Debt is Dragging us Down

By: Lynette Zang

In a statement after the FMOC meeting, Bernanke said that more stimulus is on the table as risks to the US economy remain. He also said that interest rates would remain near zero and additional tools that they have could be to buy more mortgage bonds and/or change the way they communicate policy goals to the public. In other words, savers will have to suffer and they will take even more bad loans off banks. In addition, if the FOMC “judges that we are falling sufficiently far short of our objectives in terms of inflation falling at or below its target†they would take corrective action. In other words, they will create more inflation in the economy. Unfortunately they have been attempting to do this all along and everything but real estate has inflated. Nothing they have done has created on going economic stimulus.

The reason is quite simple, too much debt. As you take on debt, you would look affluent to others, but if you take on too much debt, it then hampers your ability to maintain or grow that lifestyle because everything you take in must pay for what you’ve already bought. In addition, if you do not pay all of the interest, let alone any of the principal, that debt begins to compound, so even if you stopped spending, your debt continues to grow. It then becomes most likely, that you would be forced to declare bankruptcy. Can you see any way in which you can solve this debt problem by adding even more debt? If you could still add some debt, it might postpone the inevitable but ultimately, the debt must be paid, either by the lender or the borrower. Governments borrow on behalf of citizens, so the taxpayer/citizen would pay that debt, through taxation and inflation. That is where we are.

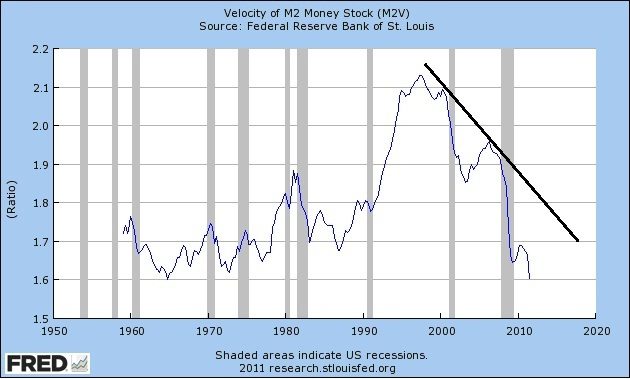

The chart below is the velocity of money chart, or how quickly money changes hands. This is an indication of how vibrant economic activity is and you can see from this chart that we are at the exact same levels that we were in the mid sixties, which was the lowest level since we began tracking monetary velocity. Keep in mind that the conversion from a creditor nation to a debtor nation began in the 1970’s when Nixon reneged on Bretton Woods and we went to a fractional reserve, debt based monetary system.

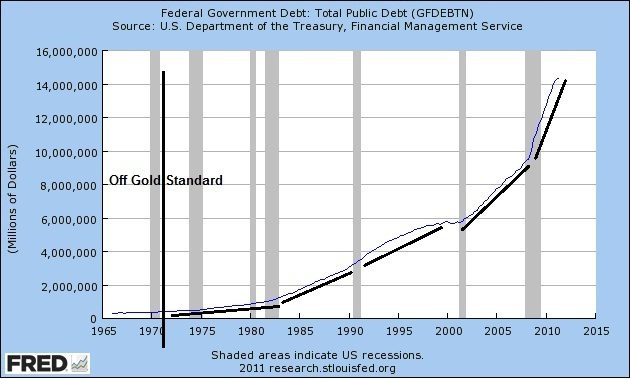

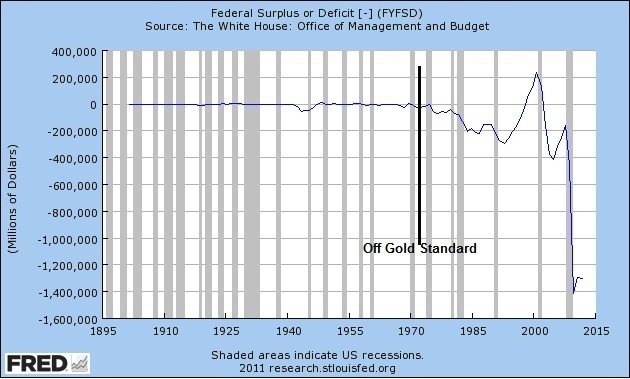

In a fractional reserve monetary system, you must create debt first, in order to create money. The chart below shows you that once there were no limitations on the amount of debt that could be created, every time we went into a recession (as shown in the vertical grey bars) the debt grew faster and faster. This was a combination of deficit spending (spending money you do not have) and compounding interest (request this report if you do not have it).

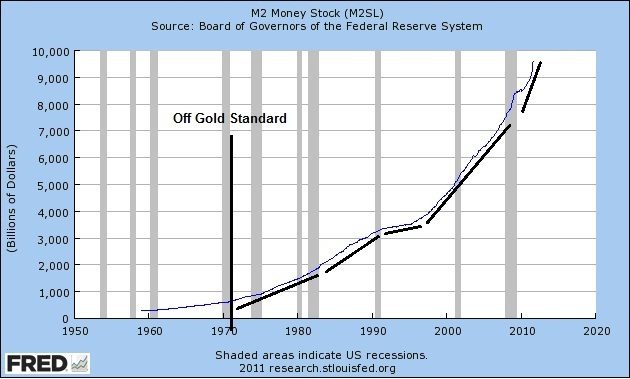

The chart below shows you the money supply. Can you see the similarity with the debt chart above? One might think that if there was more money to spend in the system, that would stimulate the economy, and in the past it has. But in the current crisis, it is not, as witnessed by the monetary velocity chart (first chart). This is because when velocity of money is low even when money creation is high, stimulus will be adversely affected because money is not changing hands (spending is low). This is happening now due to credit being tighter and the general public’s ability to borrow has been lessened by higher debt levels and unemployment.

Since 2003, we have not attracted enough buyers of the new debt we are issuing and were forced into quantitative easing (buying our own debt). What it has done, is devalued the currency and created inflation.

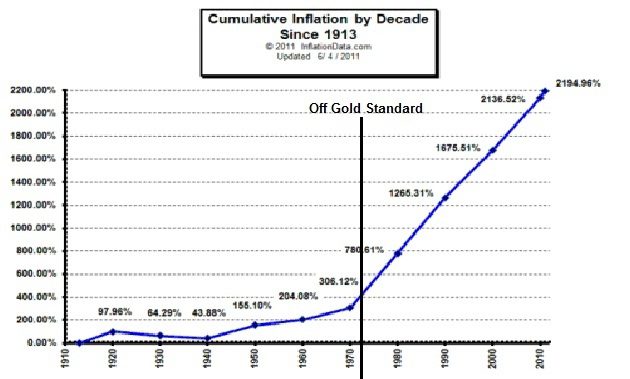

Currency devaluation is just another way of saying inflation. Inflation is an invisible tax on your wealth and one that is more palatable with governments because you think it is just what we have to deal with. But you can see how relatively tame inflation was when we were on a savings based monetary system (gold backed). The following chart shows you how fast inflation began to compound once we went to a pure debt based monetary system. And the more debt we grow, the faster the inflation transfers your wealth the government and bankers’ way.

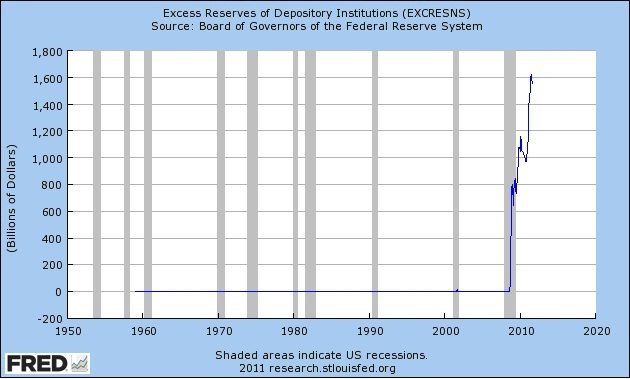

What has been the answer to all of the current debt issues? Even more debt. In this most current crisis, you might recall that the first course of action was to inject massive amounts of capital into the banking system. The following chart shows you this injection. The hope was that the banks would loan the money into the economy, which clearly, they did not.

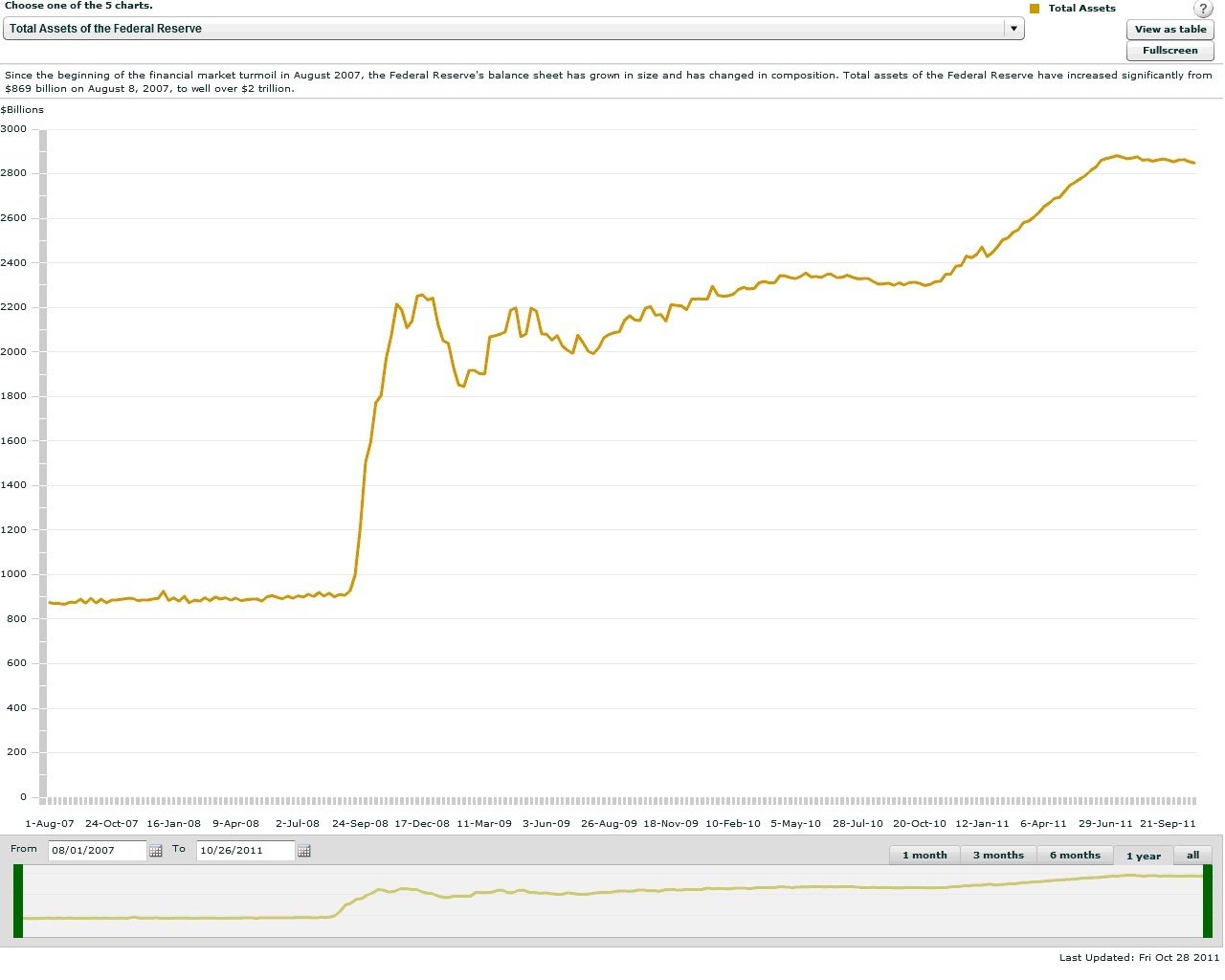

When that didn’t work, the Federal Reserve then began buying bad assets off the banks books. The chart below is directly from the Federal Reserve web site and states that their balance sheet increased from $869 billion to almost $3 trillion, as you can see.

But that isn’t working either. What it is doing, is creating more debts and deficits. The chart below clearly shows that once we converted to a debt based monetary system, we have run persistent deficits, with the current deficit level greater than at any time in our history.

The above charts reflect the US, but the same behavior is happening on a global basis. They want us to have confidence that they can figure a way out of this mess. But you cannot fix a debt crisis with more debt, sooner or later, someone will pay that debt. That someone will be those that stay inside the debt based system, either by holding onto fiat currencies or holding stocks and bonds that are fiat currency based. Historically, the only safe haven is money based upon savings; gold and silver.

The chart below shows you that both gold and silver are yelling of inflation. Soon they will scream as, ultimately, both will go to fundamental value, which is higher (in terms of dollars) than anyone would dream of at this time.

All of us are participating, we have no choice. But you do have a choice on how you will participate. Personally, I’ve chosen physical gold and silver. Because what I know is simply this, there are only four asset classes; stocks, bonds, cash and tangibles. Stocks, bonds and cash are all dollar based and are being “controlled.†In addition, the central bankers of the world are on a race to debase, so anything that is dollar based is in jeopardy and can go to zero, but physical gold and silver have never gone to zero. This is where I put my faith, so I’ll go with history and hold my wealth in physical gold and silver.