Feds Raise Interest Rates

Video

Feds Raise Interest Rates

Hi everybody Lynette Zang chief market analyst here at ITMÂ Trading a full-service physical precious metals brokerage house well as you all know probably they raise the rates yesterday it said the Federal Reserve I should say raise the interest rate and they set out plans to shrink their four point five trillion dollar balance sheets starting this year okay so here’s the headline and the reason why that was given for raising it the Federal Reserve listed a key US interest rate and laid out a plan to shrink its massive four point five trillion balance sheet starting this year a pair of moose reflecting is view that an economic expansion now entering its ninth year no longer needs so much propping up so that is what they are saying and they also have said in the past that they are data dependent so let’s look at how the markets reacted to the choices the Fed made was raising the rates.

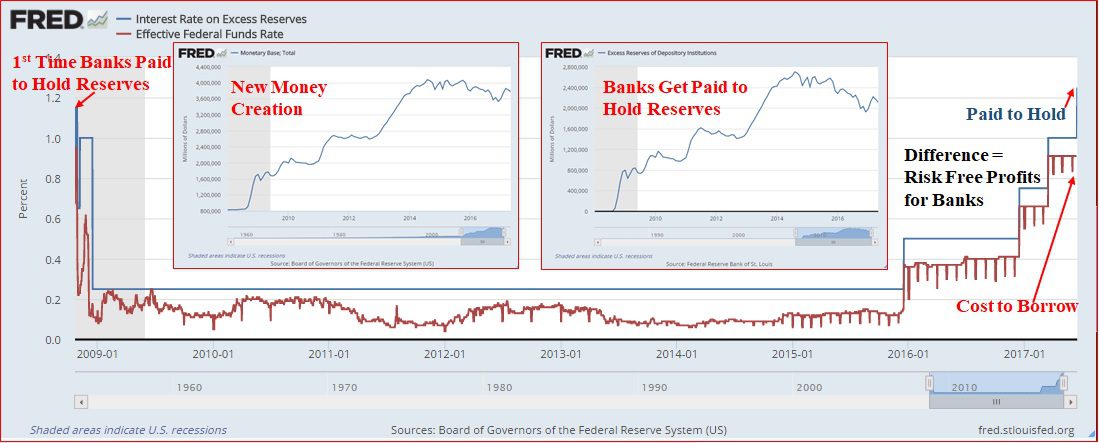

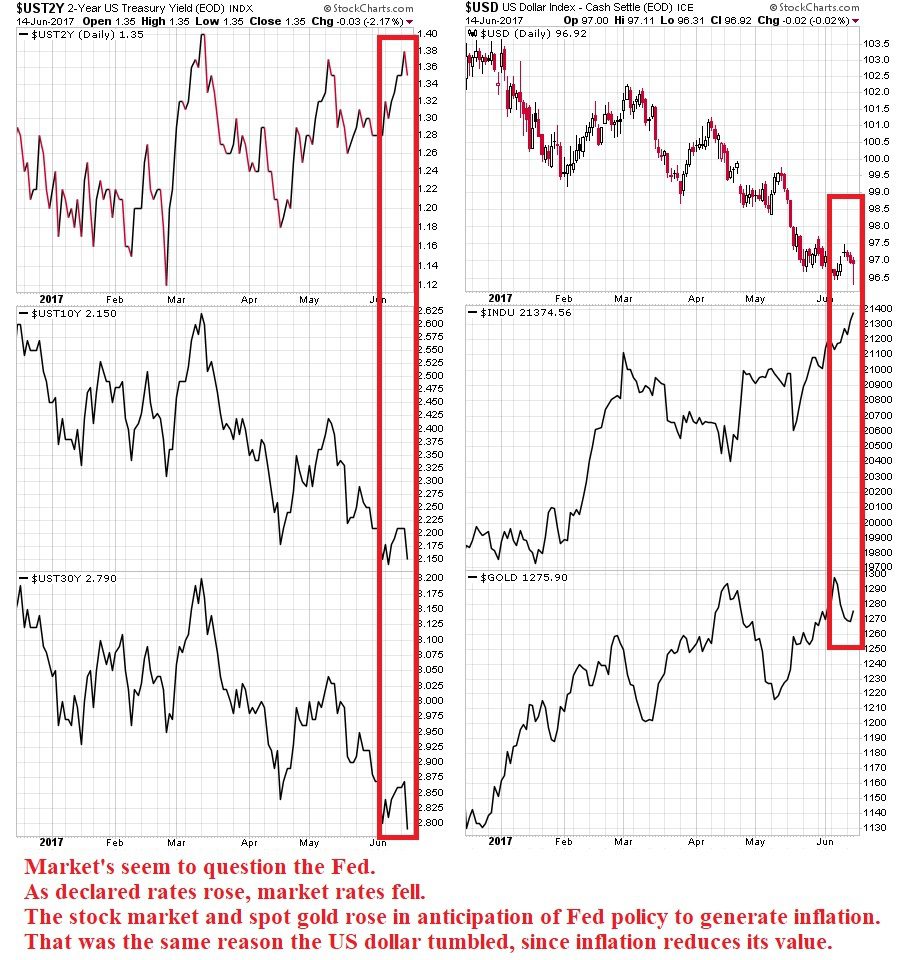

You can see these are the two year the ten-year and the 30-year bonds and you can see that is they were raising rates well the interest rates on the market declined in addition should is a dollar because they know that they’re going to have to generate more inflation that will weaken the dollar stock market liked it because again that inflationary pressure means easy money policies and goals also moved up after it got whacked last week in anticipation of this in my opinion so that’s how the market reacted to it and you could say that they didn’t really believe what Janet Yellen was saying that’s a possibility so let me show you the real impact of it okay so this is the monetary base where newly created money these are the excess reserves of the bank’s you can see that that started in okay now this is the cost to the bank tomorrow from the Fed and the blue line is what they actually get paid.

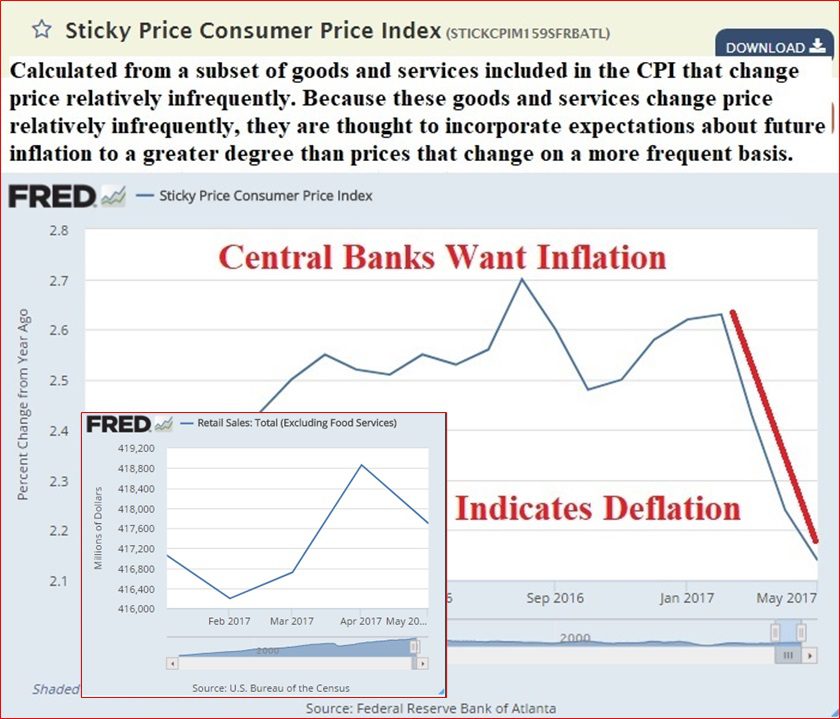

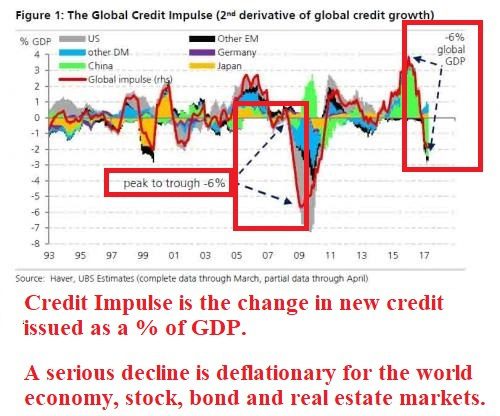

I’m holding those excess reserves so this is free money the difference between that red line and that blue line is just free money and it’s all taxpayer based so that is really the impact of the federal the Fed Funds rate increase the banks just make more free money now here’s the data that I know that they’re looking at because this is the Federal Reserve data is not mine and this is the sticky CPI right consumer price index so the sticky one are priced on goods and services that are included in the CPI that change price relatively infrequently because these the sticky is sought to incorporate expectations about future inflation to a greater degree than prices that change unaware frequent basis so what we heard about was this little box which our retail sales but in addition to that which is bad enough you have a lot of other consumer goods and look what’s happening there does it look like it’s inflationary that would be a no those are highly deflationary in theory you raise rates or the central bank raises rates to slow down inflation they’re saying that’s transitory well I’d agree but this is why we’re it you can see we’re in the deflation Airy part of the trend now this is also personal consumption expenditures and you can see that they’re at the lowest levels that they’ve been since in the midst of the crisis so you tell me does that look inflationary is that the reason why they’re really raising the rates or perhaps they’re on a mission and to raise the rates so that they can lower them which they’ve said so that they can lower them in the next crisis you can be the judge on that one because that does not look please marry to me at all and now they now let’s look at the balance sheet.

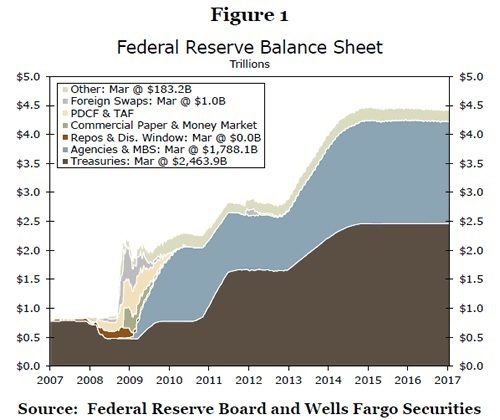

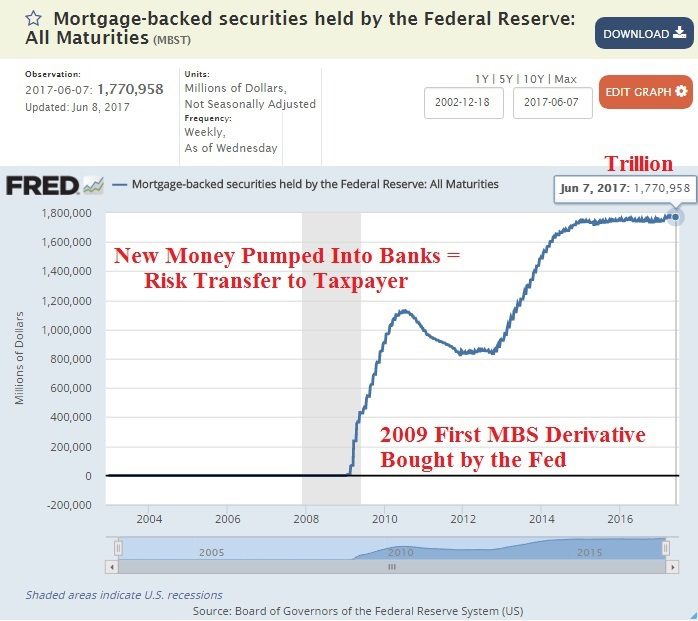

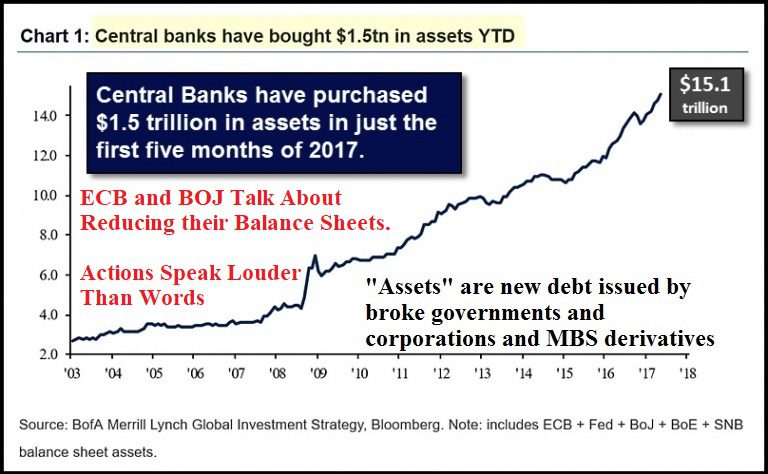

Okay this is the Federal Reserve balance sheet this bottom part are US Treasuries that they bought and then big part here are the mortgage-backed security derivatives that they have on the balance sheet okay so what they said that they’re going to initially do is just not the reason why you see this flattening out I should show you the reason why you see it just being flat here is because at least in these two areas they’re not buying more but any any interest that they get or any principal that they get they’re reinvesting them okay so we’re going to look at that it’s okay this is the quantitative easing program where the Federal Reserve bought the Treasuries okay this is Operation Twist where they substituted shorter shorter maturities for the longer maturities they only started doing this back in make no mistake this is a hyperinflationary pattern but since they’re being paid to hold those reserves it has not gone out into the economy so at some point it likely will in one way or another or as the central bank’s try and generate that inflation .

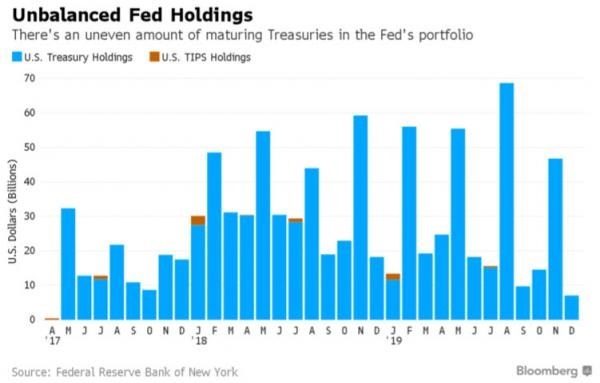

I mean does it look like they have control of this yet my opinion no but is they do not reinvest those dividends we’ve got a problem because last year % of the deficits were funded by the Federal Reserve buying Treasuries with that runoff because they’re not presumably adding more they’re just reinvesting the dividends at any principle so what’s going to happen when they’re no longer doing that who’s going to fill the gap are they going to issue more debt to fill that funding gap and will they be doing that at higher interest great can you start to see the problem with it and why I say it can’t happen it’s just talked to make you think that if it happens but you’re looking at the data and so is Wall Street and they know that this poses a big problem and this is the schedule of those bonds that are maturing that are presumably they are not going to reinvest this year so how are they going to fill that gap that’s a big question.

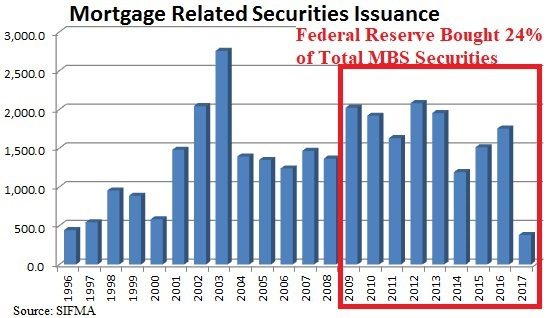

I have no idea now on the mortgage-backed securities and you can see that that too was a new thing first done in that they bought those mortgage-backed security derivatives so now again they’re reinvesting those are longer-term but they’re reinvesting any principal and interest so you can see how that has flattened out well hmm can they stop doing that considering the fact that since they got into this market they bought % of the total market and in and they bought % of the new issuance so what happens when they stop buying new ones can you see the problem there’s in my opinion there is no way on God’s green earth that they can reduce that balance sheet and at the same time that Janet Yellen was saying how wonderful things are and why they have to raise the rate because the economy is heating up well you saw that their data doesn’t support that but she also said that should they need to they would do additional quantitative easing well frankly you see how well all of that new money printing has done so far so what is doing more of the same well for it said it’s insanity and I would have to agree but the other piece of it is that is how the hyperinflation one of the ways that the hyperinflation is going to come here because what they’re doing with all that is money printing it’s not working anyway so doing more of it at some point they will lose control of the inflation and there you have it so that’s it for today I hope you can you got a lot out of this and you can see that they can say anything they want and they will to keep you in the system that is clearly from this data breaking down and from lots of other data I’ve just shown you a couple of places so

I would think that it would be kind of important to give us a call at eight eight eight six nine six four six five three and if you like this give us a thumbs up subscribe to our YouTube channel follow us on Facebook like us on Twitter and really you be safe out there and give us a call don’t forget six nine six four six five three bye bye

Feds Raise Interest Rates Images