FINAL MELT UP BEGINS? Markets 2 / Fed 0

Markets 1 / Fed 0

After securing free money for corporations through tax reform and repatriation, in January 2018, the Fed began “running off†their balance sheet, which simply means they no longer reinvested interest or maturing principal on a mere $50 billion a month. So we are not talking about selling, just allowing the bonds and MBS to mature.

At the same time, the fed raised the Fed Funds rate 4 times in 2018, perhaps forcing the yield curve inversion that occurred on December 4, 2018 (indicating a future recession) Â and threatening the maturing debt wall starting in 2019.

2018 was the worst year for the stock market since 2008.

But what the Fed was attempting to do, was create some wiggle room for the looming financial crises that has already begun to unfold, as witnessed by the global slowdown.

Welcome the taper tantrum 2018. So what did we learn?

That the economic “recovery†did not really happen. What did happen was the illusory high caused by the central bank free money drug. And like any junkie forced to consume just a little less drug than ey were used to, withdrawals occur. Markets do not want to reduce the level of free money in the markets. Neither can they afford a price increase (higher interest rates) on their debt drugs.

The Federal Reserve has tried to taper again and again backed down. Fed Chair Powell stated that the Fed “will not hesitate to make changes in light of economic and financial developments†and since they cannot raise rates to their target 3.5% (even though average drop in rates into a recession is 5.5%) if they “want to cut rates more than lower zero bound, would use full set of tools†stating that the Fed had “room to do substantially moreâ€, meaning the QE free money drug would be available.

Markets 2 / Fed 0

What can protect you as the free money drug no longer keeps the markets high, since more of the same is all that’s left? Real money gold and silver.

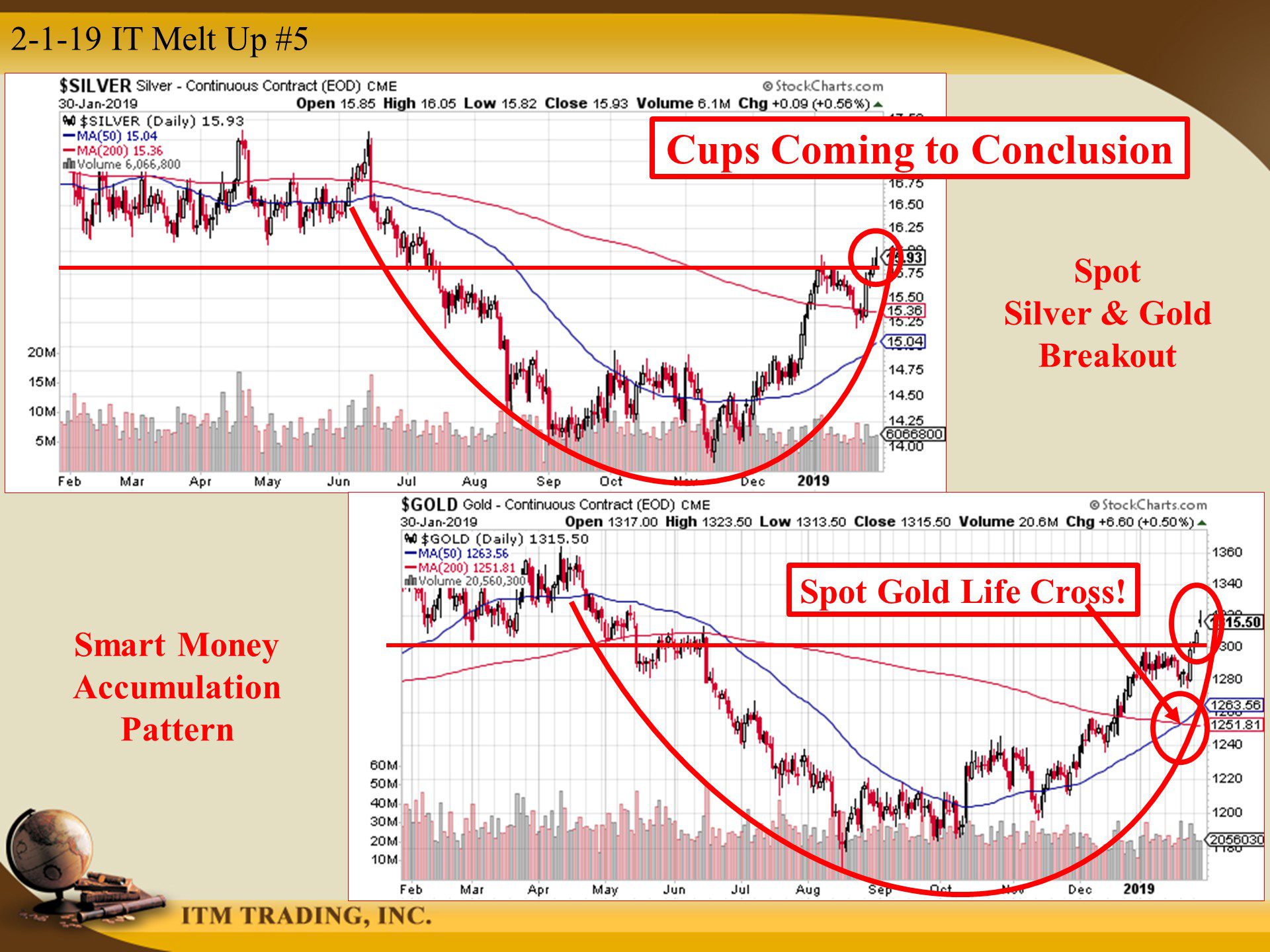

Holding physical gold in 2018 was the best performing investment in 2018, according to gold.org, but even Wall Street spot market cannot hide the true flight to gold and silver as both appear to concluding cup formations (smart money accumulation pattern).

In addition, in spot gold, the shorter-term moving average recently crossed above the longer term moving average in what I call a “Life†cross, technically confirming the upward trend. Meaning, both gold and silver are most likely to get a lot more expensive in the near future.

https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20130619.pdf

https://www.federalreserve.gov/monetarypolicy/files/FOMC20130619meeting.pdf

https://money.cnn.com/2013/06/24/investing/stocks-volatility/index.html

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

https://www.wellscap.com/pdf/expert_commentary/feds-balance-sheet-normalization-plan.pdf

https://www.stockcharts.com/h-sc/ui?s=$GOLD

https://www.stockcharts.com/h-sc/ui?s=$SILVER

May 2013 then Fed Chair Ben Bernanke mentioned the idea of slowing the free money spigot and the global markets had a taper tantrum. Fed response? Balloon their balance sheet to over $4.5 trillion.

Markets 1 / Fed 0

Welcome the taper tantrum 2018 with the worst stock market performance since 2008. So what did we learn?

The Federal Reserve has tried to taper again and again backed down. Fed Chair Powell stated that the Fed “will not hesitate to make changes in light of economic and financial developments†and since they cannot raise rates to their target 3.5% (even though average drop in rates into a recession is 5.5%) if they “want to cut rates more than lower zero bound, would use full set of tools†stating that the Fed had “room to do substantially moreâ€, meaning the QE free money drug would be available.

Markets 2 / Fed 0

What can protect you as the free money drug no longer keeps the markets high, since more of the same is all that’s left? Real money gold and silver. In fact, spot gold just exhibited a “Life†cross, technically confirming the upward trend. Meaning, both gold and silver are most likely to get a lot more expensive in the near future.