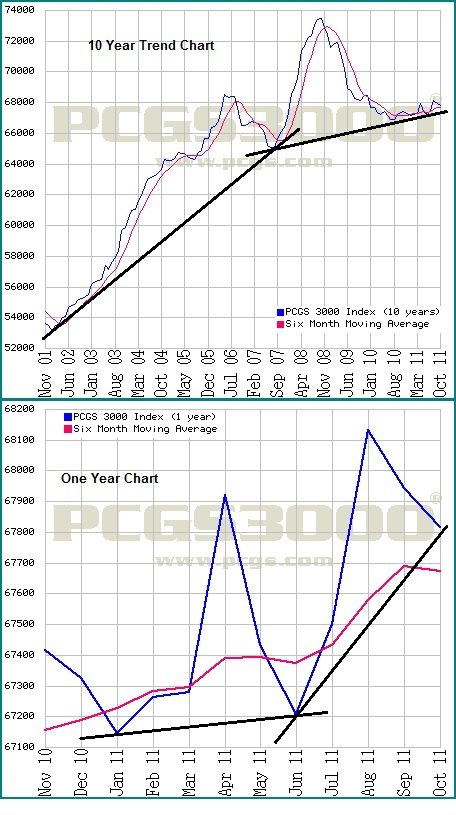

The following chart is for the numismatic market. The top chart is the 10 year trend and the bottom chart is the one year chart. You’ll notice that the 6 month trend line remains nicely in an upward direction and the current index price, remains nicely above the trend line, so while we had a tiny pull back this past week, action remains good as does availability.

And that finishes the report for this week. Be sure to check out the blog on too much debt. Those charts will open your eyes and as always, please call if you have any questions or we can be of service in any way.