The Exit Strategy: Good For the Few by Lynette Zang

In UNICORNS & FANTASY we examined the rise of the global corporate unicorn club where start-up companies use a GBF (Get Big Fast) business model that focuses on moving into an established business sector and under cutting prices to grow a customer base fast. The resulting losses are supported by many rounds of private funding, which also inflates the “stated†value of the start-up by up to 50%. Though if a company does not expect to ever show a profit, I can’t imagine why it would have a market value of at least $1 billion, which is the minimum requirement to be a unicorn.

We also saw that money managers that invest for mutual funds, ETFs, insurance companies and pension funds, most likely hold these over inflated shares and adding additional risk to the unfolding global retirement crisis and the financial system.

But you also need to understand how this potential black swan event has been set up, because now, the trigger is being pulled in the form of a flood of new stock issues by the global unicorn club. Some estimates suggest upwards of $200 billion in “stated†value, but who knows the real value of any fiat instruments these days, let alone the latest unicorn experiment that creates market value on a sea of leverage and losses.

Today we will focus on changes that have taken place since the 2012 Jobs Act that many thinks weakened consumer protections and laid the ground work for some creative interpretations of newly issued stock contracts, including wildly separate share classes that give some shareholders significantly more rights than others. Rarely used in the past, in March 2017, 8% of all list companies in the Russell 3000 Index had a multiple share class structure.

Since then its popularity has grown even more, as every round of unicorn funding carries a different share class with different controls built into the stock to justify the post-funding valuation. The overvaluation concern regards the automatic revaluation of all shares, even though they have different terms. My concern is the flawed GBF business plan, because at some point, all assets and instruments go to their fundamental, or true value. That creates both the threat and the opportunity, since wealth does not disappear, it merely shifts ownership.

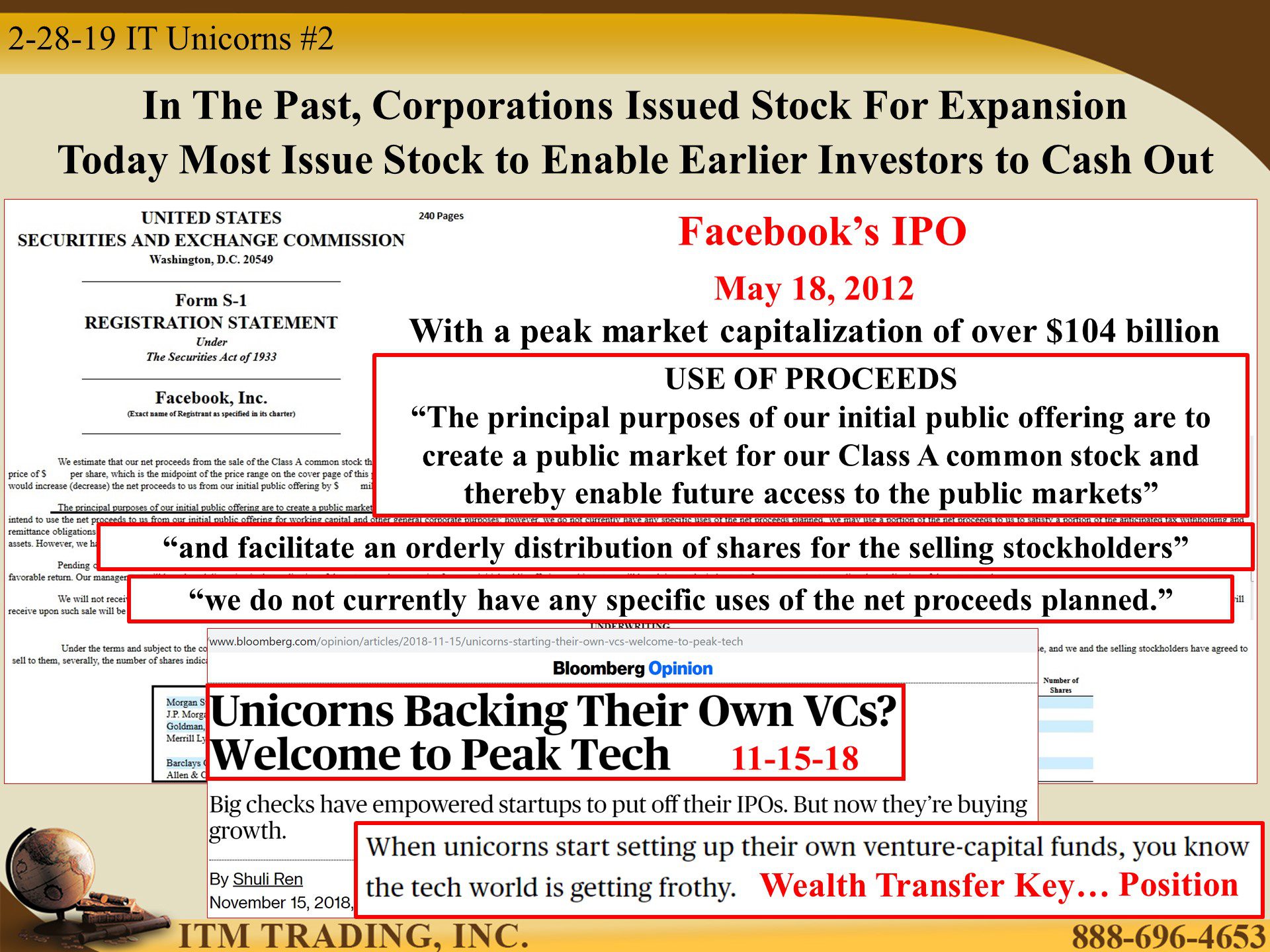

The exit strategy employed by the private money that funded these unicorns is to list shares at or above “stated†value, capturing gains, though in an IPO (Initial Public Offer) early investors are required to hold shares for a “lockup period,†normally up to 180 days. But cheap money and lots of leverage means that, even running ongoing losses, these unicorns do not necessarily need to raise funds.

What might have more value? The ability of early shareholders to sell shares at the listing and take advantage of initial market euphoria.

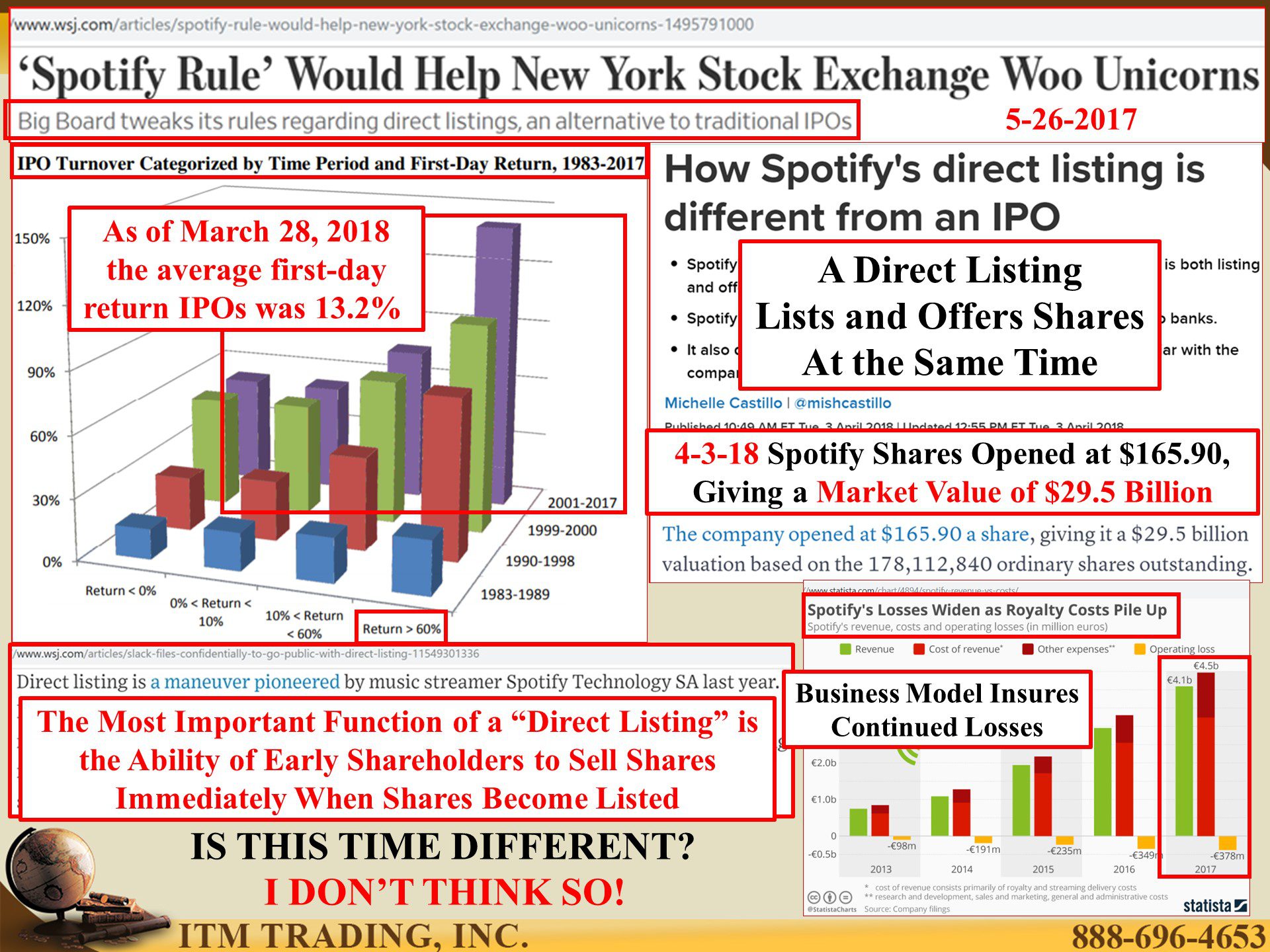

In May 2017, to attract corporate unicorns, the NYSE changed its listing rule regarding a new tool, “Direct Listing,†which was then pioneered by Spotify, who listed on the NYSE. On May 3, 2018, even with a business model that guarantees ongoing losses, Spotify shares opened at $165.90, 25% above NYSEs anticipated listing price, putting its market value at $29.5 billion. Early shareholders could have sold on the open.

Many expect corporate unicorns to take advantage of this new way to list stocks. There is just one problem, there is not a lot of new money coming into the markets to support the flood of unicorns. Even CNBCs Jim Cramer laments that money managers will have to sell something to buy the new issue which could create herding and market volatility. Further, the markets will decide the long-term value of unprofitable zombie unicorns.

Unicorn investors are ready to execute their exit strategy, the big question is if markets can remain at these elevated levels long enough to inspire new money to take the risk, or at least capture enough managed money to get out. They bought low, now they want to sell very high.

That’s my strategy too. That is why I convert my failing fiat money into real gold money. As the reset unfolds, I will take advantage of the reset valuations. Will you?

Slides and Links:

https://www.nytimes.com/2018/12/06/technology/lyft-uber-ipo.html

https://www.cnbc.com/2018/12/14/get-ready-for-the-200-billion-ipo-shakeup-in-2019.html

http://apps.olin.wustl.edu/workingpapers/pdf/2003-07-003.pdf

https://www.renaissancecaptial.com/IPO-Center/Stats

https://www.bloomberg.com/quicktake/dual-class-shares

https://www.cnbc.com/2018/03/20/shareholders-wont-force-zuckerbergs-hand-in-facebook-management.html

https://www.ft.com/content/d22eb6e8-52b4-11e8-b24e-cad6aa67e23e

https://www.cnbc.com/2019/02/04/slack-confidentially-files-to-go-public.html

https://www.wsj.com/articles/slack-files-confidentially-to-go-public-with-direct-listing-11549301336

https://www.cnbc.com/2018/04/03/how-does-spotify-direct-listing-work.html

http://fortune.com/2017/07/31/spotify-ipo-direct-listing-2/

https://www.wsj.com/articles/spotify-rule-would-help-new-york-stock-exchange-woo-unicorns-1495791000

https://www.statista.com/chart/4894/spotify-revenue-vs-costs/

https://www.nytimes.com/2019/02/25/business/stock-market-buybacks.html

https://www.stockcharts.com/h-sc/ui

https://www.wsj.com/articles/red-ink-floods-ipo-market-1538388000

https://www.oanda.com/fx-for-business/historical-rates

https://www.investing.com/analysis/this-is-what-a-bubble-looks-like:-japan-1989-edition-200197309

YouTube Short Description:

Unicorn investors are ready to execute their exit strategy, the big question is if markets can remain at these elevated levels long enough to inspire new money to take the risk, or, at least, capture enough managed money to get out. They bought low, now they want to sell really, really high.

That’s my strategy too. That why I convert my failing fiat money into real gold money. As the reset unfolds, I will take advantage of the reset valuations. Will you?