A Very Deep Problem; Should You Care? by Lynette Zang

President Trump had a very busy morning. First, he called off the North Korea summit, which could lead to an escalation of war. Next, he signed the Dodd-Frank regulation roll back order, which will dismantle many of the regulations put in place during the 2008 crisis. I’ll be checking to see if the bail-in clause will be affected. I’m betting no.

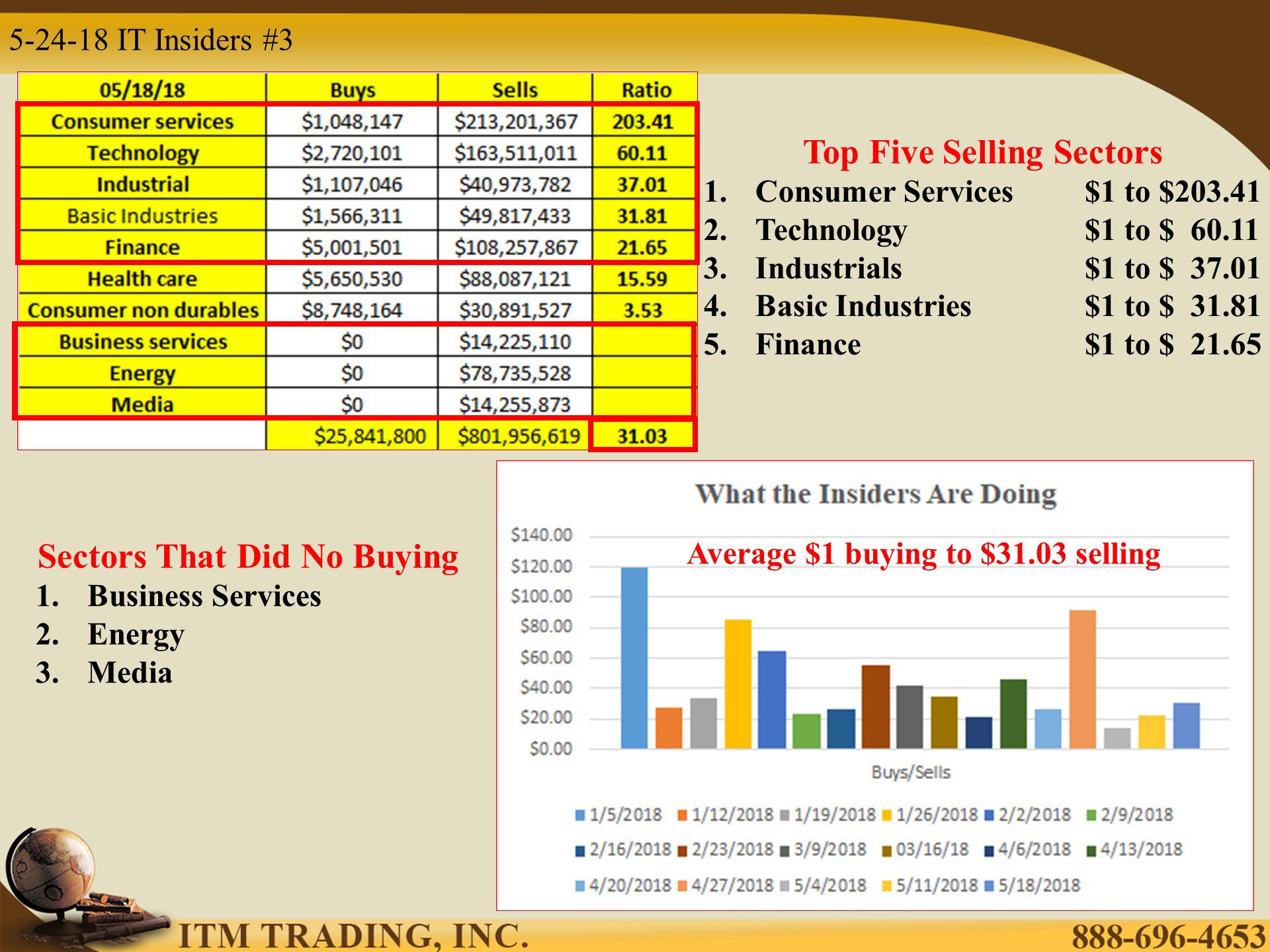

Technology continues in the top five insider selling to buying stock. In addition, there were three sectors that did no buying at all. Overall average of insider buying to selling was $31.03 of selling to every $1 of buying.

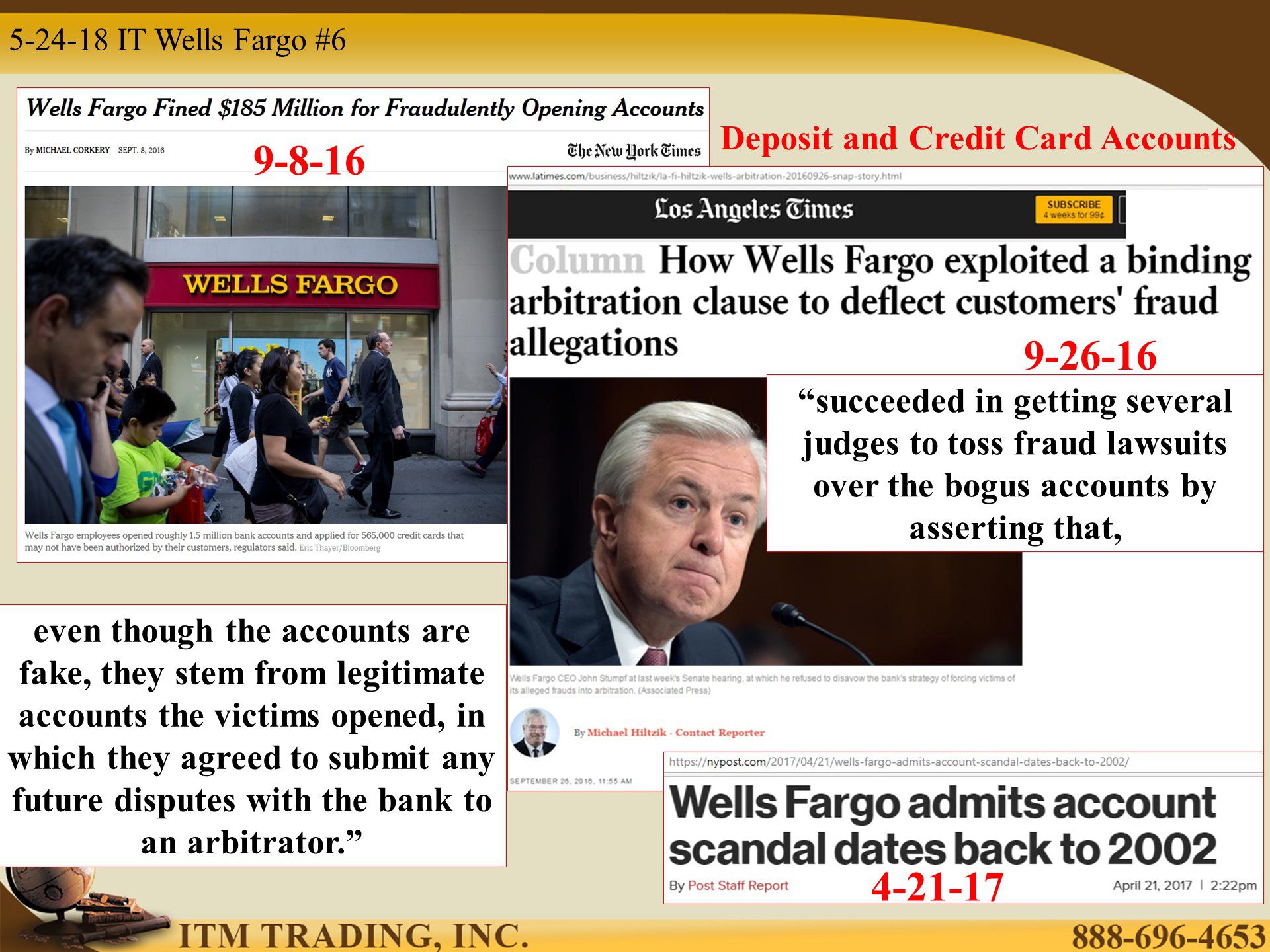

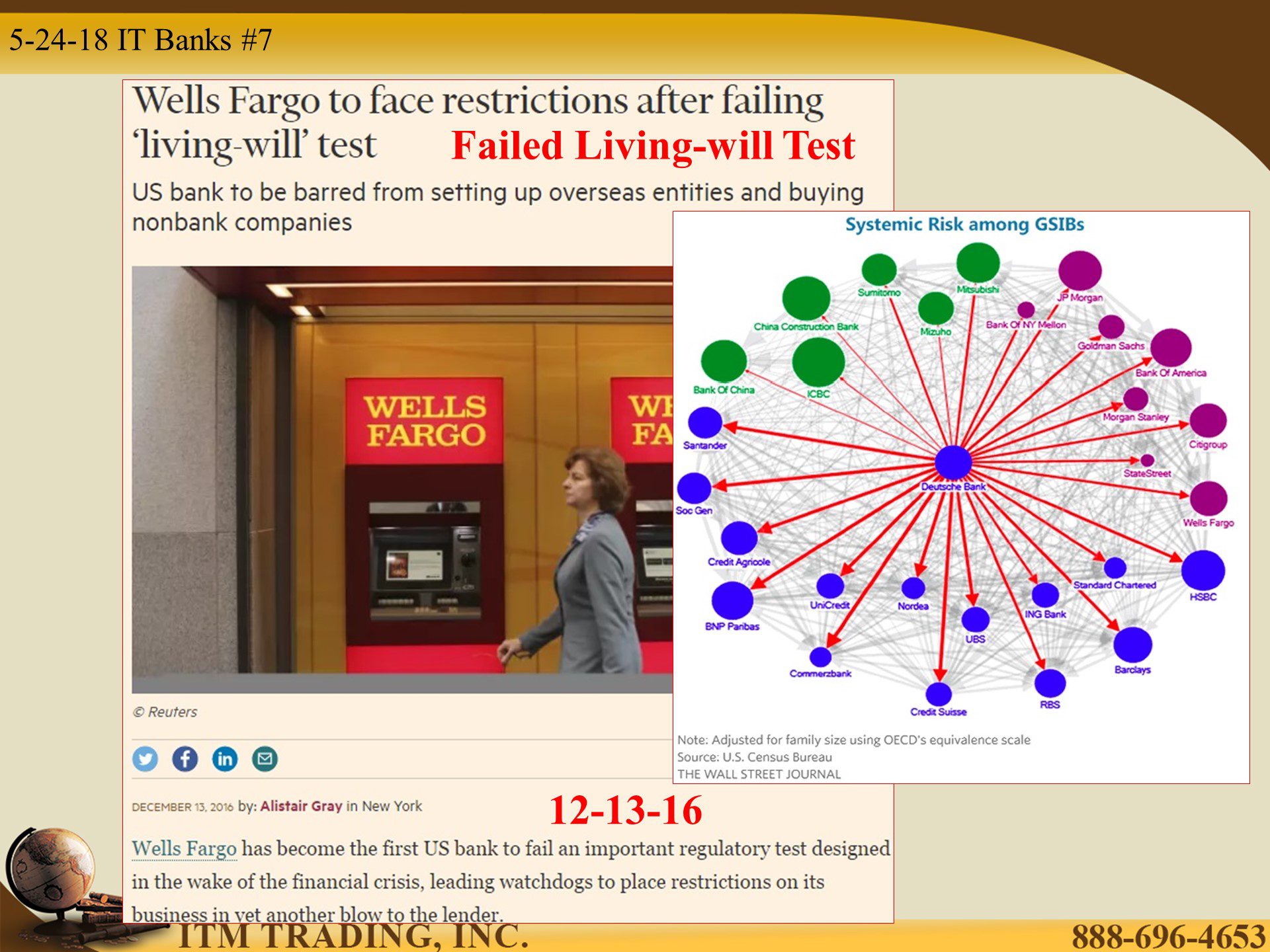

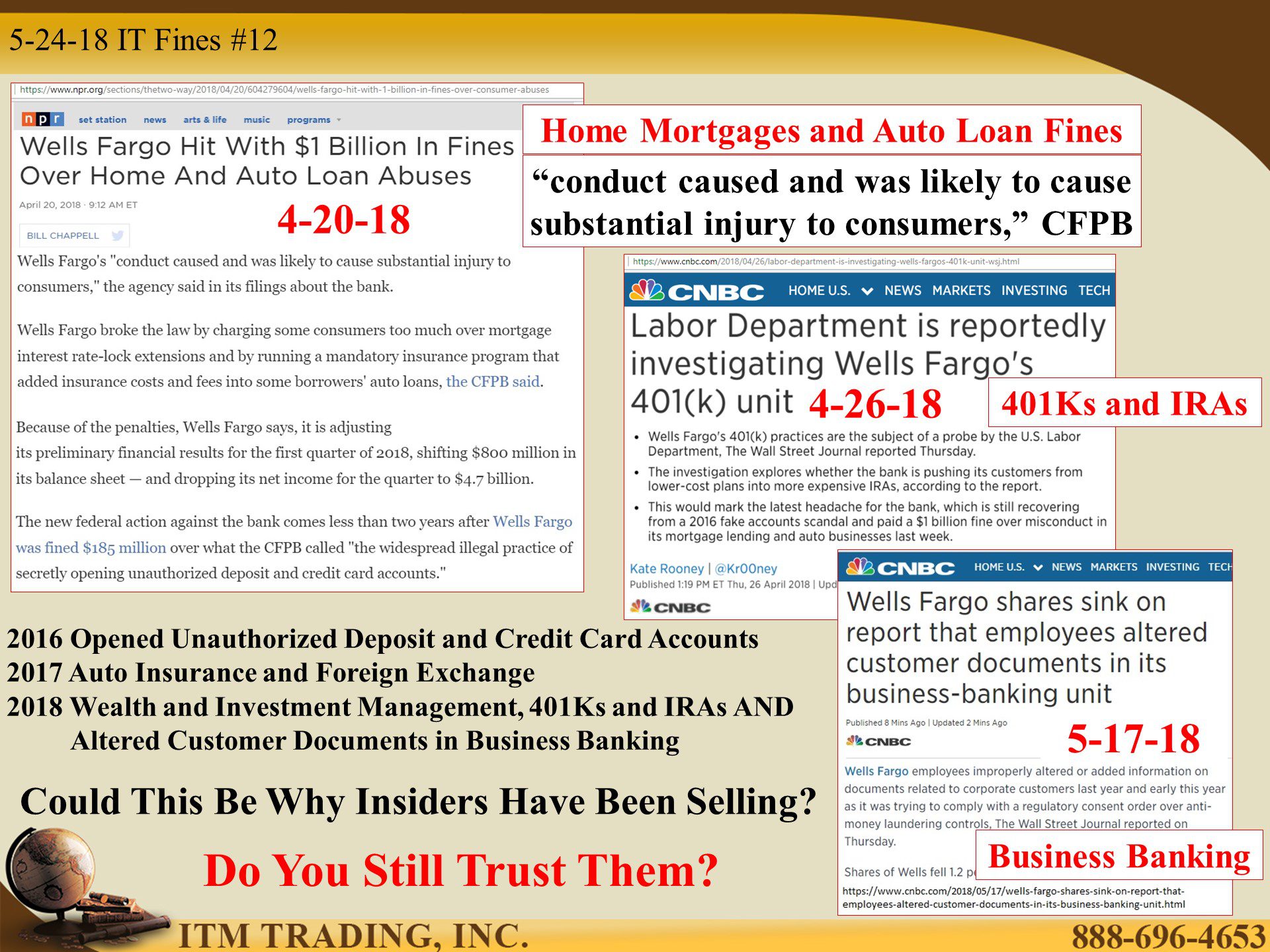

But this week we will focus on Wells Fargo. Yes, we’ve talked about them many times in the past, but they seem to be a gift that keeps on giving with their latest scandal mirroring the first. I say this because the scandal that broke in 2016 (dating back to 2002 or perhaps earlier) had employees altering new retail banking account documents and opening deposit and credit card accounts fraudulently. On 5-17-18 it was reported that business banking documents were altered fraudulently.

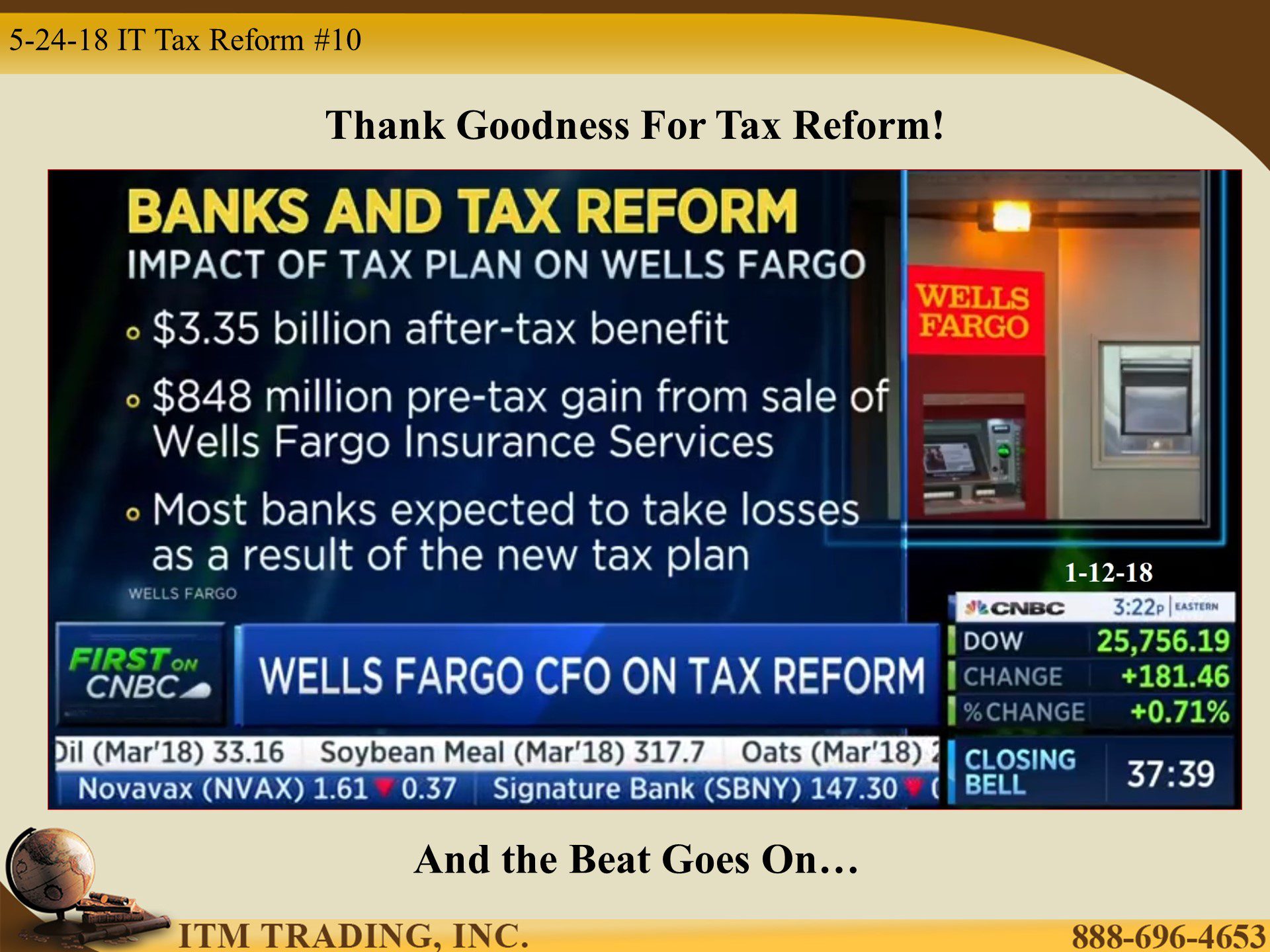

Identity theft is illegal for you and me. But Wells seems to have some very good friends in high places, like the CFTC (government watchdog agency) and even benefitted handsomely with this year’s tax changes. The stock price is certainly reflecting a positive outlook, only off roughly 15% from its all-time high and up about 30% from the beginning of their string of scandals. Certainly, deserved with the following list hitting most every area of their banking units.

2016 – Opened Unauthorized Deposit and Credit Card Accounts

2017 – Auto Insurance and Foreign Exchange

2018 – Wealth and Investment Management, 401Ks and IRAs AND Altered Customer Documents in Business Banking

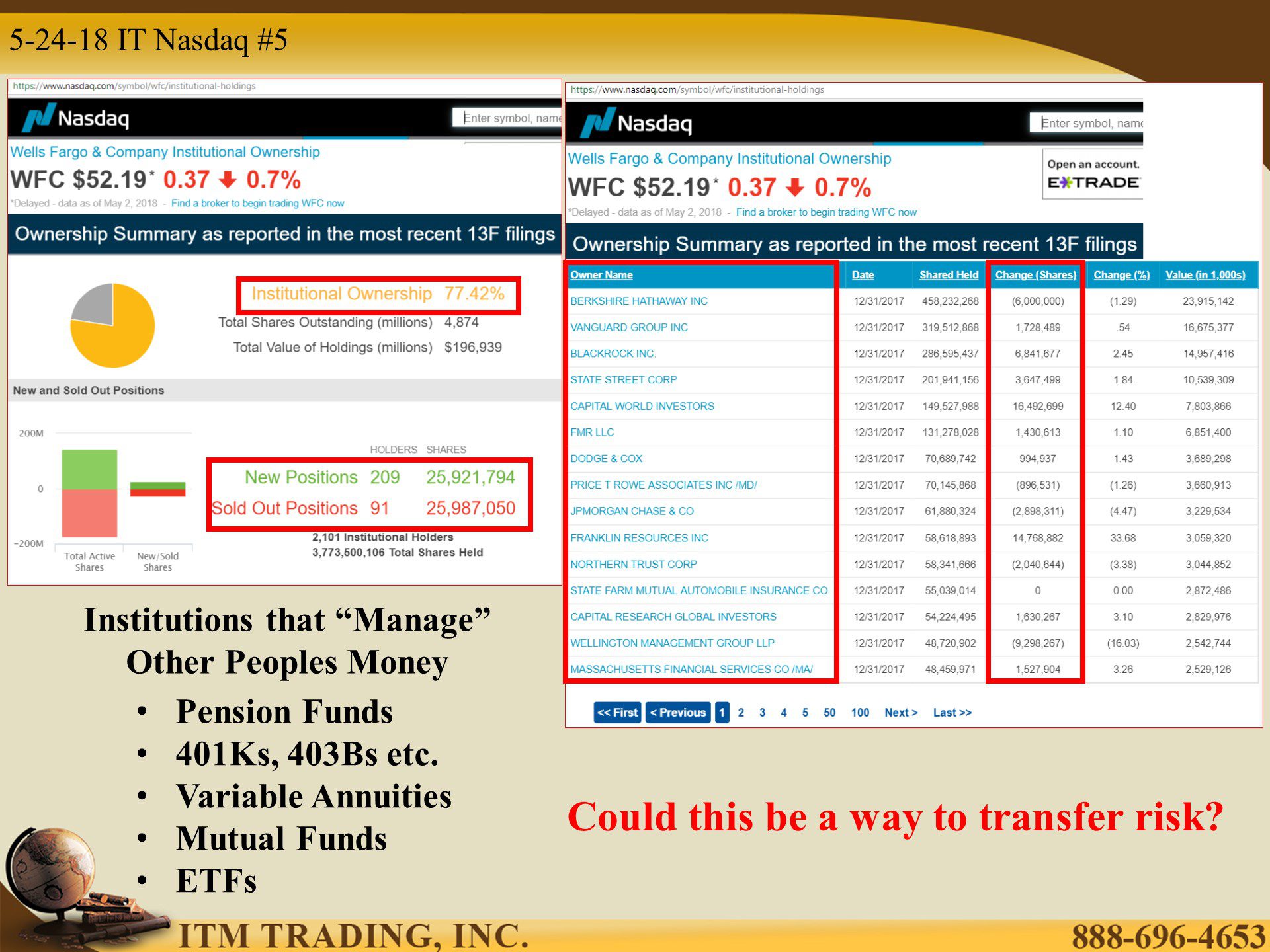

Good thing for those insiders selling out while institutions (those who play with other peoples’ money) are buying almost as much as is being sold. Could this be a good way to transfer risk?

Of course, all of these scandals have had an impact on Wells Fargo’s image. In May 2018 Wells Fargo began to repair their image.

Once hailed as one of the best banks on the street, I wonder if their culture reflects the global banking culture?

Slides and Links:

http://www.wsj.com/mdc/public/page/2_3024-insider1.html

https://www.nasdaq.com/symbol/wfc/insider-trades

http://stockcharts.com/h-sc/ui

https://www.nasdaq.com/symbol/wfc/institutional-holdings

https://nypost.com/2017/04/21/wells-fargo-admits-account-scandal-dates-back-to-2002/

https://fred.stlouisfed.org/series/MVLOAS

https://nypost.com/2017/04/21/wells-fargo-admits-account-scandal-dates-back-to-2002/

https://www.cnbc.com/2018/04/26/labor-department-is-investigating-wells-fargos-401k-unit-wsj.html

https://www.youtube.com/user/wellsfargo

https://www.wellsfargo.com/investment-institute/focus-on-gold/