FREEDOM ISN’T CONVENIENT: But it is still a choice away…

The move to cashless is not new. Bankers have been nudging us in that direction since the 1920’s. It’s just that technology is finally catching up with the dream.

WHAT ARE THE BENEFITS?

For individuals, the biggest benefit is convenience, unless of course you are one of the 1.7 billion unbanked people globally, who depend on cash for barter.

For Corporations, profits are huge benefit. Every transaction would flow through a private corporation. They would gather a fee on every transaction, but they also gather data, which is hailed as the new oil.

This data can be sold, but it can also be used as a perception management tool. Can you see how having a map of every individuals’ thought process and the resulting choices might be used to control your behavior?

Who owns personal data is currently being debated in the US, though Europe has adopted some new regulations around this issue. So has China. There, it seems the government controls (owns) everything.

For Governments, surveillance appears to be the biggest benefit. If every transaction is recorded and all fiat money is held inside the system, collecting taxes becomes much easier.

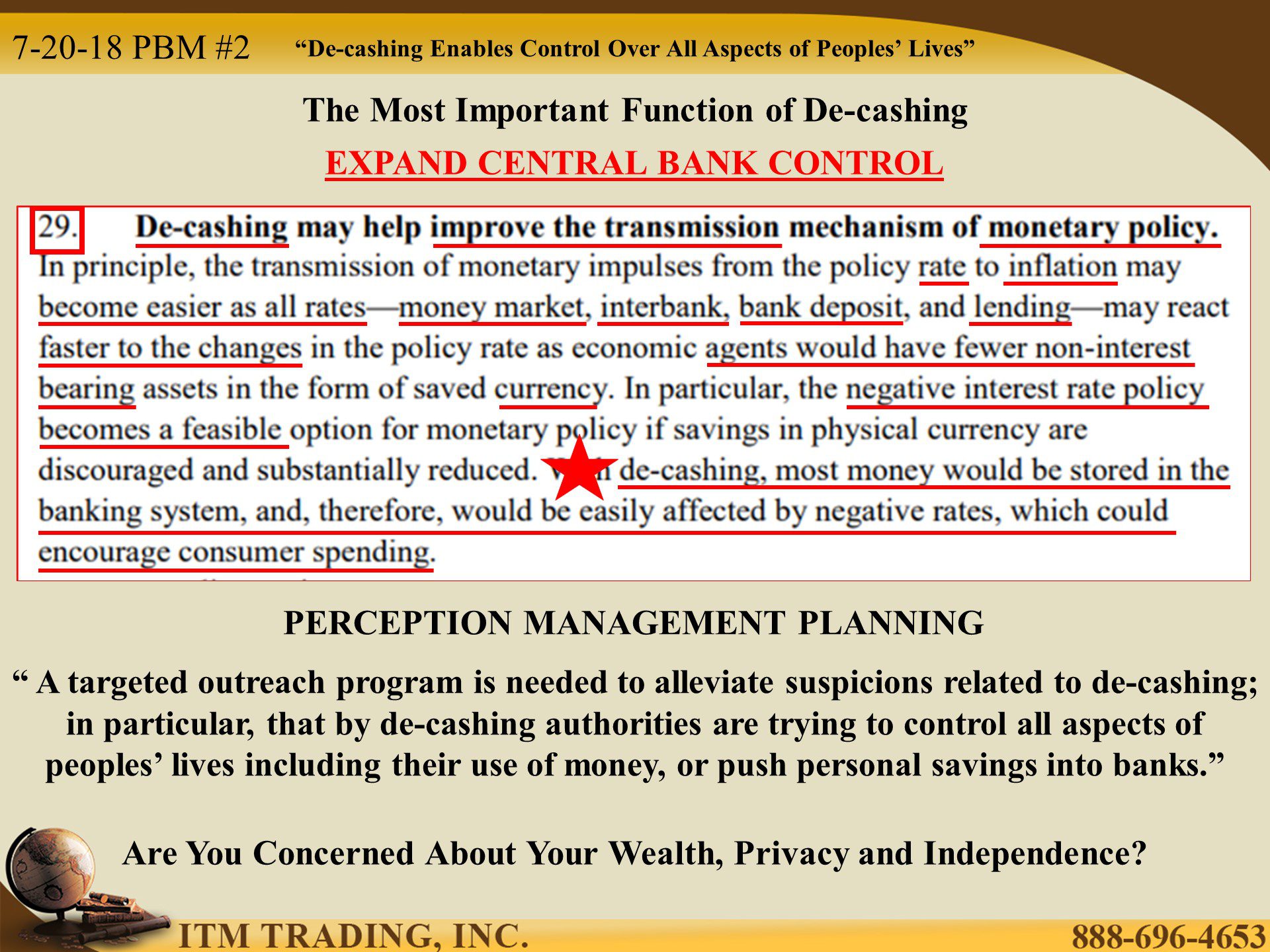

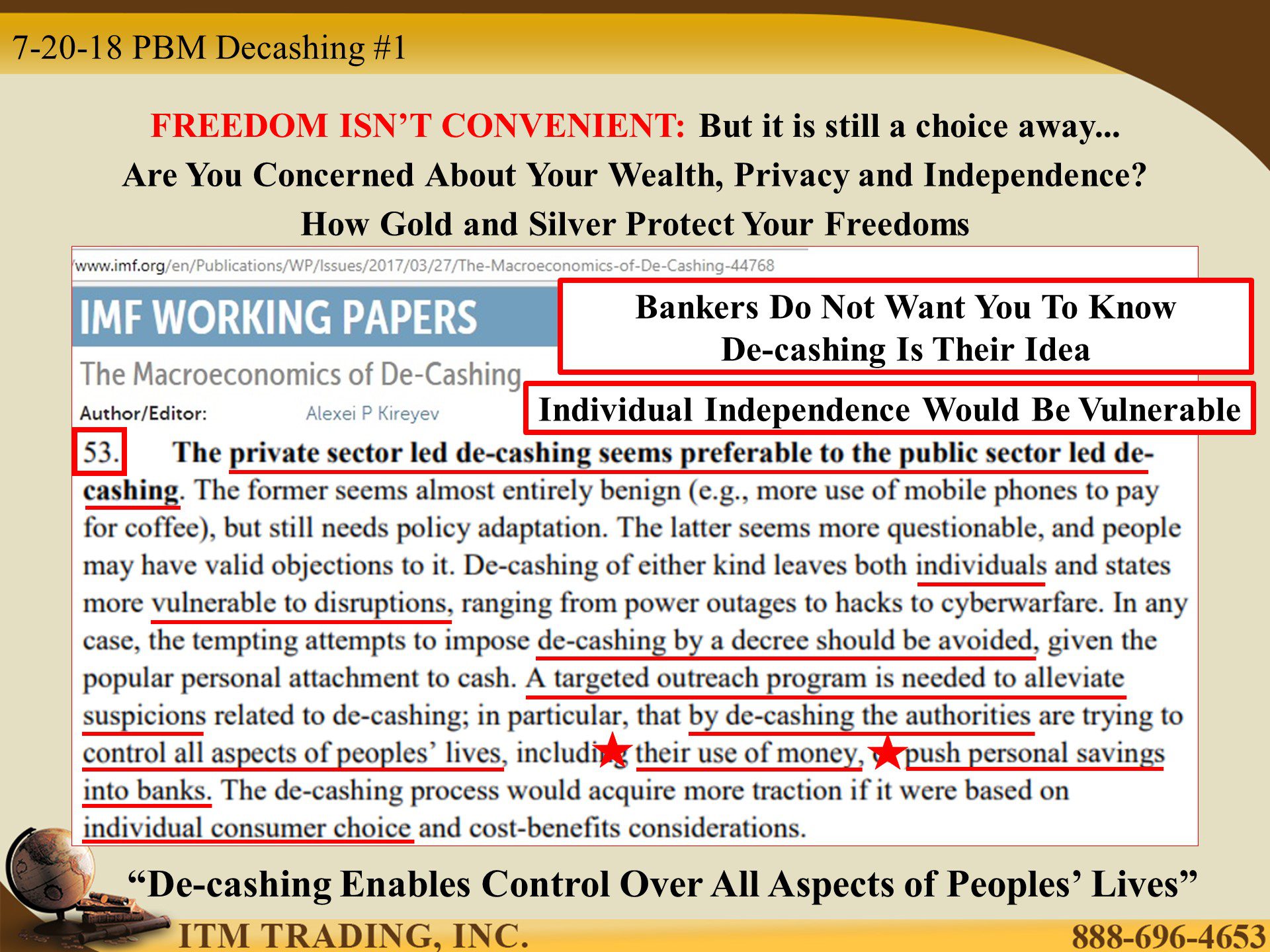

Who do you think benefits the least from going cashless? The individuals. In addition, people are suspicious “that by de-cashing the authorities are trying to control all aspects of peoples’ lives, including their use of money, or push personal savings into banks.†Therefore, “private sector led de-cashing seems preferable to the public sector led de-cashing.†(emphasis theirs https://www.imf.org/en/Publications/WP/Issues/2017/03/27/The-Macroeconomics-of-De-Cashing-44768 )

PERCEPTION IS EVERYTHING

“A targeted outreach program is needed to alleviate suspicions related to de-cashing†and the banks are leading the charge of course. They are, after all, the middleman in the money scheme and have been pushing less cash use since the 1920’s when we began the shift to a consumer driven economy.

Now that it seems the technology has finally caught up with the government and bankers dream, it just needs to appear to be YOUR choice, which is called “nudging†in behavioral economics, a key tool in the perception management tool box. Though this scheme takes time.

WHAT HAPPENS IF WE RUN OUT OF TIME?

Central bankers know the debt and leverage build up in the global financial system since 2008. They know the next financial crisis will be much bigger than the last…they all are. They know that explosion will be a black hole event sucking up any wealth held in the system.

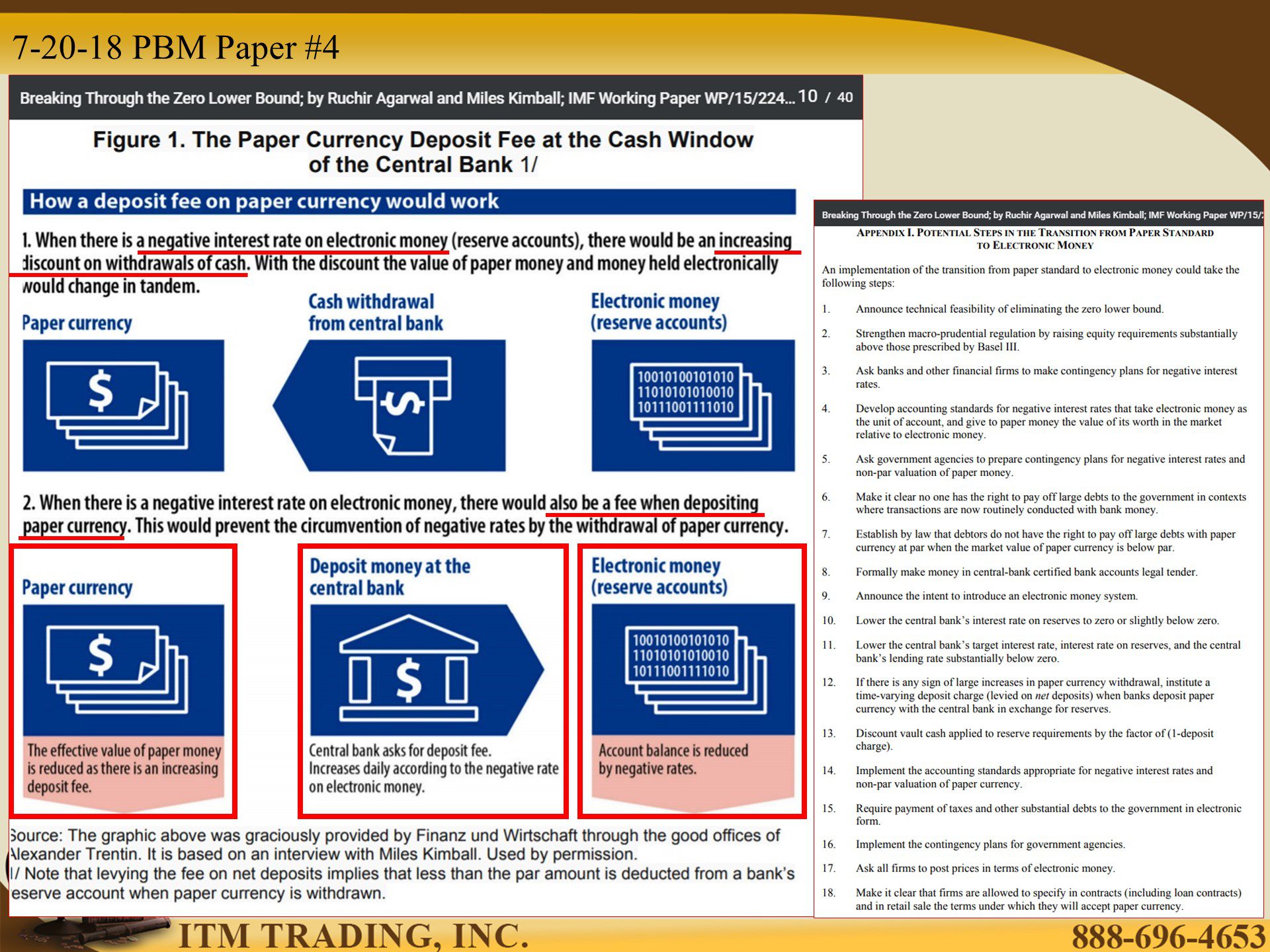

Negative rates have been tested and are no longer taboo. That means we’ve agreed to allow an overt central bank attack on our principal. Today, cash protects principal just as gold protects value. But cash is fiat and controlled by governments.

In 1933, governments and central bankers used a crisis they created to justify taking gold’s protection away from citizens. The same technique will be used in the next crisis.

THE PLAN IS IN PLACE

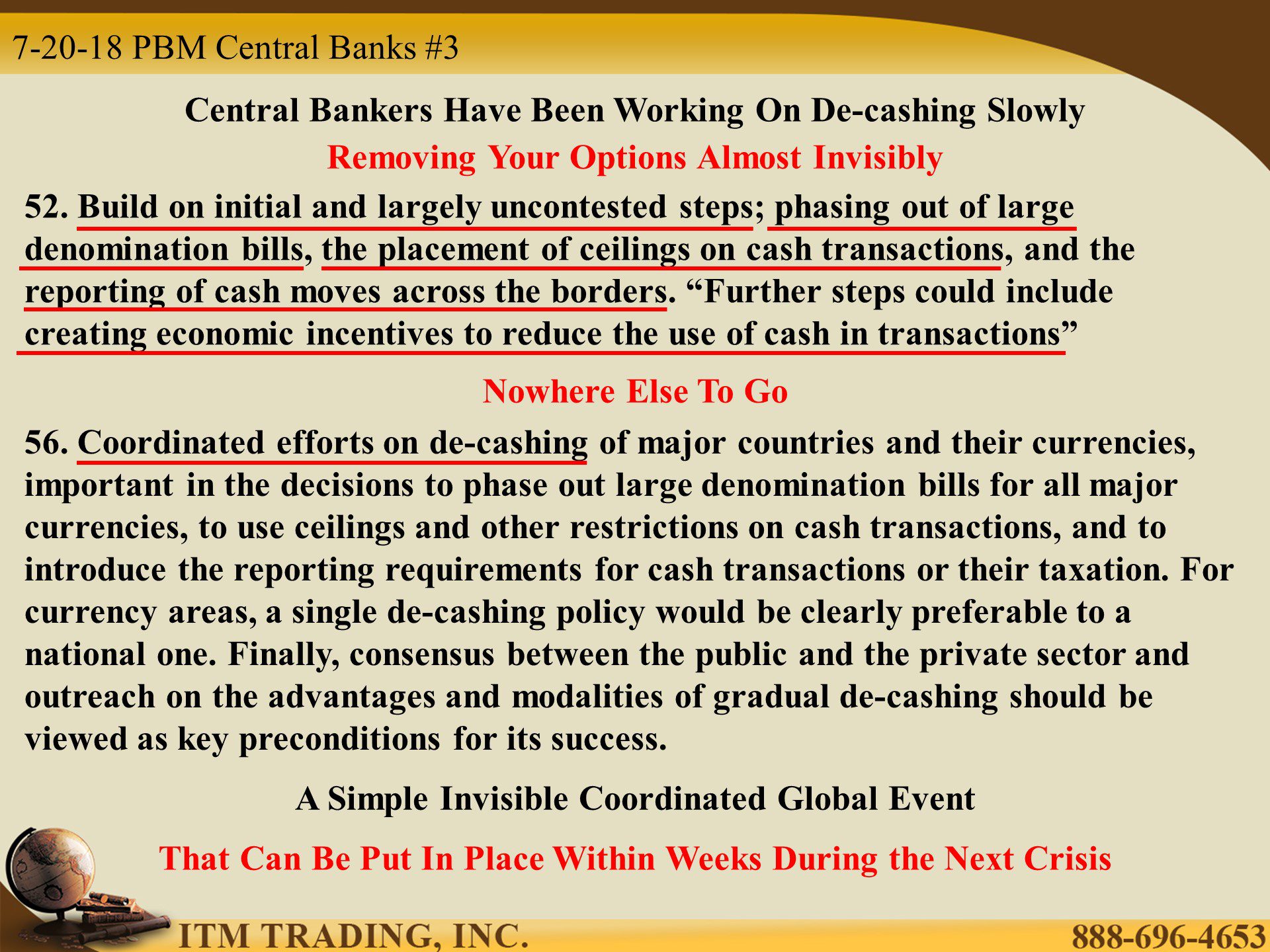

In 2015 the IMF working paper outlined how quickly and easily the plan to go cashless could be put in place (within weeks). They wouldn’t even have to ban cash by decree, which is something they prefer to avoid since that would not be YOUR idea.

It takes place invisibly at the central bank window where commercial banks go to get and deposit cash. From there, central banks can unfold their plan through retailers (banks, shops and services) by providing incentives to the public to use digital money (availability, discounts, etc.).

DO AS I SAY AND NOT WHAT I DO

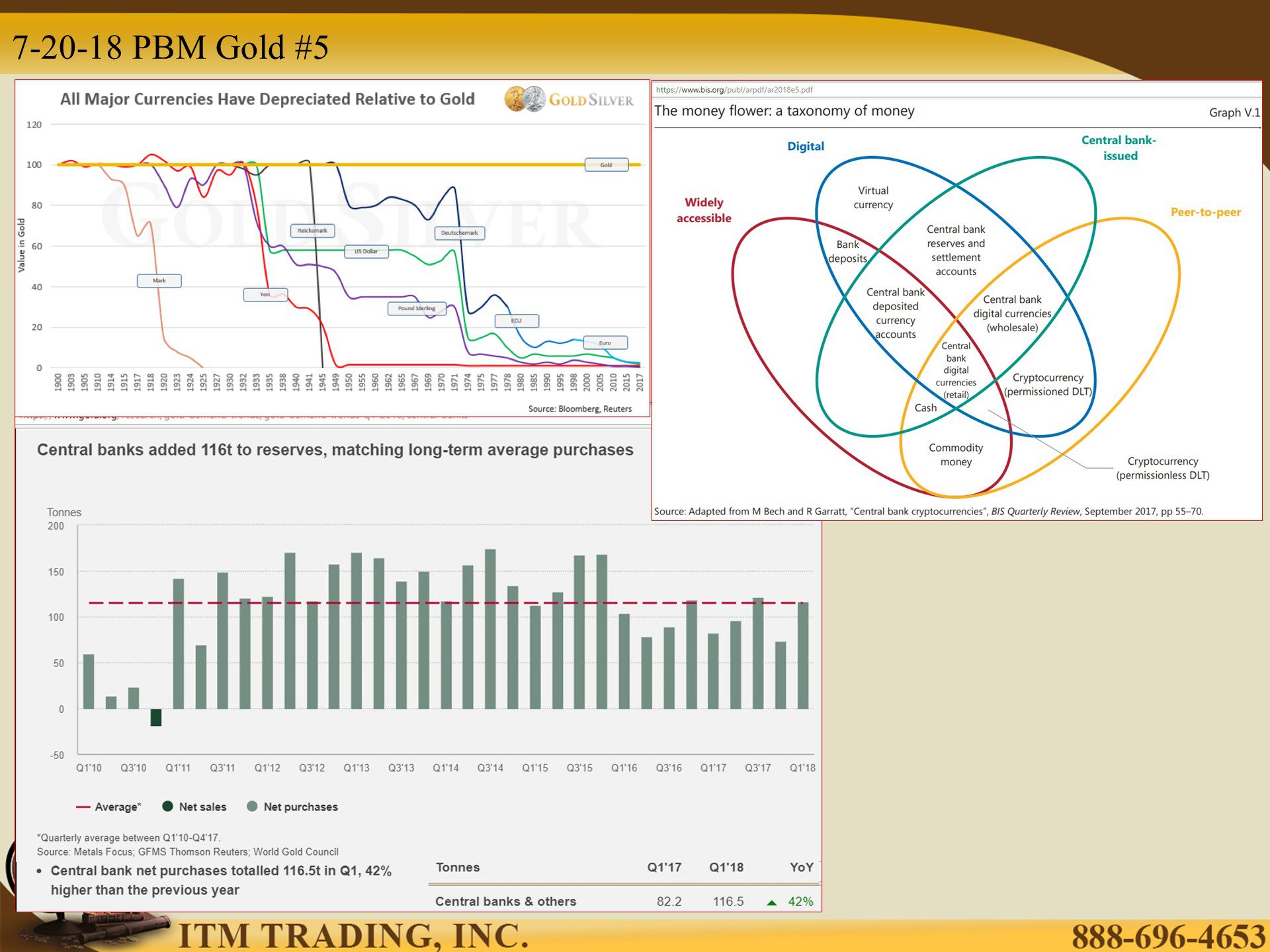

Since the crisis global central bankers have been loading up on gold, the primary currency metal. Even the Bank for International Settlements, the central bankers central bank, shows commodity money (gold and silver) as the largest form of money that is “widely accessible†and “peer-to-peer†in their money flower that is OUTSIDE of their control.

So where can you go to protect your wealth, privacy and independence? Physical gold and silver…real money. It’s certainly the largest part of my money flower too.

Links:

https://en.wikipedia.org/wiki/Cultural_hegemony

http://fraser.stlouisfed.org/docs/publications/bms/1914-1941/BMS14-41_complete.pdf

https://www.zerohedge.com/news/2018-07-19/cashless-society-con-and-big-finance-behind-it

- https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Breaking-Through-the-Zero-Lower-Bound-43358

- https://www.gold.org/research/gold-demand-trends/gold-demand-trends-q1-2018

https://www.bis.org/publ/arpdf/ar2018e5.pdf