ENTERING THE MINEFIELD: Is Your Armor Ready? By Lynette Zang

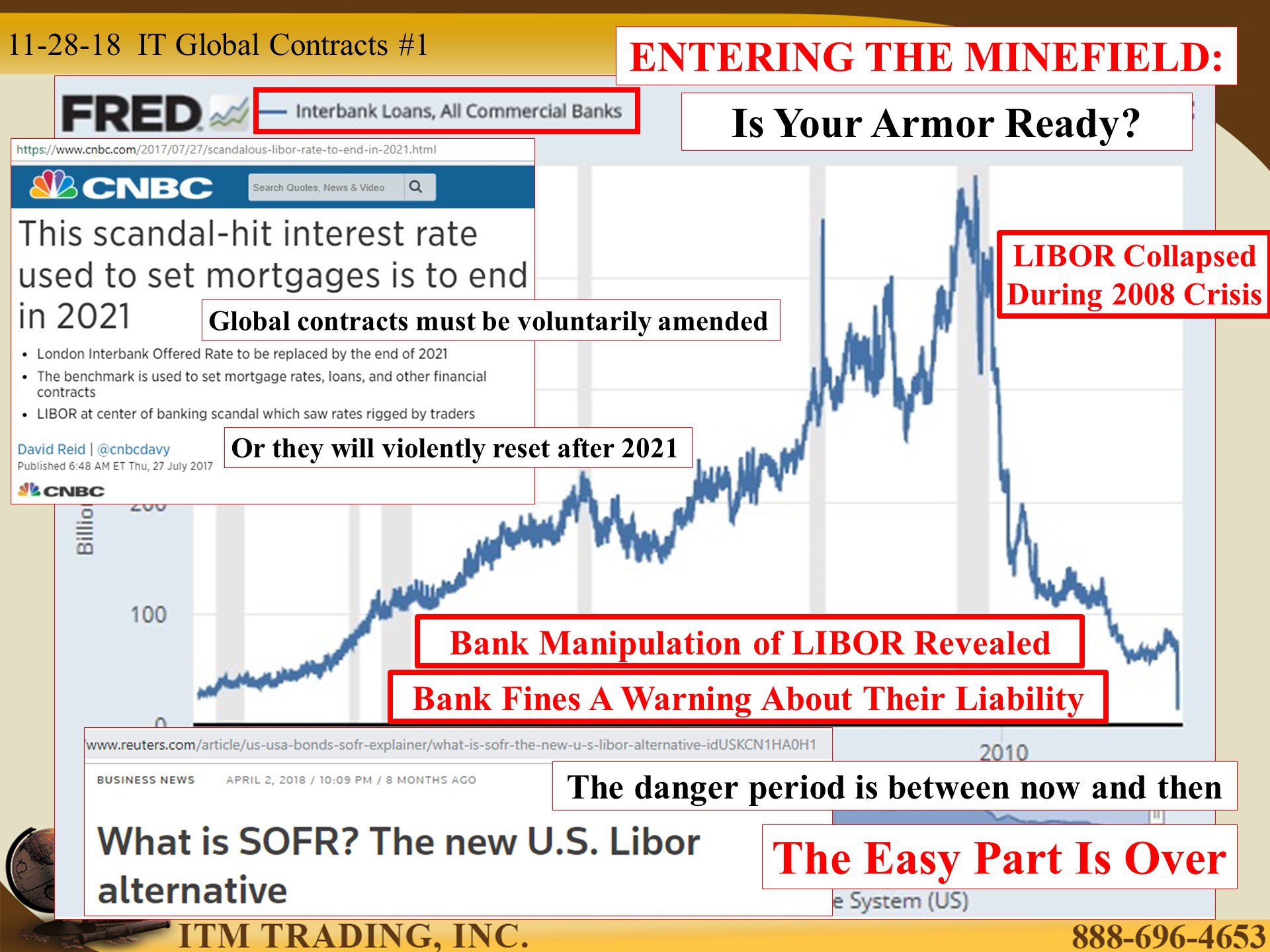

In 1986 the British Bankers’ Association first published LIBOR interest rates (consensus of 15 commercial banks), which went on to become the most important number in the financial world, with over $300 trillion financial contracts tied to it.

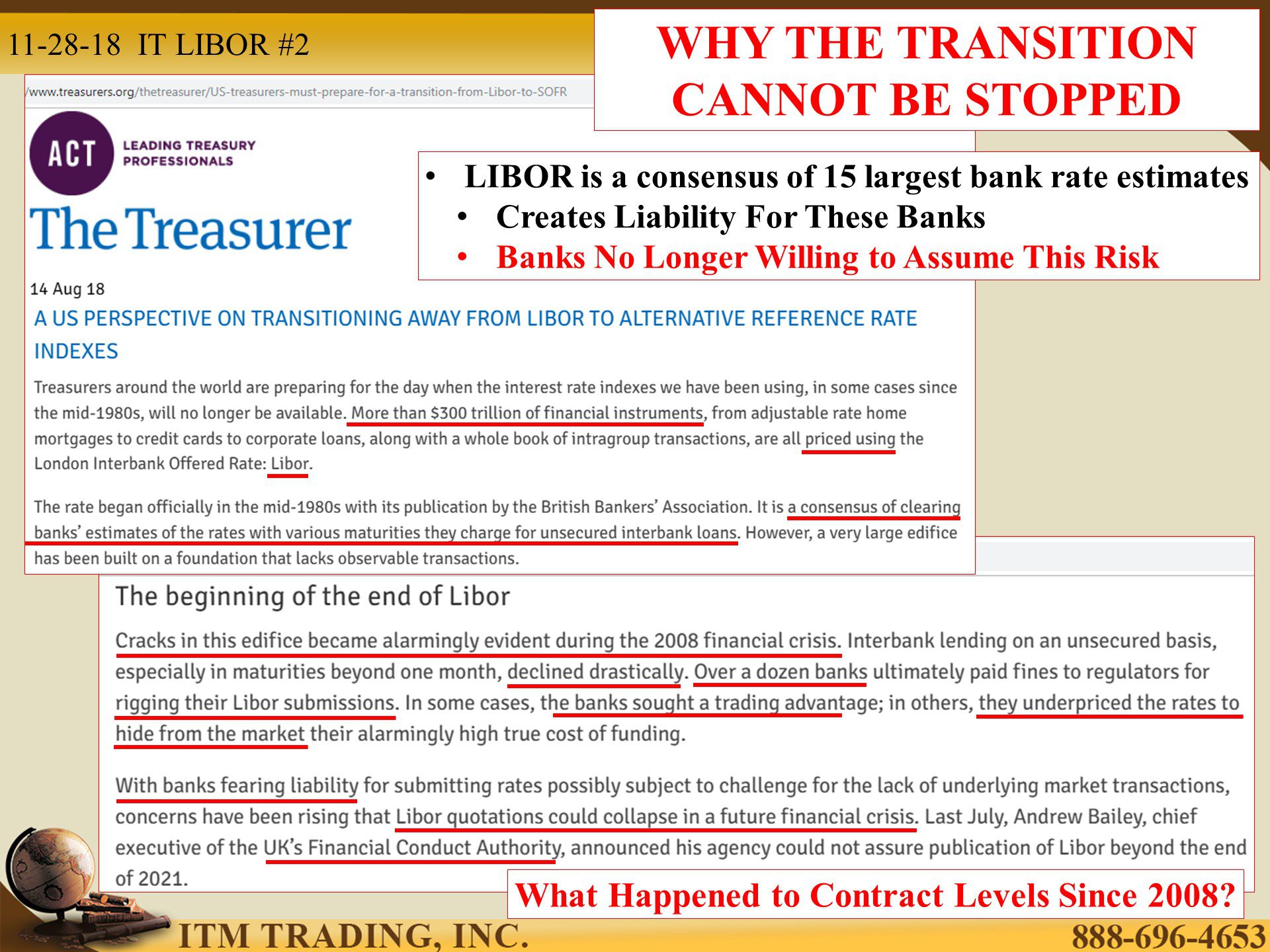

As the derivative triggered financial crisis unfolded, in 2008 all IBORs failed as market liquidity evaporated and banks stopped lending to each other.

Since LIBOR is a “consensus†interest rate number it’s easily manipulated. This manipulation was revealed to the public in 2012 and sixteen banks paid fines for this manipulation, chump change compared to the gains. But that was really a heads up to those systemically important banks, and they now understood the liability they bear, if they continue to set the rates.

In addition, global governments and central bankers now knew that banks, unwilling to assume that risk, would stop providing the markets with this benchmark rate during the next crisis, jeopardizing the valuations of over $300 trillion in fiat market contracts.

This is why new interest rate benchmarks are required. There is no choice.

Alternative Reference Rate Committee, created in 2014 as a committee of 15 banks; they selected SOFR as the USD LIBOR alternative (though Great Britain, Switzerland, Japan and the Euro Zone are all working on their own new benchmarks). This year the NY Fed began publishing the SOFR number and wall street exchanges began trading derivatives against this number. Running everything concurrently with LIBOR to familiarize the markets with this new benchmark and gain market acceptance, as they attempt to develop a robust and liquid market.

Though this was the easy part, since minimum consensus was required. But now we’re entering the transition minefield and there are some key financial mines that could explode between now and the end of 2021.

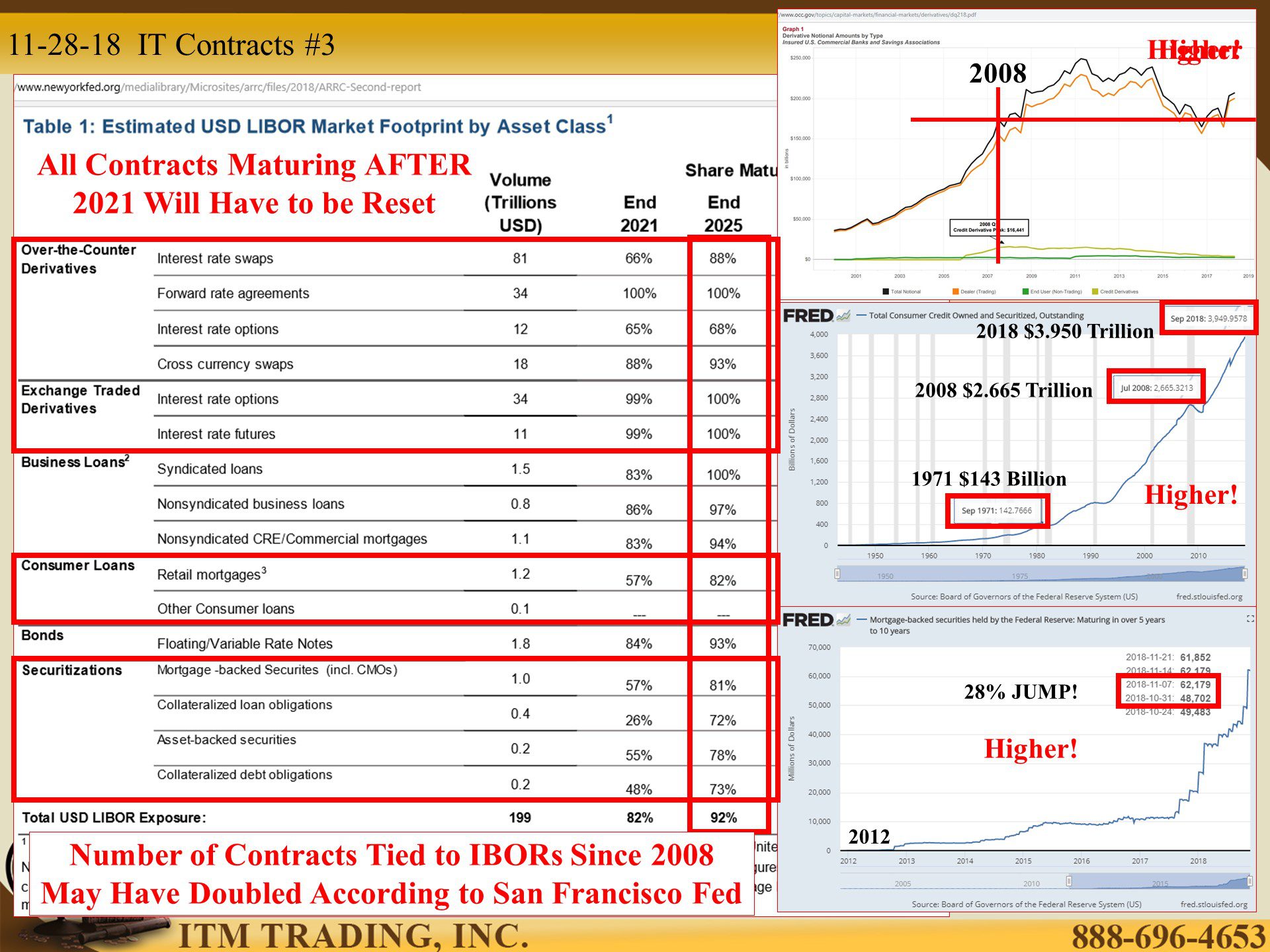

First of all, knowing that this benchmark was going away, one might have expected one of two things: either no more contracts would be written tied to this benchmark, or stronger “fall-back†language would be inserted into any new contracts written. Instead, since 2008, new contracts tied to LIBOR have doubled, according to the San Francisco Fed, and most contract “fall-back†provisions assume a short period of unavailability to LIBOR and are not permanent.

The discontinuation of LIBOR will force a reset tsunami that would be impossible to control due to the variance of terms in all the different contracts. So the banks are attempting a “controlled†transition and up next is to standardize “fall-back†provisions, which they hope to have complete in early 2019.

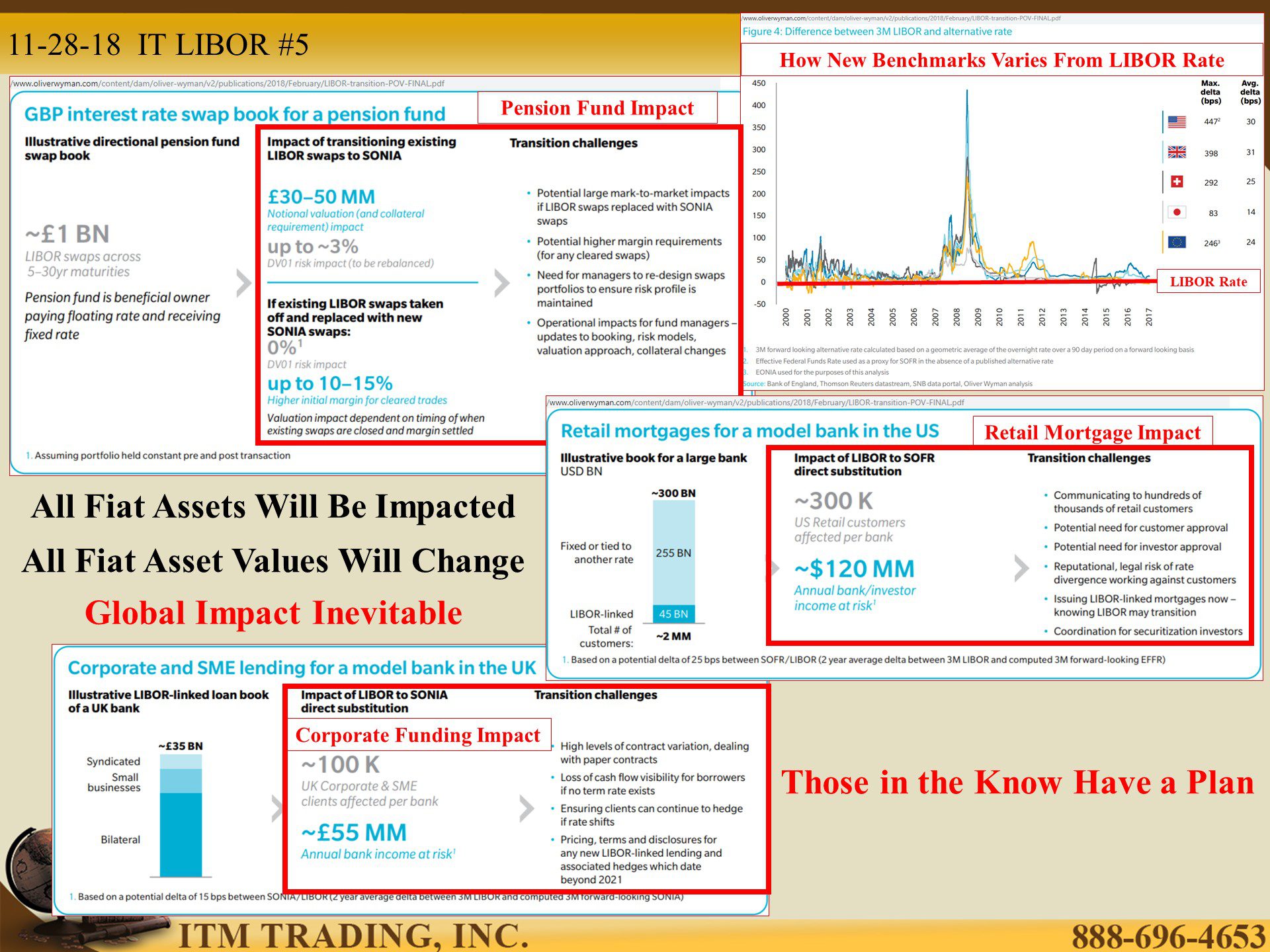

Which takes us to another financial mine since 95% of the current contracts tied to LIBOR are highly complex derivative contracts that would require 100% agreement among thousands of investors. YIKES! It’s hard enough to get two people to agree, let alone thousands, and could create a challenge to converting legacy (already existing) contracts.

But even if they are successful in creating a robust market and getting universal consensus, more risks loom large because a change in the benchmark means an inevitable change in valuations, starting with a change in the value of the underlying contracts. This in turn would impact the valuation of the corporation, leverage levels and, in the case of banks, the ability to reward shareholders and transfer wealth out of corporations. It also has significant implications for the already underfunded pension plans, retail mortgages and corporate loans. Nothing will be immune, and that’s if everything goes well!

This is why it’s so important to have a plan. Those in the know do, they buy gold. Central bank gold buying escalated 22% YOY, JPMorgan expands their control over the physical gold markets by partnering with the Bank of France to boost gold bullion services and the ultra-rarity index has climbed dramatically over the past year. Their plan is to hold real money that is outside the fiat financial system because physical gold is the only true safe haven asset, protective armor for walking through this minefield.

That’s part of my plan too.

Slides and Links:

https://www.lsta.org/document/default/…/a5694c81-d6dc-11e8-bd85-bc764e0453da

https://www.lsta.org/about/board-of-directors

https://www.newyorkfed.org/medialibrary/Microsites/arrc/files/2018/ARRC-principles-July2018

https://www.newyorkfed.org/medialibrary/Microsites/arrc/files/2018/ARRC-Second-report

https://www.cnbc.com/2017/07/27/scandalous-libor-rate-to-end-in-2021.html

https://www.newyorkfed.org/medialibrary/Microsites/arrc/files/2018/ARRC-Second-repo

https://fred.stlouisfed.org/series/TOTALSL

https://www.newyorkfed.org/medialibrary/Microsites/arrc/files/2018/ARRC-Second-report

https://fred.stlouisfed.org/series/MBS5T10

https://www.newyorkfed.org/medialibrary/Microsites/arrc/files/2018/ARRC-Progress-Timeline-Oct-30.pdf

https://www.cmegroup.com/trading/interest-rates/secured-overnight-financing-rate-futures.html

https://www.breckinridge.com/insights/details/what-to-know-about-the-libor-phaseout/

https://www.kitco.com/news/2018-09-13/Morgan-Stanley-Makes-Rare-Tactical-Case-To-Own-Gold.html

YouTube Short Description:

As the derivative triggered financial crisis unfolded, in 2008 all IBORs failed as market liquidity evaporated and banks stopped lending to each other.

In addition, global governments and central bankers now knew that banks, unwilling to assume that risk, would stop providing the markets which this benchmark rate during the next crisis, jeopardizing the valuations of over $300 trillion in fiat market contracts.

This is why new interest rate benchmarks are required. There is no choice.

This is why it’s so important to have a plan. Those in the know do, they buy physical gold. That’s part of my plan too.