ETF-YOU: Will You Get Screwed? By Lynette Zang

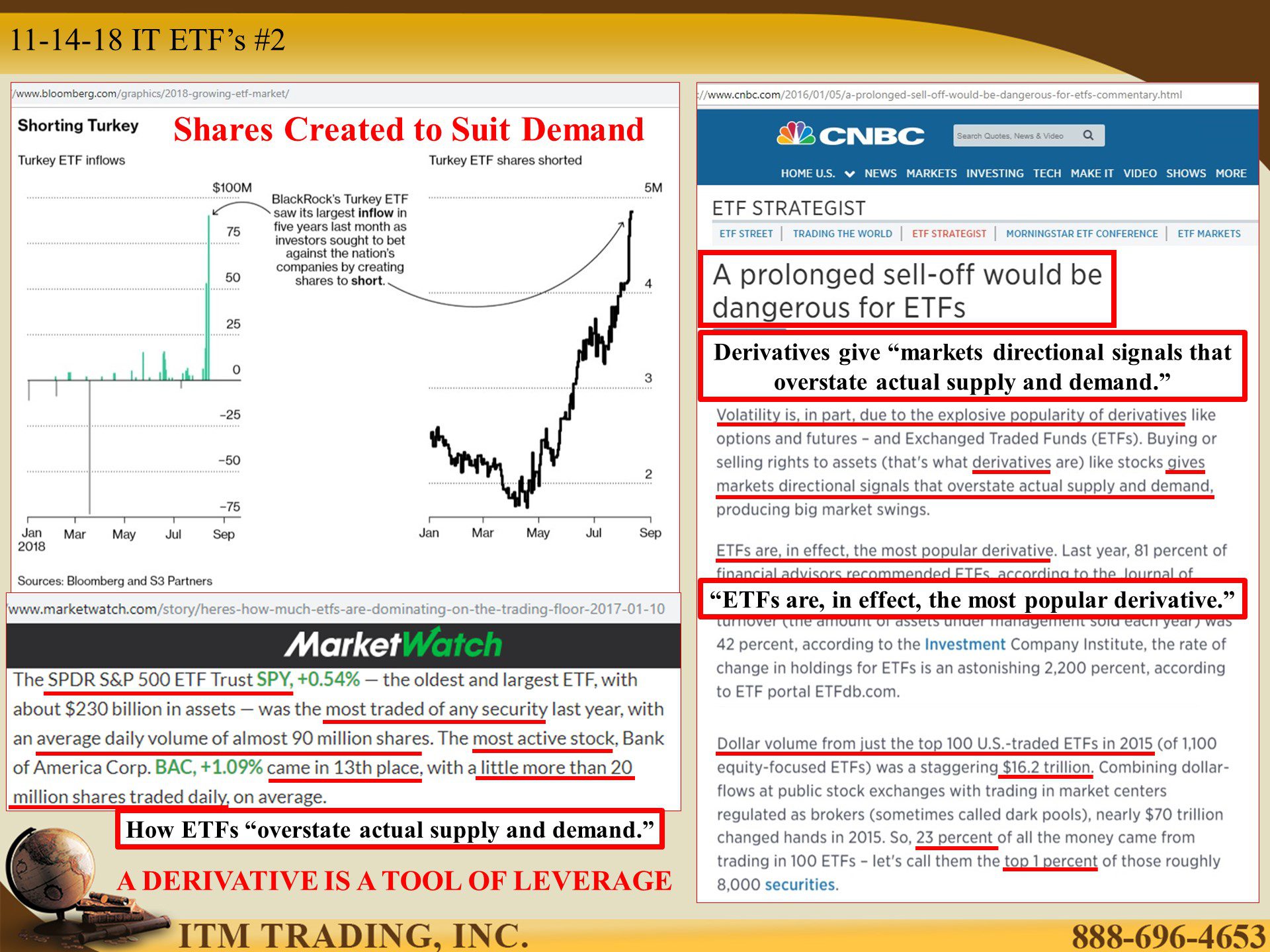

In the 2000’s wall street created a new product. Exchange Traded Funds or ETFs, which were sort of a hybrid between mutual funds, because they appeared to hold a diversified portfolio, but like a stock, they could be traded any time. Because ETFs were not a “managed†product and utilized computer trading, they were a lot cheaper.

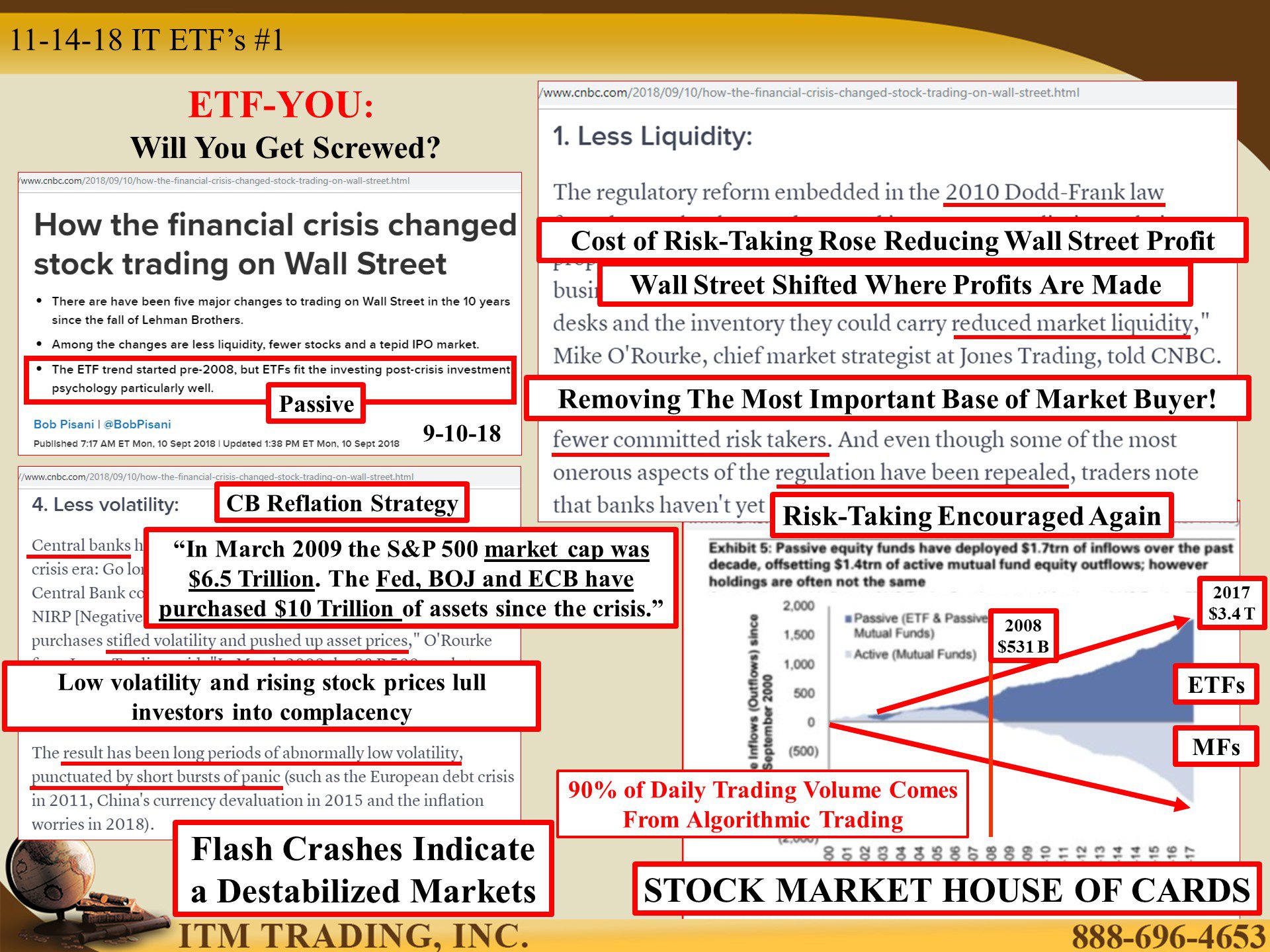

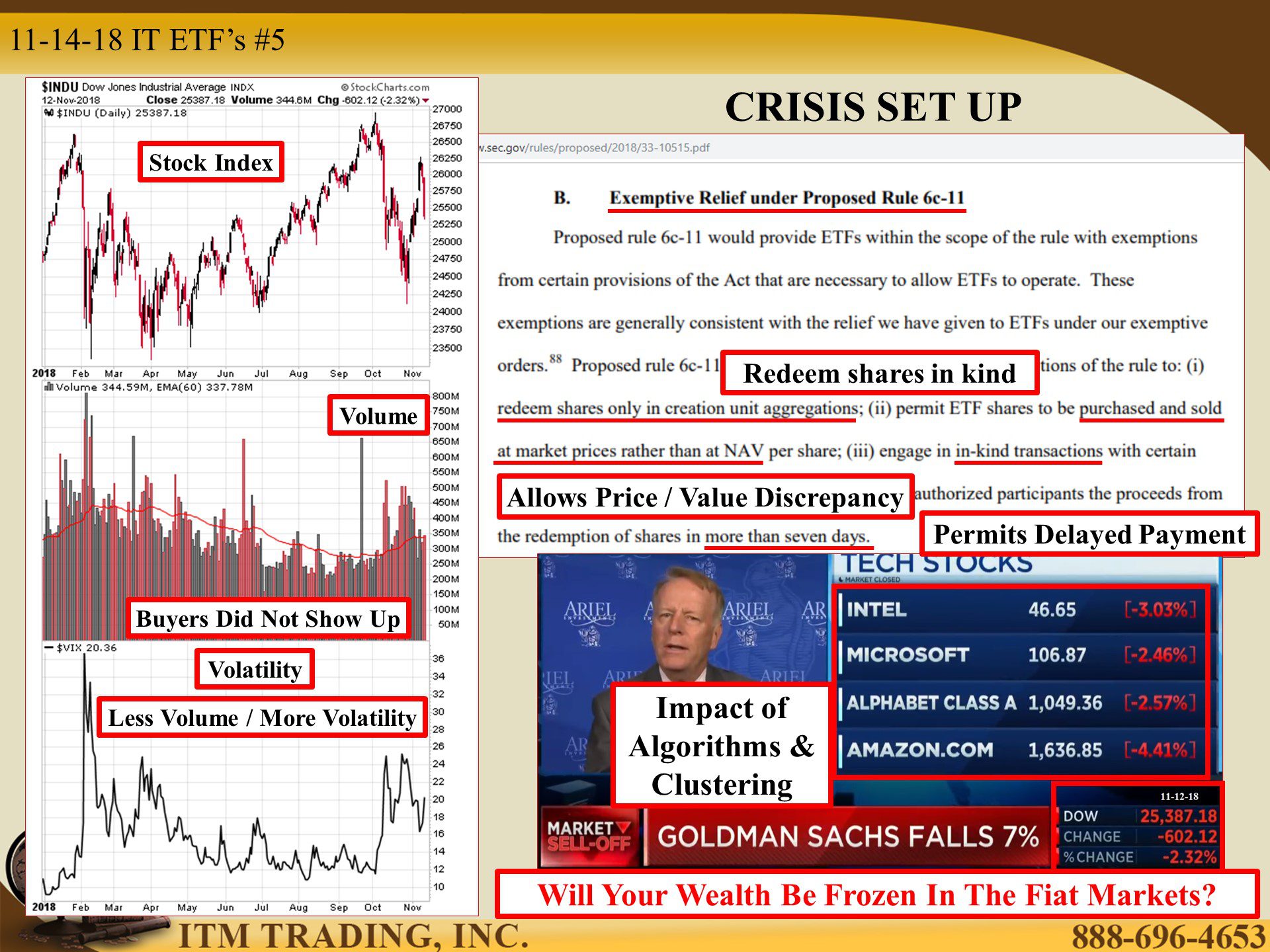

As a result, wealth poured into passive ETFs, exploding from $531 billion in 2008 to over $3.4 trillion in 2017 in what is referred to as the rise of the algorithms. Now 90% of daily trading volume is now generated by computers. Keep in mind that computers don’t reason, they compute, and once a formula is triggered, there is an automatic response.

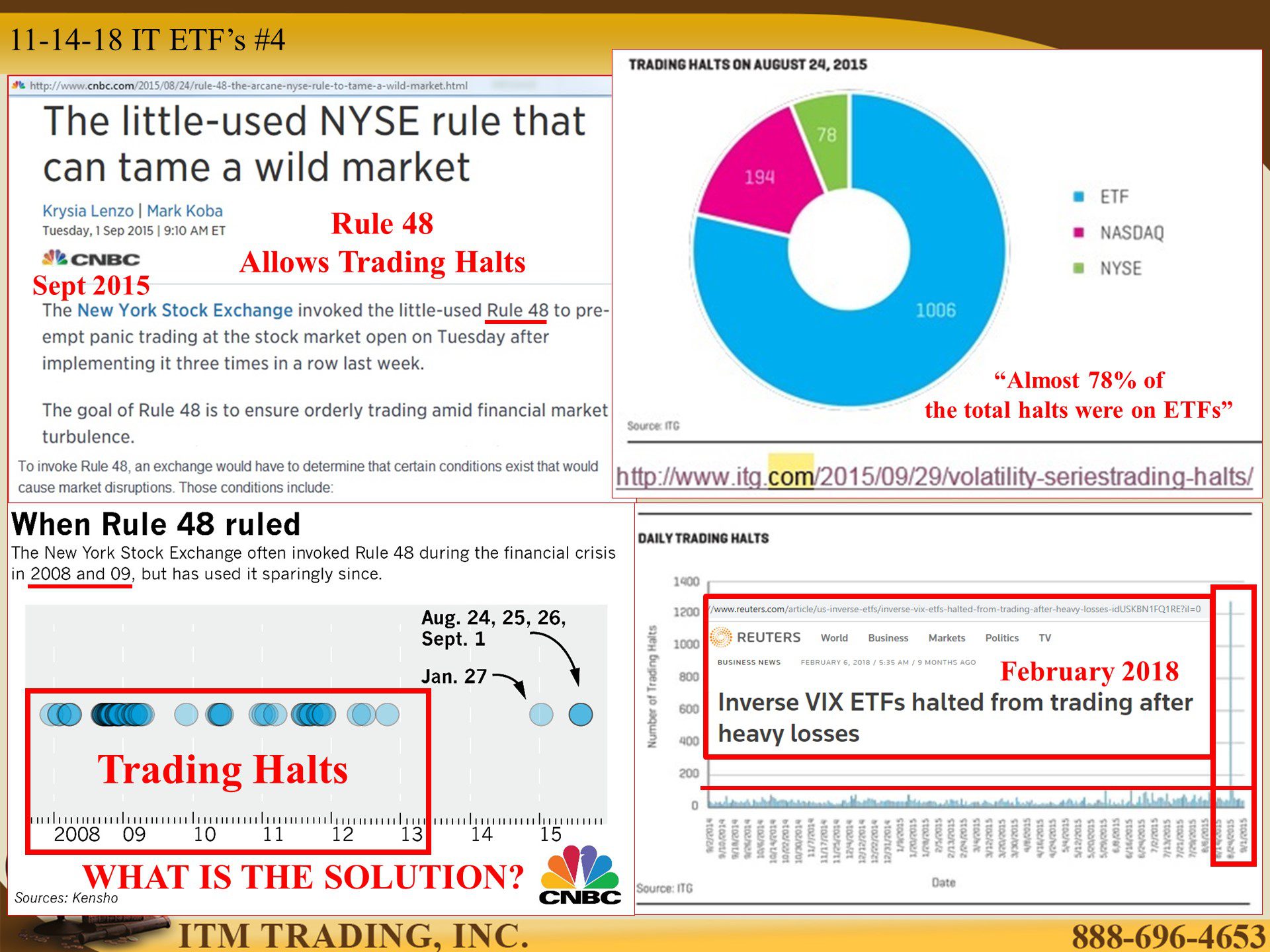

We saw what that looked like in the May 2010, August 2015 and the 2014 stock and treasury flash crashes. Just as they blocked the oversight of OTC derivatives AFTER the LTCM derivative implosion, which led to the 2008 financial crisis, rules governing ETFs have been eased.

After IMF, CME and SEC studies showing how rapidly liquidity dries up just before a flash crash, the SEC decided to enhance Rule 48, which allows exchanges to halt trading. The enhancement expanded the length of time trades could be halted. So, you might want to sell, but if trading is halted, selling is not an option.

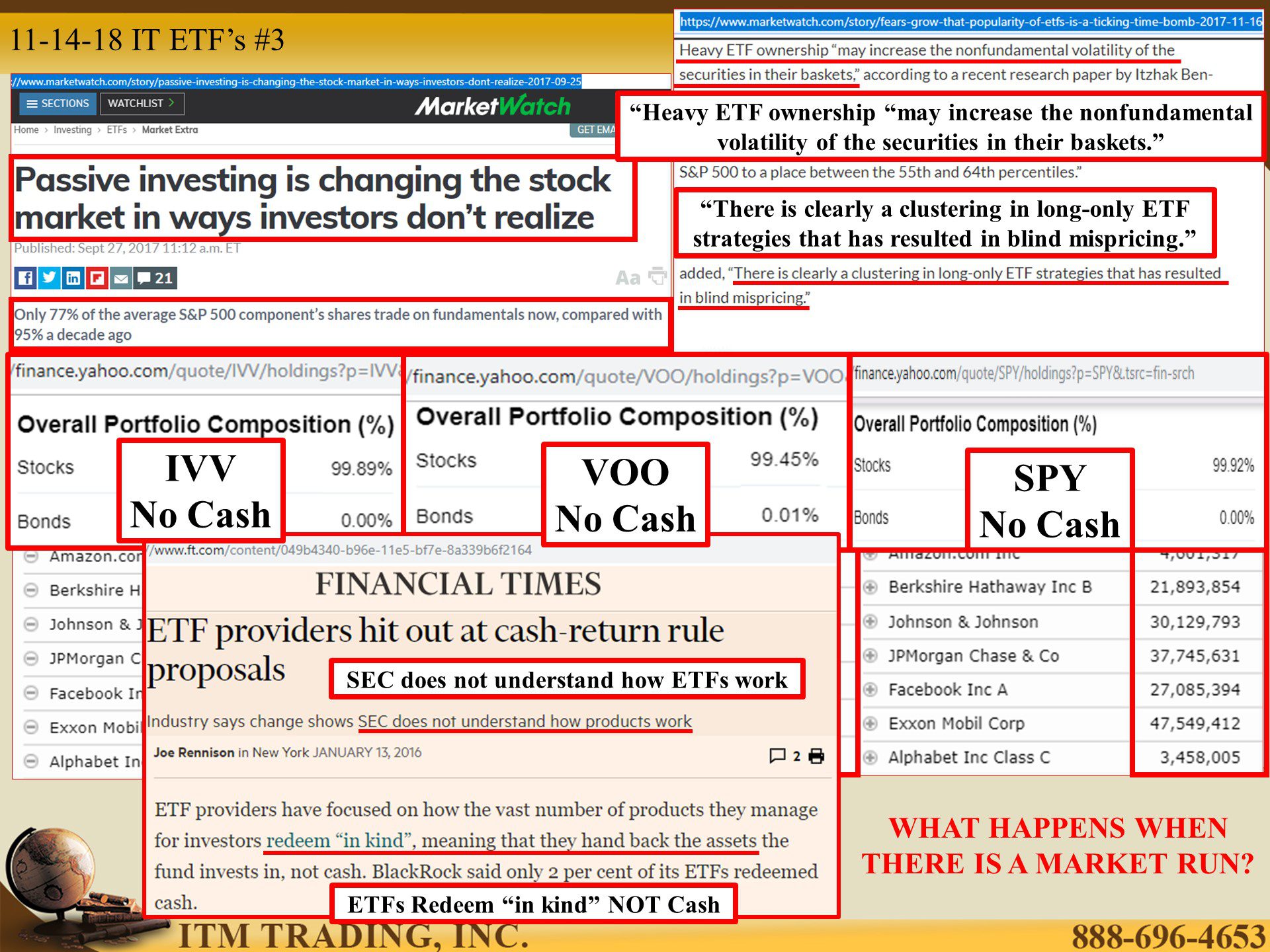

In addition, newly proposed rule 6c-11 grants ETFs certain exempt relief such as: ETFs do not have to hold cash or liquid securities because they are not required to pay out in cash, rather, they pay out in kind (either the underlying shares if you are an authorized participant) or they can pay out in shares of a different ETF entirely. In addition, if they do liquidate underlying holding to pay out authorized participants (not you) they can take more than seven days.

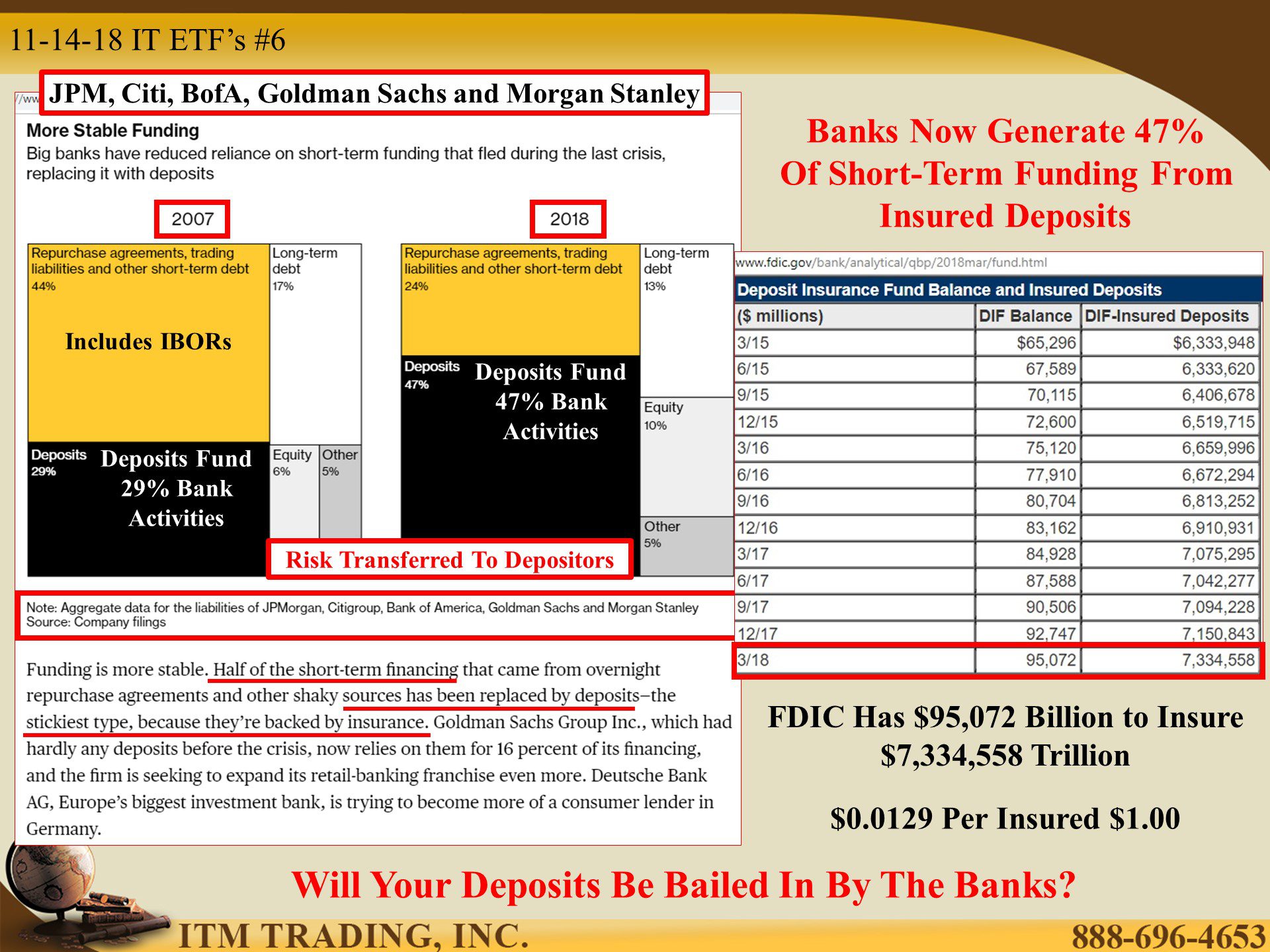

All of this shifting and fragility has been hidden by central bank cheap money policies, as well as, sovereign wealth funds and central banks buying everything from stocks to corporate bonds. All of which stifled volatility and pushed up fiat asset prices. But those policies are now changing as global central banks attempt to “normalize†their bloated balance sheets and raise interest rates, so they have some tools to work with in the next financial crisis.

Keep in mind that a large scale run on ETFs and these new rules have not been tested, but most likely will be…. during the next financial crisis.

Slides and Links:

https://www.cnbc.com/2018/09/10/how-the-financial-crisis-changed-stock-trading-on-wall-street.html

https://www.etf.com/sections/etf-league-tables/etf-league-table-2018-11-12

https://www.marketwatch.com/story/heres-how-much-etfs-are-dominating-on-the-trading-floor-2017-01-10

https://www.cnbc.com/2016/01/05/a-prolonged-sell-off-would-be-dangerous-for-etfs-commentary.html

https://www.Bloomberg.com/graphics/2018-growing-etf-market/

https://www.bis.org/publ/qtrpdf/r_qt1803j.htm

https://www.marketwatch.com/story/heres-how-much-etfs-are-dominating-on-the-trading-floor-2017-01-10

http://portfolios.morningstar.com/fund/holdings?t=SPY

http://portfolios.morningstar.com/fund/holdings?t=IVV®ion=usa&culture=en-US

http://portfolios.morningstar.com/fund/holdings?t=VOO®ion=usa&culture=en-US

https://finance.yahoo.com/quote/IVV/holdings?p=IVV&.tsrc=fin-srch

https://finance.yahoo.com/quote/SPY/holdings?p=SPY&.tsrc=fin-srch

https://finance.yahoo.com/quote/VOO/holdings?p=VOO&.tsrc=fin-srch

https://www.ft.com/content/049b4340-b96e-11e5-bf7e-8a339b6f2164

http://www.cnbc.com/2015/08/24/rule-48-the-arcane-nyse-rule-to-tame-a-wild-market.html

http://www.itg.com/2015/09/29/volatility-seriestrading-halts/

https://www.zerohedge.com/news/2017-10-16/black-monday-20-next-machine-driven-meltdown

https://www.sec.gov/rules/proposed/2018/33-10515.pdf

https://www.imf.org/external/pubs/ft/wp/2015/wp15222.pdf

https://stockcharts.com/h-sc/ui

https://www.bloomberg.com/graphics/2018-lehman-anniversary/

https://www.fdic.gov/bank/analytical/qbp/2018mar/fund.html

YouTube short description:

Wealth poured into passive ETFs, exploding from $531 billion in 2008 to over $3.4 trillion in 2017 in what is referred to as the rise of the algorithms, since 90% of daily trading volume is now generated by computers. Because of the way ETFs are created and the fact that they generally hold no cash, flash crashes can be expected. Just as they blocked the oversight of OTC derivatives AFTER the LTCM derivative implosion, which led to the 2008 financial crisis, rules governing ETFs have been eased.

I believe that this will lead to wealth remaining in the fiat system during the next financial crisis.