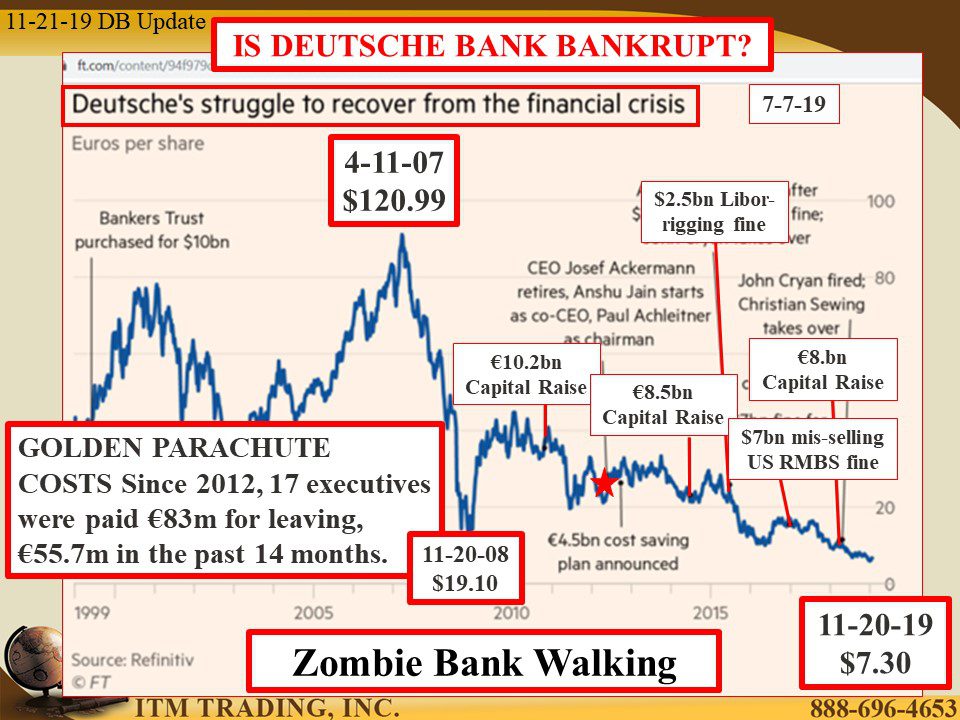

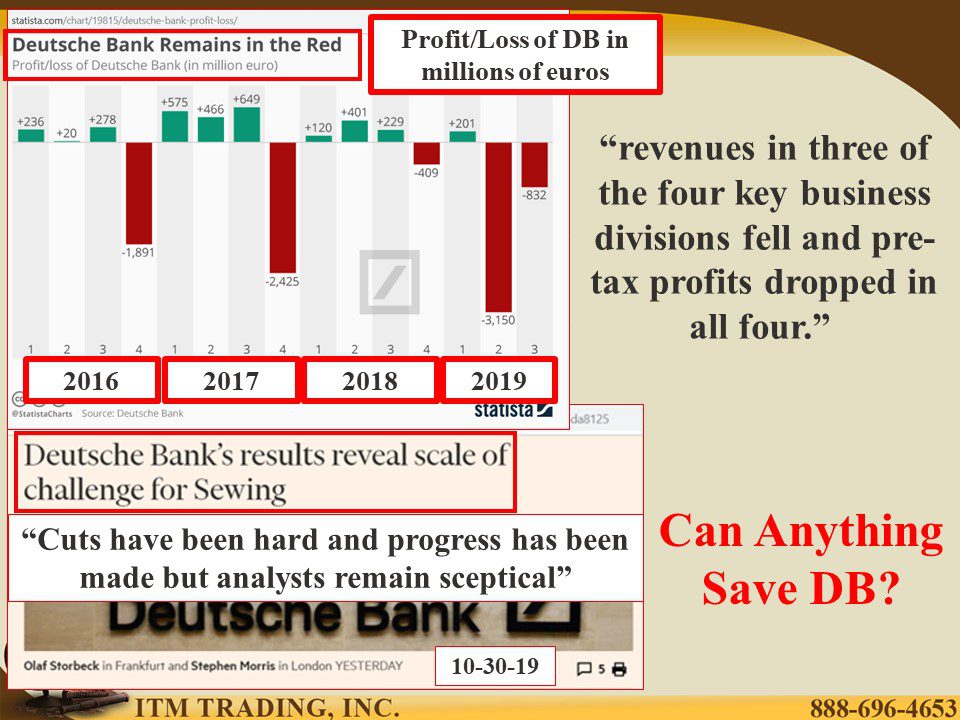

DEUTSCHE BANK GOING BANKRUPT? What Happens Next? Deutsche Bank Showing 94% Stock Loss!

The real question is “What would force Deutsche Bank into a formal bankruptcy?†The answer is the same as it was for Lehman in 2008, loss of funding. When does that happen? When it becomes too expensive to prop up.

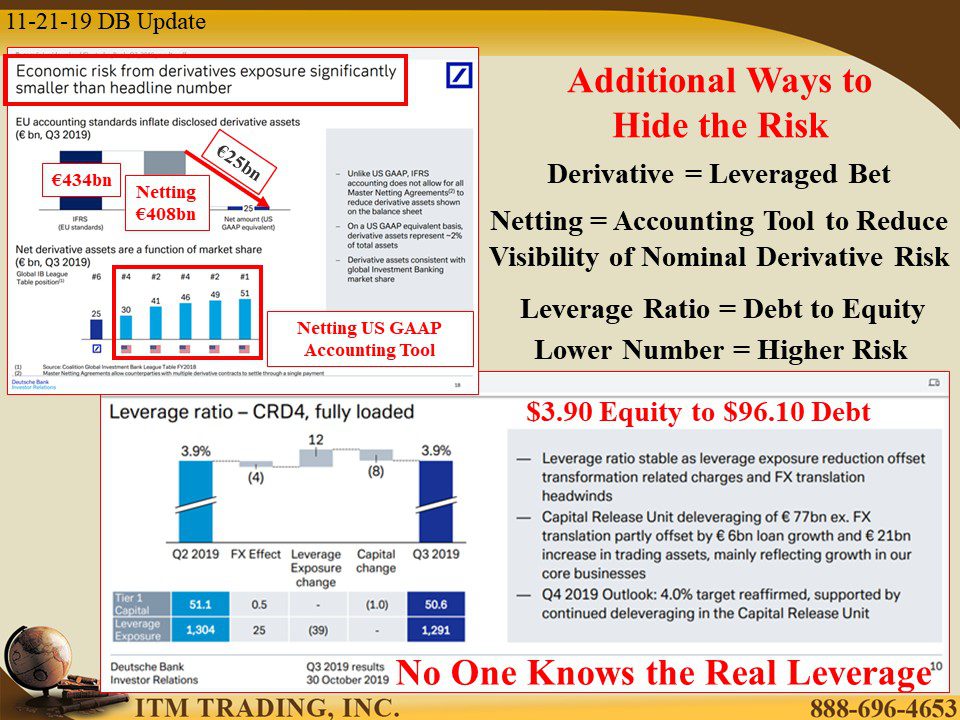

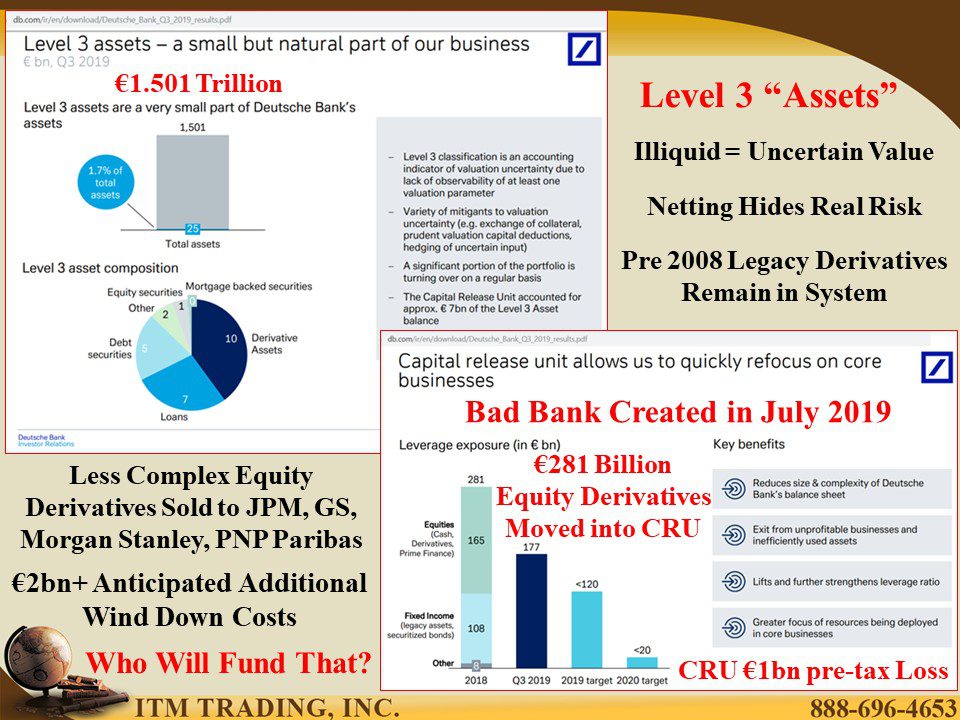

In the mean time they are trying to shrink their leverage and global footprint by creating a “Bad Bankâ€, move some illiquid equity derivatives into it, repackage them with some client assets that have value to banks and transferring the risk.

Have more questions that need to get answered? Call: 844-495-6042

The “Bad Bank†aka “Capital Release Unit†(CRU) was created last July by moving €281 Billion (out of €1.501 Trillion) in illiquid Level 3 “Assetsâ€. There is basically no market for level 3 assets, which include complex legacy derivatives that were created prior to 2008 and have no market value but carry ongoing fees to keep them afloat.

Therefore, in order to inspire another bank to buy them, valuable income producing clients are bundled together to provide some value. Even so, in its first quarter of life, the CRU pre-tax loss, as reported in their Q3 financials, at €1 billion. Keep in mind that these sales to other banks does not eliminate the legacy derivative risk, it merely moves them into another bank.

Some of these first round sales went to JPMorgan and Goldman Sachs, both FDIC banks.

An additional €2 billion wind down costs are anticipated, though I believe the costs will be much, much higher. So who will fund those costs? Previous funding rounds have burned investors, loss absorbing bail-in bonds are trading at deep discounts and credit default swap (CDS) prices are soaring. All indicators that the markets expect Deutsche Bank to fail. Therefore, the market appears to have lost faith in DB and is not likely to fund them any longer. So who’s left?

Central banks, who have used low interest rates to keep the other zombie banks and corporations appearing alive. But negative rates and bloated balance sheets mean that central banks have minimal fire power left to fight the escalating global slowdown. Would they squander it on Deutsche Bank? Would it be left to the German Central Bank?

In 2017 Germany managed to repatriate their gold. The headlines asked if they know something we don’t. They do. Germany remembers the hyperinflation that gripped it between 1919 and 1923. They know that once hyperinflation begins there is no stopping it. And they know that only gold holds value when that happens.

Like me, they’d rather be early than one second too late.

Slides and Links:

https://www.ft.com/content/94f979d8-a0a2-11e9-974c-ad1c6ab5efd1

https://www.ft.com/content/de2f0c00-0239-11ea-b7bc-f3fa4e77dd47

https://www.ft.com/content/978e7ade-fb35-11e9-a354-36acbbb0d9b6?segmentId=778a3b31-0eac-c57a-a529-d296f5da8125

https://www.statista.com/chart/19815/deutsche-bank-profit-loss/

Deutsche Bank Death Spiral Hits Historic Low. European Banks Get Re-Hammered

https://www.db.com/ir/en/download/Deutsche_Bank_Q3_2019_results.pdf

https://www.db.com/ir/en/download/Deutsche_Bank_Q3_2019_results.pdf

https://www.db.com/ir/de/download/Client_and_Creditor_Presentation.pdf

https://www.reuters.com/article/us-deutschebank-restructuring-exclusive/exclusive-deutsche-bank-sets-aside-1-1-billion-to-exit-derivatives-idUSKCN1US1Y0

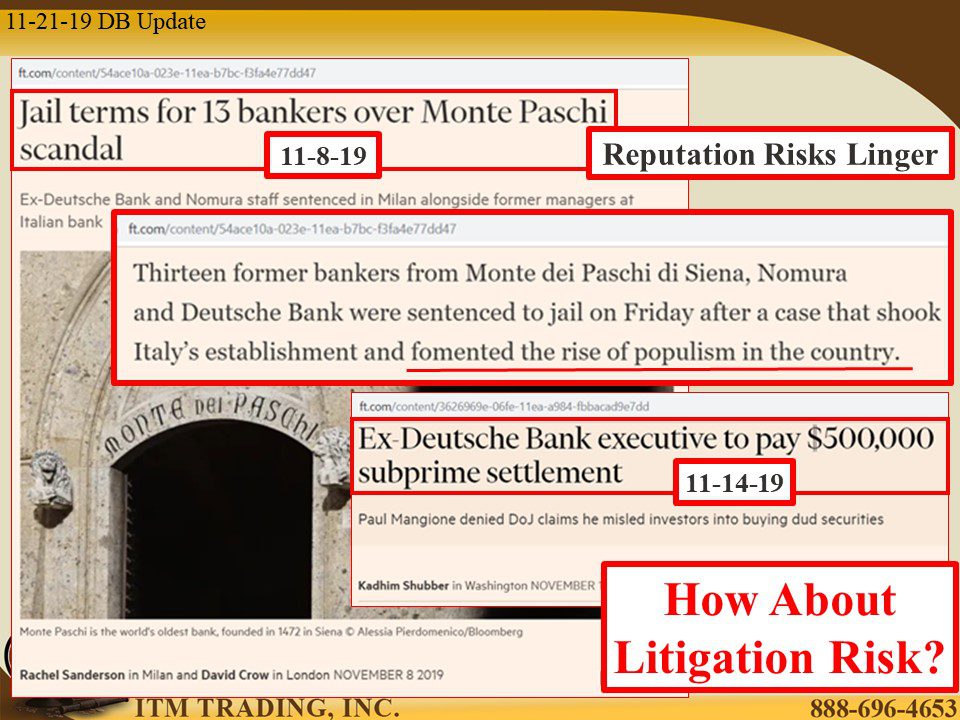

https://www.ft.com/content/54ace10a-023e-11ea-b7bc-f3fa4e77dd47

https://www.ft.com/content/3626969e-06fe-11ea-a984-fbbacad9e7dd

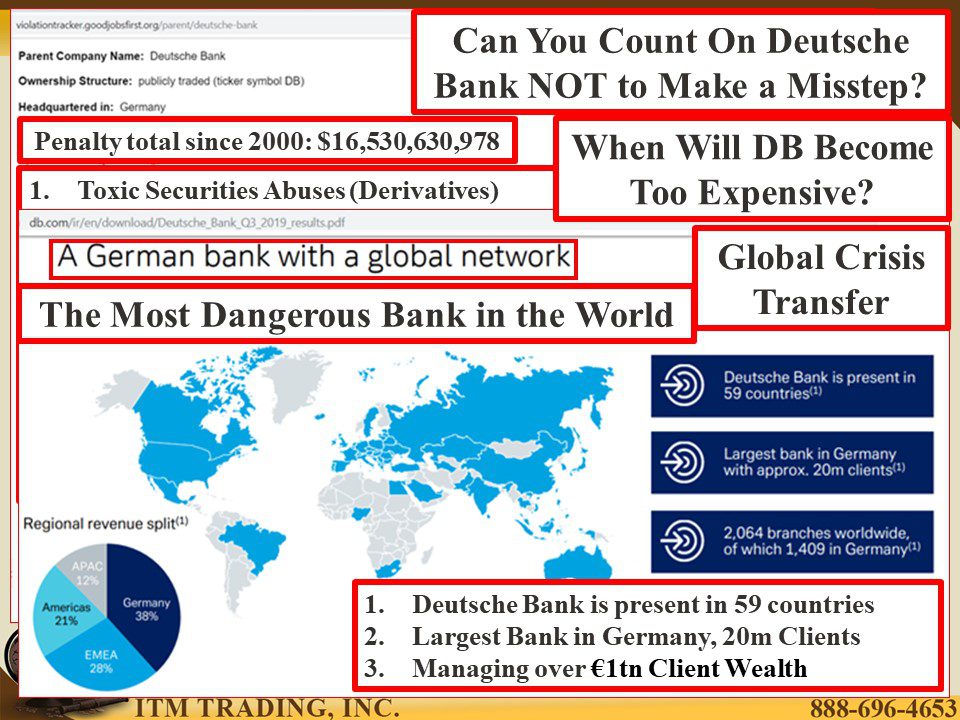

https://violationtracker.goodjobsfirst.org/parent/deutsche-bank

https://www.db.com/ir/de/download/Client_and_Creditor_Presentation.pdf

https://www.cnbc.com/2017/02/14/germany-has-got-its-gold-back–they-must-know-something-we-dont.html