EDUCATE YOURSELF NOW: Trend Cycles & Investment Opportunities… By Lynette Zang

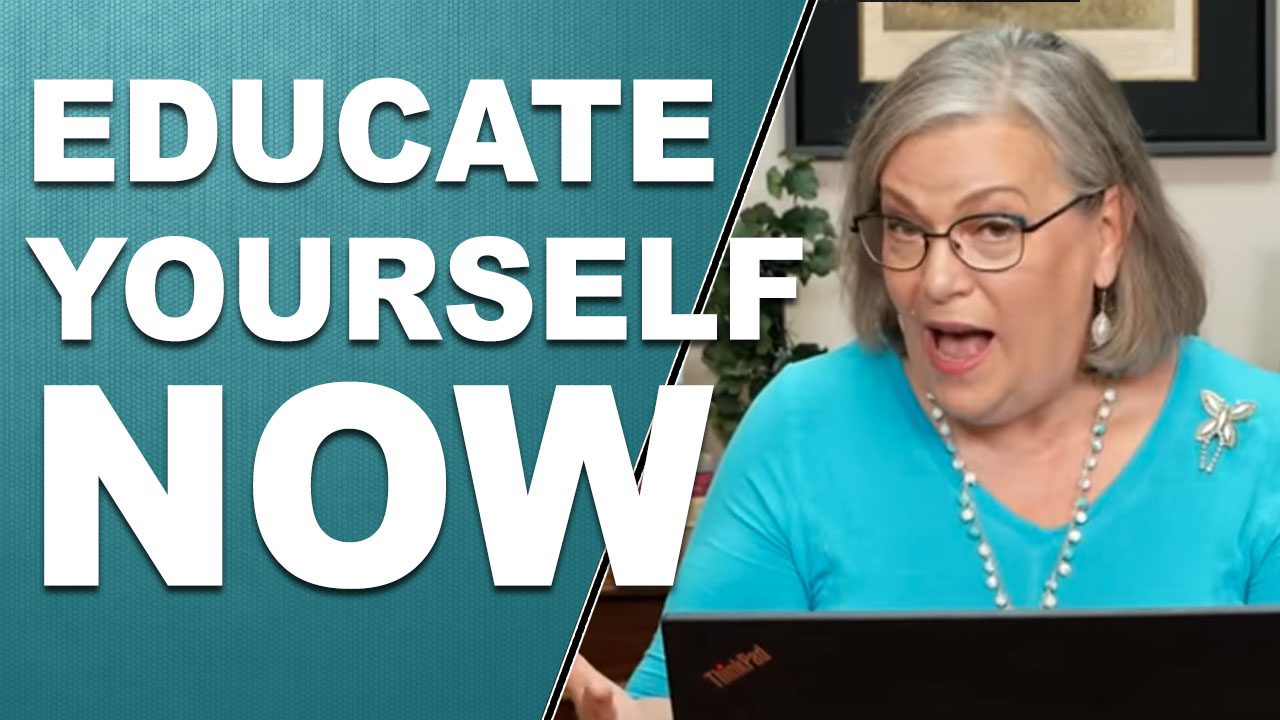

People always ask me two questions: When will the next crisis hit and Should I wait to buy gold and silver to get a better price. The good news is that all trends follow a similar path, therefore understanding the patterns of a trend can help answer both questions, though not to the exact moment of course. But if you know how to identify what phase the current trend is in, you can see what the next most likely outcome is. In other words, understanding the long-term trend helps you make educated choices, which is a focus for us here at ITM Trading. We love educated clients.

In addition, “The Strategy†is based on these repeatable patterns and if you know the most likely next outcome, no one can fool you with a lie. This video is designed to help you understand the general trend cycle and where stocks, real estate and gold are at this time.

We know that stocks in the Panic Phase because greed and central bankers have made valuations irrelevant, which is what makes taking profits the key opportunity in this phase. In addition, even though crisis indicators are screaming, we are told that this time is different, which is something we hear just before every financial crisis. Do you think it’s different this time?

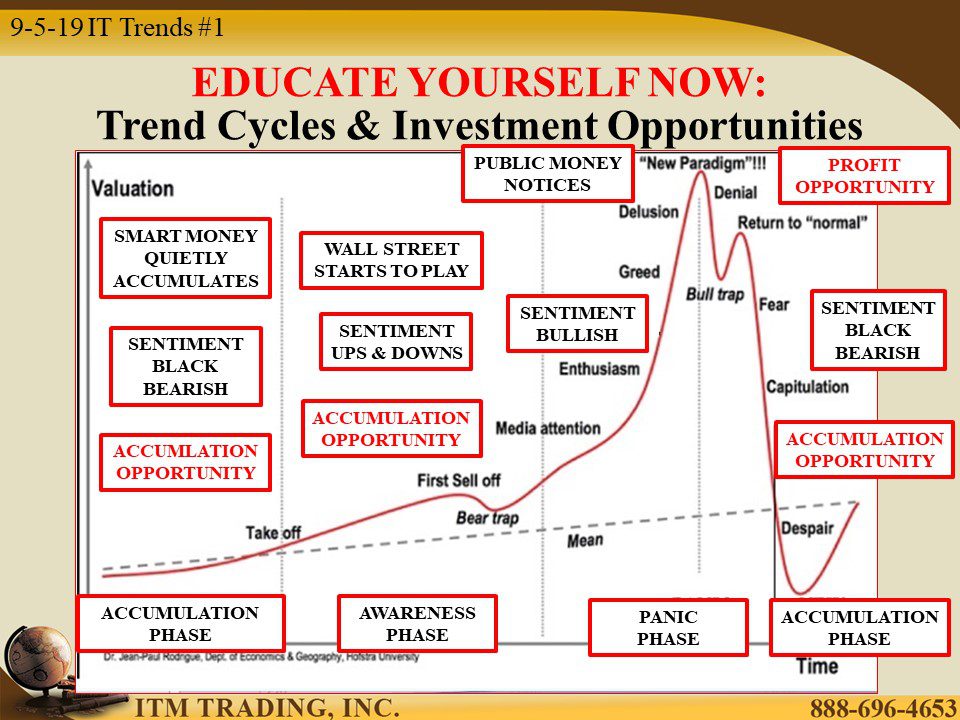

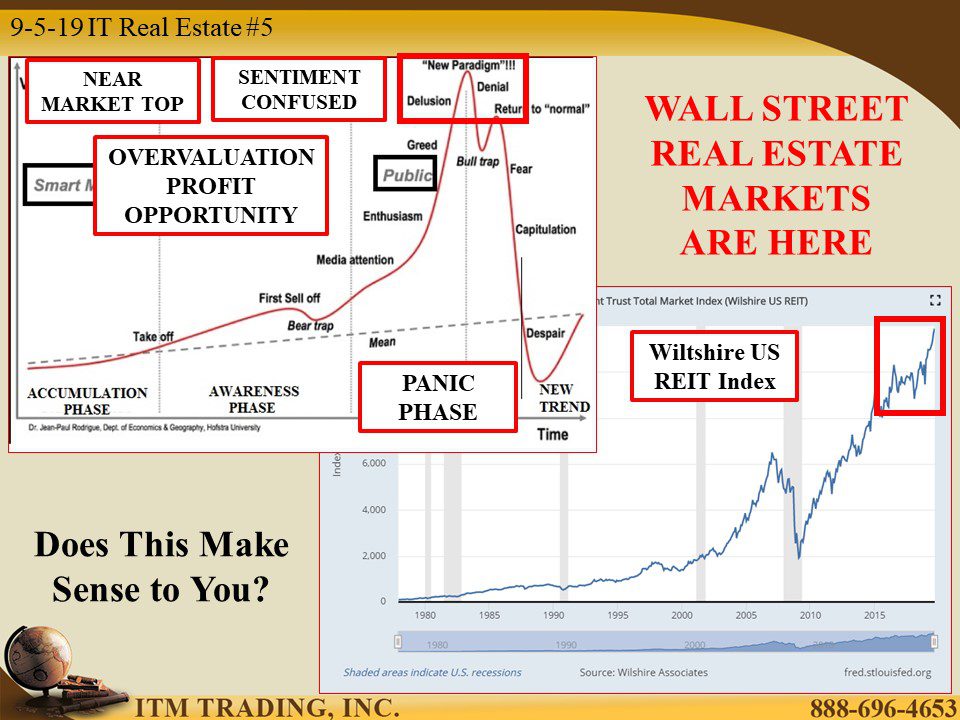

How about Real Estate? Looking at affordability, vacancy, construction and profitability is the key here. Today with massive store closings and a slowing economy, office and retail repeat sales began a downturn in 2018 that ushered in the third Hyper supply phase with increasing vacancy and new construction making a deadly cocktail for those who choose to buy at the top, but a great opportunity for those who sell.

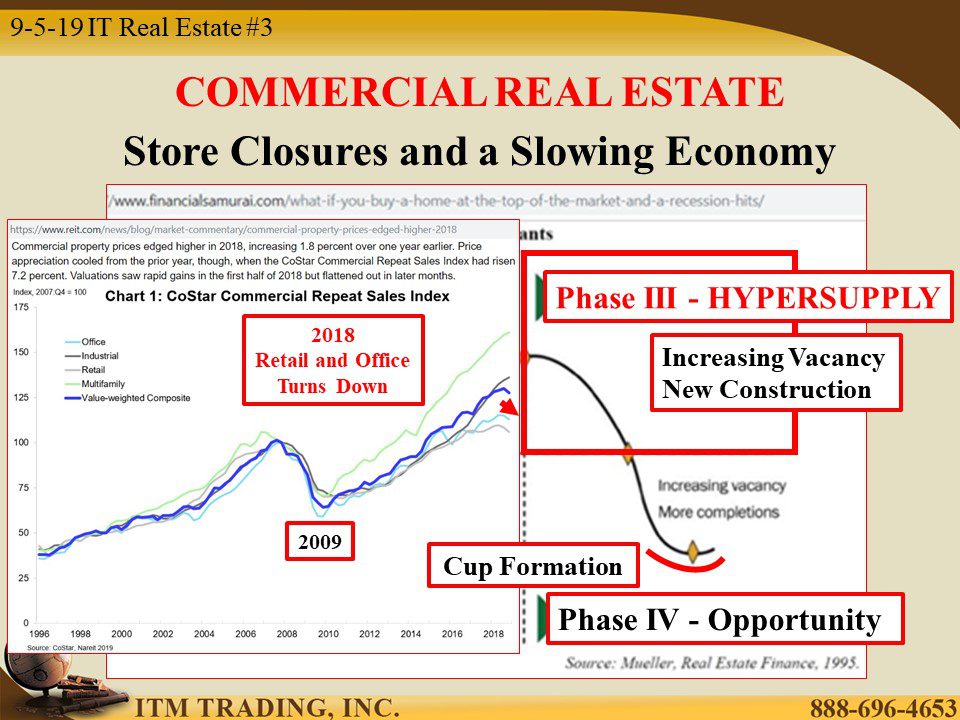

Residential real estate prices are at a new all time high. In fact, studies show that the median priced home is not affordable for the average wage earner in 71% of US housing markets. In addition, big players that took advantage of the last crisis, like Blackrock, turned homes into rentals, is selling out while small house flippers are experiencing declining profits. All signs of a market top. Bad time to buy, best time to sell.

As these physical real estate markets indicate a downturn, Wall Street REITs zoom to new highs and continue to be bought by “institutional investors†or those that invest other people’s money. This is what is typically held in pension plans, mutual funds and ETFs etc. What goes up must come down. Do you think people understand the risk?

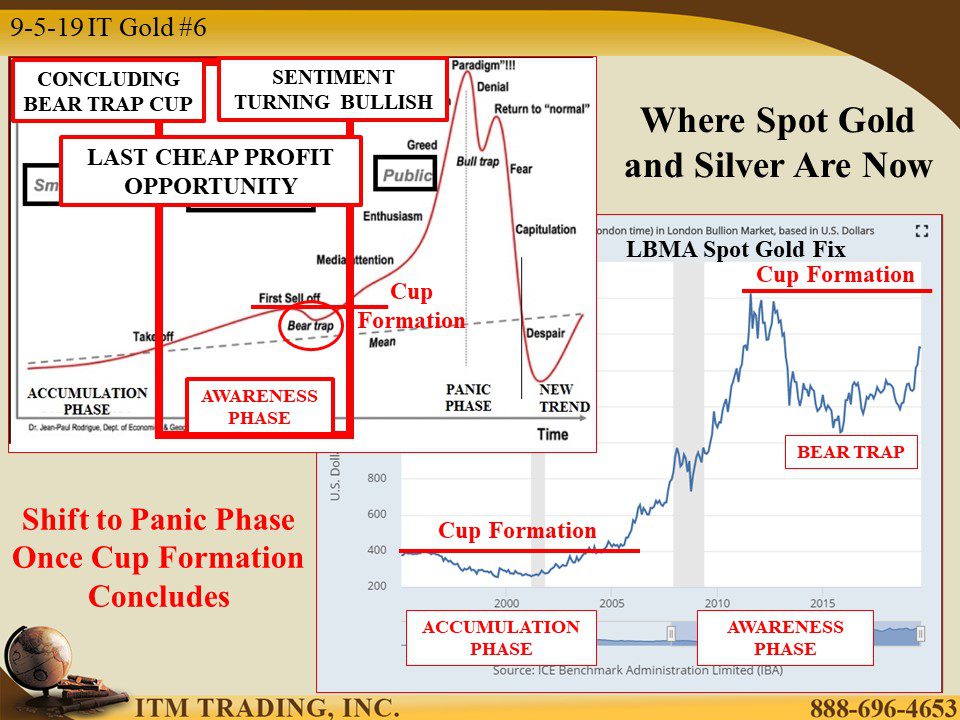

How about real money gold and silver? After entering the second awareness phase in 2004, gold is nearing completion of “Bear Trap†cup formation. When that cup completes, we will have entered the Panic Phase where prices soar. That means that this may be the last opportunity to buy at cheap prices. Spot silver has a bit further to go to come to bear trap cup conclusion, but with media attention heating up, this may well be near the cheapest you’ll be able to buy.

Using the same general trend chart, I hope you can see the pattern of a trend and use it to make educated choices in your entire portfolio. In this way, you can always hold wealth in an undervalued asset that is in a long-term positive trend and use profits from overvalued assets to roll into an undervalued opportunity.

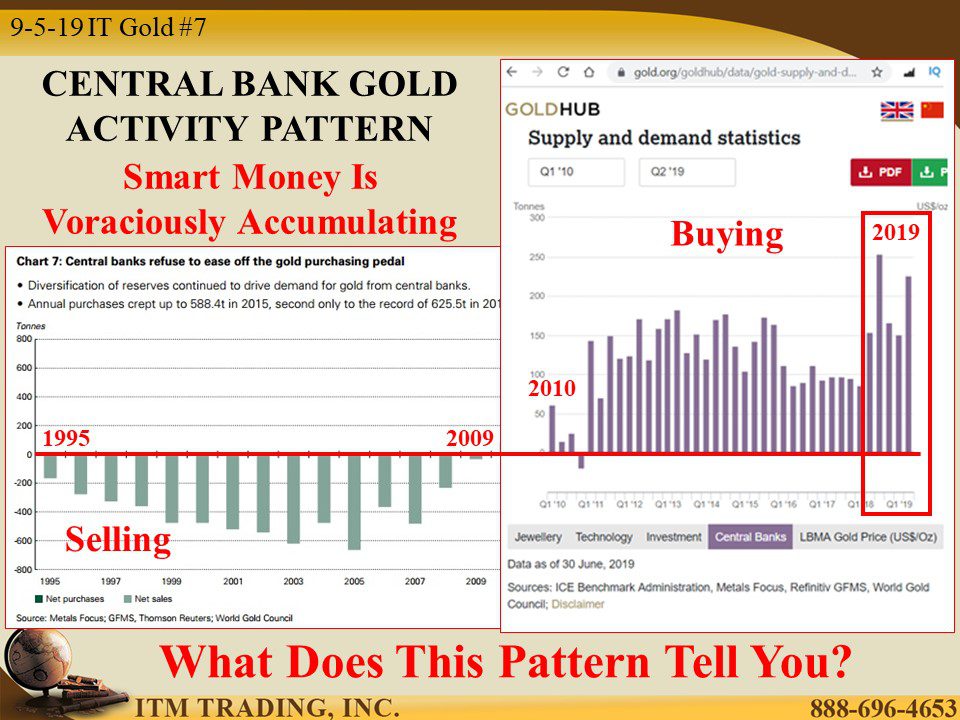

Finally, a key pattern to be aware of. Central bank gold activity pattern shows an accumulation pattern that began in 2007 and has been surging on expanded participation by global central bankers. If you learn only one pattern about money, learn this one. It tells you smart money is preparing for the next crisis. How about you?

Slides and Links:

https://www.reit.com/news/blog/market-commentary/commercial-property-prices-edged-higher-2018

https://fred.stlouisfed.org/series/CSUSHPINSA

https://www.attomdata.com/news/market-trends/attom-data-solutions-q1-2019-home-affordability-report/

https://www.sec.gov/Archives/edgar/data/1222333/000119312516458863/d138945dfwp.htm

YouTube Short Description:

People always ask me two questions: When will the next crisis hit and Should I wait to buy gold and silver to get a better price. The good news is that all trends follow a similar path, therefore, understanding the patterns of a trend can help answer both questions, though not to the exact moment of course. But if you know how to identify what phase the current trend is in, you can see what the next most likely outcome is. In other words, understanding the long-term trend helps you make educated choices, which is a focus for us here at ITM Trading. We love educated clients.

In addition, “The Strategy†is based on these repeatable patterns and if you know the most likely next outcome, no one can fool you with a lie. This video is designed to help you understand the general trend cycle and where stocks, real estate and gold are at this time.

A key pattern to be aware of. Central bank gold activity pattern shows an accumulation pattern that began in 2007 and has been surging on expanded participation by global central bankers. If you learn only one pattern about money, learn this one. It tells you smart money is preparing for the next crisis. How about you?