FOUR BIG C’s LEADING THE CRASH: Confusion, Contraction, Contagion, Chaos By Lynette Zang

The US government is now in its 12th day of an ongoing shut down, extending the political confusion that began in 2018. China’s PMI didn’t just show a slowdown, it showed a contraction. It wasn’t just visible in china, because South Korea was contractionary for the 2nd month, Taiwan’s fell to a 3-year low and Malaysia PMI scored a record low. And those countries that export to China? Europe’s growth prospects look pretty gloomy too. It seems that China’s woes are globally contagious. And all of this has been creating market chaos.

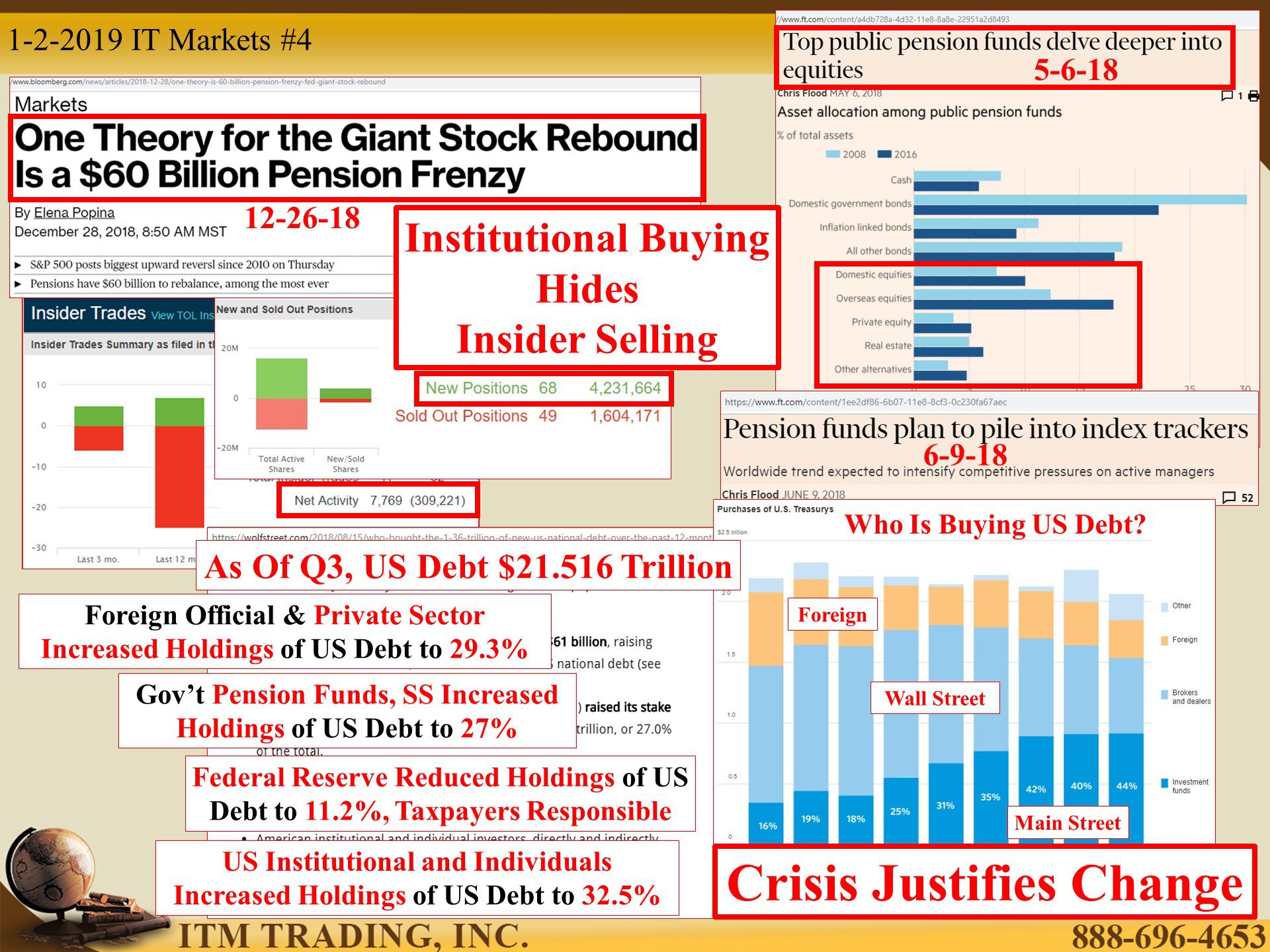

Which is likely why the 2018 stock market was as bad as it was in 2008. Just keep in mind that what saved 2009 was central bank QE (Quantitative Easing) programs that more than doubled their balance sheets. With global central banks now in QT (Quantitative Tightening) mode and attempting to reduce their balance sheet and raise interest rates, some believe they’ve pushed the world into the next crisis already.

Simply put, markets rise on liquidity and liquidity is drying up, and it isn’t just central banks that are cutting off the liquidity spigot. Wall Street has fallen into this liquidity trap too as cheap passive algorithmic trading has pushed market makers out of the market, leaving consumers as the lone market support.

Wall street is counting on consumers to keep shopping, but their credit cards may be maxed out. The answer is for corporations to raise wages, but wage inflation will hurt corporate profits and falling profits will hurt stock valuations. Even massive stock buyback programs have not been able to keep prices elevated. So, who has?

Private and public pension plans to the rescue of stock and bond markets. We’re already in a global pension crisis and as Rahm Emanuel once said, “Never let a good crisis go to wasteâ€.

While everyone will be impacted by the crisis, some will come out the other side in a much better position. Who? Those that retain real wealth. They will have the opportunity to buy real assets at bargain prices. This is why those that understand money, own gold.

Slides and Links:

https://www.marketpulse.com/20190101/chinas-december-caixin-manufacturing-pmi-falls-contraction/

https://www.wsj.com/articles/corporate-profit-crunch-looms-as-stocks-slide-11546261258

https://ftalphaville.ft.com/2018/08/23/1535008174000/Global-liquidity-is-drying-up/

https://www.wsj.com/articles/u-s-consumer-confidence-fades-a-bit-in-December-11545924288

https://fred.stlouisfed.org/series/TOTALSL

https://www.ft.com/content/1ee2df86-6b07-11e8-8cf3-0c230fa67aec

https://www.ft.com/content/a4db728a-4d32-11e8-8a8e-22951a2d8493

YouTube Short Description:

The US government is now in its 12th day of an ongoing shut down, extending the political confusion that began in 2018. China’s PMI didn’t just show a slowdown, it showed a contraction. It wasn’t just visible in china, South Korea was contractionary for the 2nd month, Taiwan’s fell to a 3-year low, Malaysia PMI scored a record low. And those countries that export to China? Europe’s growth prospects look pretty gloomy too. It seems that China’s woes are globally contagious. And all of this, and more, has been creating market chaos.

Private and public pension plans to the rescue of stock and bond markets. We’re already in a global pension crisis and as Rahm Emanuel once said, “Never let a good crisis go to wasteâ€.

While everyone will be impacted by the crisis, some will come out the other side in a much better position. Who? Those that retain real wealth. They will have the opportunity to buy real assets at bargain prices. This is why those that understand money, own gold.