Flash Crash Revisited

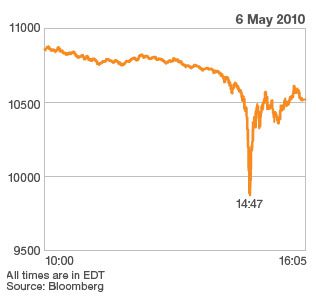

Do you remember the “Flash Crash†that occurred on May 6th of 2010? The crash that dropped the Dow Jones 650 points in a half hour and wiped out $850 billion in share prices. Dave Cliff and Linda Northrop certainly remember. They have recently co-authored a research paper, published by the Bank for International Settlements that, if it does not get to the bottom of the mess, at least it sheds light on where to look.

Do you remember the “Flash Crash†that occurred on May 6th of 2010? The crash that dropped the Dow Jones 650 points in a half hour and wiped out $850 billion in share prices. Dave Cliff and Linda Northrop certainly remember. They have recently co-authored a research paper, published by the Bank for International Settlements that, if it does not get to the bottom of the mess, at least it sheds light on where to look.

Dave Cliff, previously a trader now works for the UK and runs the government’s Large-Scale Complex Information Technology Systems project which studies the risks to various sectors that take in healthcare, finance and nuclear energy.

Linda Northrop heads a project at Carnegie Mellon University much like the one Dave Cliff works on but was set up by the U.S. military ten years ago.

Part of the problem is that no one has ever fully explained what happened on May 6, 2010, and worse, there is no indication that the source of the problem has ever been fixed.

These two groups have explored what they call socio-technical risks or the dangers of the growth of IT systems that generate systems of systems that interact in unpredictable ways that no one understands. In early 2010, long before the flash crash of 2010, their work predicted that a systems failure was imminent.

Their ongoing investigation has led to some grave findings. The most alarming is that the flash crash was not a one-time event. In fact the dangers and close calls are increasing as time goes on. Had the flash crash occurred later that day it would not have given the market time to recover which would have caused havoc in the Asian and European markets.

“The true nightmare scenario would have been if the crash’s 600-point down-spike, the trillion-dollar write-off, had occurred immediately before [US] market close,†they note. “The only reason that this sequence of events was not triggered was down to mere lucky timing. . . the world’s financial system dodged a bullet.â€

There is no evidence that we will be as fortunate next time. In the time since the flash crash there have been numerous, smaller flash crashes in the commodity markets. Some regulators insist that imposing trade limits will fix the problem, but they are not even sure what the core problem is. Add to that the size and scale of the technology we are dealing with and trade limits becomes questionable indeed.

The idea that Dave Cliff, Linda Northrop and their teams have come up with is to have regulators and bankers join forces and design a cross-boarder computing center to simulate advanced, large-scale financial scenarios. The concept is to recreate what is done in meteorology and intricate engineering to create a map of the markets.

This sounds great but the Office of Financial Research is having difficulty in stating its roll in such an undertaking and rather than admit they do not understand how the market works, regulators are more than happy to pretend that on May 6, 2010 thare never was a flash crash.