FIVE CRITICAL QUESTIONS TO ANSWER: Interest Rate Experiments Show We’re In DEEP Trouble… By Lynette Zang

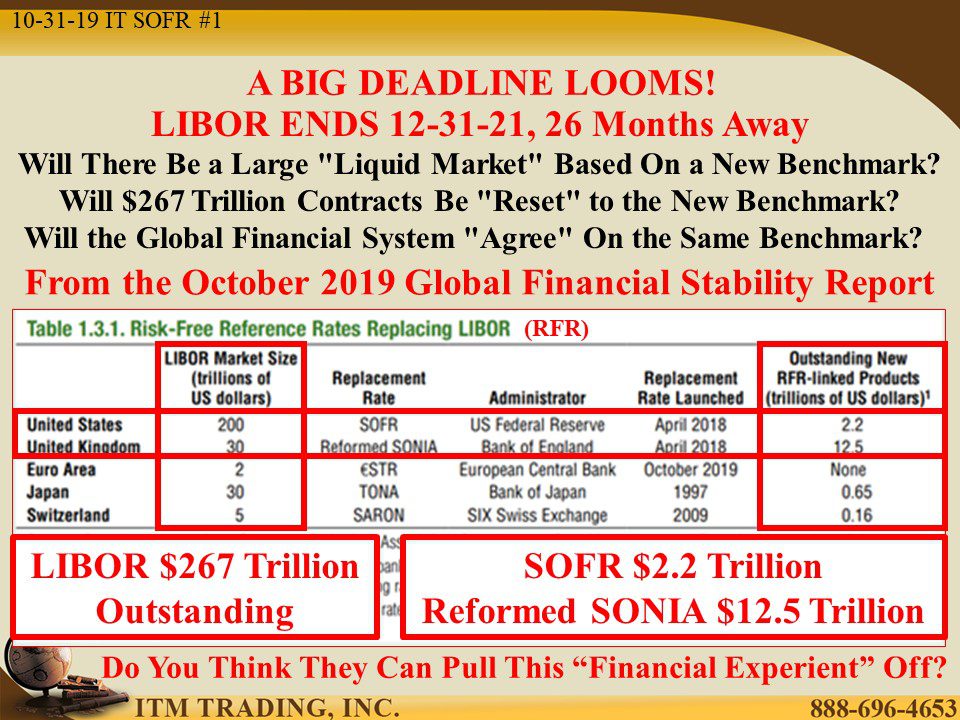

In the October 2019 Global Financial Stability Report the IMF provided an update in the transition away from the scandal ridden LIBOR to a new, yet to be determined, benchmark rate. The deadline is 12-31-21, a mere 26 months away.

Five big questions on the transition away from LIBOR remain:

- Will there be a large liquid market based on the new benchmark?

- Will $267 trillion contracts tied to LIBOR be reset to the new benchmark?

- Will the global financial system all agree on a benchmark?

- Which one will it be?

- Can Central Bankers pull off this most important experiment?

The five new benchmark contenders; SOFR, Reformed SONIA, ESTR, TONA and SARON. While the Bank of Japan’s ESTR has been around since 1997 and is the oldest of the new benchmark rates, the UK’s Reformed SONIA, launched in April 2018, is used in the largest amount of contracts at $12.5 trillion (vs $30 trillion in contracts tied to LIBOR).

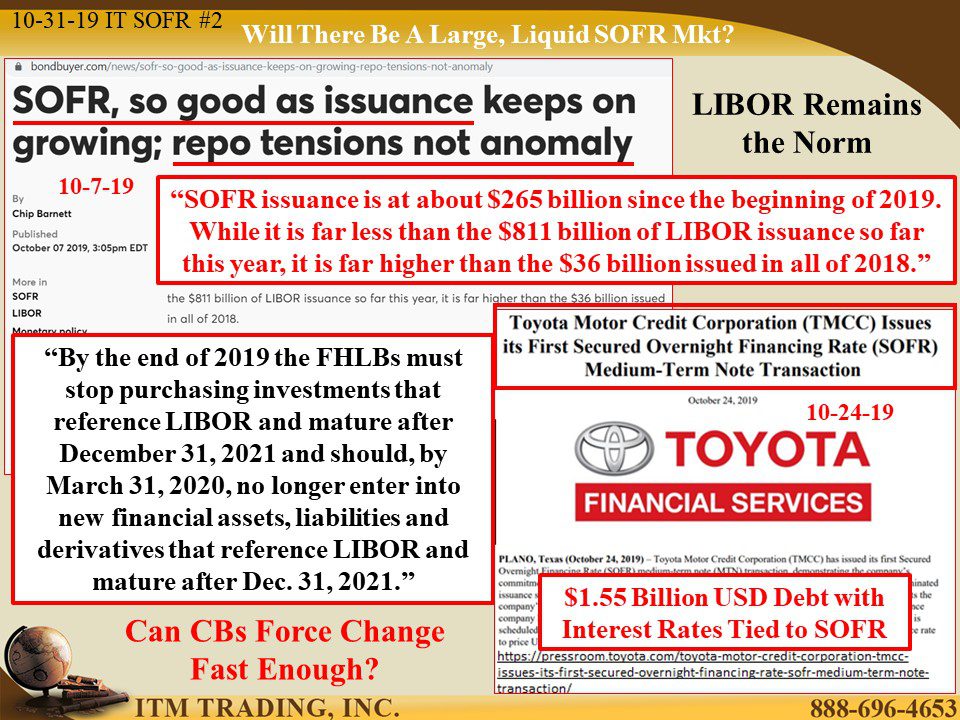

The US, with $200 trillion in contracts tied to LIBOR, (more than 10 times US GDP) has only managed to inspire $2.2 trillion in contracts tied to SOFR and as of 10-7-19, according to bondbuyer.com, for every $1 contract to SOFR, there is more than $3 new contracts tied to LIBOR. So could SOFR win global acceptance?

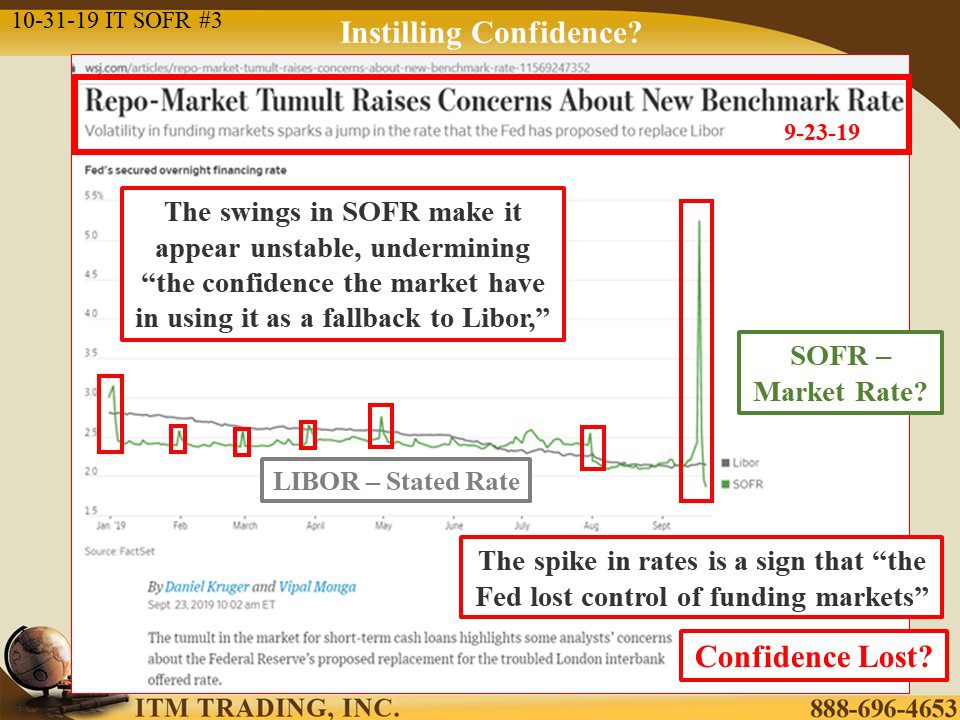

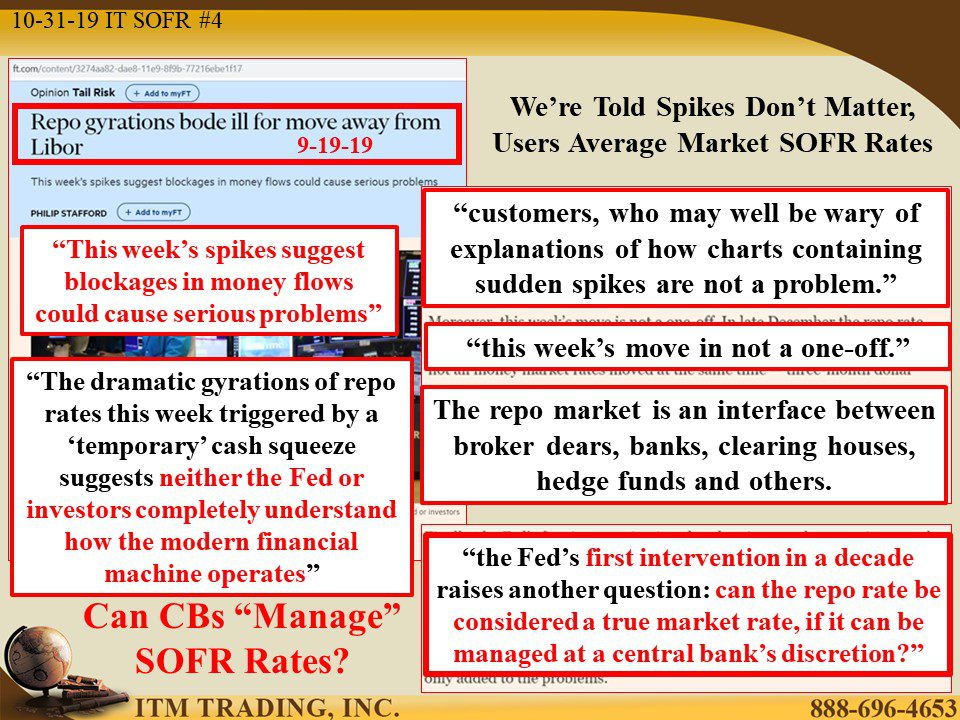

The recent turmoil in the short-term funding REPO markets exposed some key flaws in SOFR and central bank control:

- SOFR interest rate spikes are not an anomaly but have been happening consistently since, at least, December 2018 (created April 2018).

- The previous central bank experiments have changed the financial plumbing and “neither the Fed or investors completely understand how the modern financial machine operatesâ€

- SOFR was touted as a “market based†rate, yet the Fed’s first QE intervention since 2014 raises the question, “can the repo rate be considered a true market rate, if it can be managed at a central bank’s discretion?†and therefore, can SOFR truly be market based?

We need to keep in mind that a transition like this has never been attempted before and is really just another big central bank experiment. As such, confidence is required but even that does not guarantee a smooth and successful transition.

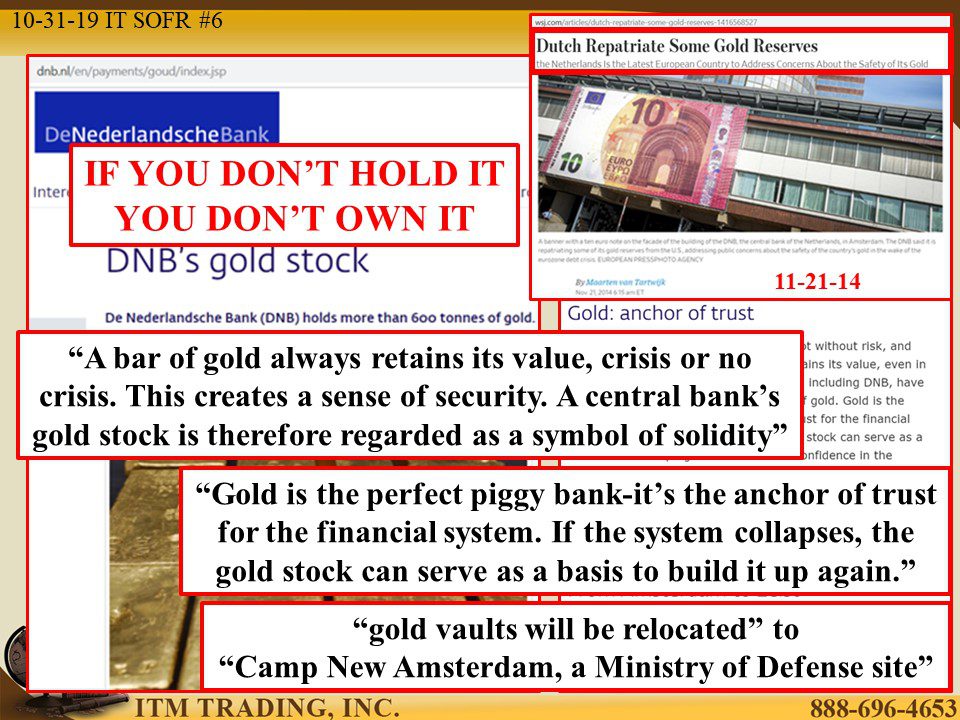

This matters to us all because it is the biggest black swan flying today and we know the day it will land. What we don’t know is the seismic impact of that landing. Central bankers understand this and have been repatriating and building gold reserves since 2008.

Why? The Netherland’s central bank (DNB) explains it well. “A bar of gold always retains its value, crisis or no crisis. This creates a sense of security.†And is “the perfect piggy bank – it’s the anchor of trust for the financial system. If the system collapses, the gold stock can serve as a basis to build it up again.†Just as it has over 6,000 years.

But they also know that IF YOU DON’T HOLD IT, YOU DON’T OWN IT and that’s why they repatriated their gold in 2014 and moved their gold vaults to a “Ministry of Defense siteâ€. They are protecting their gold from confiscation.

Do they know something you don’t?

Slides and Links:

https://www.newyorkfed.org/medialibrary/Microsites/arrc/files/2019/Users_Guide_to_SOFR.pdf

https://www.bondbuyer.com/news/sofr-so-good-as-issuance-keeps-on-growing-repo-tensions-not-anomaly

https://www.wsj.com/articles/repo-market-tumult-raises-concerns-about-new-benchmark-rate-11569247352

https://www.ft.com/content/3274aa82-dae8-11e9-8f9b-77216ebe1f17

https://www.dnb.nl/en/payments/goud/index.jsp

https://www.wsj.com/articles/dutch-repatriate-some-gold-reserves-1416568527

YouTube Short Description:

In the October 2019 Global Financial Stability Report the IMF provided an update in the transition away from the scandal ridden LIBOR to a new, yet to be determined, benchmark rate. The deadline is 12-31-21, a mere 26 months away.

Five big questions on the transition away from LIBOR remain:

- Will there be a large liquid market based on the new benchmark?

- Will $267 trillion contracts tied to LIBOR be reset to the new benchmark?

- Will the global financial system all agree on a benchmark?

- Which one will it be?

And perhaps the most important question

Can Central Bankers pull off this most important experiment?