FED TAPER & STAGFLATION…HEADLINE NEWS with LYNETTE ZANG

TRANSCRIPT FROM VIDEO:

Well, this is about as much of a magician as I am, but fed chair Powell is a much better magician than I and we’re going to talk about that coming up.

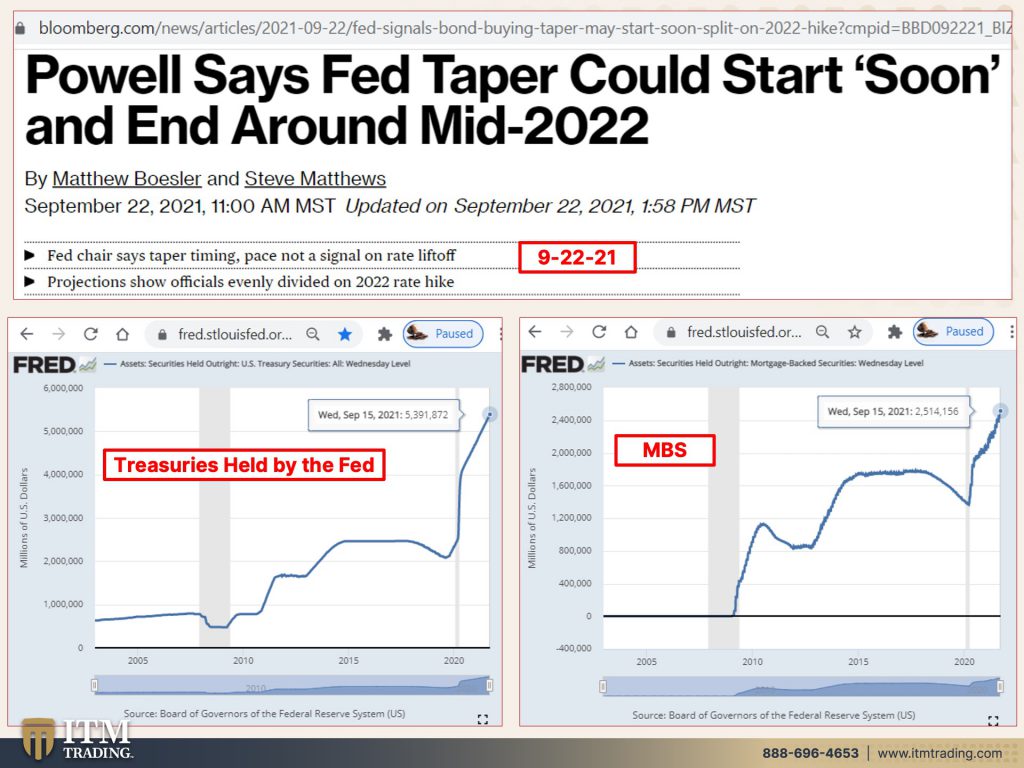

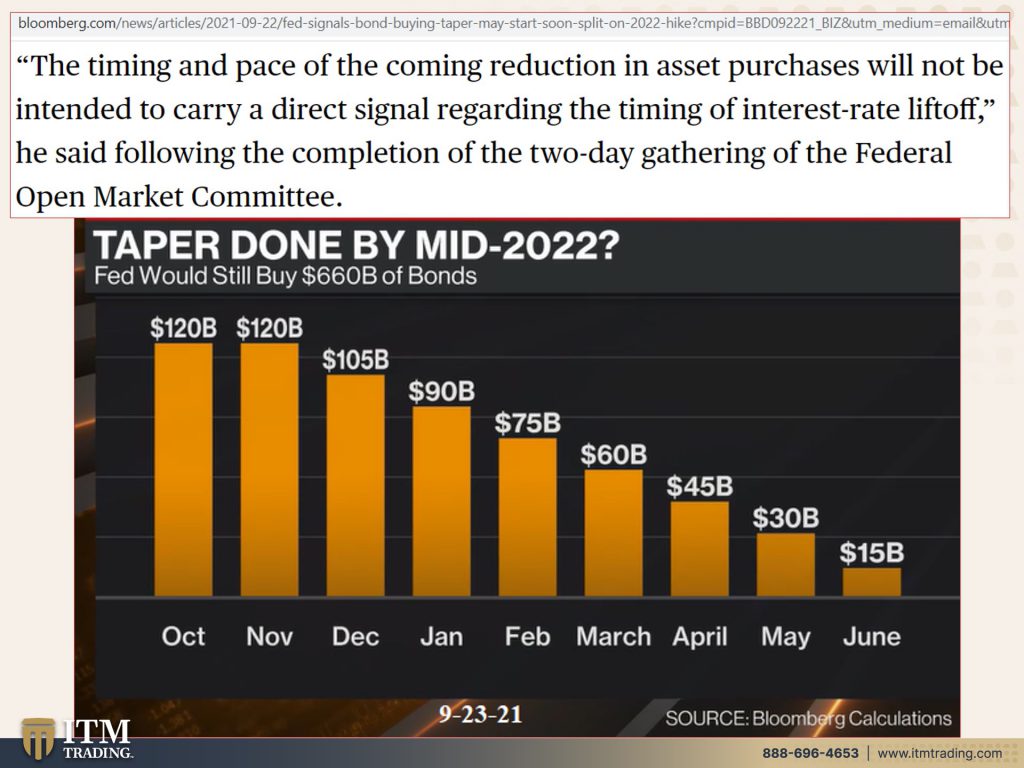

I’m Lynette Zang, Chief Market Analyst at ITM Trading, a full service, physical gold and silver dealer, really specializing in strategies that frankly we all need. So yesterday fed chair Powell came out and said that, you know, he was going to be tapering soon. And let me show you that means he’s just going to be buying a little bit less of the treasuries.

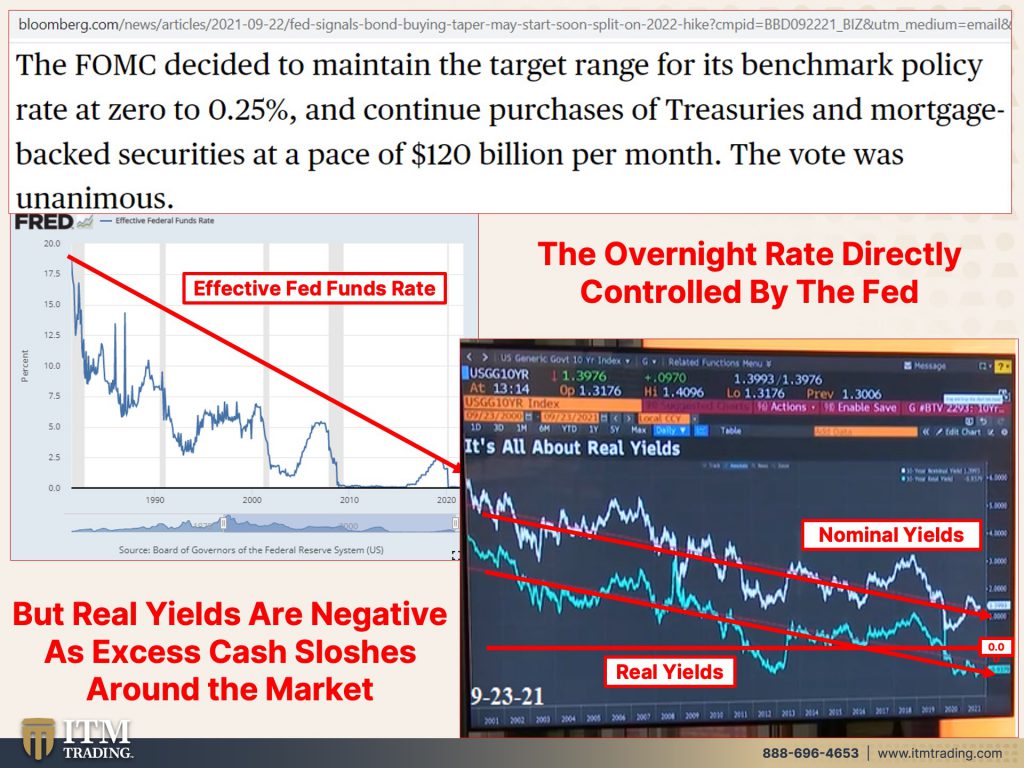

This is from the Fred. And remember all these links are on our blog and here’s your mortgage backed securities. So that might happen in November. Let’s just take a little further look at this because this is the most current fed balance sheet. So from $800 billion back in 2008 to $8.77 trillion. And this is what they’re going to, it’ll keep going up, but just not as quickly. And that’s a good thing because we’re off to such a good start. Now, the timing and the pace is questionable, and they don’t want you to think that just because they’re tapering that they would then be lifting rates because you cannot be lifting interest rates in this environment, though, I have to tell you that Turkey just did a very interesting thing today. I’ll be looking more at it and we’ll be discussing this. I’m sure the future, because in the face of massively rising inflation, they actually cut rates and central banks cut rates to stimulate, borrowing and spending, and they raise rates to reduce that borrowing and spending, which is why in the phase of inflation, many central banks will actually raise rates. Now, I don’t know if that’s going to work this time or not, but let’s just keep going with this. The FOMC while we just looked at the taper, they’re going to maintain their target range, which is the overnight rate that they can actually directly control. Now, here’s the thing we got, you can see the steady decline over years and we got to zero. We went up a little bit and then we went back to zero. We’ve got to take it to negative rates at some point, they think they’re going to lift off from here. But would you please look at when they did lift that you’ve got a series of lower and lower highs. So even if they make that attempt and they’re not talking about doing that until 2023 or 2024 or whatever, I mean, it’s a joke, but I don’t, they can’t do it. In my opinion, they cannot do it. And though it does guide other bond yields, what people don’t really realize it’s that nominal confusion. So we still have technically positive nominal yields in the U.S. But if you’re buying a bond and then, you typically aren’t taking into consideration inflation, but you should. You’re getting below zero right now. And you can see that in this graph on top of all of that, though, we are approaching quickly the debt ceiling. Now somebody asked me yesterday, do I really think that that matters?

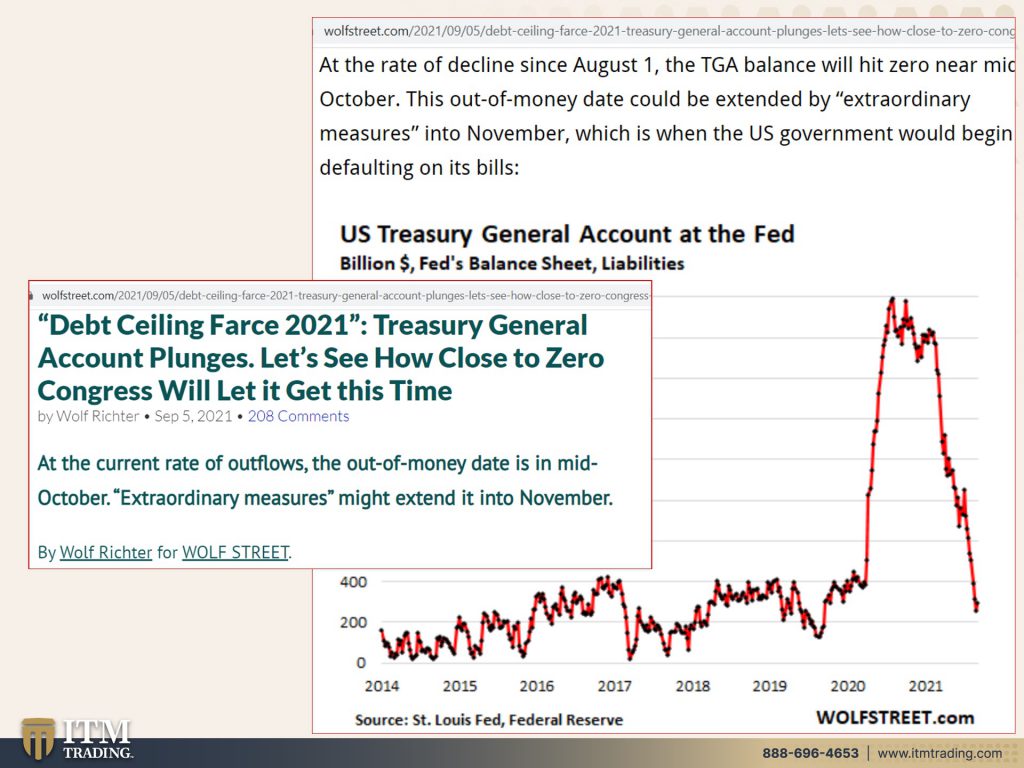

And the answer is, I’m sure they’re going to raise the debt ceiling again, because they’re not going to default on their loans. Having said that though, can we go back to that place? Having said that though, the treasury has had to work off from their general account, all of the monies that they were holding in there. So when they say, well, we’ll be able to pay our bills until mid-October November or whatever that date happens to be. It’s because they’re using this money in the treasury. And frankly, you can see that this particular graph goes back to 2013, but there was roughly, this was, was through the end of August, about $240 billion left to go through. So, you know, I mean, however, the point of this is the level of liquidity that this too pushes into the market. So here’s the switcher roo. Okay?

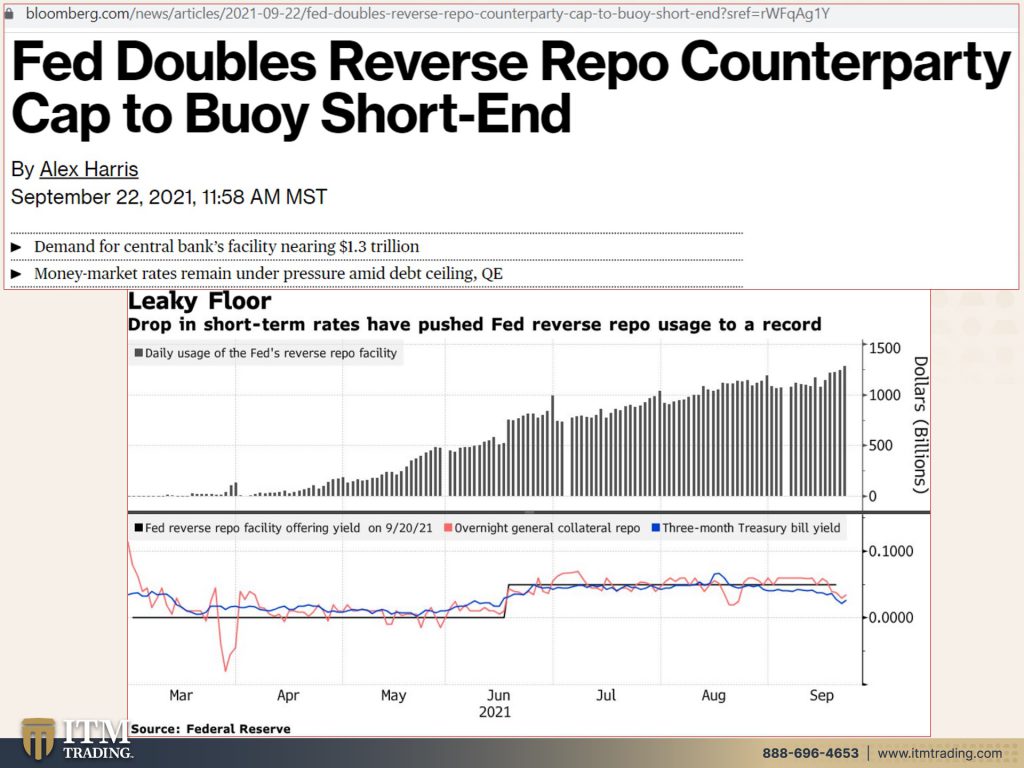

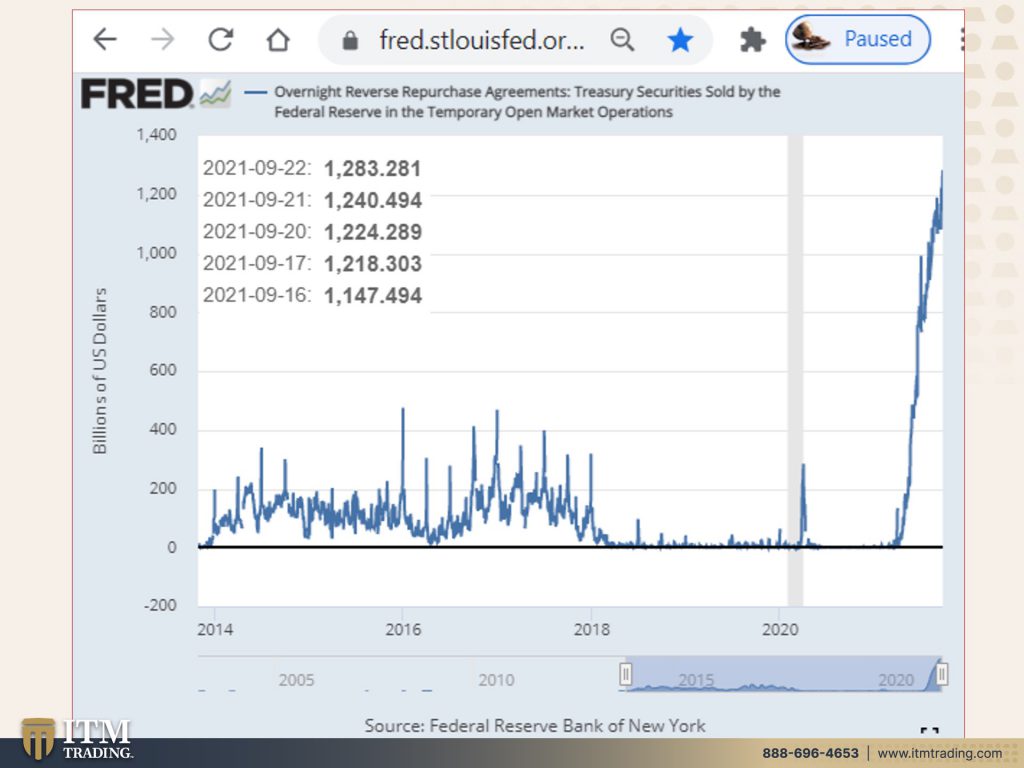

Here’s the switcheroo, because at the same time, the fed reverse repo from all that cash that’s sloshing around and the money markets is frankly exploding. And so they have to do something about that because there were too many, believe it or not too many restrictions. So they change you don’t change behavior. You change the way you account, you change the rules, change the way you account for it. You change who can participate in it, but this just goes back to last March. So, you know, or actually March, 2020, you can see how much the use of the reverse repo has grown since then. And this is, you can also see the yields. So the yield is at 0.5, but in reality, because of demand, and this is the problem it’s pushing interest rates below that. Now you’re going to notice that if you’re sitting in money markets and your yield goes below zero, because they change the rules back based on what happened in 2008, when there was a run on money markets. So if you’re sitting at money markets thinking that you’re just finding hunky Dory, well, they changed the rules and they put in gates and they put it in another words, ways to stop you, or at least at the minimum slow you down, though, they can stop it pretty easily as well. And money market rates can indeed go below zero, make no mistake about that anymore.

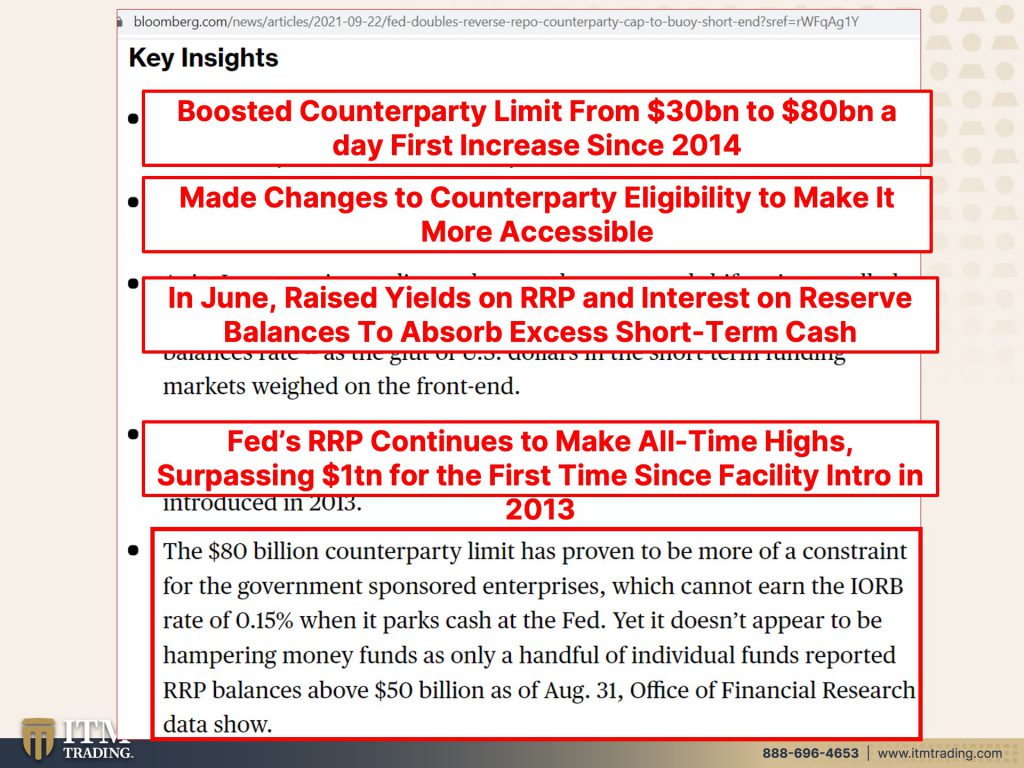

But going back to when they came up with is reverse repo market. So 2013, this is what that really looks like far more dramatic. And you can see how this has just been climbing and climbing and climbing. When we first went above a trillion, I think it was like last July. And now we’re well above a trillion and climbing and climbing and climbing. So here are some key highlights and key takeaways, right? We’re going to look at what gold has done in the face of all of this, but it was this splashed all over the news. No, no. This part was pretty quiet. So here are your key takeaways. Number one, the fed boosted the counter party limit from $30 billion to $80 billion a day more almost tripled it. Not quite, but certainly more than doubled it. So we’re going to see this getting even bigger because this money markets are the underpinning of the global financial system, right? They can’t afford to have them freeze, but every time they do something, there are some unintended consequences. And it’s like, whack-a-mole okay. So they did this, they got this result, which is what they were expecting. So they have to come up with another way to deal with that result. Okay? Now they also made changes to counter party eligibility so that it was more accessible for more counter parties. Look, whenever you have a counter party, there is risk. Anything is only as safe as the counter party to it. That’s why you want to be in physical gold and silver because according to the Bank of International Settlement, and it’s a simple fact, this is the only financial instrument that runs zero counter party, risk, everything else, all counter parties. But in June, they raised the yield on the reverse repurchase and interest on reserve balances to absorb that excess short-term cash. So that money markets did not fall below zero because if they fall below zero, you open up your statement and you go, what is that? I’m now at negative rates. I’m losing money on what I’m thinking of as a savings account. It’s not a savings account. You are loaning to hedge funds and you’re loaning to a whole bunch of entities. Short-Term commercial paper, which is corporations, et cetera. So they’re trying to make it so that you can’t see it because they are great magicians in making things look like they wanted to. It’s called that’s called oh wow. The name just escaped me. It’s been a long day and a long week. I’ll come back to it, but the feds RRP continues. That’s the reverse repurchase agreements, continue to make all time highs, surpassing a trillion for the first time since they started this experiment in 2013, and I’m going to read this whole thing and remember all the links and you can print out the slides are all on the blog. The 80 billion counter party limit has proven to be more of a constraint for the government sponsored enterprises, which cannot earn interest on reserve balance. IORB interest on reserve balance rate of 0.1, 5% when it parks cash at the fret fed yet, it doesn’t appear to be hampering money funds as only a handful of individual funds reported RRP balances above that $50 billion as of August 31st. So they’re trying to expand who can, who can use the facility and how much they can use because of all of the new money that they have created and pushed into the system and it’s breaking the underlying system, but what they don’t want to have happen is they don’t want you to know about it. And so they have to try and keep those interest rates, even if it’s even it’s nominally above zero, but they don’t want you to open your statement and then go, what is going on? Because then you’re starting to pay attention. And once you start to pay attention, I can tell you, you make different choices. And beyond that, you remember when we talked about the change in the target of the 2% inflation, which is they still get their inflation, but you don’t really notice it.

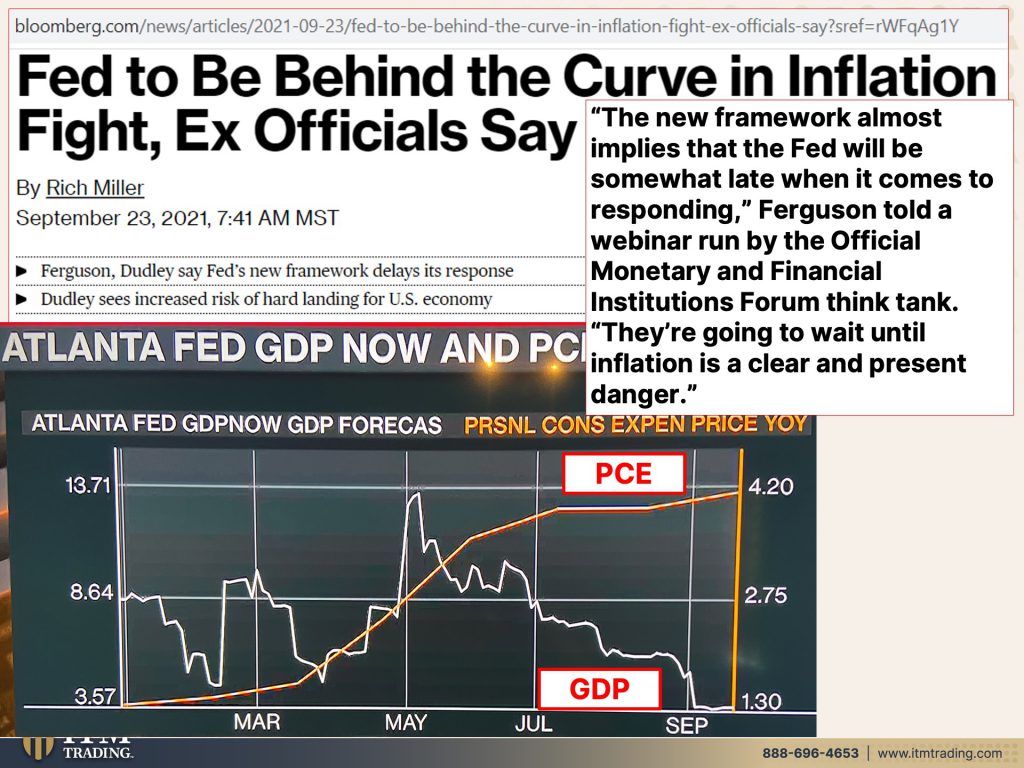

We’re starting to hear more of the term of stagflation, which is slower growth and higher inflation. And while they talk about that, being a spectre in the future, well, this is from the Atlanta Fed’s GDP now, and this is the personal consumption expense prices year over year, up at 4.20. And this is the GDP that they’re showing they anticipate, cause this is a forecast at 1.30 So if we’re just going by this graph and presuming that the fed the Atlanta fed is right, guess what? We’re already in stagflation. It’s very, very, very early stages. Now they’ll talk about that. They’ll talk about how this reminds you of the 1970s. Others will say it doesn’t remind them of the 1970s at all. And they have all these different reasons, but let me tell you what was the same then as it is now. And that is a shifting into a new social economic and financial system. And we are being warned. You can choose to pay attention to these warnings and do something to protect yourself where you can ignore them. But I don’t think we’re going to get too many more warnings to be perfectly honest with you. The new framework, which is how the fed will approach inflation almost implies that the fed will be somewhat late when it comes to responding. Let’s see, they’re going to wait until inflation is a clear and present danger because even though yesterday fed chair, Powell did admit that perhaps inflation is not quite as transitory and is more sticky than they were thinking. You know, and I’m glad to see that he at least admitted that they’re still not going to do anything about it. Even the tapering is just buying a little bit less. So they’re going to keep lots of money in the system and there’s no doubt in my personal mind, but that is what will lead when we get a nice, big shocker that they cannot paper over or hide or use their magic to get rid of that is going to be what will be what will push us into that hyperinflationary event.

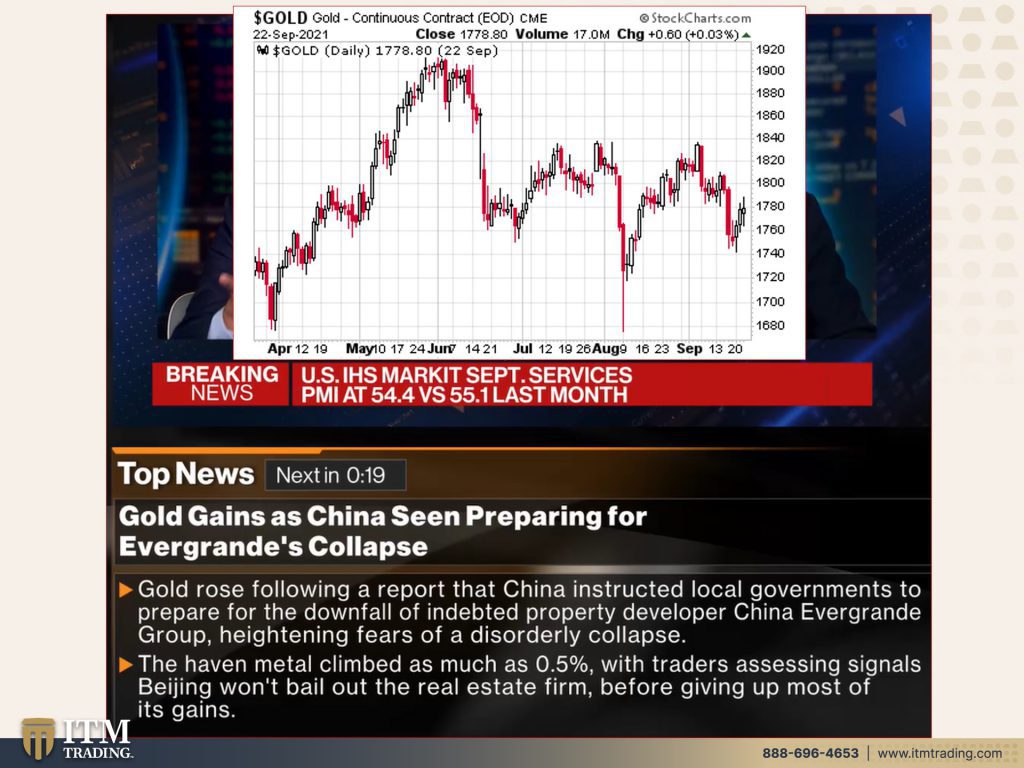

You know, a black Swan is something that nobody can see coming, but we are seeing a slow down. We just got the PMI produce. Let’s see, PMI is the I’m having a hard day today. I’m sorry. Producers manufacturing index came in below expectations and has been going down for a couple of months in a row. But I love this piece. Gold gains as China seen preparing for Evergrande’s collapse, actually gold God hammered today because it’s good to hide what’s really going on in the money markets, in the true markets underneath we are having an explosion in that RRP market, let’s see gold rose following a report that China instructed local governments. This is actually really interesting, but China instructed local governments to prepare for the downfall of indebted property developer, China, Evergrande group heightening fears of a disorderly collapse. So what they’re really trying to do is have a controlled implosion. Maybe they can pull this off? Maybe they can pull this off. I don’t know, but they injected even more. The PBOC injected even more money into the system today. And you know, frankly, I’ve been really busy today. I do know that Evergrande has stopped paying certain salaries and certain bills today is the day when their dollar bond interest payments are due. I don’t really know what happened with that yet because frankly I’ve been too busy to pay attention to that or it hasn’t come up when I have had the ability to pay attention. So I’ll be looking at that and I’ll probably be tweeting about it. So you want to stay tuned and you want to be part of the tweets, but remember this is spot gold. This does not really represent the true value of the physical metal itself. This is if you hold it, you own it. It runs no counter party risk and gold held at home is not subject to politicians and their sway. So physical gold, physical silver, get it done, but you also need food, water, energy, security, community, and shelter. Please don’t wait if you’ve been procrastinating, if you’ve been hesitating, please don’t wait. Being able to buy gold and silver at this deep discount is a gift. There is no other deep discount out there. Everything else is severely overvalued. Gold and silver, physical, is severely undervalued. And personally, I would always rather have the lion’s share of my wealth in an undervalued asset that is in a long-term positive trend, like gold and silver. Then it an overvalued instrument that runs all sorts of counterparty risk. And isn’t a long-term negative trend. And the stock market going up is not the real trend. It’s the value of the Fiat money, its purchasing power value going down. That’s the real trend cause a trillion times zero is zero.

So what a week, what a week. This has been this morning. I was on with the MMSteel club at it really was, it was really fascinating. Great questions, great presentations by a lot of people. So I hope you got to participate in it. And is there any way for them to participate in it after the fact? No, but you don’t want to miss it next year. I mean, it was really, really good. And of course, you know, I hope you’ve been enjoying all the behind the scenes that Edgar has been doing from the bug out house. You’ve been doing a lot from the bug out house and you’ll find them. Plus plus I’ve been tweeting a whole lot more @itmtrading_zang. If you want to talk to one of our representatives, our consultants just click that Calendly link below and set up a time that works for you. If there isn’t a time that works for call us, we will make it work for you because we are here to be of service. If you like this, please give us a thumbs up. Keep in mind. It is absolutely a hundred gazillion percent time for you to cover your assets. And here at ITM Trading, here’s the foundation real money. That’s what you need. Something that runs no counterparty risk because you hold it and you own it because if you don’t hold it, your perception is irrelevant in a court of law. If you don’t hold it, you don’t own it. So with everything that’s going on out there, I am tweeting a whole lot more. And until next time please be safe out there. Buh-Bye.

SOURCES:

https://fred.stlouisfed.org/series/WSHOMCB

https://fred.stlouisfed.org/series/TREAST

https://fred.stlouisfed.org/series/RRPONTSYD

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

https://fred.stlouisfed.org/series/RRPONTSYD

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

https://www.newyorkfed.org/markets/opolicy/operating_policy_210922

https://www.newyorkfed.org/markets/opolicy/operating_policy_210831